Boustead Singapore – chart poised for a bullish breakout! (23 Jun 23)

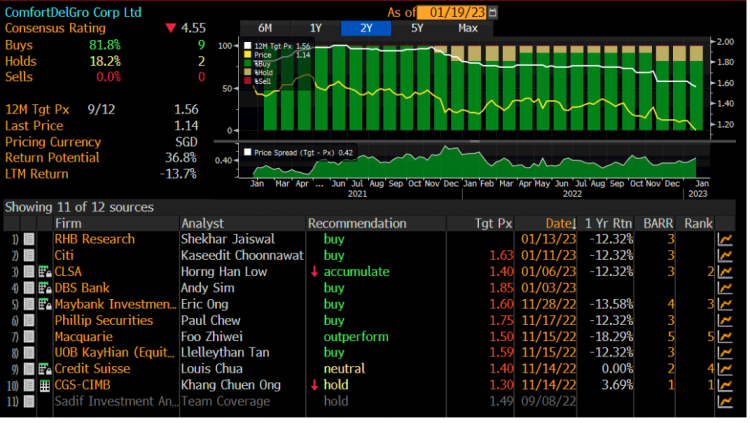

Dear all With reference to my write-up on Comfort Delgro dated 9 Jun 2023 (click HERE) where I pointed out that I am comfortable to accumulate Comfort Delgro for a trading play, Comfort Delgro closed at $1.03 on 9 Jun, the lowest close last since on 18 Mar 2004. Since my writeup, Comfort Delgro has fortunately appreciated nine out of ten trading days to close almost 15% higher at $1.18 today. This compares favourably with STI which moved up 0.2% over the same period. Another stock, Boustead Singapore has recently caught my attention due to its chart development. It closed […]