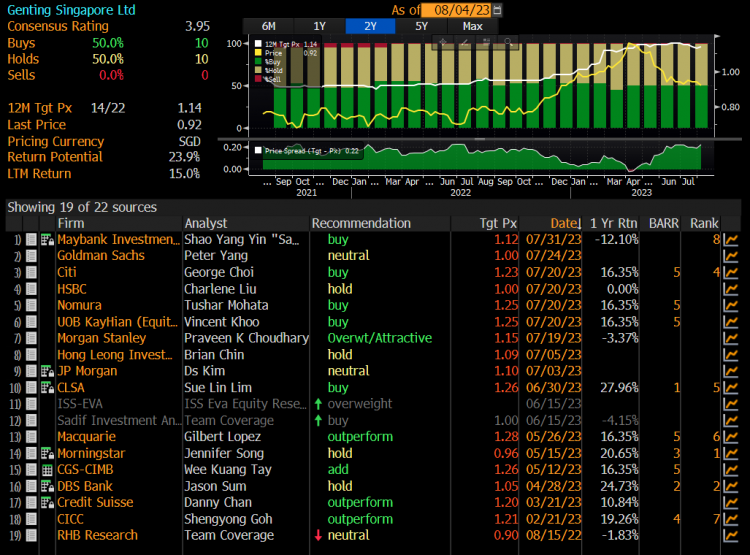

Genting Singapore, touted as a recovery play, trades near eight-month low price! (5 Aug 23)

Dear all Recently, Genting Singapore, a supposedly recovery play, closed at a near eight-month low price. It caught my attention especially after Las Vegas Sands (LVS) reported results on 19 Jul 2023. LVS reported a good set of results and indicated that there is scope for further improvement, as China tourists have not come back in full force yet. While the details (such as VIP volume growth and win percentage) may differ markedly from LVS (i.e., Marina Bay Sands) and Genting Singapore, generally speaking, the good set of results in MBS increases the chance that Genting Singapore may report similar […]