STI has fallen 125 points from the high, should you buy now? (29 Apr 16)

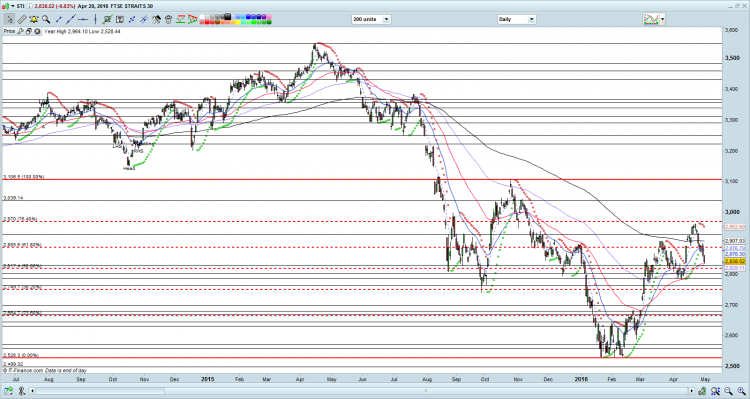

Some of you have missed STI’s sharp 432 points, or 17% rally from the intraday low of 2,532 on 12 Feb 2016 to 2,964 on 21 Apr 2016. Chart 1: STI’s phenomenal rise since 12 Feb 2016 Source: CIMB complimentary chart as of 29 Apr 2016 Usual reasons of missing this rally are: a) Fear that market may go down further when it hit 2,532 on 12 Feb. That was the 3rd time it tested 2,529 – 2,532 level; b) No time to monitor the market but do not wish to place some limit orders due to point a […]