Ernest’s market outlook (22 Jul 16)

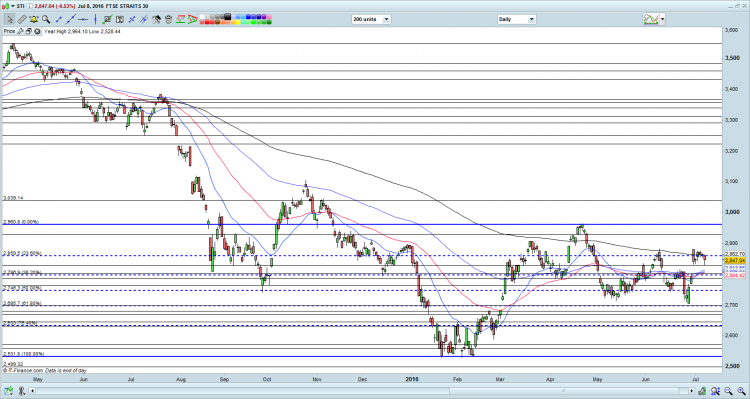

Dear readers, Markets have continued to rally with the U.S indices clocking in a fourth consecutive weekly gain. Will the markets continue to defy gravity to reach new highs? Read on for more. S&P500 Index Just to recap what I have mentioned on 8 Jul 2016 (see HERE), I wrote “Given the low ADX, bearish divergences between price and OBV, MACD and RSI, it is unlikely that S&P500 may stage a sustainable rally above an intraday all time high of 2,135 on 20 May 2015.” –> On the contrary, S&P500 breached 2,135 and stayed above the level for the […]