Dear Readers,

As you are aware, I usually will do a stock screening using Bloomberg at the start of each month. In the screening, Comfort Delgro (“CD”) pops out on attractive valuations via my metrics. This is not the first time that CD pops out in my screening. However, coupled with some of the points below, it may arguably be a good time to take a closer look in CD.

Due to time constraints, this write-up will be brief and I will just raise some pertinent points and risks. For a more complete picture, it is advisable to refer to CD’s analyst reports (Click HERE); SGX website (Click HERE) and CD’s corporate website (Click HERE).

Interesting points on CD

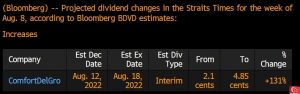

a) Potential 131% hike in 1HFY22F interim dividend

Based on Bloomberg (See Table 1 below), analysts are projecting CD to hike its interim 1HFY22F dividend from $0.021 / share in 1HFY21 to $0.0485 / share. To be honest, I do not know how accurate this projection is. If this is accurate, and if I based on the conservative assumption that CD may give $0.021 / share for 2HFY22F (similar to 2HFY21; i.e., no improvement for 2H on a year-on-year basis), then total dividends may amount to $0.0695. This translates to 4.8% FY22F estimated dividend yield.

Table 1: Projected dividend change in CD’s interim dividend

Source: Bloomberg 5 Aug 22

b) Chart seems bullish

Based on Chart 1, it is apparent that CD is in a multi-month base building formation. Since Nov 2021, it has been trading in a broad multi-month trading range $1.35 – 1.52. It is noteworthy that CD is challenging its strong cluster of resistance (long-term downtrend line established since Apr 2021 and its 200D SMA and 200D EMA) around $1.45 – 1.46. There is a pickup in volume yesterday, coupled with a small price increase to $1.44. This seems positive but we need confirmation. It will be bullish if CD can breach $1.46 on a sustained basis with volume expansion and even more bullish if CD can stage an upside break from its multi month trading range $1.35 – 1.52. An upside break above $1.52 points to an eventual technical measured target of around $1.69. Conversely, a sustained close below $1.33 – 1.35 with volume expansion is bearish.

Near term supports: $1.42 / 1.40 / 1.38 / 1.35 – 1.36

Near term resistances: $1.45 – 1.46 / 1.50 / 1.52 / 1.55

Chart 1: CD – Multi month base building; challenges downtrend line

Source: InvestingNote 5 Aug 22

c) Attractive valuations

Based on Bloomberg, CD’s valuations are low at 1.1x P/BV which is approximately 1.8 standard deviations below its 10Y P/BV of around 2.0x. This is particularly attractive given that it is likely that CD should be able to post improving results as economies recover and re-open from Covid over the long term.

d) Analysts are positive on CD

With reference to Chart 2 below, there are 10 buy calls; 1 hold call on CD. Average analyst target price is around $1.76. Coupled with an average estimated dividend yield of 4.3% (also based on Bloomberg), total potential return is around 26.5%. Readers should refer to the analyst reports HERE for more information

Chart 2: 10 buy calls; 1 hold call; Average analyst target $1.76

Source: Bloomberg 1 Aug 22

Risks

Naturally, there are risks involved. Examples of risks are

a) Buying before results involves risks

As I have shared with my clients, buying a stock before its results release involves risks. There is no guarantee that the share price may rise even if it beats estimates / guidance. However, should it disappoint the market, odds are higher that the share price may fall. Since Nov 2021, CD has been trading in a range $1.33 – 1.52. At $1.44, this is still in the middle of its multi-month trading range. Thus, it should be reasonable to assume that expectations for earnings / guidance beat may not be super high. At the moment, CD has not announced when it is going to release its 1HFY22F results yet.

b) Chart reading is subjective

Chart reading is subjective. As you are aware, a picture is worth a thousand words and the same chart can be read differently by different people.

c) Risk of being dropped out of STI remains

Based on this website (click HERE), CD continues to rank among the lowest STI component stocks in terms of market capitalisation, if not the lowest. Thus, based on this simple observation, there is a possibility that CD may drop out of STI. (To caveat, I am not an expert in index reshuffling hence the above is just based on my simple observation).

Conclusion

CD has been trading at low valuations for quite some time. However, coupled with its upcoming results (will be interesting to see CD’s results & outlook and whether it will hike its interim dividend) and a price chart which has been base building for 8 – 9 months, it may arguably be a good time to take a closer look in CD. Nevertheless, readers need to be aware of the aforementioned risks.

In addition, to reiterate, for a more complete picture, it is advisable to refer to CD’s analyst reports (Click HERE); SGX website (Click HERE) and CD’s corporate website (Click HERE).

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

P.S: I am vested in CD.

Disclaimer

Please refer to the disclaimer HERE

I’ll right away grab your rss feed as I can not find your email subscription hyperlink or e-newsletter service.Do you have any? Please permit me understand so that I may subscribe.Thanks.

Hello Dear, are you truly visiting this web page regularly, if so

afterward you will absolutely take pleasant experience.

знакомства для интима в шымкенте москва секс канал секс знакомства девяткино индивидуалки зрелые

метро марьино

I like this site very much, Its a very nice post to read and obtain info.Raise blog range

What’s up, the whole thing is going well here and ofcourse every one is sharing information, that’s really excellent, keep up writing

вакансии поселок хор тц пиастрелла вакансии секретарь делопроизводитель обязанности резюме

вакансии в планету здоровья пермь как

найти кпд машины за цикл работы