On 1 Sep, it was announced that Comfort Delgro (“CD”) will drop out of STI after being first included in the STI on 28 Jul 2010. Subsequently, there was turmoil in United Kingdom (“UK”) gilts and currency as UK government led by Prime Minister Liz Truss unveiled a (surprisingly) GBP45b plan to reduce taxes (click HERE for more information).

Although CD may see some near-term price weakness, at Friday’s close of $1.32 (CD touched an intraday low $1.29 at the point of writing this), I personally believe most of the negatives may have already been priced in.

Why am I bullish on CD? Read on for my basis and the risks below.

*Basis*

a) Improving results

It is likely that CD may post stronger core results in the upcoming quarters as

- The removal of restrictions in Singapore was largely only from 29 April with more easing subsequently;

- There are numerous shopping, seminars, conferences and exhibitions (MICE) events in Sep such as Comex IT, Great Singapore Sale and F1 etc. Based on its FY21 annual report, Singapore contributed 53.8% and 57.7% to group revenue and operating profit respectively;

- Rail ridership may benefit from the return to office and increase in social activities;

- Taxi rebates may end or reduce in Sep.

b) Compelling valuations

Based on Bloomberg, CD trades at 1.0x P/BV, almost two standard deviations below its 10Y average P/BV of 1.9x. FY22F estimated div yield is around 5.2%. Suffice to say CD trades at compelling valuations and seems to offer a good margin of safety. Furthermore, shareholders are paid decent dividends while waiting for the company to deliver on its results and to be re-rated by the market.

c) Attractive dividend yield AND dividends are likely to rise over time

Based on Bloomberg, CD trades at an estimated dividend yield of around 5.2%. However, there is scope for CD to pay more dividends as its results improve over time. It is noteworthy that (pre-pandemic), CD paid $0.105 / share and $0.0979 / share in dividends in 2018 and 2019 respectively. At $1.32, this works out to be around 7.4% – 7.9% dividend yield should it repeat such dividends in future.

d) Rock solid balance sheet, backed by net cash $643m

Based on 1HFY22 results, CD’s balance sheet has strengthened further. It has net cash amounting to $643m vs $493m in 1HFY21. Such strong balance sheet should be able to support its dividends and any acquisitions for future growth. Moreover, in a rapidly rising interest rate environment, ceteris paribus, a net cash company is generally likely to be less affected than a heavily leveraged company.

e) Chart – showing some green shoots of a potential near term recovery

Since Mar 2020, CD has been trading in a range of approximately $1.31 – 1.79. It has tested the lows of around $1.31-1.35 on numerous occasions throughout this period and rebounded. It is noteworthy that during the heights of the pandemic (where things are uncertain and gloomy), CD traded to an approximate low of around $1.31. It traded to an intraday low $1.29 on 30 Sep (Friday) before closing at $1.32. Based on chart, there are several noteworthy points on the trading seen on Friday.

- A potential bullish hammer formation seems to have occurred on Friday. However, we still require sustained follow through buying, coupled with volume expansion to confirm this bullish formation;

- Total volume of shares transacted on 30 Sep 2022 was around 19.2m shares. Excluding the turnover on 16 Sep 2022 (where it was effectively out of STI), 30 Sep marks the highest volume of shares transacted since 19 May 2022 à Such high volume increases the veracity of this candlestick formation;

- RSI hit an oversold level 21.6. Based on observation, since 2009, RSI typically rebounds after touching this level (excluding the pandemic period).

Near term supports: $1.29 – 1.31 / 1.26 / 1.24

Near term resistances: $1.34 / 1.36 / 1.38 / 1.40 – 1.42

Chart 1: A potential bullish reversal pattern, coupled with volume expansion and oversold level

Source: InvestingNote 30 Sep 22

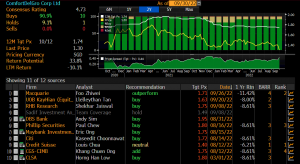

f) Analysts are generally positive on CD; Average analyst target $1.74

Based on Bloomberg (see Figure 1 below), 11 analysts cover CD with 10 buys; 1 hold; 0 sells. Average analyst target is around $1.74. Coupled with an estimated dividend yield of around 5.2%, total potential return is around 37%

Figure 1: Analyst target prices for CD

Source: Bloomberg 30 Sep 22

g) Not its first time to drop out of an index

This is not the first time that CD has dropped out of an index. At the close of 12 May 2020, MSCI announced that it would drop CD, SPH, Sembcorp Industries and SATs effective at the close on 29 May 2020. CD share price dropped from $1.60 on 12 May 2020 to $1.44 on 29 May 2020, before rebounding to $1.61 within three trading days (i.e., on 3 Jun 2020).

The above example illustrates to some extent that being dropped out of an index does not constitute a death sentence.

Risks

a) Persistent share price weakness

Notwithstanding the compelling basis above, since Mar 2020, CD has been trading in a range of approximately $1.31 – 1.79. It has tested the lows of around $1.31-1.35 on numerous occasions throughout this period. CD is once again back at the lower end of the range. Some reasons for this persistent share price weakness may be:

- CD’s risk of being dropped out of STI has been there for quite some time. This may have resulted in tepid sustainable buying interest as buyers are worried of this overhang;

- On 30 Aug 2022, Pyrford International Ltd has ceased to be a substantial shareholder of CD by selling 767,600 shares @approx $1.41. This reduces its stake to 4.995%, amounting to approximately 108.2m shares. As its stake has gone below 5%, it is not required to make any further reports should it sell more shares;

- Failure of its Australia subsidiary IPO to proceed. Click HERE for more;

- On 11 Nov 2021, it was announced that SBS Transit’s Downtown Line (DTL) will transition to New Rail Financing Framework Version 2 (NRFF (V2) (read HERE for more). The effect of which is outlined below in point c “decline in bus contracting revenue;

- Results have not yet improved tremendously at the moment hence market has not ascribed a high valuation on CD at the moment;

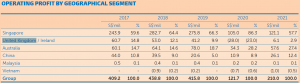

- UK, which CD has business in, was suddenly thrown into turmoil as UK government led by Prime Minister Liz Truss unveiled a (surprisingly) GBP45b plan in Sep to reduce taxes. In FY21 annual report, UK / Ireland contributed about 22.8% of group revenue. Fortunately, in terms of FY21 operating profit (see Table 1 below), UK / Ireland only contributed about 2.9% of the entire group’s operating profit. If an actual recession happens in UK, the impact to CD may not be as large as if it were to happen in Australia or Singapore.

Table 1: CD’s operating profit by geographical segment

Source: CD FY21 annual report

Besides the above potential reasons which may cast a pallor in its share price, there may be other reasons known to the market but unknown to me which cause the persistent share price weakness.

b) China likely to continue its zero Covid policy perhaps with some limited easing

In 1HFY22 results, CD set aside $10mn rebates to taxi drivers in various cities in China. Based on Philip Securities report, its China operations suffered an operating loss of S$3.2mn in 2Q22. China seems to be continuing its zero Covid policy at the moment (perhaps with some limited easing). Thus, this segment may not improve that much in the near term.

c) Decline in bus contracting revenue effective 1 Sep 2022

Based on 1HFY22 results, CD shared that its Singapore Public Transport Services will also be affected by an amendment to the service fee payable by the LTA on 5 public bus contracts from 1 Sep 2022 to a rate that is benchmarked against recent bus tenders and is lower than the current service fee, as agreed as part of the transition of the Downtown Line to NRFF 2. This has been made known to the public some time back.

d) May have some selling pressure in the near term

In the near term, besides the broad market weakness, CD may face some selling pressure as markets fret over the turmoil and repercussions from UK. Furthermore, we are not sure whether Pyrford International Ltd may continue its sale as it does not need to report of its sales anymore with its stake dipping below 5%.

e) Foreign currency exposure thrown into the limelight given GBP sharp decline

Based on this chart (click HERE), GBPSGD has declined 12.1% from 1.8245 on 31 Dec 2021 to 1.6046. According to CD’s FY21 annual report, CD typically has a natural currency hedge in the regions which they operate in and also through active currency management using hedging instruments such as forwards and options where necessary. Personally, based on my reading of its FY21 annual report, I am not sure the actual impact of GBP’s decline to their bottom line but I reckon it will not be hugely significant.

Conclusion

In summary, CD seems to be offering an attractive risk reward trade amid its improving results; strong balance sheet; attractive dividends and valuations etc. Nevertheless, it is noteworthy that in the near term, there may be some selling pressure as we are not sure whether Pyrford International Ltd may continue its sale and how the turmoil and repercussions in UK may pan out.

For a more complete picture, it is advisable to refer to CD’s analyst reports (Click HERE); SGX website (Click HERE) and CD’s corporate website (Click HERE). You can also refer to the article HERE on why analysts recommend to buy on recent share price weakness.

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Lastly, in line with my usual practice of compiling SGX stocks sorted by total potential return at the start of the month, readers who wish to receive my manual compilation of stocks sorted by total potential return can leave their contacts HERE. I will send the list out to readers around 8 – 9 Oct 2022.

P.S: I am vested in CD.

Disclaimer

Please refer to the disclaimer HERE

Great write..

Good write.. awesome.

Appreciate you sharing, great article post.Much thanks again. Keep writing.

I really liked your article post. Awesome.

Really informative post. Want more.

Thanks a lot for the blog.Thanks Again. Keep writing.

We were hesitant to invest in Google PPC, but the agency in https://brianclubcm.cc/ Nottingham helped us understand the value and has delivered great results.

Major thanks for the blog article.Thanks Again. Much obliged.

Very neat article.Really thank you! Will read on…

I am so grateful for your article post. Cool.

Im grateful for the article post.Thanks Again. Want more.

A big thank you for your blog post. Cool.

I really liked your blog article.Thanks Again. Cool.

I value the post.Much thanks again. Want more.

Very informative blog.Much thanks again. Want more.

I appreciate you sharing this blog post.Much thanks again. Really Great.

Thanks for the article post.Thanks Again. Fantastic.

I cannot thank you enough for the blog.Much thanks again. Want more.

This is one awesome blog post.Really looking forward to read more. Keep writing.

I am so grateful for your blog post.Much thanks again. Really Great.

Thanks a lot for the blog article.Much thanks again. Great.

Thank you ever so for you article.Really thank you! Will read on…

Thank you ever so for you article.Thanks Again. Awesome.

This is one awesome article.Much thanks again. Really Great.

Wow, great article.Really looking forward to read more. Fantastic.

Muchos Gracias for your blog post. Cool.

Fantastic article post. Fantastic.

Really appreciate you sharing this blog post.Thanks Again. Want more.

I think this is a real great post.Thanks Again. Want more.

Really informative post.Thanks Again. Cool.

Thanks so much for the blog article.Much thanks again. Really Cool.

I value the article post. Want more.

Really enjoyed this post.Much thanks again. Really Great.

wow, awesome blog post.Really looking forward to read more. Really Cool.

Enjoyed every bit of your article post.Really looking forward to read more. Want more.

Thank you for your blog post.Really looking forward to read more. Much obliged.

Major thankies for the article post. Really Great.

Thanks again for the post.Much thanks again. Will read on…

Fantastic blog. Really Great.

I truly appreciate this article. Cool.

I appreciate you sharing this blog.Really thank you! Fantastic.

Say, you got a nice article post.Much thanks again. Awesome.

I am so grateful for your blog.Really thank you! Fantastic.

Im grateful for the blog.Really looking forward to read more. Really Great.

I am so grateful for your article.Really looking forward to read more. Really Great.

Thank you ever so for you blog post.Really thank you! Fantastic.

Major thankies for the blog article.Really looking forward to read more. Much obliged.

Thanks for the article. Fantastic.

A big thank you for your blog article.Much thanks again. Fantastic.

A big thank you for your blog article. Much obliged.

Great article post.Thanks Again. Awesome.

Thanks for sharing, this is a fantastic blog post.Thanks Again.

I cannot thank you enough for the article post.Much thanks again. Awesome.

Thanks a lot for the article post.Thanks Again. Will read on…

Im thankful for the blog post. Keep writing.

I am so grateful for your post. Much obliged.

Really enjoyed this post.Much thanks again. Great.

Thanks for the post.Really thank you! Cool.

I really like and appreciate your article post.Really thank you! Keep writing.

Fantastic blog article.Thanks Again. Keep writing.

Thanks again for the blog.Really looking forward to read more. Fantastic.

Fantastic blog post.Really thank you! Really Cool.

Really informative blog article.Much thanks again.

Im grateful for the post.Really thank you! Awesome.

I truly appreciate this article post.Thanks Again. Much obliged.

A round of applause for your article.Really thank you! Much obliged.

Really enjoyed this article.Thanks Again. Really Cool.

I am so grateful for your blog article.Thanks Again. Want more.

Thanks again for the post.Really thank you! Much obliged.

Fantastic post. Will read on…

Say, you got a nice article post.Much thanks again. Fantastic.

I loved your article post.Really looking forward to read more. Much obliged.

Thank you ever so for you article post.Much thanks again. Awesome.

I think this is a real great post.Really thank you! Want more.

Really appreciate you sharing this article.Really thank you! Really Cool.

I really liked your blog. Really Cool.

Really informative blog article. Cool.

Major thanks for the article.Much thanks again. Awesome.

Thanks again for the blog article.Really thank you! Really Great.

Hey, thanks for the blog post.Really thank you! Really Great.

Wow, great blog post.Much thanks again. Great.

Looking forward to reading more. Great blog.Really looking forward to read more. Fantastic.

Thanks-a-mundo for the article post. Cool.

Major thanks for the post.Much thanks again. Keep writing.

Great article.Really thank you! Will read on…

Great, thanks for sharing this article.Much thanks again.

Very informative blog article.Really looking forward to read more. Really Cool.

I appreciate you sharing this post.Thanks Again. Great.

Really enjoyed this blog.Thanks Again. Awesome.

This is one awesome blog article.Thanks Again. Fantastic.

wow, awesome article. Awesome.

I am so grateful for your blog article.Really looking forward to read more.

I really liked your post.Thanks Again. Will read on…

Major thankies for the post.Really thank you! Really Cool.