October is indeed a month to forget, especially for those who have bought the infamous trio just before they crashed. Within a few sessions, the trio, namely Asiasons, Blumont and LionGold lost an approximate S$8.7b in market value. As a result of such colossal drop in their share prices, it inevitably caused collateral damage to other small to mid cap stocks. However, there are exceptions. An example is Nam Cheong which is trading at the upper end of its five month trading range $0.260-0.295

Chart observations

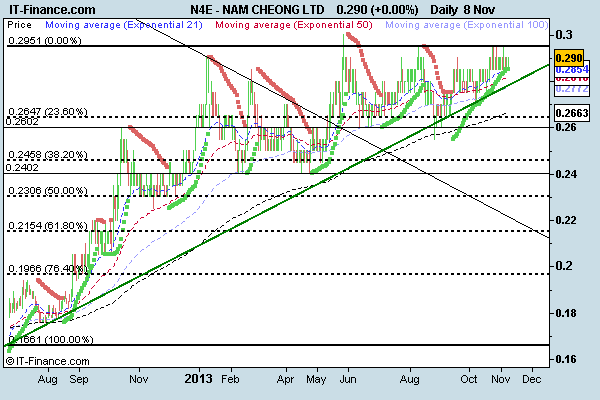

With reference to Chart 1 below, it is evident that Nam Cheong is on the verge of (once again) challenging the six times tested resistance of $0.295. It has been trading within the range of $0.260 – 0.295 for more than five months. The moving averages (21D, 50D, 100D & 200D EMA) are moving higher with golden crosses. Indicators such as OBV are trending higher towards its all time high. ADX has turned higher since 21 Oct and was around 29 last Friday which was indicative of a trend.

Chart 1: Nam Cheong approaches all time high

Source: CIMB itrade complimentary chart (8 Nov 13)

Results to be out on 12 Nov morning

Besides the technical aspect, one factor which may increase the odds of a successful breakout is its upcoming 3QFY13 results release. According to a DMG report dated 8 Nov 2013, Nam Cheong will report results on 12 Nov, Tuesday morning. DMG expects Nam Cheong to post a record quarterly profit in 3QFY13. DBS Vickers postulates that there may be potential positive earnings surprise in 3Q / 2HFY13.

Average analyst target is around $0.360

Based on Figure 1 below, average analyst target price polled by Bloomberg is around $0.360. This represents a potential capital appreciation of around 24%. However, it is noteworthy that some analysts are valuing Nam Cheong based on blended FY13-FY14F earnings. Hence as we approach 2014, it is likely that the analysts may raise the target price by rolling forward their valuations based on FY14F earnings. In addition, it is likely that FY14F earnings are higher than that of FY13F earnings as Nam Cheong has increased their shipbuilding program from 19 vessels in 2013 to 28 vessels in 2014. Readers can refer to the analyst reports on Nam Cheong http://www.namcheong.com.my/investor-relations/research.cfm,

SGX announcements and my writeup appended here http://www.sharesinv.com/articles/2013/07/22/nam-cheong-%E2%80%93-likely-beneficiary-of-malaysia%E2%80%99s-oil-and-gas-capex-plans/ for more information.

SGX announcements and my writeup appended here http://www.sharesinv.com/articles/2013/07/22/nam-cheong-%E2%80%93-likely-beneficiary-of-malaysia%E2%80%99s-oil-and-gas-capex-plans/ for more information.

Figure 1: Analysts’ target prices for Nam Cheong

Source: Bloomberg (11 Nov 13)

Conclusion – 3Q results may be the impetus for breakout

If Nam Cheong can break its six times tested resistance $0.295 with volume expansion, an eventual technical target price is around $0.330. However, this is an eventual technical target which may or may not be reached in the near term. It is noteworthy that Nam Cheong’s upcoming 3Q results may provide the impetus for it to move higher.

P.S: Do note that chart reading is subjective in nature and different people may have different interpretations on the same chart.

DisclaimerThe information contained herein is the writer’s personal opinion and provided to you for information only, and is not intended to, or nor will it create/induce the creation of any binding legal relations. The information or opinions provided herein do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or invest in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein are suitable for you. The writer will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials appended herein. The information and/or materials are provided “as is” without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

This is one awesome article post.Really thank you! Great.

Very good blog article.Really thank you! Keep writing.

Enjoyed every bit of your post.Much thanks again. Fantastic.

I am so grateful for your article. Keep writing.

Major thankies for the post.Really thank you! Really Cool.

Major thankies for the blog.Really looking forward to read more. Really Cool.

I appreciate you sharing this article post. Much obliged.

I really liked your blog post. Want more.

Very informative blog post.Thanks Again. Awesome.

I really liked your blog post.Really thank you! Really Great.

I really like and appreciate your blog article.Really thank you! Fantastic.

Looking forward to reading more. Great blog article.Really thank you! Awesome.

I appreciate you sharing this blog.Really thank you! Great.

This is one awesome blog post.Thanks Again. Cool.

Wow, great article. Great.

I think this is a real great blog post.Really looking forward to read more.

Thank you for your blog post. Really Cool.

Thanks again for the post.Really thank you! Really Cool.

I think this is a real great blog.Much thanks again. Fantastic.

This is one awesome blog article.Really thank you! Fantastic.

Great blog post.Really looking forward to read more. Keep writing.

Enjoyed every bit of your blog post.Really looking forward to read more. Want more.

Looking forward to reading more. Great blog article.Really thank you! Awesome.

Really enjoyed this post. Will read on…

Hey, thanks for the article.Really thank you! Want more.

Thanks for the blog article.Much thanks again. Much obliged.

Major thankies for the article. Great.

Really informative blog post.Much thanks again. Cool.

Really informative post.Thanks Again. Keep writing.

Looking forward to reading more. Great blog article.Really thank you! Will read on…

Very informative post.Really thank you! Want more.

Looking forward to reading more. Great post.Much thanks again. Great.

Say, you got a nice post.Much thanks again. Great.

I appreciate you sharing this blog article.Really thank you! Will read on…

I really like and appreciate your blog article.Really looking forward to read more. Really Cool.

Very neat blog article.Thanks Again. Cool.

Muchos Gracias for your post.Really looking forward to read more. Will read on…

I think this is a real great article post.Much thanks again. Will read on…

I really enjoy the article post.Really thank you! Great.

Muchos Gracias for your blog article. Awesome.

Hey, thanks for the post.Much thanks again.

Awesome article.Much thanks again. Cool.

A round of applause for your article.Really thank you! Much obliged.

Awesome blog.Really looking forward to read more. Want more.

Thanks a lot for the article post.Thanks Again.

I am so grateful for your blog post. Really Great.

Really informative article post. Want more.

A round of applause for your article. Cool.

I cannot thank you enough for the article post.Much thanks again. Great.

I really like and appreciate your article post.Much thanks again.

Hey, thanks for the blog article.Really looking forward to read more. Much obliged.

Thanks so much for the blog article.

I really like and appreciate your article. Much obliged.

A round of applause for your article post. Fantastic.

Enjoyed every bit of your article post.Thanks Again. Great.

Major thankies for the article post.Much thanks again. Really Cool.

I think this is a real great article post.Really looking forward to read more. Great.

I truly appreciate this blog post.Really looking forward to read more. Awesome.

Fantastic article.Much thanks again. Really Great.

I loved your article.Really looking forward to read more. Great.

I truly appreciate this blog.Really thank you! Keep writing.

Im thankful for the article post. Awesome.

Really appreciate you sharing this article post.Really looking forward to read more. Keep writing.

Thanks a lot for the blog article.Really looking forward to read more. Really Cool.

Thank you for your article.Thanks Again. Great.

Hey, thanks for the article.Really looking forward to read more. Really Cool.

I think this is a real great blog article.Really looking forward to read more. Keep writing.

Im obliged for the post.Really thank you! Much obliged.

Say, you got a nice blog.Really looking forward to read more. Really Cool.

Really informative blog post.Much thanks again. Fantastic.

Very good article post. Great.

Im obliged for the blog. Cool.

I truly appreciate this blog post.Really thank you! Fantastic.

Very informative article.Really looking forward to read more. Awesome.

Very informative article.Much thanks again. Fantastic.

Major thankies for the blog. Keep writing.

Thanks a lot for the blog article.Thanks Again. Fantastic.

Great article. Great.

Wow, great article.Really looking forward to read more. Cool.

This is one awesome article.Really looking forward to read more.

I loved your blog.Thanks Again. Awesome.

I think this is a real great blog post.Really looking forward to read more. Will read on…

Very good article.Much thanks again. Really Great.

Very informative blog article.Really looking forward to read more. Really Cool.

Appreciate you sharing, great article post.Thanks Again. Fantastic.

I think this is a real great post.Really looking forward to read more. Really Great.

Im obliged for the post.Thanks Again. Much obliged.

Thanks for the article.

Very neat blog.Really looking forward to read more. Cool.