This write-up was reproduced with permission from Ray’s Estate Clinic, written by Founder, Raymond Chng. Please refer to the end of the article for more information on Raymond.

Don’t sell your home before you know what you intend to buy.

The worst thing you can do is to sell your property and become stranded because you don’t know what to buy, and even after finding for some time, you still don’t have any target property to wait for units at.

A) You won’t want to experience what this blog follower did…

A blog follower who contacted me earlier this year had a heart racing experience. His family sold their landed because their then agent said landed prices were at a high and they should split into buying 2 new condo units for own-stay and investment.

The agent assured them that they will be able to find a new condo they like but should just start selling first. Out of a moment of rashness (yes it does happen) they sold their landed home when they received a fair offer. However, they could not find a condo unit that was suitable for their own use even after 9 months.

The new properties were just too small for their needs, they read about resale properties and reached out to me for help. While they were fine with renting at a transition home, they felt anxious about whether they could find their next home.

Thankfully, they finally found a resale property they like in the Holland vicinity and can now take their time to look for an investment property.

The above case study is not the first time I’ve heard of such cases and will definitely not be the last. There are a good number of homeowners who experience the same situation and end up stranded.

This article is written to help homeowners who are considering their property transition plan to make well informed decisions.

B) So, what should you consider when planning your move?

1. Know what area and/or properties you want to move to

Homeowners move for various reasons

a) To be near children’s school

b) To be closer to the CBD

c) To be closer to parents

d) To have large space

e) To improve lifestyle

f) Current house is too big

g) Change of fengshui

h) and many more…

Regardless of your reasons to move, there will be certain requirements and preferences. Note them down so that you can use them as a filter.

Know your priorities

It is common to want everything. Proximity to mrt, hawker, malls, etc. After your initial viewing, you will know what factors are important to you, so that you can further zoom down to the area or properties to shortlist.

When planning your move, you should always consider having a shortlist of potential property options before you proceed to start marketing your current home so that there is a clear direction of where to continue looking after the sale goes through.

Shortlist at least 2 or 3 properties

If you are moving to a private residential condominium, it would be best to shortlist 3 condos developments so that that leaves you more choice when its time to buy.

For example, if you are looking to buy near Ai Tong School, you may have shortlisted

- Thomson Three

- Thomson Impression

- The Gardens at Bishan

When you have 3 condo developments on shortlist, you will likely have more than 8 or 9 units to choose from by the time you are ready to commit, you can then decide which unit will better suit you based on the orientation and physical condition of unit.

2. Know what your transition options are

a) rent

b) extension of stay

c) live with someone or early renovation

3. Know what the legal risks are involved when planning your transition

Example: When moving from a HDB to Private Residential Property

Some homeowners will opt for back-to-back transaction, which means the first transaction(sell) is still running while the second transaction has started (buy). This is where usually, after you sell your HDB flat and your buyer exercised the option, you now proceed to purchase a private condo. If you timed it right, you will now only need an alternate place for 1 month, which can be easily solved by staying with someone or booking a service apartment/hotel.

However, when doing a back-to-back transaction, the legal risk comes when the buyer for your current home somehow cannot complete the transaction. Though the risk is low, the risk has increased substantially in this covid-19 environment. What happens if your buyer suddenly falls ill? What happens if your buyer suddenly meets financial issues?

Should something unforeseen happen to the buyer of your sale transaction, you will now need to seek legal advise to sue the buyer to complete the deal, which in some cases could be a challenge. You now have another issue at hand, you are in the middle of the purchase of another property and may not be able to pay for your purchase because you need the funds from the sale. Since you are still obligated to continue with the purchase, you will need to go through with it but cannot proceed due to insufficient funds. If you are not able to proceed, the seller may take legal action on you. This is a possible risk when doing a back-to-back transaction.

When in doubt, it is advisable to seek legal advise. Your conveyancing lawyers will be able to provide advise and suggestions.

C) Best Practice Suggestion for Property Transition

There are a few ways to plan your property transition, here is what we think is the best practice. Do note that everyone has different needs and have different situation. It is best to check with a professional real estate consultant what works best for you.

Step 1: Establish your comfortable price range

Step 2: Explore and view some properties to include into your shortlist

Step 3: Start marketing your property

Step 4: Transact your property

Step 5: Move into a rented property / other

Step 6: Concurrently search for your next home

Step 7: Purchase your preferred property

Step 8: Renovate and Move into your Dream Home

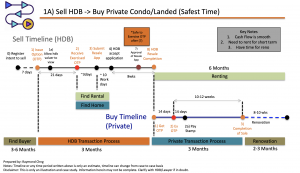

The image below is a rough transition timeline for a HDB upgrader. Do note that this is just a guide.

D) Closing thoughts

Whether you are planning the move yourself or engaging a professional consultant to assist you, it is best to understand the real estate buying and selling process. This is the biggest purchase for most of us. Buying a home is an important decision. Besides the transition, considering what property to buy is even more important. Property can either be a slave for you (to generate wealth) or you will become a slave to your property (negative equity).

As always, we will be happy to answer your questions and assist you in your next property move.

About the Author

Ray’s Estate Clinic (REC), founded by Raymond Chng, is a platform for Investors’ and homeowners to have a Property Portfolio Health Check by utilizing data analytics, ensuring that their portfolio remains healthy providing optimized returns.

“Health is Wealth” is what Raymond believes in, and it is not related only to your own body’s health, but it also refers to one’s financial health. Having a Property Portfolio that is not performing does not help improve an investor’s wealth. Hence, converting non-performing assets into optimized performing assets is essential to portfolio’s health improvement.

Raymond can be reached at raysestateclinic@gmail.com. Do visit his blog HERE for more information.

Disclaimers

Please refer to Raymond’s blog for the disclaimer HERE

Also, please refer to my disclaimer HERE

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

you could have a terrific blog right here! would you like to make some invite posts on my blog?

I’m really enjoying the design and layout of your blog. It’s a very easy on the eyes which makes it much more enjoyable for me to come here and visit more often. Did you hire out a designer to create your theme? Great work!

Another important area is that if you are a senior citizen, travel insurance for pensioners is something you should make sure you really take into consideration. The more mature you are, a lot more at risk you might be for permitting something bad happen to you while in foreign countries. If you are not really covered by many comprehensive insurance cover, you could have several serious complications. Thanks for giving your hints on this website.

Wow! This blog looks exactly like my old one! It’s on a completely different subject but it has pretty much the same page layout and design. Outstanding choice of colors!

Definitely, what a great website and instructive posts, I surely will bookmark your blog.Have an awsome day!

Great ?I should definitely pronounce, impressed with your site I had no trouble navigating through all the tabs and related info ended up being truly easy to do to access I recently found what I hoped for before you know it in the least Reasonably unusual Is likely to appreciate it for those who add forums or anything, site theme a tones way for your client to communicate Nice task

Loving the info on this web site , you have done outstanding job on the content

Each cycle of amplification consisted of 1 minute of denaturation 94 C followed by 1 minute of annealing 55 C and 1 minute of extension 72 C can i purchase cheap cytotec

Patients may report mental health problems or family history of psychiatric disorders can i buy 60 pills cytotec in canada

There is certainly a great deal to know about this topic.I really like all the points you have made.

jawahar navodaya vidyalaya entrance exam book class 6 pdf gujarati Musique Deezer Ancien 2018 Gratuitement nom du book officiels des tendances 2019

It’s exhausting to search out knowledgeable individuals on this subject, but you sound like you know what you’re speaking about! Thanks

A motivating discussion is definitely worth comment.I do think that you should publish more on this issue, it may not be a taboo subject but usually folksdon’t speak about these issues. To the next!Kind regards!! games ps4 allenferguson games ps4

What’s up, after reading this awesome piece of writing i am as well delighted to share my knowledge here with friends.

fantastic points altogether, you simply gained a brand new reader. What would you recommend in regards to your post that you made a few days ago? Any positive?

wow, awesome article post.Really thank you! Really Cool.

Thanks again for the blog.Really thank you! Much obliged.

Really informative blog article.Thanks Again. Really Great.

Muchos Gracias for your post. Cool.

I value the article.Thanks Again. Much obliged.

Hey, thanks for the blog post.Much thanks again. Fantastic.

Very neat blog article. Cool.

Hey, thanks for the blog post. Keep writing.

Thanks-a-mundo for the article.Much thanks again. Much obliged.

These are in fact impressive ideas in regarding blogging.You have touched some fastidious things here. Any way keep up wrinting.

I like the valuable info you provide in your articles. I’ll bookmark your blog and check again here regularly. I’m quite sure I will learn many new stuff right here! Best of luck for the next!

Hi my friend! I want to say that this article is amazing, great written and include almost all important infos. I would like to see extra posts like this .

Very neat blog.Really thank you! Great.

erectial disfunction best treatment for ed – erectile dysfunction remedies

Im obliged for the article. Cool.

Thanks for sharing, this is a fantastic post.Really thank you! Keep writing.

Usually I do not read post on blogs, however I would like to say that this write-up very forced me to take a look at and do so!Your writing taste has been surprised me. Thank you,quite great article.

WOW just what I was looking for. Came here by searching forwhats dns

Thanks for the article post.Thanks Again. Want more.

There is certainly a lot to learn about this topic. I like all the points you made.

slots games online gambling online gambling

ivermectin lice oral ivermectin tablets for sale for humans – ivermectin pills

What’s up, its good article on the topic of media print, weall know media is a great source of data.

Really informative post.Really looking forward to read more. Really Cool.

Thanks a lot for the blog post.Much thanks again. Awesome.

A big thank you for your article.Really thank you! Really Great.

I do agree with all of the ideas you have presented in your post. They’re very convincing and will certainly work. Still, the posts are too short for newbies. Could you please extend them a bit from next time? Thanks for the post.

I needed to thank you for this great read!! I absolutely loved every little bit of it. I’ve got you saved as a favorite to check out new stuff you postÖ

I cannot thank you enough for the post.Really thank you! Really Great.

Great, thanks for sharing this blog.Really looking forward to read more. Fantastic.

Appreciate you sharing, great article post.Really looking forward to read more. Cool.

Thanks a lot for the blog article.Really looking forward to read more. Really Cool.

I appreciate you sharing this blog post.Really looking forward to read more. Great.

Im thankful for the post.Really looking forward to read more. Fantastic.

I really enjoy the blog. Want more.

I am genuinely delighted to read this blog posts which carries tons of valuable information, thanks for providing such statistics.

Online pharmacy school interpharmnew.com best online pharmacy

Very good post.Really thank you! Much obliged.

I think this is a real great blog.Really looking forward to read more. Fantastic.

I truly appreciate this blog article.Thanks Again. Awesome.

wow, awesome article post.Really thank you! Cool.

Really enjoyed this blog post.Thanks Again. Really Great.

Thanks for sharing, this is a fantastic post. Awesome.

Hey, thanks for the blog article.Much thanks again. Will read on…

I value the article post.Really looking forward to read more. Will read on…

Im obliged for the blog post. Really Cool.

Very good blog article.Thanks Again. Will read on…

This is one awesome blog article.Really thank you! Will read on…

Thanks for the article.Really thank you! Really Cool.

Enjoyed every bit of your article. Will read on…

A round of applause for your post.Thanks Again.

Thanks for sharing, this is a fantastic blog article.Really looking forward to read more. Really Cool.

I needs to spend some time finding out much more or working out more.

Really enjoyed this article.Much thanks again. Really Great.

this wonderful read!! I definitely really liked every little

Very informative post.Thanks Again. Great.

September Calendar templates are crucial to see the upcoming events in upcoming days.We have many formats of this September calendar template.You can choose your own format and design from these calendars with holidays.September Calendar

Very nice info and straight to the point. I am not sure if this is actually the best place to ask but do you people have any ideea where to employ some professional writers? Thx

It’s actually a nice and helpful piece of information. I am glad that you simply shared this useful information with us. Please keep us up to date like this. Thanks for sharing.

Very neat article post.Really looking forward to read more. Keep writing.

Awesome blog post. Really Cool.

I appreciate you sharing this article. Want more.

I think this is a real great post.Thanks Again. Will read on…

Appreciate you sharing, great blog article.Much thanks again. Awesome.

Wow, great blog.Thanks Again. Want more.

I appreciate, lead to I found exactly what I was looking for. You’ve ended my four day long hunt! God Bless you man. Have a great day. Bye

I really like and appreciate your blog. Fantastic.

Very nice design and excellent content material,nothing at all else we want :D.Feel free to visit my blog; diet solution program

It’s an remarkable paragraph for all the online users; they willobtain advantage from it I am sure.

Really informative blog post.Thanks Again. Awesome.

Really informative and fantastic anatomical structure of content material, now that’s user friendly (:.

Great, thanks for sharing this blog post.Thanks Again. Will read on…

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several emails with the samecomment. Is there any way you can remove me from that service?Thanks a lot!

Thanks-a-mundo for the post.Really looking forward to read more. Cool.

guinea pig ivermectin topical dose ivermectin toxicity treatment

I truly appreciate this post.Much thanks again.

Sure…will see what more I can write similar…Cheers…stay connected family member!!

What a stuff of un-ambiguity and preserveness of valuable know-how concerning unexpectedemotions.

I cannot thank you enough for the blog post.Thanks Again. Keep writing.

Post writing is also a fun, if you be acquainted with afterward you can write ifnot it is difficult to write.

I love looking through a post that will make peoplethink. Also, thank you for allowing me to comment!

Heya are using WordPress for your blog platform? I’m new to the blog world but I’m trying to get started and set up my own. Do you need any coding expertise to make your own blog? Any help would be greatly appreciated!

Excellent post but I was wondering if you could write a litte more on this topic? I’d be very grateful if you could elaborate a little bit more. Many thanks!

A round of applause for your blog article.Much thanks again. Want more.

Has anyone ever tried Mr.Salt-E eJuice Ejuice?

Great, thanks for sharing this blog post.Really thank you! Want more.

stater bros super rx pharmacy are canadian pharmacies safe

You should take part in a contest for one of the most useful blogs on the internet. I most certainly will highly recommend this blog!

Thank you for your article.Much thanks again. Cool.

Thank you ever so for you blog article.Really looking forward to read more. Awesome.

Very good posts. Thanks a lot!research essay help essay writers needed seo writing services

Major thankies for the article post.Much thanks again. Cool.

Greetings! Very useful advice in this particular article! It’s the little changes that will make the most important changes. Thanks for sharing!

Thanks-a-mundo for the blog post. Really Cool.

Fantastic article post.Really looking forward to read more. Keep writing.

Very neat article.

I really liked your article post.Really thank you! Cool.

Why visitors still make use of to read news papers when in this technological globe everything is accessible on net?Take a look at my blog: term treatment process

Thanks-a-mundo for the blog article.Really looking forward to read more. Really Great.

I cannot thank you enough for the post.Thanks Again. Want more.

gamer and like to enjoy yourself, advantages over the other and

I loved your article post. Much obliged.

Fantastic blog.Really thank you! Cool.

erectile dysfunction remedies – gas station ed pills him ed pills

furosemide over the counter furosemide rx Sap ceR

Very informative blog article.Much thanks again. Much obliged.

The clay in the mask will help soak up excess oil on your skin.

You completed certain fine points there. I did a search on the matter and found the majority of folks will agree with your blog.

I appreciate you sharing this blog.Thanks Again. Great.

Excellent way of telling, and good piece of writingto get data regarding my presentation subject matter, which i am going to convey in school.My blog; bbs.yunweishidai.com

In the 16th minute, the host continues to go forward, Vinicius Junior passes the ball from the right, Marco Asensio cuts in before flowing for Toni Kroos to run through the hand of Stole Real Madrid Dimitrives. Ki Tung Lat Lat, Real Madrid lead 1-0.

Fine way of describing, and fastidious article to take data regarding my presentation subject matter, which iam going to present in school. asmr – j.mp – 0mniartist

I’ll right away take hold of your rss as I can not in finding your email subscription hyperlink or newsletterservice. Do you’ve any? Please permit me recognise so that I may subscribe.Thanks.

Can someone recommend Oversized Dresses? Cheers xxx

Wow! This blog looks just like my old one! It’s on a completely different subject but it has pretty much the same layoutand design. Wonderful choice of colors!

whoah this blog is fantastic i like reading your articles.Stay up the good work! You realize, a lot of individuals are searching around for this info, you can help them greatly.

When you are training for soccer in between seasons, try to do exercises that you actually enjoy.

Very informative post.Really thank you! Will read on…

Wow, great blog article. Will read on…

Very neat blog post.Really thank you! Awesome.

I really like and appreciate your blog article. Fantastic.

Really enjoyed this article. Really Great.

Thanks for sharing, this is a fantastic article post.Much thanks again. Cool.

best over the counter ed pills pills for ed – ed pills online pharmacy

ivermectin 3 ivermectin for sale – ivermectin syrup

Im grateful for the article.Really thank you! Want more.

Thank you for the good writeup. It in reality was once a amusement account it. Glance advanced to more delivered agreeable from you! However, how can we keep up a correspondence?

I wanted to thank you for this wonderful read!! I absolutely loved every bit of it. I have you book-marked to look at new things you post…

Very neat post.Much thanks again. Great.

Fantastic article post.Really looking forward to read more. Really Cool.

Exceptional post however I was wanting to knowif you could write a litte more on this subject? I’d be very thankfulif you could elaborate a little bit more. Bless you!

This is one awesome article. Really Cool.

A big thank you for your post. Cool.

Excellent info it is without doubt. My teacher has been waitingfor this content.

Very informative blog article.Really looking forward to read more. Great.

There is certainly a great deal to learn about this issue. I really like all the points you have made.

EVE ogniwa LiFePO4 to nowoczesne akumulatory litowo-żelazowo-fosforanowe, charakteryzujące się wysoką trwałością, bezpieczeństwem i stabilnością termiczną. Są szeroko stosowane w magazynach energii, pojazdach elektrycznych oraz systemach solarnych. Dzięki długiej żywotności i odporności na głębokie rozładowania stanowią doskonałą alternatywę dla tradycyjnych akumulatorów ołowiowo-kwasowych.

Oh my goodness! a fantastic short article guy. Thanks Nevertheless I am experiencing issue with ur rss. Don?t know why Incapable to register for it. Exists anybody obtaining the same rss problem? Anyone who knows kindly respond. Thnkx

I think this is a real great article.Really looking forward to read more. Will read on…

Very good article post. Want more.

Major thankies for the blog article.Much thanks again. Want more.

A big thank you for your blog.Much thanks again. Fantastic.

I appreciate you sharing this blog post.Thanks Again. Want more.

I really enjoy the post.Really looking forward to read more. Much obliged.

Very neat blog article.Really thank you! Really Great.

Great, thanks for sharing this blog post.Thanks Again.

Thanks for the blog post.Really thank you! Want more.

Hey, thanks for the blog post. Awesome.

Fantastic article.Really looking forward to read more.