This write-up was reproduced with permission from Ray’s Estate Clinic, written by Founder, Raymond Chng. Please refer to the end of the article for more information on Raymond.

Don’t sell your home before you know what you intend to buy.

The worst thing you can do is to sell your property and become stranded because you don’t know what to buy, and even after finding for some time, you still don’t have any target property to wait for units at.

A) You won’t want to experience what this blog follower did…

A blog follower who contacted me earlier this year had a heart racing experience. His family sold their landed because their then agent said landed prices were at a high and they should split into buying 2 new condo units for own-stay and investment.

The agent assured them that they will be able to find a new condo they like but should just start selling first. Out of a moment of rashness (yes it does happen) they sold their landed home when they received a fair offer. However, they could not find a condo unit that was suitable for their own use even after 9 months.

The new properties were just too small for their needs, they read about resale properties and reached out to me for help. While they were fine with renting at a transition home, they felt anxious about whether they could find their next home.

Thankfully, they finally found a resale property they like in the Holland vicinity and can now take their time to look for an investment property.

The above case study is not the first time I’ve heard of such cases and will definitely not be the last. There are a good number of homeowners who experience the same situation and end up stranded.

This article is written to help homeowners who are considering their property transition plan to make well informed decisions.

B) So, what should you consider when planning your move?

1. Know what area and/or properties you want to move to

Homeowners move for various reasons

a) To be near children’s school

b) To be closer to the CBD

c) To be closer to parents

d) To have large space

e) To improve lifestyle

f) Current house is too big

g) Change of fengshui

h) and many more…

Regardless of your reasons to move, there will be certain requirements and preferences. Note them down so that you can use them as a filter.

Know your priorities

It is common to want everything. Proximity to mrt, hawker, malls, etc. After your initial viewing, you will know what factors are important to you, so that you can further zoom down to the area or properties to shortlist.

When planning your move, you should always consider having a shortlist of potential property options before you proceed to start marketing your current home so that there is a clear direction of where to continue looking after the sale goes through.

Shortlist at least 2 or 3 properties

If you are moving to a private residential condominium, it would be best to shortlist 3 condos developments so that that leaves you more choice when its time to buy.

For example, if you are looking to buy near Ai Tong School, you may have shortlisted

- Thomson Three

- Thomson Impression

- The Gardens at Bishan

When you have 3 condo developments on shortlist, you will likely have more than 8 or 9 units to choose from by the time you are ready to commit, you can then decide which unit will better suit you based on the orientation and physical condition of unit.

2. Know what your transition options are

a) rent

b) extension of stay

c) live with someone or early renovation

3. Know what the legal risks are involved when planning your transition

Example: When moving from a HDB to Private Residential Property

Some homeowners will opt for back-to-back transaction, which means the first transaction(sell) is still running while the second transaction has started (buy). This is where usually, after you sell your HDB flat and your buyer exercised the option, you now proceed to purchase a private condo. If you timed it right, you will now only need an alternate place for 1 month, which can be easily solved by staying with someone or booking a service apartment/hotel.

However, when doing a back-to-back transaction, the legal risk comes when the buyer for your current home somehow cannot complete the transaction. Though the risk is low, the risk has increased substantially in this covid-19 environment. What happens if your buyer suddenly falls ill? What happens if your buyer suddenly meets financial issues?

Should something unforeseen happen to the buyer of your sale transaction, you will now need to seek legal advise to sue the buyer to complete the deal, which in some cases could be a challenge. You now have another issue at hand, you are in the middle of the purchase of another property and may not be able to pay for your purchase because you need the funds from the sale. Since you are still obligated to continue with the purchase, you will need to go through with it but cannot proceed due to insufficient funds. If you are not able to proceed, the seller may take legal action on you. This is a possible risk when doing a back-to-back transaction.

When in doubt, it is advisable to seek legal advise. Your conveyancing lawyers will be able to provide advise and suggestions.

C) Best Practice Suggestion for Property Transition

There are a few ways to plan your property transition, here is what we think is the best practice. Do note that everyone has different needs and have different situation. It is best to check with a professional real estate consultant what works best for you.

Step 1: Establish your comfortable price range

Step 2: Explore and view some properties to include into your shortlist

Step 3: Start marketing your property

Step 4: Transact your property

Step 5: Move into a rented property / other

Step 6: Concurrently search for your next home

Step 7: Purchase your preferred property

Step 8: Renovate and Move into your Dream Home

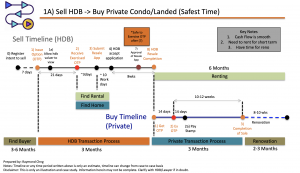

The image below is a rough transition timeline for a HDB upgrader. Do note that this is just a guide.

D) Closing thoughts

Whether you are planning the move yourself or engaging a professional consultant to assist you, it is best to understand the real estate buying and selling process. This is the biggest purchase for most of us. Buying a home is an important decision. Besides the transition, considering what property to buy is even more important. Property can either be a slave for you (to generate wealth) or you will become a slave to your property (negative equity).

As always, we will be happy to answer your questions and assist you in your next property move.

About the Author

Ray’s Estate Clinic (REC), founded by Raymond Chng, is a platform for Investors’ and homeowners to have a Property Portfolio Health Check by utilizing data analytics, ensuring that their portfolio remains healthy providing optimized returns.

“Health is Wealth” is what Raymond believes in, and it is not related only to your own body’s health, but it also refers to one’s financial health. Having a Property Portfolio that is not performing does not help improve an investor’s wealth. Hence, converting non-performing assets into optimized performing assets is essential to portfolio’s health improvement.

Raymond can be reached at raysestateclinic@gmail.com. Do visit his blog HERE for more information.

Disclaimers

Please refer to Raymond’s blog for the disclaimer HERE

Also, please refer to my disclaimer HERE

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ