Profit from the Panic – Developers’ Deadlines? BREXIT? (Guest post)

– Developer’s deadlines to sell units are reaching – Where are the opportunities?

– Is the Singapore Property Market bottoming out?

– If ABSD is removed who will benefit the most?

– Does BREXIT pose risks to Singapore Property Markets? What are the other risks?

Developers’ deadlines to sell units are reaching – Where are the opportunities?

With many developers hitting their deadlines for Qualifying Certificate (QC) – which need to sell within 5 years of construction else fined 8/16/24% for 1st/2nd/3rd year OR ABSD (developers to pay 15% absd if deadline hit), there will be opportunities as developers try to sell off their units. The developments highlighted in yellow (Fig.1), will be or have already started special promo of 10-15% discounts which have garnered huge interests from investors. For eg. OUE sold more than 80 units at TwinPeaks, D’Leedon & Interlace selling more than 100 units over last weekend. The window of opportunity has arrived for investors who have planned and are ready to act. Good Deals currently – OUE Twin Peaks, Ardmore Three and D’leedon Developments to look out for as promotions are expected are – The Crest, The Nassim, Mon Jervois.

Fig. 1 – Selected Developer Affected by QC and ABSD

Source: The Edge Property, Compiled by Raymond Chng

Is the Singapore Property Market forming a bottom?

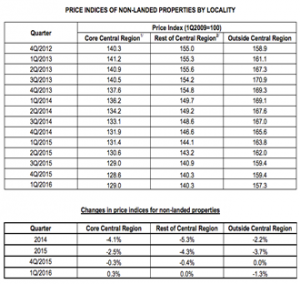

Past research from 2004 have shown that the property market usually starts to bottom out and pick up when the prime properties see a rebound. In 1Q 2016, we have finally seen the property price index reverse and is up 0.3% from 4Q 2015 (seen in fig. 2) after the prime property market (CCR) has been in downtrend for 12 consecutive quarters since 1Q 2013. This does not mean that the property markets have reversed fully into an uptrend, but a period where the reversal may happen soon.

It remains to be seen if there is continuation of this trend over the next few quarters. Should there be continuation, we can confirm that we have reversed the downtrend. It is also noteworthy to consider that the pricing may not immediately shoot up just yet, constant increase in transaction volumes need to be seen in order for the prime property market to move up steadily, while the rest of the market follow in tandem.

Fig. 2 – Property Index by Segment

Source: SRX Analyzer, URA

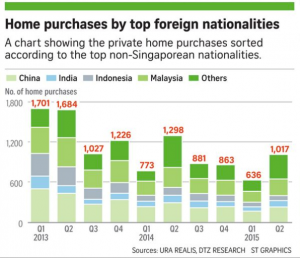

If ABSD is removed, who will benefit most?

The ABSD was introduced as a measure to stop property speculations as a whole. However, the highest ABSD was to foreigners and companies. This severely reduced the number of foreign buyers. In 3Q 2013, foreign purchases (seen in fig.3) accounted for 10% of the transactions, while in 3Q 2015, the foreign purchases accounted for only 4% which is a drop of more than 50%. From the ground, with talks with estate agents servicing foreign clients, it is known that there are still a lot of money waiting to be allocated into Singapore properties, the only concern is paying the ABSD.

Qing Jian, a china developer has aggressively tendered two plots of land in Singapore. One which is the enbloc of ShunFu Estate for (S$638mil) and Bukit Batok Mix Development (S$301mil). Qing Jian outbid many local developers, showing that they are still aggressively land bank in Singapore.

One reason could be the diversification of their businesses away from China, and Singapore still being a place where they see value. Singapore Properties are still in demand, as seen from the array of property funds, foreign developers and foreign ultra high net-worth still picking up properties here. Demand for properties here has picked up recently especially within the Prime Property Segment. Comparing Singapore’s property markets vis a vis developed markets like Hong Kong, Singapore’s prime properties are at a ~30-40% discount, Thus making our prime market an attractive proposition for investors.

Between 2010 and 2012, property prices sky rocketed with the influx of foreign buyers (on a backdrop where many Singaporeans expected the markets to drop with some even selling off their properties in anticipation of market correction). With all factors considered, it is very likely that when ABSD is reduced or removed, the prime segment will be the first to move. Investors who collect deep valued prime properties will reap the returns of the market recovery.

Fig. 3 – Home purchases by top foreigners

Source: URA, DTZ Research

What are the potential risks for the Property Market now?

Many investors have expressed concerns about BREXIT and its potential spillover effects into the Singapore Property Market. For the past few years, hot money has been flowing into UK properties, however with BREXIT uncertainties money will flow out of the UK & Europe. As a result, it is likely money will flow into Asia, in particular, Singapore Properties in search of safe real assets for wealth preservation. A more detailed report on “The BREXIT effect” will be release in due time.

Others potential risks are the threat of china’s slowing economy and high corporate debts which could affect the global financial markets. Other headwinds include the rising tensions over the China Sea, 2016 US presidential elections. Baring all unforeseen circumstances, these risks are unlikely to cause a great impact in the Singapore property markets. Properties are a hedge against inflation and with recent negative interest rate environment in Japan and Europe, real assets (properties) remain one of the safer investment picks available.

P.S: This write-up was reproduced with permission from Raymond Chng (singaporepropertyinsights.blogspot.com).

Raymond Chng joined the Real Estate industry in 2011. He graduated from Singapore Management University with a Bachelors of Business Management (Finance). He believes strongly in building multiple assets that makes people’s hard earn money work for them. His aim is to help property buyers and investors to be able to make a well informed decision based on transactional trends and financial risk management to ensure a minimal risk entry. He can be contacted at raychngrx@gmail.com

Really enjoyed this article post.Really thank you! Fantastic.

Hi there, just became alert to your blog through Google, and found that it’s really informative I am going to watch out for brussels I抣l appreciate if you continue this in future A lot of people will be benefited from your writing Cheers!

Life insurance is necessary that is why i always make sure that i get a reputable insurance company;;

I love what you guys are usually up too. Such clever work and exposure!Keep up the amazing works guys I’ve added youguys to my blogroll.

I really liked your article post. Really Great.

Thanks for sharing, this is a fantastic blog.Really thank you! Awesome.

Thank you ever so for you blog post.Thanks Again. Want more.

Thanks a lot for the article.Thanks Again. Great.

Say, you got a nice post.Really looking forward to read more.

I really like and appreciate your post.Really looking forward to read more. Awesome.

I used to be able to find good info from your blog articles.

My brother suggested I might like this blog. He was entirely right.This post actually made my day. You cann’t imagine just how much time I had spent for this info!Thanks!

medicine erectile dysfunction – best treatment for ed all natural ed pills

I am not sure where you are getting your information, but good topic. I needs to spend some time learning much more or understanding more. Thanks for fantastic information I was looking for this info for my mission.

Hello! This post could not be written any better!Reading through this post reminds me of my old room mate!He always kept chatting about this. I will forward this article to him.Fairly certain he will have a good read. Thanks for sharing!

Hmm is anyone else having problems with the images on this blog loading?I’m trying to figure out if its a problem on my endor if it’s the blog. Any suggestions would be greatly appreciated.Visit my blog post; tutorial videos

There is certainly a lot to learn about this issue.I like all of the points you have made.

When I originally commented I clicked the -Notify me when new feedback are added- checkbox and now each time a comment is added I get 4 emails with the same comment. Is there any way you’ll be able to take away me from that service? Thanks!

Almost all of what you assert happens to be astonishingly legitimate and that makes me ponder the reason why I had not looked at this with this light previously. This particular piece truly did turn the light on for me as far as this particular topic goes. But at this time there is actually one issue I am not really too comfortable with so while I attempt to reconcile that with the central idea of your position, allow me observe what all the rest of your visitors have to say.Nicely done.

I do agree with all of the ideas you have presented in your post. They’re very convincing and will certainly work. Still, the posts are very short for newbies. Could you please extend them a little from next time? Thanks for the post.

I in addition to my buddies have been analyzing the best hints found on your website and so before long got an awful suspicion I never expressed respect to you for those tips. The ladies were certainly passionate to learn all of them and now have in fact been taking pleasure in these things. Thanks for simply being well considerate and then for making a decision on this sort of fantastic subject areas millions of individuals are really desperate to be aware of. My personal sincere regret for not expressing gratitude to you sooner.

Wow! Thank you! I continually wanted to write on my site something like that. Can I take a portion of your post to my site?

Hello there, simply turned into alert to your blog thru Google, and found that it’s really informative. I’m gonna be careful for brussels. I will be grateful in the event you proceed this in future. Lots of other folks can be benefited out of your writing. Cheers!

Hola! I’ve been reading your website for a long time now and finally got the bravery to go ahead and give you a shout out from Dallas Tx! Just wanted to tell you keep up the great job!

I’ve been absent for a while, but now I remember why I used to love this site. Thanks , I’ll try and check back more frequently. How frequently you update your web site?

Thanks a lot for sharing this with all of us you actually know what you are talking about! Bookmarked. Please also visit my site =). We could have a link exchange arrangement between us!

free credit score experian annual credit report completely free government my credit scoring free credit scores

great post, very informative. I wonder why the other specialists of this sector do not notice this. You must continue your writing. I am sure, you have a great readers’ base already!

I am so happy to read this. This is the type of manual that needs to be given and not the random misinformation that is at the other blogs. Appreciate your sharing this best doc.

Hi! I’ve been reading your blog for some time now andfinally got the courage to go ahead and give you a shout out from New CaneyTexas! Just wanted to say keep up the good job!

I just could not depart your web site before suggesting that I extremely enjoyed the standard information a person provide for your visitors? Is going to be back often to check up on new posts

Thank you ever so for you blog article.Really looking forward to read more. Fantastic.

stromectol cream ivermectin lotion for lice

Very informative blog post.Really thank you! Will read on…

A round of applause for your blog post.Really thank you! Want more.

Something that is remarkable and should be learned. Thank you for providing this great concept. 토토

Very neat blog post. Want more.

This is one awesome blog article.Really looking forward to read more. Really Cool.

Really many of wonderful facts.how to write a creative nonfiction essay paper writing service custom written dissertations

Major thankies for the post.Thanks Again. Really Cool.

You mentioned this well. provigil vs nuvigil

instarect ed pills – hamdard medicine for erectile dysfunction and premature ejaculation montana ed pills

A man can’t be led by the nose easily, he must have tenacity and self-denial. Click:rape.

I really liked your article post.Thanks Again. Much obliged.

Enjoyed every bit of your blog. Really Cool.

Thanks for the article post.Much thanks again. Want more.

Hello, just wanted to tell you, I loved this blog post. It was funny. Keep on posting!

Hello! Do you know if they make any plugins to help with SEO?I’m trying to get my blog to rank for some targetedkeywords but I’m not seeing very good success.If you know of any please share. Thanks!

Hi, I do think this is a great blog. I stumbledupon it I am going to return yet again since I bookmarked it. Money and freedom is the best way to change, may you be rich and continue to guide others.

I am going to return yet again since I bookmarked it. Money and freedom is the best way to change, may you be rich and continue to guide others.

Heya i’m for the first time here. I found this board and I to find It truly helpful & ithelped me out much. I am hoping to offer something back andhelp others such as you aided me.

I would by no means understand. It seems too complicated and very wide for me.

Hi i am kavin, its my first time to commenting anywhere,when i read this post i thought i could also make comment due to this brilliantparagraph.

I’ll immediately clutch your rss as I can not to find your email subscription link or e-newsletter service. Do you have any? Kindly let me recognise so that I may just subscribe. Thanks.

It’s hard to find well-informed people in thisparticular subject, but you seem like you knowwhat you’re talking about! Thanks

Is anyone in a position to recommend quality Nhs Dentistry B2B Marketing List? Thanks very much

I think this is a real great blog.Really looking forward to read more. Keep writing.

I?¦ll right away clutch your rss feed as I can not in finding your e-mail subscription link or e-newsletter service. Do you’ve any? Kindly permit me realize so that I could subscribe. Thanks.

walnut apartments rentberry scam ico 30m$ raised apartments in mableton ga

I blog frequently and I genuinely thank you for your information. Your article has truly peaked my interest. I will book mark your blog and keep checking for new information about once a week. I opted in for your Feed as well.

over 50 dating singlesfree local personal ads

I needed to thank you for this very good read!! I definitely loved every little bit of it. I’ve got you saved as a favorite to look at new things you post…

all natural ed pills with ginseng – ed pills sam ellioty ed pills covered by medicaid

Thanks for the auspicious writeup. It in truth was once a amusementaccount it. Look advanced to more brought agreeablefrom you! By the way, how can we keep in touch?

Great blog article.Thanks Again. Really Cool.

I have been examinating out many of your stories and i must say clever stuff. I will definitely bookmark your blog.

Thanks so much for the article.Much thanks again.

A fascinating discussion is definitely worth comment. I believe that you need to write more on this subject matter, it may not be a taboo matter but generally folks don’t discuss these topics. To the next! Kind regards!!

Hello.This post was extremely motivating, particularly since I was looking forthoughts on this issue last Tuesday.Also visit my blog post diabetic diet

like that should never be kind of anarchy it’s not

This great model incorporates a bit of length on click here prime thatHair Styles – The Most Beautiful Hairstyle New Popular Hairstyleshair styles

It¦s actually a great and useful piece of information. I¦m glad that you shared this helpful information with us. Please keep us informed like this. Thanks for sharing.

You could definitely see your skills within the paintings you write. The arena hopes for even more passionate writers such as you who are not afraid to mention how they believe. At all times go after your heart.

There is certainly a lot to learn about this subject. Ilike all of the points you’ve made.

I delight in, cause I found exactly what I was taking a look for.You have ended my four day lengthy hunt! God Bless you man.Have a nice day. Bye

Wonderful blog! I found it while searching on Yahoo News.Do you have any tips on how to get listed in YahooNews? I’ve been trying for a while but I neverseem to get there! Many thanks

An intriguing discussion is really worth remark. I do imagine that you ought to publish more about this subject, it may not be a taboo topic but typically people don’t mention this sort of topics. To the next! Quite a few thanks!!

Looking forward to reading more. Great article post.Much thanks again. Really Great.

A round of applause for your blog article. Much obliged.

I really liked your post.Really looking forward to read more.

I value the blog article.Really looking forward to read more. Want more.

Hello! Do you use Twitter? I’d like to follow you if that would be okay.I’m absolutely enjoying your blog and look forward tonew updates.

Hey! I just wanted to ask if you ever have any trouble with hackers? My last blog (wordpress) was hacked and I ended up losing months of hard work due to no back up. Do you have any methods to prevent hackers?

Nice respond in return of this question with solid arguments and explaining all regarding that.

Powerball administrators hope the new Monday drawing will leadto larger prizes and elevated sales.

Really appreciate you sharing this article post.Really thank you! Want more.

I will immediately grab your rss feed as I can’t in finding your email subscription link ornewsletter service. Do you’ve any? Please let me realize in order that Icould subscribe. Thanks.

meds from india: meds from india best online international pharmacies india

Thanks for the blog article.Really thank you! Really Cool.

This is a very good tip particularly to those new to the blogosphere.Brief but very precise information… Thank you for sharing this one.A must read article!

Very useful information, and good for Group Tours to Central Asia

A big thank you for your article. Really Great.

I really like and appreciate your blog. Really Great.

When I originally commented I clicked the «Notify me when new comments are added» checkbox and now each time a comment is added I get three emails with the same comment. Is there any way you can remove me from that service? Cheers!

I blog frequently and I truly appreciate your content. Your article has truly peaked my interest. I’m going to take a note of your blog and keep checking for new information about once per week. I subscribed to your RSS feed too.

Great article post.Thanks Again. Really Cool.

Hi there, its pleasant post concerning media print, we all be aware of media is a fantastic source of facts.

Looking forward to reading more. Great post.Thanks Again. Much obliged.

This is a really good tip especially to those fresh to the blogosphere. Brief but very accurate information… Many thanks for sharing this one. A must read article.

Oh my goodness! Impressive article dude! Thanks, However Iam experiencing problems with your RSS. I don’t understandwhy I can’t join it. Is there anybody having identical RSSissues? Anyone that knows the solution will you kindlyrespond? Thanks!!

Hi! Do you know if they make any plugins to safeguard againsthackers? I’m kinda paranoid about losing everything I’ve worked hard on.Any suggestions?

Very good article.Much thanks again. Will read on…

Trực Tiếp Soccer Thời Điểm Hôm Nay, Liên Kết Xem đá Bóng Trực Tuyến 24h

Dead indited subject material, thanks for information. “Life is God’s novel. Let him write it.” by Isaac Bashevis Singer.

Very informative article post.Really looking forward to read more.

Great info. Lucky me I came across your blog by accident (stumbleupon). I’ve saved as a favorite for later!

I read this paragraph completely on the topic of the resemblanceof latest and preceding technologies, it’s amazing article.

I really liked your article.

Very informative blog. Fantastic.

Really informative article. Really Cool.

Thank you ever so for you blog.Thanks Again.

Thank you for the good writeup. It in reality used to be aamusement account it. Look complex to more brought agreeable fromyou! By the way, how can we keep in touch?

Very neat article.Much thanks again. Want more.

I actually like looking by means of an article that could make men and ladies Consider. Also, many thanks for permitting me to remark!

Hey, thanks for the post.Much thanks again. Cool.

Appreciate you sharing, great blog post.Really thank you! Fantastic.

Really informative article.Thanks Again. Cool.

Awesome blog post.Really looking forward to read more.

Appreciate you sharing, great blog post.Thanks Again.

I loved your blog.Much thanks again. Will read on…

Xwjtmi – essay writing pollution Askkms gepnvx

stromectol oral ivermectin for humans for sale – ivermectin over the counter canada

When I initially commented I clicked the “Notify me when new comments are added” checkbox and noweach time a comment is added I get three e-mails with the same comment.Is there any way you can remove me from that service?Thanks!

Looking forward to reading more. Great blog.Thanks Again. Really Great.

This is one awesome blog post.Thanks Again. Will read on…

Really informative blog article. Cool.

I need to say your site is really helpful I also love the theme, its amazing!

Appreciate you sharing, great article.Thanks Again. Awesome.

Thanks a lot for the article.Thanks Again. Cool.

Thanks so much for the article post.Really thank you! Much obliged.

Very informative article post.Much thanks again. Really Cool.

I appreciate you sharing this blog article. Great.

Thanks again for the blog.Much thanks again. Keep writing.

wow, awesome blog.Thanks Again. Really Cool.

Enjoyed every bit of your blog article. Keep writing.

Really enjoyed this article.Much thanks again. Fantastic.

Enjoyed every bit of your article.Really thank you! Want more.

Thanks again for the blog article.Really looking forward to read more. Keep writing.

I think this is a real great blog article.Thanks Again. Want more.

continuously i used to read smaller content which as well clear their motive,and that is also happening with this piece of writing which I am reading here.

I value the article post.Really thank you! Awesome.

I really liked your article post.Really looking forward to read more. Much obliged.

Asla beklemedigim 1-2 kisiyi g?r?nce sok ge?irdim ??Loading…

natural ed remedies: ed treatment natural – generic ed pills

Greetings! Very helpful advice in this particular article! It is the little changes which will make the most important changes. Many thanks for sharing!

I used to be recommended this blog by means of my cousin. I’m not certain whether or not this publish is written by him as nobody else recognise such unique about my difficulty. You are incredible! Thanks!

You’ve made my day! Thx again. Nice read. It’s like you wrote the book on it or something. I enjoyed your post. Thank you.

Great blog article.Really thank you! Great.