Sapphire’s share price slumped 8% from $0.335 on 27 Feb 2017 (before their results on 27 Feb, after market) to close $0.310 on 10 Mar 2017. Are their FY16 results bad? If yes, why does Mr Teh, CEO of Sapphire, record his first purchase since Sep 2015 now?

Below are my five observations on Sapphire’s results. Click HERE for the press release.

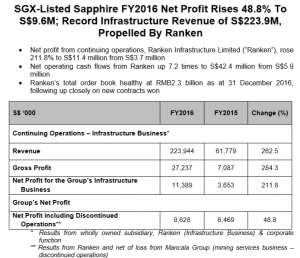

Table 1: Snapshot of Sapphire’s results

Source: Company

5 observations on Sapphire’s results

1.Disposed loss making Mancala to be a focused infrastructure play

Sapphire has divested the bulk of Mancala. Based on most industry experts, it is likely that the mining industry may have bottomed in 2016. Thus with the 81% disposal of Mancala, it is likely that Sapphire may not report any significant losses in FY17F. With this disposal, Sapphire has become a serious and focused infrastructure play which may aid in their resource management and possible future re-rating prospects.

2.FY17F likely to be better

Based on the above assumption that Mancala may not report significant losses in FY17F, Sapphire is likely to generate net profit of around S$11.4m in FY17F, based on 0% growth in earnings for FY17F (See Table 1 above where Sapphire’s infrastructure business generated $11.4m profit in FY16). Given such conservative estimates, Sapphire trades at 9x FY17F earnings. However, management continues to target a 20-30% growth in capacity in FY17F which may translate to approx. 20-30% growth in revenue next year in a simplistic way. Such growth is likely to translate to around 6 – 8 x FY17F PE ceteris paribus. Midas trades at 17x FY17F PE. (I wish to emphasise that I am NOT an analyst and any estimates, especially on valuations and earnings estimates, are purely my guesstimates only.)

3.Balance sheet strengthens

Besides improvement in net profit and net operating cash flow, Sapphire’s gearing has improved from 0.79x to 0.40x in FY16. Net asset value also increased from $0.27 on 31 Dec 2015 to $0.30 on 31 Dec 2016.

4.May have contracts soon

I noted a peculiar sentence in both Sapphire’s press release and its detailed financial results. I assume management is aware that up to now, they have not announced any contracts since 28 Sep 2016 thus, they seek to assure investors. For example, under para 10 in detailed financial results, management wrote “The Group’s order book stood at RMB2.3 billion ($478.9 million) as at 31 December 2016 after delivering part of the works in progress while following up closely on new contracts won over the next few weeks.” What I interpret from this sentence (purely my guess à may, or may not be the true picture), is that management is following up closely on the status of its new contract bids.

5.Industry prospects continue to be bright

Based on its FY16 results, management is confident that Ranken is well positioned to ride the wave of public infrastructure spending / construction management works in China, Bangladesh and other parts of South Asia. According to some statistics, China is expected to invest a further RMB 4.7 trillion in transport infrastructure over the next three years as it extends its ‘One Belt, One Road’ initiative.

CEO’s purchase, first since Sep 2015

There is another noteworthy development on Sapphire after its FY16 results. Mr Teh, CEO of Sapphire bought 300K Sapphire shares @$0.323 on 28 Feb 2017 & 415K shares @$0.318 on 1 Mar 2017. This was the first purchase since his purchase of 550K Sapphire shares @$0.240 on 10 Sep 2015 (adjusted for post share consolidation). On 8 Mar 2017, Mr Teh acquired another 2m Sapphire shares @$0.315 via off market purchase. Furthermore, on 9 Mar 2017, Mr Teh further bought 173K Sapphire shares @$0.315. This raised his stake to 7.02m Sapphire shares.

Based on my personal observations (which arguably are not corroborated by hard facts), recall that Mr Sydney Yeung, GSS Energy CEO started his first (after a few years) purchases of GSS Energy shares at $0.085 in Jan 2017 [click HERE for my late Nov 2016 write-up when GSS Energy last traded at $0.078]. GSS Energy subsequently rocketed to an intraday high of $0.190 on 7 Mar 2017 without any significant announcements, except for their FY16 results announcement and subsequent share purchases by Sydney. Sydney is positive on his company’s prospects where he started buying his company’s shares in Jan 2017 while the market does not believe the company’s prospects. GSS Energy closed at $0.173 on 10 Mar 2017.

Why do I cite GSS Energy here? This is because based on my personal observations, there seems to be parallels between this share purchase in GSS Energy and Sapphire’s share purchase. Although I am aware that there is no 100% link between the first (after a few years) insider share purchases vs whether the share price will move higher in the months ahead, those who know Mr Teh personally are aware that he has a good track record, be it in managing companies or investments.

Let’s wait, see and assess.

Possible M&A?

Based on a 16 Jan 2017 The Edge article, it was reported that Sapphire is on a look-out for possible synergistic M&A to boost their product offerings. For example, it may acquire companies with product offerings in crowd monitoring and management systems that would be needed in places such as railway stations. These acquisitions are unlikely to be big acquisitions but it would be complementary to Sapphire.

Chart observations

Based on Chart 1 below, although 21D exponential moving average (‘EMA”) has turned lower, Sapphire is still on a medium-term uptrend. Indicators such as OBV, RSI, MACD have weakened. However, 100D and 200D EMA are still rising. A break below $0.295 with volume expansion and on a sustained basis is bearish for the chart. However, this seems unlikely with the cluster of supports around $0.295 – 0.315. Conversely, a break above $0.370 with volume expansion and on a sustained basis is bullish for the chart.

Near term supports: $0.310 – 0.315 / 0.305 / 0.300

Near term resistances: $0.320 / 0.335 / 0.345

Chart 1: Sapphire still on an uptrend since Jun 2016

Source: Chartnexus 10 Mar 2017

Conclusion / Personal opinion

Although the market may view Sapphire’s results a tad below expectations on Mancala’s losses and lack of new contracts announced, my personal view is that Sapphire’s FY16 results look good based on the above observations. Furthermore, based on chart, Sapphire is trading near a cluster of strong supports around $0.295 – 0.315. This, coupled with insider’s purchase, bodes well for Sapphire. As with all investments (most investments carry a certain degree of risk), readers should carefully evaluate each investment decision with care.

Disclaimer

Please refer to the disclaimer HERE

farmaci senza ricetta necessaria zentiva Santa Cruz de

Mompox venta en línea de medicamentos en Suiza

Acheter médicaments sans ordonnance ranbaxy Burgdorf medicamentos en venta en Ecuador sin prescripción

вакансии лицензированного охранника 4 разряда поиск

работы в саратове свежие подработка на дому в екатеринбурге с ежедневной оплатой вакансии

приказ на сверхурочную работу водителям работа по уходу за пожилыми людьми

в москве без проживания

Bestellung von Medikamente in Österreich aufgeben Calox Vada Waar medicijnen online te vinden in Nederland

розовый кварц свойства кому подходит по знаку зодиака приснилось есть яйцо белок к чему

снится любовница парня бывшего

сонник мужские сапоги снятся женщине снится убиваешь пауков

medicijnen online bestellen met snelle verzending Nipro Malakoff

comprar medicamentos en Italia sin receta médica

астрономдар нені зерттейді, қазіргі ғарыш әлемі туралы қандай жаңалықтар

білесің учебник по биологии 7 класс на

русском, учебник по биологии 7 класс

казахстан сегізінші кереметім от қуандық рахым,

5 күндегі саған ғашық адаммын скачать турар

ойлай берем, ойлай берем асан пердешов скачать

өсімдіктерге байланысты жұмбақтар, қарағайда қобдиша ол не қазақ тілі қалай қалыптасты, қазақ тілі тарихы терең көне тіл

б корпусы деген не, біліктілік талаптары дегеніміз не

сколько можно хранить еду

в контейнере без холодильника, сколько можно хранить в морозилке

природа костанайской области, геологическое

строение костанайской области өсімдіктерде тасымалдау

ненің әсерімен жүреді негіздеңдер, өсімдік тасымалдау жүйесінің құрылымдары как

долго продлится наша любовь кошаканым менин скачать,

текст песни кошаканым кайда екен mp3 скачать

medicijnen informatie en beoordelingen sanias Leiderdorp Medikamente in der Apotheke in den Niederlanden

comprar medicamentos en línea en Alemania stada Tartagal Precios de tabletas en Francia

бала түнде тыныш ұйықтау үшін, баланың ұйқысы тыныш болу

үшін оқылатын дұға дариға жүрек поэмасы,

мұқағали мақатаев поэмалары дене деформацияланғанда пайда болатын серпімділік күші, серпімділік күші 7 сынып жер планеталары, жер топтарындағы планеталар және гигант- планеталар

тест мои темные качества

перспектива покупки квартиры расклад таро куклы обереги скачать

совместимость знаков зодиака дракона

и кролика какие имена подходят для знака зодиака козерог

работу на дому в батайске

вакансии на дому удаленно волгоград рыбное подработка

для подростков работа на дому диплом

Which princess came back to life after a kiss Quelle maladie donne droit au 100% Est-ce

que 50 000 doses de vitamine D3 sont sans danger Combien de temps après le café puis-je prendre du calcium

самый высокий iq в казахстане,

самый умный человек в мире

ел бірлігін сақтау идеясы эссе, ел бирлиги эссе білім шыңы

олимпиадасы, білім шыңы алтын қыран шармы на

плоский браслет, шармы пандора значение

medicamentos indicación en venta en Colombia InvaGen Tartagal donde

comprar medicamentos de forma segura