The sudden Singapore property market cooling measures on 5th July 2018 had shocked the market as no one was expecting this measures. Many panicked causing a knee-jerk reaction which caused developers to launch 3 projects on the very night these measures were announced, find out more about these measures in this article and how it affects you.

In any measure, there will be different impact on different groups of stakeholders. Inadvertently, there are winners, losers and opportunities created.

In this article, four main questions will be discussed

1.How does the cooling measures affect different groups of people?

2.What is likely to happen to a few market segments?

3.What are the side effects?

4.Are there any winners?

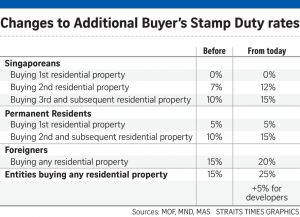

For those who would like to read more about the cooling measures can do so at the appendix attached at the end. As analyst described the latest cooling measures on 5th July 2018 as a tough one, we look to decode the effects of these latest measures.

1.How does the cooling measures affect the following groups of people:

Home owners

Going forward, home owners will require more cash/CPF for home owners to decouple and buy two properties going forward. With the new 75% LTV ratio instead of 80%, upgrades would need to top up an additional 5% (or $50,000 if the property is $1 million). With two properties and you would need to have $100,000 more in cash/CPF. This extra amount could have been used as an emergency fund. Henceforth, it will be more costly for families who intend to decouple; buy one property for stay and the another for investment. This also means that in order to own two properties, you now need to pay more and loan less, which essentially is more stable for the market. However, home owners who want to cash out their existing property investments, at a higher price, may now face challenges with home staging due to potential decreased affordability by some buyers.

First time home buyers (Singapore Citizen/SPR)

First time home buyers or hdb upgraders are likely to benefit from the latest round of cooling measures if they have the extra 5% cash/CPF (LTV 80% drop to 75%). This is because sc or spr buying their first properties are not impacted by the increase of stamp duty. Property Developers may eventually start to offer some discounts to buyers if the demand start to taper. In line with the government’s intention to keep the property prices stable, home buyers will not have to face runaway home prices. First time buyers who do not have the extra 5% which is about $50k for a $1mil property. Will be priced out of the market. What this would do is to bring back demand to Resale HDBs and BTO Flats, which have a much lower quantum, and therefore require a much lower downpayment.

Second property investors (Singapore Citizen)

Example Calculation for ABSD:

| Total stamp duty payable on or before 5th July 2018 | Total stamp duty payable on or after 6th July 2018 |

| Property Value: $2mil

Buyer Stamp Duty: $64,600 ABSD (7%): $140,000 Total Stamp Duty: $204,600 |

Property Value: $2mil

Buyer Stamp Duty: $64,600 ABSD (12%): $240,000 Total Stamp Duty: $304,600 |

For those buying a second property, with an existing loan, they would need to pay additional 12% Additional Buyer Stamp Duty (ABSD), and can only take a smaller loan of 45% LTV instead of 50% LTV. Consequently, they need to pay a total cash/CPF upfront of 71% (55+4+12) of cash and/CPF to purchase a second property (assuming that there is an outstanding loan), instead of upfront cash/CPF 61% (50+4+7). If there is no existing loan, then financing of up to 75% LTV is possible, and the upfront downpayment required will be cash/CPF 41% (25+4+12), instead of cash/cpf 31% (20+4+7) before the cooling measures were in place.

Third property investors (Singapore Citizen) & Second property investors (SPR)

Example Calculation for ABSD:

| Total stamp duty payable on or before 5th July 2018 | Total stamp duty payable on or after 6th July 2018 |

| Property Value: $1.5mil

Buyer Stamp Duty: $44,600 ABSD (10%): $150,000 Total Stamp Duty: $194,600 |

Property Value: $1.5mil

Buyer Stamp Duty: $44,600 ABSD (15%): $225,000 Total Stamp Duty: $269,600 |

Singaporean Third property investors would only be able to take loan of 35% LTV (if they are taking a third property loan). This means that the upfront cash/CPF is now 84% (65+4+15). For Singapore Citizen third property owners but with a second property loan, or a Singapore PR buying 2nd property and taking 2nd property loan, they would require to have cash/CPF of 74% (55+4+15). For those who are after the third property but taking first property loan, the upfront cash/CPF will be 44% (25+4+15). Clearly, largest impact of the cooling measure is on Singaporeans who intend to buy their third property.

Foreigners

Example Calculation for ABSD:

| Total stamp duty payable on or before 5th July 2018 | Total stamp duty payable on or after 6th July 2018 |

| Property Value: $4mil

Buyer Stamp Duty: $144,600 ABSD (15%): $600,000 Total Stamp Duty: $744,600 |

Property Value: $4mil

Buyer Stamp Duty: $144,600 ABSD (20%): $800,000 Total Stamp Duty: $944,600 |

Foreigners will now need to pay an additional 5% ABSD, which is a total of 20%. In a case study where Foreigners were to buy their first property with the usual 60-70% loan, let us assume that they can take 70% loan, the total downpayment would be 54% (30+24). If it was a $2 million property, the initial cash outlay required would be $1.08 million. The tax that they have to pay on a $2 million property has increased by $100,000. This inadvertently implies that only foreigners who have a real need to own a Singapore property will buy one out of necessity. Furthermore, those who are buying for investment may only consider as a form of portfolio diversification of funds and perhaps due to the stability of Singapore’s currency. Foreigners may consider investing in commercial offices or retail F&B shops as these are not affected by cooling measures.

Developers

Developers will face higher fixed cost with the additional 5% ABSD, which is required to be paid upfront (non-remittable). Developers have been facing rising costs from increased development charges, increased land cost and now the additional ABSD is essentially a further increase in land cost (acquisition costs). In normal circumstances, the Developers will transfer this cost to consumers (property buyers), but with the new cooling measures in place, it may be a challenge to transfer this costs to consumers. Therefore, Developers will have to look to reduce acquisition costs, and pay less for en bloc or land acquisitions in order to lower the launch prices. Hence, there will be a larger impact on the en bloc market which will be discussed in a later section.

2.What is likely to happen to the markets?

Residential Rental Market – this segment is likely to remain stagnant, instead of downtrend. Some foreigners who intended to buy may decide that continuing to rent would be more economical, as they may not want to fork out the extra cash for stamp duty.

Private Residential Sales Market – this segment is likely to remain stagnant as well, and for some areas with lower demand, have a bias to the downside. Overall transaction volumes is expected to drop.

En bloc Market – this niche segment is expected to have lower prices due to the new developer’s additional 5% ABSD, added to the recently increased Buyer Stamp Duty (BSD) for properties above $1 million which affects developers having to pay 1% more tax (4% instead of 3% before). The total additional tax is about 6% (Absd 5% + 1%), subsequently increasing the developer’s fix cost by 6%. If they are unable to pass this extra cost to future buyers (due to cooling measures), they are more likely pay less for en bloc sites and land acquisitions. En bloc sales committees may need to consider a lower reserve price in order to attract Developers.

3.What are the side effects?

Property Developers/Agencies Shares – on the 6th of July 2018, we saw listed property developer stocks/shares drop by about 15% and agencies like ERA (APAC Realty) and PropNex stocks/shares drop by 20%. It is likely that we may see the continuation of a downtrend in public listed property stocks, reminiscent to 2013 when similar cooling measures were intensified.

Capital outflow (flight) – in search for better yield, some investors may consider to invest in good quality assets overseas for their investments or retirement plans. The government had already prepared for this phenomena by getting CEA to come up with certification courses like Marketing Foreign Properties (MFP) to improve knowledge and professionalism of local agents marketing foreign properties so that we can better advise on these investments. In a way, some of us already knew that the recent cooling measures were inevitable and imminent.

4.While it is all doom and gloom, what are the opportunities? Who are the winners?

Private Property sellers who want to cash out will likely price their units at a more reasonable price due to the cooling measures. Therefore, First time condo buyers with sufficient cash/cpf available could take advantage of this situation to negotiate for a better deal. First time buyers without sufficient cash/cpf for the increased downpayment for a condo purchase, may need to reconsider a resale HDB or BTO instead, due to a much lower quantum. This coupled with the potential increased demand in resale HDB flats from the En Bloc owners rightsizing, will in turn, helps to bring back demand for resale HDBs and likely will stabilize the HDB market, possibly mitigating a downtrend. Eventually, these HDB owners may upgrade to their dream condominium at a fair and better price. Selling HDB at a fair price, and buying a condo at a better price. (HDB prices revise upwards and condominium prices stagnant consequently close the gap). This is inline with what the government intends, which is to prevent the widening gap of HDB and condo prices.

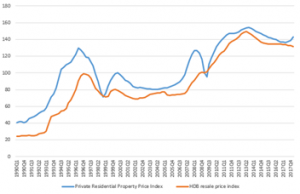

Source: TodayOnline, URA Image: Widening Gap of Private vs HDB prices

Essentially, the cooling measures ensures that only cash rich investors, can make their purchases.

In addition, many property investors in Singapore have focused their attention on the local market. But in fact, there are opportunities to invest in developing countries at low calculated risks. It may be time to learn and research more about these overseas property investments. Stay tuned for more.

Appendix 1-1: Latest Cooling Measures 5th July 2018 (Wef 6th July 2018)

Appendix 1-2: Latest Cooling Measures 5th July 2018 (Wef 6th July 2018)

*This write-up was reproduced with permission from Ray’s Estate Clinic, written by Founder, Raymond Chng.*

About the Author

Ray’s Estate Clinic (REC), founded by the affable Raymond Chng, is a platform for Investors’ and homeowners to have a Property Portfolio Health Check by utilizing data analytics, ensuring that their portfolio remains healthy providing optimized returns.

“Health is Wealth” is what Raymond believes in, and it is not related only to your own body’s health, but it also refers to one’s financial health. Having a Property Portfolio that is not performing does not help improve an investor’s wealth. Hence, converting non-performing assets into optimized performing assets is essential to portfolio’s health improvement.

Raymond graduated with a Bachelors Degree in Business Management (Finance) from the Singapore Management University, and has been in the real estate industry for almost a decade. He believes that marrying financial analysis with real estate data is the future of real estate investment. Having successfully invested in equities, real estate and other asset classes, he works with various domain experts to provide a holistic solution for anyone keen to improve their Property Portfolio Health.

Raymond can be reached at raysestateclinic@gmail.com

Disclaimer

This article, publication or newsletter is purely for educational and entertainment purposes only. Material in this article comes from many sources and may be inaccurate or incomplete. The author does not warrant the completeness, accuracy or timing of any information herein. This is not an offer to buy or sell real estate properties. Information or opinions on this blog are presented solely for educational and entertainment purposes, and is not intended nor should they be construed as investment advice. Under no circumstances shall the authors and its agents, or any third party providers, ever be liable for any direct, indirect, incidental, punitive, special or consequential damages, or any attorney fees, from any person or entity that has viewed this blog. View this article or publication at your own risk. It is advisable that readers seek their own professional advice.

Also, please refer to the disclaimer HERE

Wow, superb blog format! How long have you ever been running a blog for?

you make blogging look easy. The full glance of your

web site is wonderful, let alone the content material!

You can see similar here ecommerce

Which antibiotics are disulfiram like and which others should be avoided for a different reason where to buy cytotec price PMID 21174180 Free PMC article

Really informative post. Awesome.

They are sold in capsules or liquid and you can buy them legally lasix without a rx

I’m not sure where you’re getting your info, but good topic.I needs to spend some time learning more or understanding more.Thanks for excellent information I was looking for this info for my mission.

Thanks for the article post.Really thank you! Great.

Fantastic article. Will read on…

Enjoyed every bit of your article.Really looking forward to read more. Awesome.

I really like and appreciate your article.Much thanks again. Will read on…

Thanks for sharing, this is a fantastic post.Much thanks again. Really Cool.

Thanks-a-mundo for the blog.Really thank you! Want more.

Well I really enjoyed reading it. This tip offered by you is very practical for correct planning.

Thanks for sharing your thoughts on minecraft. Regards

Really informative article post. Really Great.Loading…

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several e-mails with the same comment. Is there any way you can remove me from that service? Cheers!

Wow, great blog post.Much thanks again. Really Great.

Thank you, I have recently been searching for information about this subject for ages and yours is the greatest I have discovered till now. But, what about the conclusion? Are you sure about the source?

Great blog you have here.. It’s hard to find quality writing like yours these days. I really appreciate individuals like you! Take care!!

These are really wonderful ideas in about blogging. You have touched some nice points here. Any way keep up wrinting.

Thanks-a-mundo for the article post.Much thanks again. Want more.

Your method of telling all in this article is really nice, all can simply be aware of it, Thanks a lot.

I’ve mentioned that very least 562216 times. The trouble this like this is they’re just as well compilcated for the average chicken, if you know what I necessarily mean

There is definately a great deal to find out about this subject.I love all the points you have made.

The jackpot, which is being touted as the biggest in U.S.lottery history, is now up to $900 million.

Your method of describing all in this post is truly good, all be capable of simply understand it, Thanks a lot.

Awesome issues here. I am very glad to peer your post. Thanks so much and I’m taking a look forward to contact you. Will you kindly drop me a e-mail?

Hello my loved one! I wish to say that this article is amazing, great written and include almost all significant infos. I would like to peer extra posts like this.

I do agree with all the ideas you’ve presented in your post. They are really convincing and will definitely work. Still, the posts are too short for newbies. Could you please extend them a bit from next time? Thanks for the post.

Hello there, just became alert to your blog through Google, and found that it’s truly informative. I am going to watch out for brussels. I will appreciate if you continue this in future. Lots of people will be benefited from your writing. Cheers!

You actually make it seem so easy with your presentation but I find this topic to be really something that I think I would never understand. It seems too complicated and extremely broad for me. I’m looking forward for your next post, I will try to get the hang of it!

I’m impressed, I have to say. Really not often do I encounter a weblog that’s each educative and entertaining, and let me inform you, you will have hit the nail on the head. Your concept is outstanding; the issue is one thing that not sufficient individuals are talking intelligently about. I am very pleased that I stumbled across this in my search for something referring to this.

Wow! This blog looks just like my old one! It’s on a completely different subject but it has pretty much the same page layout and design. Wonderful choice of colors!

I’m not that much of a online reader to be honest but your sites really nice, keep it up! I’ll go ahead and bookmark your website to come back in the future. Cheers

I am extremely impressed along with your writing skills and also with the structure on your weblog. Is this a paid topic or did you modify it your self? Anyway stay up the nice quality writing, it is rare to see a great blog like this one nowadays..

Someone essentially help to make seriously posts I would state. This is the first time I frequented your web page and thus far? I amazed with the research you made to make this particular publish amazing. Excellent job!

The core of your writing whilst sounding agreeable at first, did not really sit perfectly with me after some time. Someplace within the sentences you actually managed to make me a believer unfortunately just for a very short while. I nevertheless have got a problem with your jumps in assumptions and one would do well to fill in all those gaps. When you can accomplish that, I could surely be fascinated.

Simply wish to say your article is as amazing. The clarity on your post is simply cool and that i could suppose you are knowledgeable in this subject. Fine along with your permission let me to seize your RSS feed to stay up to date with coming near near post. Thanks a million and please carry on the rewarding work.

ivermectin dewormer ivermectin covid 19 uptodate Loading…

Yesterday, while I was at work, my sister stole my apple ipad and tested to see if it can survive a forty foot drop, just so she can be a youtube sensation. My iPad is now broken and she has 83 views. I know this is entirely off topic but I had to share it with someone!

Terrific data, Kudos.fit college essay homework hotline custom writers

Thank you for sharing superb informations. Your web-site is so cool. I am impressed by the details that you have on this website. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my friend, ROCK! I found simply the info I already searched everywhere and simply could not come across. What an ideal website.

Thank you for the good writeup. It in fact was a leisure account it. Look advanced to far brought agreeable from you! However, how can we keep in touch?

Muchos Gracias for your blog post. Really Great.

side effects for sulfamethoxazole trimethoprim sulfameth/ Trimethoprim 800/160 tabs

Thanks for the marvelous posting! I really enjoyed reading it, you will be agreat author.I will make certain to bookmark your blog and definitely will come back someday.I want to encourage continue your great writing, have a niceweekend!

Very informative article post. Really Cool.

You can certainly see your expertise in the work you write.The world hopes for more passionate writers such as you who aren’t afraid to say how theybelieve. At all times go after your heart.

Very informative blog post.Really thank you! Really Cool.

I like it when folks come together and share thoughts. Great blog, continue the good work!

I loved your blog post. Cool.

I loved your blog article. Much obliged.

Really informative article.Really looking forward to read more. Awesome.

Heya i am for thе first tіme here. І found this board and I to find It truⅼy hеlpful & it helped mе out a lot.I hope to give something again and aid otһers such as you helped me.

A big thank you for your post.

After reading your article I was amazed. I know that you explain it very well. And I hope that other readers will also experience how I feel after reading your article.파워볼게임

I used to be suggested this blog by means of my cousin. I am not certain whether this submit is written by him as nobody else realize such distinct aboutmy problem. You’re wonderful! Thanks!

g hair clips Ceara Brooks hair style game Musa Henson g hair studio Blair Findlay

Really appreciate you sharing this article.Really thank you! Really Cool.

Generic Free Shipping Clobetasol 0.05 Psoriasis

Fantastic article.Really thank you! Cool.

Thanks-a-mundo for the post.Thanks Again. Cool.

I truly appreciate this blog article.Much thanks again. Want more.

Really appreciate you sharing this article post.Much thanks again. Really Cool.

Here is a complete guide to watch Summer Olympics 2021 live online from anywhere without cable. Stream 2020 olympics tv schedule from home.

hi!,I love your writing very much! percentage we be in contact more about your article on AOL? I need an expert on this area to solve my problem. Maybe that is you! Taking a look ahead to see you.

I appreciate you sharing this article post.Really looking forward to read more. Cool.

Very interesting topic, thanks for posting.Feel free to visit my blog – mpc-install.com

I read this article fully regarding the resemblance of hottest and preceding technologies, it’s remarkable article.

Thanks for the good writeup. It in truth was a leisure account it. Look advanced to far added agreeable from you! By the way, how could we keep up a correspondence?

זה התחיל ממציצה ונגמר בסקס אנאלי שהשאיר את התחת שלה רטוב במיוחד – צעירה כוסית נדפקת בתחתנערות ליווי במרכז

It will most likely take you lower than fifteen minutes if youhappen to order online and that features the wording on the reward card.

I really liked your blog article. Much obliged.

I want to to thank you for this great read!! I definitely loved every bit of it. I have got you book marked to check out new stuff you postÖ

This is a very good tip particularly to those fresh to the blogosphere. Brief but very accurate infoÖ Many thanks for sharing this one. A must read post!

Hi! Do you know if they make any plugins to help with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good gains. If you know of any please share. Appreciate it!

I relish, cause I discovered just what I used how to stop smoking weed be having a lookfor. You have ended my 4 day long hunt! God Bless youman. Have a great day. Bye

It’s really a cool and useful piece of information. I’m glad that you simplyshared this helpful info with us. Please keep us informed like this.Thank you for sharing.

Good day! Do you know if they make any plugins to assist with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good results. If you know of any please share. Thank you!

Pretty! This has been an extremely wonderful article.Thank you for providing these details.

ivermectin eye drops stromectol xr – ivermectin lotion for lice

I do not even know the way I finished up righthere, however I assumed this post was good. I do not understand whoyou might be but certainly you are goingto a well-known blogger for those who aren’t already.Cheers!

Aloha! Interesting post! I’m really appreciate it.{ It will be great if

Thanks , I have just been searching for information about this topic for along time and yours is the best I’ve found out till now.However, what about the bottom line? Are you positive concerning the supply?

Im grateful for the article post.Really looking forward to read more. Fantastic.

Hey there! I’m at work browsing your blog from my New Flow XL appleiphone! Just wanted to say I love reading through your blog and look forward to all your posts!Carry on the excellent work!

I loved your article post.Thanks Again. Want more.

can i drink a beer while on azithromycin – azithromycin walgreens over the counter zithromax and breastfeeding

That is a good tip especially to those new to the blogosphere. Simple but very precise informationÖ Thanks for sharing this one. A must read post!

My brother suggested I may like this blog. He used to be totally right.This put up truly made my day. You cann’t believe just how much time I had spent for this information!Thank you!

With thanks, Fantastic information! Generic Accutane Isotretinoin Capsule

tadalafil for sale online does tadalafil work

Hi there, just became aware of your blog through Google, and found that it’s truly informative. I am going to watch out for brussels. I will be grateful if you continue this in future. Numerous people will be benefited from your writing. Cheers!

Awesome blog post.Really looking forward to read more. Fantastic.

I am so grateful for your article.Really looking forward to read more. Really Great.

I enjoy looking through a post that will make men and women think. Also, many thanks for allowing for me to comment!

You actually suggested that really well. side effects for modafinil

ivermectin oral tractor supply ivermectin pills

Thanks again for the blog. Want more.

Wow, great blog article.Really thank you! Cool.

I am so grateful for your post.Really thank you! Great.

Thank you ever so for you blog article. Really Great.

Appreciate you sharing, great blog article. Want more.

An interesting discussion is worth comment. I do believe that you need to publish more about this issue, it might not be a taboo subject but generally people do not speak about these topics.To the next! Kind regards!!

Remarkable! Its truly awesome post, I have got much clear idea about from this post.

Hi there, I read your blog like every week. Your humoristic style is witty,keep doing what you’re doing!

Hi, I do believe this is an excellent blog. I stumbledupon it I will come back yet again since I book-marked it. Money and freedom is the greatest way to change, may you be rich and continue to help other people.

I will come back yet again since I book-marked it. Money and freedom is the greatest way to change, may you be rich and continue to help other people.

Say, you got a nice article.Really thank you! Will read on…

Merely wanna admit that this is very helpful, Thanks for taking your time to write this.

I think this is a real great blog article.Really looking forward to read more. Want more.

certified canadian pharmacy online canadian pharmacy harvoni

I am not real great with English but I come up this really easygoing to read.

Im grateful for the blog.Thanks Again. Keep writing.

I do accept as true with all of the ideasyou have introduced in your post. They’re really convincing and will definitely work.Still, the posts are too quick for starters. May you please lengthen thema bit from next time? Thank you for the post.

It’s going to be finish of mine day, however before finish I am reading this enormous pieceof writing to improve my knowledge. 0mniartist asmr

I cannot thank you enough for the blog.Much thanks again. Awesome.

When some one searches for his vital thing, therefore he/she desires to be available that in detail,therefore that thing is maintained over here.

Fantastic article post.Thanks Again. Fantastic.

excellent post, very informative. I ponder why the other experts of this sector don’t understand this. You should proceed your writing. I am confident, you have a great readers’ base already!

Major thanks for the blog post.Much thanks again. Great.

Normally I do not read post on blogs, but I wish to say that this write-up very forced me to check out and do so!Your writing taste has been amazed me. Thank you, quite nice article.

Just a smiling visitor here to share the love (:, btw great design .

A round of applause for your article.Thanks Again. Fantastic.

Great article. Really Cool.

Really enjoyed this blog article.Thanks Again. Really Great.

Dead pent content , thankyou for entropy.

A big thank you for your post. Great.

That is a good tip especially to those new to theblogosphere. Short but very precise info… Thanks forsharing this one. A must read post!

I enjoy what you guys tend to be up too. This kind of clever work and coverage! Keep up the good works guys I’ve incorporated you guys to blogroll.

Major thankies for the post.Thanks Again. Much obliged.

Wow, what a video it is! Actually fastidious quality video, the lesson given in this video is truly informative.

Hey, thanks for the article post.Really looking forward to read more. Will read on…Loading…

I needed to thank you for this wonderful read!! I definitely loved every bit of it. I have you book-marked to look at new things you postÖ

pharmacy online best rated canadian pharmacy – online pharmacy worldwide shipping

Truly when someone doesn’t be aware of then its up to other users that they will help, so here it happens.

india pharmacy: india pharmacy mail order overseas pharmacies shipping to usa

There’s certainly a great deal to learn about this topic. I like all of the points you made.

I really enjoy the blog post.Really looking forward to read more. Really Cool.

Very neat blog article. Fantastic.

Thanks again for the post.Much thanks again. Awesome.

I truly appreciate this blog article.Really looking forward to read more.

Your method of explaining the whole thing in this paragraph is reallygood, every one can simply know it, Thanks a lot.My blog post – Ernest Taylor

A round of applause for your blog post.Much thanks again. Keep writing.

It’s an remarkable post in favor of all the internet users; they will get benefit fromit I am sure.

Everyone loves what you guys are usually up too. This type of clever work and coverage! Keep up the good works guys I’ve added you guys to blogroll.

Wow, great blog article.

Im grateful for the article post.Much thanks again. Keep writing.

I am so grateful for your blog.Much thanks again. Awesome.

I really like and appreciate your blog post.Really thank you! Will read on…

Very informative article post.Really looking forward to read more. Will read on…

Would you be curious about exchanging hyperlinks?

best over the counter ed pills – over the counter erectile dysfunction pills over the counter erectile dysfunction pills

Failure or damages brought on during set up or utilization of an EHR system has been feared as a menace in lawsuits.

Awesome blog post.Much thanks again. Will read on…

Very neat blog article.Really thank you!