UnUsUaL Limited – Potential removal of share overhang & Andy Lau’s concert may propel the share price (25 Jul 24)

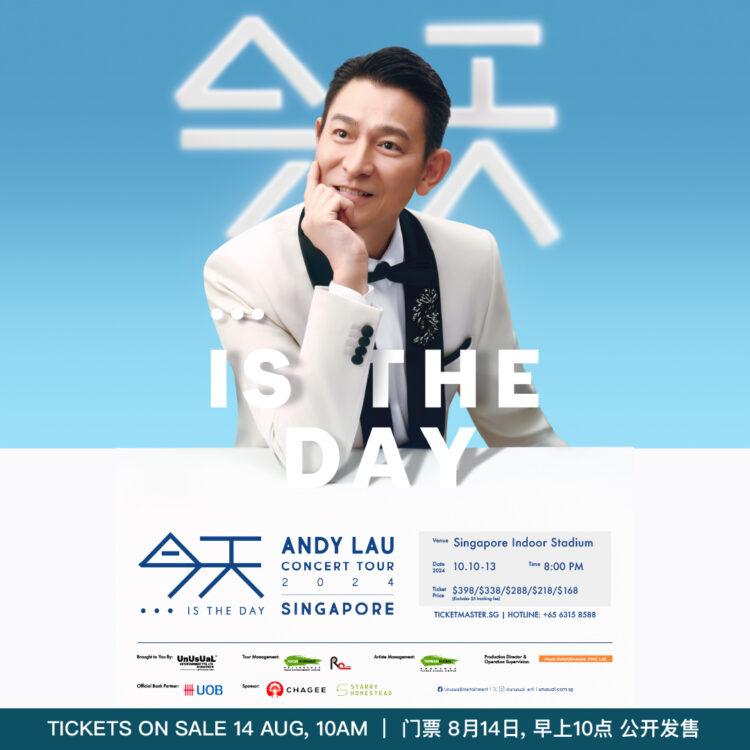

Dear all, UnUsUaL Limited (UnUsUaL) recently caught my attention due to a) It has slumped approximately 29% from $0.170 on 30 May to touch $0.120 on 16 – 17 Jul; b) Married deals of 19.0m shares transacted at $0.120 on 19 Jul and 1.6m shares at $0.125 on 22 Jul; c) Andy Lau is reportedly going to sing in Singapore. For the above point c), UnUsUaL announced yesterday on their Facebook (click HERE) that Andy Lau will be coming to Singapore for four nights from 10 – 13 Oct at Singapore Indoor Stadium. Given the above developments, it may arguably […]