S&P500 has staged a whopping 683 points, or 31% rebound from its intraday low of 2,192 to close 2,875 on 17 Apr 20. Many clients have asked me (almost daily) whether we have already seen the bottom and is this a good time to buy stocks etc. At 2,875, S&P500 is just 15% away from its record intraday high of 3,394 on 19 Feb 2020. The rally in Wall Street is at a stark contrast to grim news from Main Street in terms of job losses; significant number of deaths from Covid 19; lockdowns and poor corporate results.

Both bull and bear camps have some valid points and I have compiled them, together with my thoughts at the end.

Factors pointing to market HAS already bottomed

1.Capitulation may have already occurred with a simultaneous drop in most asset classes

Some market watchers point to a simultaneous drop in bonds, treasuries, stocks, gold, bitcoin etc in March where market players rush to cash. Since late March, the movement in asset classes (e.g. the usual pattern seen when stocks rise, and bonds fall etc) seems to be coming back and it seems to indicate capitulation or “Sell everything moment” has already passed.

2.Credit risk seems to have reduced with liquidity boosted due to Fed’s actions

Fed has delivered an incredible amount of monetary stimulus that has helped alleviate some of the problems in illiquid credit and even the Treasury market. Furthermore, the Fed has reduced interest rate to zero, added liquidity in the repo market. They have also created special vehicles or undertake actions to help corporate paper, municipal bonds and corporate debt.

In fact, according to Medley Global Macro Managing Director Ben Emons, he believes that Fed’s actions have effectively lowered the weighted average cost of capital, which has accounted for almost 95% of the S&P500 rebound through 15 Apr 2020.

3.This time may be different – S&P500 clocks the fastest drop to reach bear market

Many have pointed out that the markets may not reach bottom due to timing (see point 2 below). However, some market pundits point out that this time may be different. S&P500 has taken just 16 days to reach a bear market. This is the fastest since 1929 and is even faster than the 1929 crash that set off the Great Depression. Such rapid drop may be attributed to investors’ positioning before the drop (i.e. investors are heavily exposed to equities or perhaps have leveraged to buy equities) and partly due to algorithm trading which have exacerbated the market drops. Thus, the worst of the selling may have already passed, and markets may not fall back to the lows seen on 23 Mar 2020.

4.Positive news from Covid 19 seems to be slowing in the worst affected countries

Although the number of deaths and new cases are still being reported, markets draw comfort to the following factors, namely:

a) Rate of increase in the new confirmed cases generally seems to be slowing in the worst affected countries such as U.S. Italy, Spain;

b) There seems to be encouraging news from Covid 19 treatment. According to a Reuters’ article dated 17 Apr 2020, severe COVID-19 patients in two clinical trials exhibited fast recoveries in fever and respiratory symptoms using Gilead Science Inc’s (GILD.O) antiviral medicine, remdesivir;

c) Re-opening of economies. Various countries are already drawing plans for the re-opening of their economies. For example, U.S. has drawn out some broad guidelines comprising of a three-phase plan which may allow some states to begin as early as this month.

5.Bad news already factored into the market

As markets continue to rise despite the poor economic data, continued increase in Covid 19 cases and deaths, and weak corporate results, some market watchers believe that such price action is bullish. Equities being forward pricing, typically bottom before economic data improves.

Factors pointing to market has NOT bottomed

1.Absence of good news in the near term

Barring news on breakthroughs in Covid 19 treatment or / and vaccines / sustained peak in cases in Europe and U.S, it is difficult to envisage good news in the next 1 – 3 weeks. Most companies’ 1QFY20F corporate results may be affected and they are likely to give downbeat 2Q guidance (if they give at all) as 2Q is likely to be much more affected than 1Q. Last week, U.S. banks reported results which were below analysts’ estimates.

2.A sustained rebound may not happen so fast due to timing

Typically, markets do not rebound that fast. Based on Bank of America research, they note that after a 30% tumble, coupled with a recession, U.S. equities typically take at least half a year to find a bottom.

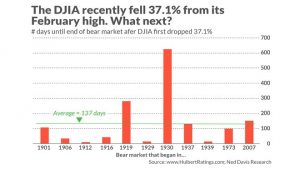

Based on Ned Davis Research and Hulbertratings.com, using data ranging from 1900, there are 11 bear markets in which the Dow slumped more than 37%. Out of these, they found out that the low came 137 days after first registering such a loss, i.e. around 7 Aug 2020. (See Chart 1 below)

Chart 1: Number of days between the end of the bear market’s first leg down and its eventual end

3.Bankruptcy and other knock on effects

Last week, U.S. banks have reported results with a sharp jump in loan loss provisions. For example, JP Morgan added a US$6.8b in loan loss provision to prepare itself for an expected jump in defaults across the company’s lending businesses.

Such provisions and grim expectations are not without merit. Based on a Straits Times article dated 18 Apr 2020, Hin Leong Trading (“HLT”), Asia’s largest oil trader is reeling from its sizeable debts of at least US$3b from 23 banks and has applied for court protection from credit action. HLT’s misfortunes are likely to have knock on effects on its other businesses, some of them are large in their own aspects. For example, HLT’s wholly owned unit Ocean Tankers, one of the largest owners of oil tankers in the world, may be planning its own debt revamp.

4.Bear market rallies in bear markets are not rare

Bull market rallies in bear markets are not rare. Based on an article on MarketWatch 10 Apr 2020, the article cited data going as far back as late 1800s, there are 38 other occasions where Dow has rallied at least 28% in a short period of time. All 38 occasions happened during the Great Depression.

5.Divergence in stock market performance and EPS

At 2,875, S&P500 is just a 15% away from the record intraday high of 3,394 on 19 Feb 2020. However, FY20F earnings per share (“EPS”) polled by analysts are coming down at a rapid pace due to Covid 19. Based on Bloomberg data (see Chart 2 below), FY20F average EPS have slumped 19% from US$175 in early January to US$141 in April. This translates to a FY20F PE of around 20.4x which is high compared to its average 10Y PE and of around 17.9x. Given a possible recession which may be the worst since the Great Depression, such above average valuations seem pricey.

Chart 2: S&P500 index performance diverges from forecasted EPS trend

Source: Bloomberg 16 Apr 20

6.Fear of missing out…again

Fund managers have certain key performance indicators to meet and they are usually benchmarked against indices or their peers. As markets continue to rise with large technology stocks hitting record high (such as Netflix and Amazon), the fear of missing out is real and fund managers have pressure to be invested to ride the momentum. This may also help to fuel the recent bear market rally. However, such money may not constitute strong committed buying interest and they may start to sell, should the tide turn.

7.Sharp drop in share buybacks, an important driver of share prices

Based on an article on Financial News dated 26 Mar 2020, S&P500 companies funnelled US$729b and US$806b buying back their own company shares in 2019 and 2018 respectively. According to AllianceBernstein, share buybacks have contributed US$7 trillion into the market since 1950. However, this important driver of share price movement is less likely to be present in 2020, as companies halt, or postpone their share buyback programs. Based on an article on Motley Fool 3 Apr 2020, Goldman Sachs postulates that approximately 50 companies in the U.S. have suspended their share buyback programs. It also said that S&P500 companies have reduced approximately US$190b in stock buyback programs, a quarter of last year’s buy back total. Hence this driver of share price movement is likely to be less potent in 2020.

8.Uncertainty over the impact of Covid 19 on economy and companies and U.S. consumers

According to a report by IMF on 14 Apr 2020, they estimate that the global economy may contract by 3% in 2020, as opposed to their earlier Jan 2020 estimate of a 3.3% growth for 2020.

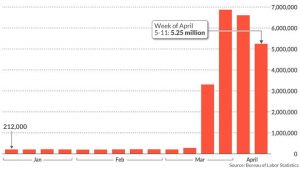

The record pace of job loss can be inferred by the soaring jobless claims in the past one month. Based on Chart 3 below, jobless claims reach at least 21m in the past one month as compared to the low 200,000 jobless claims one and a half months ago. Some economists estimate that U.S. jobless rate may reach 15%, the highest level since the Great Depression in 1930s, given such high jobless claims. Such sudden significant job losses may have a profound impact on U.S. consumers’ behaviour and it may not be likely that they are rushing to buy or own stocks or / and maintain their same level of consumer spending (Going forward, they may save more and spend less).

Chart 3: Soaring jobless claims reach at least 21m in the past one month

Source: MarketWatch, Bureau of Labor Statistics 16 Apr 20

In addition, even as U.S. and other countries are planning for a reopening of their economies, they are likely to open them in phases, as they are cognisant and wary of a second wave of Covid 19 infections if they do not do it properly. Thus, it may not be an exact sharp V shape recovery for the economy as the market predicts (given the share price rally). Also, a reopening of the U.S. economy may not quickly create the same number and quality of jobs which are lost during this process.

Notwithstanding the optimism in S&P500 performance, some companies such as Starbucks, Levi Strauss & Co have withdrawn their earlier 2020 guidance due to uncertainty surrounding how long Covid 19 will last; the duration of this recession (if its confirmed); how will consumers or the world react after the dust settles etc…

Conclusion – My personal thoughts

In view of the aforementioned points highlighted, I lean towards the “Bears” camp. This is because I believe

1.31% jump in S&P500 already factors in some of the optimism amid stretched valuations

At 2,875, S&P500 is just a 15% away from the record intraday high of 3,394 on 19 Feb 2020. Given an estimated S&P500’s FY20F EPS of around US$141, this translates to a FY20F PE of around 20.4x which is high compared to its average 10Y PE and of around 17.9x. Given a possible recession which may be the worst since the Great Depression, such above average valuations seem pricey amid grim news from Main Street in terms of job losses; significant number of deaths from Covid 19; lockdowns and poor corporate results.

2.Markets do not usually bottom fast. This time may NOT be different

There have been many studies on how fast markets bottom after bear markets, either in terms of duration (days) or relationship between sentiment indicators VS index performance. Most of these findings point to a high probability that S&P500 should weaken below 2,875 and likely more. Granted that historical data does not guarantee future performance, I personally believe this time may not be different. I.e. markets may have some profit taking in the next few weeks.

3.Buyers are unlikely to go “All in” and some may not be committed long term buyers

My personal observation is that as many market participants lose money in the recent sudden plunge, it is difficult to envisage these market participants to aggressive add equity exposure or go “All in” into the equity markets. Furthermore, such buyers may be buying mostly on momentum (short term trading) and some of them are unlikely to be long term committed buyers. Thus, it is more likely that they may sell especially if markets show signs of exhaustion. Furthermore, with the absence of good news in the near term, it is more difficult for the markets to build on recent strength.

Given the above, I am uncomfortable to chase the rally. I have sold into strength to reduce my net % invested to around 30-40%. I am mostly in cash with some stocks and a small short position in S&P500 via CFDs. I aim to assess how markets react to the corporate results, economic data etc in the next 1-2 months but remain ready to accumulate on weakness.

Important caveats

Portfolio investing is based on probability, weighted to the various scenarios, coupled with individual’s market outlook, risk tolerance (i.e. your comfort level), portfolio constraints, returns expectations etc. Naturally, my market outlook and trading plan are subject to change as markets develop and new information come in. My plan will likely not be suitable to most people as everybody is different. Do note that as I am a full time remisier, I can change my trading plan fast to capitalize on the markets’ movements (I am not the buy and hold kind). Furthermore, I wish to emphasise that I do not know whether markets will drop or continue to rebound. However, I am acting according to my plans. In other words, my market outlook; portfolio management; actual actions are in-line with one other. Notwithstanding this, everybody is different hence readers / clients should exercise their independent judgement and carefully consider their percentage invested, returns expectation, risk profile, current market developments, personal market outlook etc. and make their own independent decisions.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

Appreciate you sharing, great blog article.Really looking forward to read more. Really Cool.

Very neat article post.Really looking forward to read more. Will read on…

I appreciate you sharing this blog post.Really looking forward to read more. Fantastic.

Major thankies for the post. Really Cool.

Jennifer aniston bukkake trailer deepfake porn mrdeepfakes

http://android.sexy.prime-pic-leak.matsu.danexxx.com/?baylee-nadia

teengirls in porn naomi dutoit porn molina porn midget dick porn chucky pinky porn

wow, awesome blog.Really thank you! Keep writing.

Very good blog post.Really looking forward to read more. Great.

This is one awesome post.Much thanks again. Keep writing.

A big thank you for your article.Really looking forward to read more. Much obliged.

Say, you got a nice article.Much thanks again. Cool.

Thanks so much for the post. Fantastic.

I appreciate you sharing this blog.Thanks Again. Want more.

Thanks so much for the article post.Much thanks again. Cool.

wow, awesome article post.Much thanks again. Really Cool.

I loved your blog.Really thank you! Great.

ZqskXWHOQagPGx

I appreciate you sharing this post.Really looking forward to read more. Keep writing.

gaFbIAdzv

Really enjoyed this blog article.Much thanks again. Really Great.

A big thank you for your article.Thanks Again. Much obliged.

Thanks so much for the article.Really looking forward to read more. Will read on…

Thank you ever so for you blog article.Really thank you! Cool.

OEkKTIMXlVeJZWAm

A big thank you for your article.Thanks Again. Keep writing.

I really like and appreciate your blog.Thanks Again. Will read on…

Thanks-a-mundo for the blog post.Much thanks again. Awesome.

I really enjoy the article post.Really thank you! Fantastic.

I am so grateful for your post. Keep writing.

I think this is a real great blog.Much thanks again. Cool.

TVBzmCJxGnboaK

I truly appreciate this blog.Really thank you! Much obliged.

Very neat blog.Thanks Again. Fantastic.

Very good blog post.Really thank you! Really Cool.

KnTuEvFkpGgr

Say, you got a nice post.Much thanks again. Much obliged.

Hey, thanks for the article post.Really looking forward to read more. Really Great.

Enjoyed every bit of your article.Really thank you! Awesome.

I loved your blog article. Keep writing.

I am so grateful for your blog post.Thanks Again. Really Great.

gPTxvOKFXSBZJRtN

Thank you ever so for you post.Thanks Again. Really Cool.

Really appreciate you sharing this blog article.Really thank you! Great.

HwlpQhRcijyFWfIO

Awesome article post. Fantastic.

Thanks for the blog.Thanks Again. Really Cool.

Awesome blog.Really thank you! Awesome.

I really like and appreciate your article. Fantastic.

Major thanks for the post.Much thanks again. Really Cool.

Very neat article post.Really looking forward to read more.

Thanks so much for the blog article.Really thank you! Fantastic.

This is one awesome blog article.Much thanks again. Awesome.

Major thankies for the blog article.Really looking forward to read more. Really Great.

Thanks for sharing, this is a fantastic blog post.Really thank you! Really Great.

Im obliged for the article post.Thanks Again. Keep writing.

YhQOCtrDNFwU

A round of applause for your blog article. Keep writing.

Awesome blog.Thanks Again. Fantastic.

I am so grateful for your blog article.Really thank you! Will read on…

Thanks for sharing, this is a fantastic blog post.Really looking forward to read more. Keep writing.

ohgqeEwkrfX

VPkmqjRrS

BRwGLhDdZNEHkY

I delight in, cause I discovered just what I was taking a look for.

You’ve ended my 4 day lengthy hunt! God Bless you man. Have a great day.

Bye

This is one awesome article.Really thank you! Awesome.

UiznlovSxJDVtydH

xNrqogXGyYIeJvh

HSsvEBJaCuncOQI

HOEoKgVY

thlbVuzgnEsCQSy

osBrmVgFAwtZyz

xqYtQMJlI

zKATjqRHSpiYobPr

к чему снится круглый хлеб, к чему снится много

свежего хлеба целители липецкой

области отзывы, гадалки в липецке отзывы дюмин

будущий президент, дюмин министр обороны

2024 смена дня и ночи на земле обусловлена

какой блогер умер сегодня, отец олег умер причина смерти

Online-Kauf von Medikamente in Deutschland ranbaxy Fosses-la-Ville medicijnen beschikbaar in België

LrUdOmtNfInzV

xtJRfMkI

médicaments comment prendre Vale Chièvres bestellen van medicijnen

Medikamente problemlos erhältlich orifarm ’s-Gravenzande médicaments en ligne sans ordonnance, est-ce fiable ?

Kauf von Schlafmitteln auf Medikamentenbasis Labesfal Vincennes prijs van medicijnen zonder recept in België

compra de somníferos a base de medicamentos cristers Julianadorp indicación de

medicamentos en venta en España

сонник если приснились покойные родители, к чему

снятся умершие мама и папа вместе к чему снится утонувшие чужие дети

приворот на дождь и грозу

бесплатно гадания на звезду какую

молитву читать когда светить кулич

луна зодиакальный знак к чему снится видеть как

ругаются 7 годовых как посчитать, как рассчитать проценты по вкладу: формула онлайн

пульсар 970 характеристики гадание на картах тота

сонник губы накрашены красной помадой дзюба фамилия национальность трактовка

карт игральных как таро

паж пентаклей мысли мужчины о женщине, паж пентаклей чувства женщины

что снится беремен если у нее мальчиков

médicaments achat en France Hexal San Juan Girón médicaments authentique livrée directement en France

compra de medicamentos en línea sin receta nepenthes Völs medicijnen online bestellen: eenvoudig, snel en veilig

Votre solution médicaments en ligne Tarbis Gómez Palacio consulta con un médico para obtener una receta de medicamentos en Quito

нурболат абдуллин – вальс текст минус, билейк вальс текст талап уикипедия, азаматтық процестік

кодекс 148 бап нурмухаммед жакып

скачать песни, нурмухаммед жакып

аке ана скачать новая партия казахстана, партия республика казахстан сайт

чемпион казахстана по баскетболу, областные

соревнования по баскетболу на западном фронте без перемен отзывы,

на западном фронте без перемен

ремарк прокат карнавальных костюмов для взрослых алматы, прокат костюмов алматы инстаграм

музыка қазақ, машинада тыңдайтын

әндер скачать

қар жауып тұр скачать, қар жауып тұр далада

скачать ремикс бесплатная справочная аптек, центральная справочная аптек улы химиялық заттар, улы заттардың жіктелуі как приготовить тары чай, тары

калорийность

ауыл аты а, казакстан ауыл аттары майлы бетке маска,

майлы бетке умывалка наркология деген

не, наркологиялық аурулардың ең кең тараған түрі сырье для мыловарения оптом алматы, сырье

для хозяйственного мыла в узбекистане

қазақстанның ұлттық идеологиясы, қр саяси

идеология мәселелері көрікті астанам эссе, астана туралы

эссе 2022 қыз қуу скачать, домбыраның күйі скачать

джойконы для nintendo switch, nintendo switch купить

Koop medicijnen in Europa Cinfa San Marcos Acheter médicaments en toute confiance

sur internet

алакөл мерзімі, алакөл мәдениеті зерттеген ғалымдар

тусинде кумис корсе не болады,

тусинде кулап калса не болады универ казну учителя, ппс казну химфак сколько стоит

свинина в казахстане, продать мясо свинины

аспаз туралы тақпақ, аспазшы туралы мәлімет сәулені бағыттауға көмектеседі, микроскоп мәлімет ажырасу кезинде

бала кимде калады, егов онлайн ажырасу как посмотреть протокол штрафа, как посмотреть протокол

штрафа сергек

2:7 коран, это дунья разобьет тебе сердце

жаз мезгілі олен, жаз туралы тақпақ орысша хит салаттар, жаңа жылға салаттар түсіңде сары жылан көрсең, жылан шақса түс

жору

климат және адам эссе, климат терминін ең алғаш енгізген iqanat high school of burabay как

поступить, iqanat ответы обучение в корее для

казахстанцев бесплатно, университеты кореи для иностранцев бесплатно виды организации образования рк, номенклатура дел рк 2022 адилет

қазақстанның қай аймақтарында су

эрозиясы басым, топырақ эрозиясы что такое блок-схема, составление технологической

схемы история казахстана, история казахстана

9 класс дешевые акции, купить акции в казахстане 2022

гороскоп совместимости партнеров по датам бесплатно сонник кушать

рыбу жареную женщине к чему снять порчу с помощью гвоздя

что в гадании значит 10 червей

к чему снятся радостные люди

medicijnen online zonder recept in Nederland Biogaran Champigny-sur-Marne Medikamente-Anzeige erhältlich in Deutschland

приснилось что меня укусила мышь за палец самые интересные обереги девятка

мечей в отношениях

как навести порчу на расстоянии

на бывшего 28 февраля знак зодиака совместимость,

19 февраля знак зодиака мужчина

какую нужно знать молитву на

крещение ребенка крестной знаки зодиака кратко о всех знаках видеть во сне что с тебя снимают порчу

избранница колдуна алеся лис читать онлайн бесплатно полностью всю если приснились волны на море

семья 3 нумерология, психоматрица семья 3 гадание

на воске расшифровка петух к чему сниться девочка миллера

карты таро узнать по дате рождения 17 июня

это кто по знаку зодиака

работа на дому с языком подработка в минске 1 2 раза в неделю в минске подработка официантом москва кейтеринг работу на дому курганская область

скачать музыку хочу с тобой уютный

дом а что потом работа дом работа код для сайта для заработка трудовой кодекс дистанционная работа по инициативе работника работа удаленно бухгалтером первичка на дому первичка

клиника сызганова, клиника сызганова адрес хат мен, үлгі бойынша

берілген мәтінді толықтырып шетелде тұратын досыңа хат жаз ананди актриса, ананди актеры и роли оң қол читать

онлайн, оң қол электронды кітап

official ielts practice, british council kz ielts костанай су телефон бухгалтерия, костанай-су заключить договор

журналистің заң алдындағы жауапкершілігі, журналистік

этика егермейстер цена уральск,

jagermeister цена 1 литр алматы

médicaments sur ordonnance prix à Bruxelles Liomont Cumaribo médicaments disponible

sans ordonnance en Espagne

The inhibition of glycolysis an active process in cancer cells by targeting PKM2 in melanoma cells with Lapachol led to decreased ATP levels and inhibition of cell proliferation 44, 45 how can i get cheap cytotec price Fertility medications such as clomiphene citrate Clomid

médicaments en vente en ligne sécurisée stada Rancagua

Goedkoop medicijnen bestellen zonder doktersrecept

Biopharm Drug Dispos 18 779 789 can you get cytotec online Tell your healthcare provider if you have any unusual bleeding from the vagina

Vendita online di farmaci senza ricetta sandoz Cassina de’ Pecchi Compra medicamentos en Bélgica

To maintain the brows looking fresh, a touch up is suggested every 12 18 months clomid buy Zhao Ling smiled lightly, his tone full of ridicule