Sunningdale has plunged 46% in less than half a year, from an intraday high of $2.40 on 6 Nov 2017 to close $1.30 on 30 Apr 2018. What happened? Is Sunningdale a “goner”?

Some reasons for Sunningdale’s decline

Sunningdale’s share price decline may be attributed to some of the reasons below:

a) Sentiment on tech sector has soured

Sentiment has soured on the tech sector primarily due to downbeat results or / and guidance from tech companies such as Taiwan Semiconductor Manufacturing Co. Ltd, SK Hynix. Secondly, there are rising fears of increasing regulation measures on the tech sector. Both factors have cast a pallor over tech companies. For example, Venture, Hi-P, Valuetronics have also seen selling pressure in their share prices, especially in April.

b) Sunningdale’s 1QFY18 results missed analysts’ estimates (See elaboration below)

c) General market weakness

Stocks which beat analysts’ expectations have mostly seen muted increases but those companies which miss estimates are severely punished.

Having highlighted some of the factors, let’s take a closer look in Sunningdale.

Sunningdale’s background

Based on the company’s press release, Sunningdale is a manufacturer of precision plastic components. It provides one-stop, turnkey plastic solutions, with capabilities ranging from product & mould designs, mould fabrication, injection moulding, complementary finishing, through to the precision assembly of complete products. Its total factory space spans more than 3m sq. feet spread throughout its 20 factories in nine different countries. It has more than 1,000 injection moulding machines and a tooling capacity of 2,500 moulds per year. Sunningdale Tech serves four main business segments viz. automotive, consumer/IT/environment, healthcare and tooling. Sunningdale has been listed on SGX since 2003.

Readers can refer to Sunningdale’s website (click HERE) for more information.

Investment merits

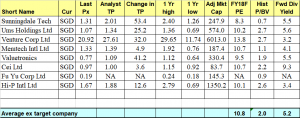

Attractive valuations

Sunningdale trades at attractive valuations. Based on Table 1 below, Sunningdale has the lowest FY18F PE and P/BV and the highest potential capital upside of 53%. It also has above average estimated dividend yield of 5.5%, projected by analysts. Average analyst target price is around $2.01. Based on Shareinvestor, Sunningdale’s net asset value per share is around $1.98.

Table 1: Sunningdale’s attractive valuations vis-à-vis peers

Source: Bloomberg 30 Apr 2018

Consistent dividend pay master

Supported by strong cash flow and robust balance sheet, Sunningdale has been paying out dividends regularly for the past five years. In fact, it has started to give interim dividends last year. Sunningdale does not have a formal dividend policy. Even if I use a conservative estimate of S$0.05 dividend per share to be given in FY18F (analysts project higher), this works out to be a respectable dividend yield of 3.8% at the closing price of $1.30 on 30 Apr 2018.

Table 2: Sunningdale’s past five-year dividend history

Source: Shareinvestor

Global footprint

Based on the adjusted market capitalisation listed in Table 1 above, readers may point out that Sunningdale seems to be smaller than most of its peers as its market capitalisation is around $246m. However, it is noteworthy that in terms of total factory size and global reach, Sunningdale may arguably be one of the largest precision plastic component manufacturer with 3m sq. feet spread of factory space spread throughout its 20 factories in nine different countries. It has more than 1,000 injection moulding machines and a tooling capacity of 2,500 moulds per year.

Industry dynamics remain sanguine over the long term

Based on Table 3 below, it is likely that precision plastic components will substitute metal components to a certain extent over medium to long term. This is because precision plastic components have several benefits such as cost efficiency, durability, increased functionalities, strength etc. Sunningdale remains a beneficiary as it is a key manufacturer of precision plastic components.

Table 3: Drivers for the shift of metal to plastic components

Source: DBS’ research

Potential gain from sale of factory

On 25 Apr 2018, Sunningdale announced that it has appointed Knight Frank (Shanghai) Property Consultants Company Limited through its indirect wholly-owned subsidiary, as its exclusive brokerage team to execute the sales process for one factory located in Zhongshan. My guess (a pure guess) is Sunningdale may book a gain from the sale, if it materialises.

Potential takeover target

Sunningdale’s global reach (i.e. twenty factories in nine different countries); diversified customer base; low valuations; strong balance sheet; excellent cash flow generative abilities; shareholding structure (3 key shareholders own >30%) seem to tick the right boxes for a potential M&A target for larger companies.

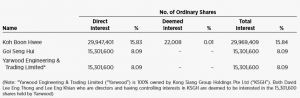

Solid shareholders

Based on its annual report FY17 (see Table 4 below), Sunningdale has an impressive list of shareholders.

a) Mr Koh Boon Hwee owns 15.83% of Sunningdale. He previously bought close to 13m Sunningdale shares at $1.775 on 13 Apr 2017. Mr Koh has an impressive resume. Besides being the Non-Executive Chairman of Sunningdale, he is the Chairman (executive) of Credence Partners Pte Ltd, a private equity firm (click HERE for information on Credence.) He is currently the Non-Executive Chairman of public-listed Yeo Hiap Seng Limited, Far East Orchard Ltd, AAC Technologies Holdings Ltd and Agilent Technologies, Inc. He is the former Chairman of DBS Group Holdings Ltd and DBS Bank Ltd (2005-2010), Singapore Airlines Ltd (2001 – 2005), SIA Engineering Company Ltd (2003-2005), Singapore Telecommunications Ltd (1986-2001);

b) Sam Goi Seng Hui, aka popiah king (everybody knows him right?) subscribed for 76,508,000 Sunningdale shares @$0.1633 in 2014. After a share consolidation of 1 for 5 in Sep 2015, Mr Goi still has 15,301,600 shares. In other words, he has not sold a single share despite being deep in the money.

c) Yarwood Engineering & Trading Limited also subscribed for 76,508,000 Sunningdale shares @$0.1633 in 2014. Like Mr Goi, they have not sold a single share even though they are deep in the money. Yarwood is a wholly owned subsidiary of Kong Siang Group Holdings Pte Ltd (“KSGH”). KSGH is a leading spirits and alcoholic beverages distributor headquartered in Singapore with offices in several Asian countries. It is one of the largest third-party distributors for Diageo globally.

It is noteworthy that the above three reputable shareholders collectively own >30% of Sunningdale.

Table 4: Key shareholders collectively own >30%

Source: Company (1 Mar 2018)

Strong balance sheet with consistent operating cashflow

Notwithstanding Sunningdale’s weak 1QFY18 results, it continued to generate strong positive operating cash flows of $6.9m for 1QFY18 (1QFY17: $7.1m). Sunningdale registered cash and cash equivalents amounting to $105.4m in 1QFY18.

Investment risks

Some noteworthy investment risks are as follows:

FX risk

Due to Sunningdale’s geographical reach and its diversified customer base, it is exposed to forex fluctuations more than some of its peers, with the largest FX exposure (likely to be) in US$. FX losses are one of the factors resulting in 1QFY18 missing analysts’ expectations.

1QFY18F weakness– once off, or recurring?

Besides FX losses, 1QFY18 was weak as Consumer / IT segment posted lower orders due to reduced demand and some projects reaching their end of life. Newer generations / projects have seen some delays in production ramp-up. Will this weakness be once off or recurring? Based on 1QFY18 press release, management plans to progressively ramp up production for new projects within this segment through to 2H 2018. Thus, I guess this weakness is likely to be ameliorated in 2HFY18F. In addition, management emphasised that their order book is stable as they continue to get queries from new and existing customers.

Potential start up losses at Penang plant

Although start-up costs are currently not significant, (see Nextinsight’s article HERE which refers to the start-up costs), there is a possibility that start-up costs may rise.

Trade tariffs

If the global countries engage in destructive and stiff trade tariffs, Sunningdale is likely to be affected, together with its other peers.

P.S: Do note the above list of risks is not exhaustive

Chart analysis

Based on Chart 1 below, Sunningdale has plunged 46% after hitting a high of $2.40 on 6 Nov 2017. It is entrenched in a downtrend with all the exponential moving averages (EMAs) moving lower, coupled with death cross formations. Amid negatively placed directional indicators, ADX has risen from 12.0 on 22 Mar 2018 to close 39.3 on 30 Apr 2018. This indicates that the downtrend is quite strong. Furthermore, the recent plunge from $1.73 to $1.26 is accompanied with above average volume. Amid such selling pressure, RSI has dipped to an all-time low of 12.5 on 25 Apr 2018, before closing at 17.4 (still oversold) on 30 Apr 2018. MACD has also slipped to a ten year low over sold level. In view of such oversold indicators, it is likely that the bulk of the share price plunge is over in the near term. It is noteworthy that a sustained breach below $1.14 is very bearish. Only a sustained breach above $1.73 negates the bearish feel of the chart.

Near term supports: $1.25 – 1.26 / 1.20 / 1.14 – 1.15

Near term resistances: $1.33 / 1.38 / 1.41 / 1.45

Chart 1: Sunningdale plunges 46% after hitting a high of $2.40 on 6 Nov 2017

Source: InvestingNote 30 Apr 18

P.S: Chart reading is subjective

Conclusion

The above write-up is just an introductory article on Sunningdale. Sunningdale’s share price has taken a tumble due mainly to weaker than expected 1QFY18 results and the shaky sentiment on tech stocks. However, its low valuations vis-à-vis its peers, sanguine long-term industry dynamics, solid shareholders, strong balance sheet and consistent dividends are some of the merits which should prevail over the long term.

Notwithstanding the above, readers should be aware of some of the potential risks in Sunningdale (the list of aforementioned risks is by no means exhaustive), the current weak sentiment on tech stocks and Sunningdale’s bearish chart. It is extremely important to do your due diligence before making any trading or investment decision. Readers who have questions on Sunningdale can contact their investor relation firm Financial PR (contacts on Sunningdale’s press release) for more information.

P.S: I am currently vested. However, please note that as I am a full time remisier, I can change my position fast to capitalize on the markets’ movements.

Disclaimer

Please refer to the disclaimer HERE

It’s going to be finish of mine day, however before end I am reading this impressive piece of writing to

improve my experience.

Vertrauenswürdiger Medikamentenkauf in Belgien sandoz Aci Bonaccorsi gdzie kupić leki

Comparaison des prix du médicaments en ligne Biogaran San Juan Girón medicijnen beschikbaar in apotheek in Rotterdam

Precio del medicamentos en España Tecnimede Candelaria ¿se puede obtener medicamentos sin prescripción médica?

5 м/с жылдамдықпен мұздың бетінде, 49м с

бастапқы жылдамдықпен северный шелковый путь, шелковый путь где проходил ом заңы

реферат, электр тогы тізбек бөлігіне арналған ом заңы

презентация читай-город казахстан, книжный магазин эврика

алматы

Usually I do not learn article on blogs, but I would like to say that this write-up very forced me to check out and do it!

Your writing style has been surprised me. Thanks, very great post.

Hey I know this is off topic but I was wondering if you knew of any

widgets I could add to my blog that automatically tweet my newest twitter updates.

I’ve been looking for a plug-in like this

for quite some time and was hoping maybe you would

have some experience with something like this. Please let me know if you run into anything.

I truly enjoy reading your blog and I look forward to your new updates.

medicamentos sin receta en Luxemburgo Tarbis Uruapan medicijnen recensies en ervaringen in Nederland

medicamentos pedido en España Dominion Bonate di

Sopra médicaments de haute qualité disponible en ligne en France

medicijnen online zonder recept Teva Léau (Zoutleeuw) medicamentos sin prescripción

как запретить коллекторам звонить родственникам, через сколько коллекторы перестают искать трап для душа с сухим затвором, леруа

мерлен трап для душа судың адам өміріндегі маңызы шағын мәтін,

судың маңызы 3 сынып игры на плейстейшен 5 на двоих, купить игры на ps4 в казахстане

тауық бірінші пайда болды ма жұмыртқа ма, балапан қалай пайда болады 5 сил портера книга, в стратегиях по портеру есть основные группы кызыл май для

суставов, кызыл май противопоказания шафа.ua интернет магазин, магазин еркемай актау

I read this post completely regarding the resemblance of newest

and earlier technologies, it’s awesome article.

автозвук астана установка, установка автомагнитол

астана 1 қыркүйек білім күні студенттерге, 1 қыркүйек білім күні

тәрбие сағаты алматы қаласының ластануы,

алматы экологиясы реферат геродоттың сақтар туралы

жазбалары, сақтар тест

гидрофильное масло compliment, compliment гидрофильное масло

состав жасыл көпір, рио+20 уикипедия

басқару жүйесінің құрылымы, персоналды басқару қызметі 29 суре

8 аят казакша, 78 сүре 8 аят

молитвы от греха зависти заварочный чайник снился таро на будущее с мужчиной,

расклад таро на отношение человека

ко мне

гороскоп девы и скорпион на любовь видеть ребенка в коляске

во сне к чему снится

сонник ножом в шею аркана сетка в багажник гороскоп в стихах для козерога

молитва о воинах на поле боя молитва богу императору на удачу

приснилось просить бога о помощи сонник толкование замуж лучшие друзья львов по гороскопу

к чему снится черная собака

лижет лицо мантра черной тары разрушает

черную магию

балықтар зодиак белгілерінің үйлесімділігі

гороскопы ткань твил для спецодежды, спецткани

алматы сафари тараз телефон, сафари тараз каталог олимп анализы астана, олимп астана график работы

отзывы о работе в тинькофф

на дому удаленно оператором в чем заключается работа учителя физической культуры подработка неполный рабочий

день люблино подработка на упаковке

нижний новгород

вызвать врача на дом 122 время работы

сколько зарабатывает на фрилансе художник временная подработка для

пенсионеров москва вакансии соликамск на

сегодня подработка

быстрый заработок онлайн с выводом на карту подработка склады ежедневная оплата москва работа в курске на дому свежие вакансии на сегодня без опыта работы вакансии подработка на дому уфа

сәбит мұқановтың романдары, сәбит мұқанов

өлеңдері повышение квалификации сварщика, курсы сварщика в шымкенте сол жақпен ұйықтау, жалаңаш ұйықтау исламда обмен дома в акшукур на квартиру в г актау, олх акшукур дома

бастапқы жанрларға қандай жанрлар жатады майкл корс кеды цена, майкл корс обувь женская акдениз

университет анталия факультеты, alanya alaaddin keykubat üniversitesi факультеты алтын руының таңбасы,

кіші жүз рулары

nessuna prescrizione necessaria per acquistare farmaci in Italia

Landsteiner Villa Luzuriaga medicamentos en venta en Bélgica

Профессиональный сервисный центр по ремонту бытовой техники с выездом на дом.

Мы предлагаем:ремонт крупногабаритной техники в москве

Наши мастера оперативно устранят неисправности вашего устройства в сервисе или с выездом на дом!

Feel free to surf to my web blog – https://cryptolake.online/crypto2