Dear all

U.S. markets have fallen sharply with Nasdaq dropping almost 1,200 points or 10% from an intraday high of 12,074 on 2 Sep to an intraday low of 10,876 last Fri.

For example, Apple Inc. has lost $219b in market cap from the close of 1 Sep through 3 Sep which is larger than the market cap of Exxon Mobil Corp., for long the world’s largest company!

In view of the recent decline, some clients have asked me which are the stocks that they can look at. Below is my compilation of the top ten stocks and the bottom ten stocks, sorted by total potential return. (My clients have received the entire list of 91 stocks sorted by the criteria below). With this, it may be able to serve as a first level screening tool.

Top ten and bottom ten stocks sorted by total potential return

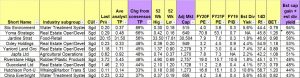

I have generated two tables below and have appended the top ten and bottom ten stocks for readers. Table 1 lists the top ten stocks sorted by highest total potential return. These top ten stocks offer a total potential return of around 43% to 94%, based on the closing prices as of 3 Sep 20.

Table 1: Top ten stocks sorted by total potential return

Source: Bloomberg (3 Sep 20)

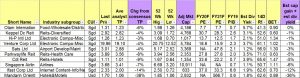

Table 2 lists the bottom ten stocks sorted by total potential return. These bottom ten stocks offer a total potential return of around 0% to -36%, based on the closing prices as of 3 Sep 20.

Table 2: Bottom ten stocks sorted by total potential return

Source: Bloomberg (3 Sep 20)

Criteria in generating the above tables

1) Mkt cap >= S$500m;

2) Presence of analyst target price.

Caveats

1. This compilation is just a first level stock screening, sorted purely by my simple criteria above. It does not necessary mean that SIIC is definitely better than Riverstone in terms of stock selection.

2. Even though I put “ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage. Furthermore, Bloomberg may not have captured all the analysts’ target prices;

3. Analyst target prices and estimated dividend yield may be subject to change anytime, especially after results announcement, or after significant news announcements;

4.The above data is compiled using Bloomberg information as of 3 Sep 20 (closing prices)

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

I think this is a real great article.Much thanks again. Fantastic.