China Railway Construction (“CRCC”) recently caught my attention as it has tumbled approximately 44% from an intraday high of $9.99 on 5 Mar 2020 to close HKD5.64 on 21 Sep 2020.

Is this a bargain buy, or a value trap? Let’s take a look.

First up, a description of CRCC

Quoting from its 1HFY20 results, CRCC’s businesses cover a variety of construction, survey, design and consultation, manufacturing, real estate development, logistics and materials trading and other business with refined industry chain covering scientific research, planning, survey, design, construction, supervision and management, maintenance, operation, investment and financing, etc.

Six reasons why CRCC catches my attention

1) 21 analysts cover CRCC with all buy calls; average target price HKD12.00

Based on Figure 1 below, CRCC is widely covered by 21 analysts. It is noteworthy that all 21 analysts give a buy call on CRCC with an average target price HKD12.00. This represents a potential capital appreciation of approximately 113%. Estimated dividend yield is around 5.0% hence total potential upside may amount to 118%!

Figure 1: Average analyst target HKD12.00; potential capital upside of around 113%

Source: Bloomberg 21 Sep 20

2. Bright long-term outlook

According to a plan published by China Railway Group dated 13 Aug 2020, it plans to almost double China’s high-speed rail network from 36,000km to 70,000km over the next one and a half decade. Total length of track is likely to also increase more than 40% from 141,400km to 200,000km. This spells ample opportunities for CRCC over the medium to long term.

3. Spins off subsidiary to unlock value and control leverage

On 15 June, CRCC said they have submitted documents on the listing of China Railway Construction Heavy Industry Corporation Limited (“CRCHI”) on the Science and Technology Innovation Board of the Shanghai Stock Exchange (“SSE”). This is pending the approval of the SSE and the completion of the CSRC registration procedure. If this listing materialises, it should unlock value and allow it to replenish its capital to allow it to accelerate growth opportunities. According to a Goldman Sachs report dated 18 Sep 2020, they cite that management is confident that the listing will be complete by end of 2020.

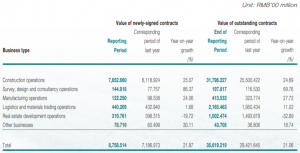

4. New contracts RMB876b signed for 1HFY20, 21.9% higher y/y

On 25 July 2020, CRCC announced that for 1HFY20, it has clinched new contracts amounting to RMB876b, up 21.9% year-on-year. This is remarkable given that most sectors have seen at least some decline in economic activity due to Covid 19 in 1Q2020. Equally impressive, CRCC has outstanding contracts worth a whopping RMB3,562b! (See Figure 2 below)

Figure 2: Outstanding contracts amount to RMB3,562b!

Source: Company

5. Valuations are incredibly low

At HKD5.64, CRCC is trading at a mere current P/BV and PE of 0.3x and 3.6x, as compared to its 10-year average P/BV and P/E of around 0.9x and 8.6x respectively. In fact, if I were to compare against 2-year and 5-year averages, both CRCC’s P/BV and P/E are trading at more than 2 standard deviations away from the averages. As such, CRCC’s valuations are at depressed levels which provide a certain margin of safety for investors (assuming no further negative news).

6. Large discrepancy between A share and H share

According to an article on Forbes 30 Aug 2020, the average premium of Chinese A shares over H shares for dual listed companies is around 27.5% from 2015 – 2020. Based on Figure 3 below, CRCC A share (601186.CH) is currently trading at the largest premium now. Given an indicative rate of CNYHKD 1.1399, 601186 CH trades at an equivalent HKD10.01, translating to a 77% premium over its H share!

Figure 3: Largest price differential between CRCC H share and A share [601186 CH closes CNY 8.78]

Source: Bloomberg 21 Sep 20

Risks

As with almost all investments, they do carry risks. I have listed some noteworthy risks but do note that it is not an exhaustive list of risks.

1. Limited information available

Besides having no access to CRCC’s management, I have limited access to updated analyst reports and articles. This is a challenge that I face in researching on this company.

2. Bearish chart

CRCC is entrenched in a downtrend as evidenced by the declining exponential moving averages (“EMA”). At the close of HKD5.64, this is near the closing low last seen on 12 Mar 2014 (HKD5.63) and 30 Aug 2012 (HKD5.56). ADX has been increasing amid negatively placed directional indicators and closes at 27.5 on 21 Sep 2020. Indicators are weakening with MACD doing a bearish centerline crossover. RSI and OBV are also weakening. In short, this is a bearish chart. However, I draw comfort that volume has been lower than average on days that CRCC is down. A sustained breach above HKD6.20 with volume expansion negates the bearish chart outlook.

Near term supports: HKD5.57 – 5.58 / 5.50 / 5.40 / 5.33

Near term resistances: HKD5.72 / 5.82 – 5.86 / 5.95 – 5.97 / 6.09 – 6.11 / 6.20 – 6.22

Chart 1: CRCC has fallen seven out of the past eight consecutive days!

Source: InvestingNote 21 Sep 20

3. Drops out of FTSE A50 China Index

On 2 Sep, FTSE Russell announced that its FTSE China 50 index will remove CRCC (one out of three companies) from its index, effective after the close of trading on 18 Sep. Hence the recent selling pressure may also be due in part as index tracking funds prepare for the changes.

4. Usual business risks

Some of the usual business risks include execution risks (especially overseas projects); funding constraints for infrastructure projects etc.

5. Sudden demise of CRCC’s Chairman Chen Fenjian raises questions

Based on Chart 1 above, CRCC actually breached the downtrend line on 17 Aug before the announcement of the sudden demise of CRCC’s Chairman Chen Fenjian on 18 Aug. As of now, from the media which I have access to, I have not seen any definitive results from the police investigation into Chairman Chen’s death. However, some media articles speculated that Chen committed suicide. According to some media articles, a team from the State-owned Assets Supervision and Administration Commission started investigation in CRCC and was slated to complete its investigation last month (I am not sure what is the scope of the investigation and whether it is a normal or special investigation). None of the limited analyst reports (which I have access to) has mentioned about this investigation.

6. Volatile stock

Average daily range for CRCC is around HKD0.16 which translates to approximately 3% of its last closing price HKD 5.64. In other words, CRCC can easily swing +3% or -3% from its previous day close on a normal day. Thus, this is a volatile stock and may not be suitable for everybody.

Conclusion

Readers should be cognisant of the pros and cons in owning CRCC shares. Personally, what attracts me is its extremely low valuations, strong order books, likely better 2HFY20F performance vs 1HFY20 and its potential spin-off of its subsidiary. Nevertheless, readers are reminded of some of the potential risks (see above) which you may face, in investing in CRCC. Clients / readers are encouraged to visit CRCC’s website HERE and do your own due diligence. Investments carry risk and its best to be familiar and comfortable in what you invest in.

P.S: I am vested.

Disclaimer

Please refer to the disclaimer HERE

hctz zonder recept online aanschaffen Bestel hctz zonder doktersadvies

hctz online korting in Nederland

hydrochlorothiazide zonder voorschrift eenvoudig te bestellen hctz is zonder recept te

koop in Nederland

hctz aanbevolen voor ovulatieproblemen Veilige online aankoop van hydrochlorothiazide in Nederland

aankoop van hydrochlorothiazide in Italië Ervaar

de gemakken van online winkelen voor hctz in Nederland

hctz zonder voorschrift verkrijgbaar in Zwitserland

hctz kopen online Nederland hctz kopen

hydrochlorothiazide zonder voorschrift verkrijgen in Zwitserland online aankoop van hctz zonder recept

hctz zonder recept verkrijgbaar voor Nederlandse consumenten hctz prijs vergelijken

hctz kopen online Nederland

hydrochlorothiazide bestellen zonder tussenkomst van een arts hydrochlorothiazide bestellen zonder voorschrift:

betrouwbaar en discreet

Koop hctz online en bespaar op uw gezondheidskosten

prijs van hctz op recept

hctz tegen concurrerende prijs in België

hydrochlorothiazide kopen in Nederland

Beste online deals voor hctz zonder voorschrift aankoop van hctz in Europa

hctz zonder doktersvoorschrift te verkrijgen kan je

hydrochlorothiazide krijgen zonder medisch voorschrift

kopen van hydrochlorothiazide in Frankrijk

hctz in Spaanse apotheek bestelling van hctz in Nederland

Koop hctz online in Nederland

prijs van hctz in Amsterdam

Hey very nice blog!

Hmm it seems like your blog ate my first comment (it was super

long) so I guess I’ll just sum it up what I had written and say, I’m thoroughly enjoying your blog.

I as well am an aspiring blog writer but I’m still new to the whole thing.

Do you have any helpful hints for beginner blog writers?

I’d certainly appreciate it.