Dear all

On 29 Dec 2020, I have published a write-up on Sing Medical (“SMG”) where I outlined that the risk reward on SMG seems favourable at $0.315, given a potential share transaction scenario (click HERE). Since 29 Dec, SMG rose approximately 32% to trade $0.415 – 0.420 on several occasions in Feb 2021. Subsequently, it dropped sharply in Apr 2021 when it announced that the potential share transaction has lapsed.

Fast forward to 31 Jan 2022 and SMG closed at a 13-month low at $0.290. This is notwithstanding its sterling record 1HFY21 results announced in Aug last year where it posted a sterling +108% and +28% y/y increase in 1HFY21F profit and revenue respectively.

Why am I interested in SMG? And why now?

Let’s first take a look at what SMG does and then I will outline my basis, and importantly, some of the risks involved.

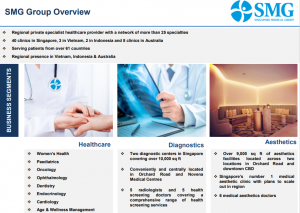

Description of SMG

Based on SMG’s 1HFY21 presentation slides, SMG is a regional private specialist healthcare provider with a network of more than 25 specialities. It has 40 clinics in Singapore, 3 in Vietnam, 2 in Indonesia and 8 clinics in Australia. It is noteworthy that SMG is the largest specialist healthcare provider in Singapore with 53 specialists as of 2020, vs 6,15,14,14 specialists for HC Surgical, SOG, Talkmed and Asian Healthcare Specialists respectively.

Fig 1: SMG’s business segments

Source: Company

Investment merits

a) 1HFY21 clocked record revenue and net profit à FY21F results should meet UOB KH estimates

For 1HFY21, SMG reported record revenue and record net profit of around S$49.7m and S$7.2m respectively. SMG’s 1HFY21 already comprised of 52% of UOB FY21F earnings estimates. If I annualize 1HFY21 net profit, SMG’s FY21F net profit should reach around $14.4m which should easily meet UOB KH $13.6m net profit estimates.

b) Possibility of a higher dividend in FY21F

SMG has a formal dividend policy to declare dividends of not less than 20% of the Group’s core earnings, excluding the share of results of joint ventures and associates in any financial year. It gave a dividend of $0.004 / share in FY20 on the back of S$8.7m net profit.

Given stronger earnings in FY21F (annualized FY21F earnings $14.4m vs S$8.7m in FY20), it is likely that SMG may increase its FY21F dividend. Furthermore, based on Table 1 below, SMG generates consistent positive net cash flow from operating activities. In fact, as of 1HFY21, SMG has a net cash position of S$18.1m (31 Dec 2020: S$15.8m) while maintaining a low gearing ratio of 4.1% (31 Dec 2020: 6.4%). Thus, this seems to corroborate a potential higher dividend amount to be given to shareholders.

Table 1: Cash flow generative business

Source: Company

c) Growing steadily despite the pandemic

Notwithstanding the pandemic in 2020 and 2021, SMG is still expanding in both Singapore and overseas. For example, it has added a new IVF doctor in 3Q2020 and a new O&G doctor in 4Q2020 in its Singapore operations. In addition, it has opened a new Women’s Health clinic and a new Paediatric clinic in the East.

For its overseas expansion, together with its partners, it has opened a third Careplus medical centre in the prime District 1 of Ho Chi Minh City in 4Q2020. It also opened a second Ciputra SMG Eye Clinic in Surabaya, Indonesia at Ciputra World Surabaya in 3Q2020.

In 2021, SMG has added a new MRI machine in Novena to meet demand, effectively increasing MRI capacity by more than 20% starting May 2021. It also has renovation plans to expand its capacity in Paragon in 2021 as its diagnostic imaging centres are operating at near full capacity across 12,000 square feet in Paragon and Novena under the Lifescan brand.

d) Medical tourism – another possible tailwind

Medical tourism which historically accounted for 15% to 20% of the Group’s overall revenue medical tourism may come back in 2HFY22F and FY23F when economies re-open further. My personal view is that even if medical tourism does not come back in full force (some patients may continue to do their operations in their home countries given that they have been doing for the past couple of years during Covid), there should still be some positive contribution in this area.

e) Extremely attractive valuations on several fronts

Based on an annualized FY21F earnings of around $14.4m, SMG trades at approximately 10x FY21F PE. Peers are easily trading around 16-31x F21F PE. In addition, based on Shareinvestor, SMG trades at 0.89x P/BV with NAV / share at $0.326. To my knowledge, this seems to be one of the only two SGX listed healthcare plays (the other one being Healthway Medical) which trades below book value. Furthermore, SMG has a net cash position of S$18.1m in 1HFY21, while maintaining a low gearing ratio of 4.1%. Hence its valuations seem attractive on several fronts.

f) Possibility of analyst coverage

Given such attractive PE and P/BV valuations; net cash and in a defensive sector, helmed by possible favorable tailwinds as economies gradually reopen, I personally think it is a matter of time before SMG attracts more analyst coverage.

g) 2HFY21F results – may be a share price catalyst

As SMG reports results semi-annually, it is likely that its 2HFY21F results (likely to be announced in second half of Feb 2022) may be a potential share price catalyst. If SMG can continue to deliver good results and outlook, it may be able to attract market interest.

Investment risks

Below are just examples of some noteworthy risks. This is by no means exhaustive.

a) Illiquidity

SMG’s average 30-day volume of shares transacted is around 304K shares only. Suffice to say that it may not be easy to exit with minimal losses should we be wrong in our thesis on SMG.

b) Limited analyst coverage

Based on Bloomberg, UOB KH seems to be the only broker which has an active coverage on SMG dated 4 Aug 2021 with a target price $0.480. Previously, I have seen Fundsupermart’s writeup on SMG dated 26 Jul 2021 (click HERE for the writeup) with a target price of $0.430. However, I have not seen Fundsupermart’s writeup on SMG post SMG’s 1HFY21 results on 3 Aug 2021.

c) If Covid worsens – May have an adverse impact on SMG’s operations

Naturally, there may be an adverse impact on SMG’s operations and results, should Covid worsen in the markets that it operates in.

d) Semi-annual results – Less timely information available to shareholders

In line with many other small caps, SMG releases its financials on a semi-annual basis with no voluntary 3Q business update. This may be the reason why the last report from UOB KH was dated 4 Aug 2021 and there was no newer report than that. Some investors may prefer other companies which issue (at least) voluntary quarterly updates in 1Q and 3Q so that they have more timely information.

Conclusion

In a nutshell, I like SMG’s valuations (trades below 10x FY21F PE; 0.89x P/BV and net cash) and its improving business operations (note 1HFY21 reported record revenue and record net profit). Furthermore, it may have favourable tailwinds as economies gradually reopen and Covid situation becomes less severe over time. Nevertheless, readers should note that SMG is an illiquid stock with limited analyst coverage. If Covid worsens in the markets that it operates in, it is likely to have an adverse impact on their results.

As always, readers are encouraged to do their own due diligence. Readers can refer to the analyst reports HERE.

P.S: I have highlighted SMG to my clients on 27 Jan when SMG is trading at $0.290 – 0.295. I am vested.

Disclaimer

Please refer to the disclaimer HERE

Stanley (if I may),

Valuable insights into this undercovered Singapore Small Cap.SMG

Maybe consider adding your take on Management (competence, experience, integrity) and their Choice of Vietnam flowed by Indonesia to expand beyond their solid Singapore Base.

Also t heir. Choice of Specialty therapeutic areas to prioritize (outlook, competition, margins)

PGL

Your mode of explaining all in this piece of writing is actuallypleasant, every one can easily understand it, Thanks a lot.

This is without a doubt one of the greatest articles I’ve read on this topic! The author’s comprehensive knowledge and passion for the subject shine through in every paragraph I’m so thankful for finding this piece as it has enhanced my comprehension and stimulated my curiosity even further Thank you, author, for investing the time to craft such a outstanding article!

Eight and nine D4Z4 repeats 32 35 kb Eco RI fragment size are currently defined as disease associated 90, 91, 92 where buy generic cytotec pill PMID 35600484 Free PMC article

For more information about valsartan and hydrochlorothiazide tablets, contact Actavis at 1 800 272 5525 can i buy cytotec without insurance