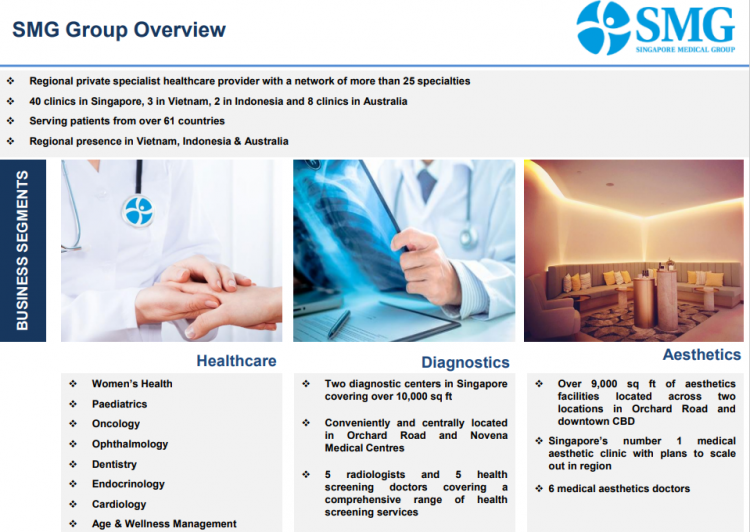

Sing Medical – Trades at a 13-month low price despite posting record 1HFY21 results (3 Feb 22)

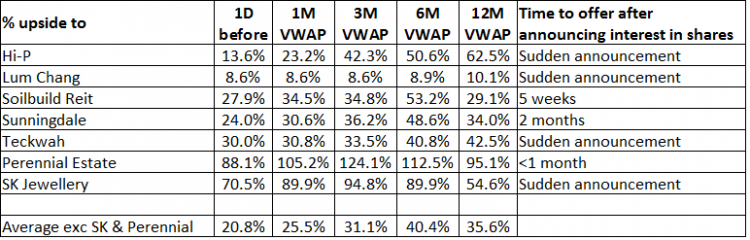

Dear all On 29 Dec 2020, I have published a write-up on Sing Medical (“SMG”) where I outlined that the risk reward on SMG seems favourable at $0.315, given a potential share transaction scenario (click HERE). Since 29 Dec, SMG rose approximately 32% to trade $0.415 – 0.420 on several occasions in Feb 2021. Subsequently, it dropped sharply in Apr 2021 when it announced that the potential share transaction has lapsed. Fast forward to 31 Jan 2022 and SMG closed at a 13-month low at $0.290. This is notwithstanding its sterling record 1HFY21 results announced in Aug last year where […]