Hatten Land Limited – “Capitaland” of Malacca (10 Mar 17)

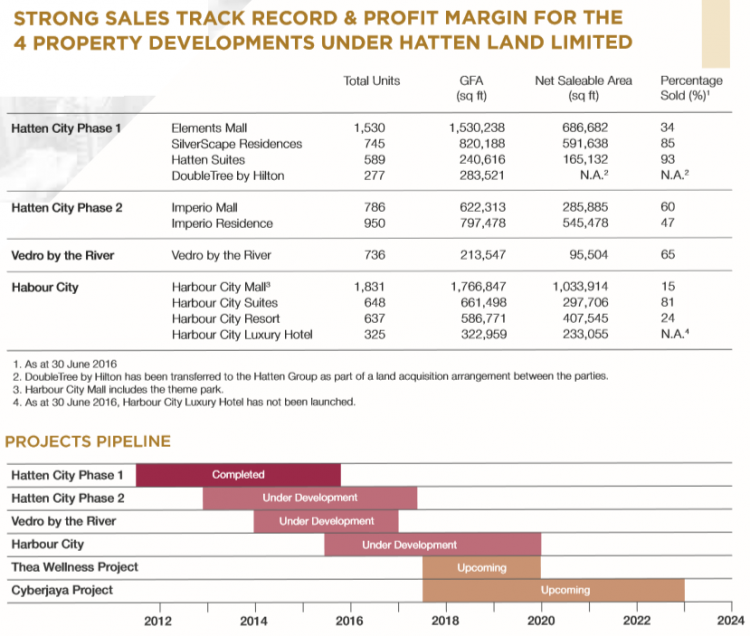

For those who have gone to Malacca, they may have seen some of the developments by Hatten Land. Some may have gone as far to say that Hatten Land in Malacca may be considered as our “Capitaland” (to some extent) in Singapore. For those who are not familiar with Hatten Land, below is a short write-up. Company description Hatten Land is the property development arm of the conglomerate Hatten Group with business in property development, property investment, hospitality, retail and education. Based on their circular, Hatten Land’s core business (See Table 1 below), is to sell all developed units […]