For those who have gone to Malacca, they may have seen some of the developments by Hatten Land. Some may have gone as far to say that Hatten Land in Malacca may be considered as our “Capitaland” (to some extent) in Singapore. For those who are not familiar with Hatten Land, below is a short write-up.

Company description

Hatten Land is the property development arm of the conglomerate Hatten Group with business in property development, property investment, hospitality, retail and education.

Based on their circular, Hatten Land’s core business (See Table 1 below), is to sell all developed units in order to maximise economic benefit. It does not intend to own any units in its own developments. Its current development portfolio comprises three integrated mixed use development projects in Malacca, Malaysia. They are (a) Hatten City Phase 1 (incorporating Elements Mall, SilverScape Residences, Hatten Suites, and a tower block that has been taken up by DoubleTree by Hilton); (b) Hatten City Phase 2 (incorporating Imperio Mall and Imperio Residence); and (c) Harbour City (incorporating a mall, a theme park and three (3) hotels). Hatten Land has also designed and is developing a retail mall in Malacca, Malaysia called Vedro by the River.

Hatten Land is helmed by Dato Colin Tan and Dato Edwin Tan. Colin is the Executive Chairman and Managing Director and Edwin is the Executive Director and Deputy Managing Director.

Table 1: Property development process

Source: Company

Investment merits

Beneficiary of Malacca’s growth

Hatten Land is one of the prominent developers in Malacca with the bulk of its land bank located around the Straits of Malacca. Based on the company’s circular, Hatten Land is likely to benefit from the factors listed below:

a) Malacca’s residential market has been given a boost with the recognition of Malacca as a UNESCO World Heritage Site in 2008;

b) Growth in the median household income levels, coupled with the upcoming KL-Singapore High Speed Rail, (which has a stop in Ayer Keroh, Malacca), supply in the serviced apartment sector should be well absorbed in the short-to-medium term, resulting in an upward price trend;

c) Tourist receipts grew by 39.5% in 2015, the highest annual growth since 2010. With the impending RM42b Melaka Gateway project, Malacca’s popularity as a tourism destination is slated to rise. This should inevitably lead to an increased demand for hotels and potentially more hospitality developments;

d) The expansion of the Malacca International Airport coupled with regular scheduled flights to and from Guangdong, China (every five days) to be operated by China Southern Airlines may increase the number of Chinese investors and tourists to Malacca;

e) According to an article dated 20 Jun 2015 in The Star, Malacca’s state government wants to revive the 1.6km monorail spanning from Taman Rempah in Pengkalan Rama to Kampung Bunga Raya Pantai along the Malacca River. If this is successful, this should boost the tourism along the Malacca River and should benefit Hatten Land.

Robust project pipeline

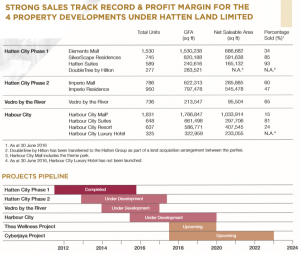

Based on Table 2, Hatten Land has strong sales track record. It also has a robust project pipeline which provides visibility to their results to some extent.

Table 2: Strong sales track record and robust project pipeline

Source: Company

Concentrated shareholding structure

After the compliance placement of 144.3m placement shares @$0.280, comprising of 95.0m new shares and 49.3m vendor shares, Hatten Holdings, together with the existing directors command 87.0% of the outstanding shares. One of my personal preferences is in companies with tightly held shares so that it is less easily targeted by short sellers.

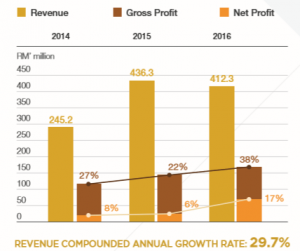

Revenue grew at 30% CAGR since FY14; margins steady

Based on Table 3, Hatten Land’s revenue grew at a compound annual growth rate of 30% since FY14. Gross margins and net margins remain healthy at 38% and 17% respectively in FY16. Lim & Tan pointed that Hatten Land’s operating cash flow should improve in FY17 as a) there is no major project capital expenditure in 2017 and b) Both Hatten City Phase Two and Vedro by the River will be completed in 2H2017 and 1H2017 respectively.

Table 3: Financial highlights for the past 3 years

Source: Company

Potential partnership with other developers

There has been an increased investment in Malaysia by China state-owned enterprises (“SOEs”). Lim & Tan rightfully pointed out that Hatten Land, being the largest property developer in Malacca, has been approached by several PRC investors and companies in the last one year. Collaborations or partnership with other developers should be beneficial to Hatten Land in the long term.

Trades at 24% to RNAV

Based on the circular, as at 30 Jun 2016, the market value of Hatten Land’s four projects namely, Hatten City Phase 1 & 2, Harbour City and Vedro by the River amounted to approximately S$506m. At the last closing price of $0.280, Hatten Land is trading at 24% to RNAV. However, it is noteworthy that Hatten has access to more than 20 land bank and development rights in high growth cities held by the Hatten Group for future development amounting to 215 acres. Land acquisition is likely to be value accretive and can further boost its RNAV.

Investment risks

Execution risk

Although Hatten Land has a good track record of property development, corroborated by the numerous awards won, there will always be execution risk. In addition, any delay in the completion, or / and cancellation of the SPA or MOU projects will have an adverse effect on Hatten Land.

Geographical risk

Most of Hatten Land’s projects are in Malacca. Therefore, the development, growth and prosperity of Malacca is extremely important to Hatten Land. Furthermore, it is subject to the laws and policies in Malacca and Malaysia.

Dilution from share issuance

Based on NRA’s report, they postulate that Hatten Land may issue new shares to fund its developments, as they may not be able to get enough debt funding for their upcoming projects. This may lead to dilution in the near term. However, if Hatten Land can justify the rationale of issuing shares and especially if the other party is a reputable strategic partner, it should be beneficial to Hatten Land in the medium to long term.

Limited analyst coverage

There is limited analyst coverage. NRA is the only house with a rated report on Hatten Land. Their target price is $0.440. Lim & Tan has an unrated report (i.e. no target price). It is likely that the investment community is not familiar with Hatten Land yet. However, if Hatten Land can deliver with consistent results, I would think it is a matter of time before other analysts cover Hatten Land.

Chart observations

Hatten Land has limited trading history post RTO / compliance placement (See Chart 1 below). However, it is noteworthy that Hatten Land seems to have rebounded from the support region of $0.265 – 0.270. There may be some minor resistance around $0.280 as Hatten Land has done a compliance placement to place out 144.3m new and vendor shares @$0.280. Chart seems to be on an uptrend as evidenced by the rising exponential moving averages.

Near term supports: $0.265 – 0.270 / 0.255 / 0.250

Near term resistances: $0.280 / 0.300 / 0.325

Chart 1: Hatten Land’s rebounded from the support region $0.265 – 0.270

Source: Chartnexus 10 Mar 2017

Conclusion / Personal opinion

This is an introduction of Hatten Land. Whether it can become the “Capitaland” of Malacca, or even Malaysia, it remains to be seen. Nevertheless, based on their project pipeline and track record, it certainly looks interesting. As with all investments (most investments carry at least some degree of risk), readers should carefully evaluate each investment decision with care.

Disclaimer

Please refer to the disclaimer HERE

A round of applause for your article.Much thanks again. Fantastic.

Thanks again for the blog post.Really looking forward to read more.

Thanks for sharing, this is a fantastic post.Really thank you! Awesome.

This is one awesome blog post.Thanks Again. Really Great.

Im obliged for the article.Really thank you! Keep writing.

Major thanks for the post.Much thanks again. Will read on…

Major thanks for the blog post.Thanks Again. Will read on…

I loved your blog.Thanks Again. Fantastic.

wow, awesome blog post. Fantastic.

Thanks so much for the post.Really thank you! Want more.

I really enjoy the article.Thanks Again. Will read on…

Great article.

Muchos Gracias for your blog post.Really thank you! Will read on…

Awesome blog article.Thanks Again. Really Great.

Great blog.Really looking forward to read more. Much obliged.

I think this is a real great blog post.Thanks Again. Cool.

Thank you for your blog article. Awesome.

I appreciate you sharing this blog post.Really thank you! Want more.

Really informative post.Really thank you! Fantastic.

I appreciate you sharing this blog article.Thanks Again. Fantastic.

Thanks for sharing, this is a fantastic article post.Thanks Again. Great.

Great blog.Thanks Again. Awesome.

Thank you ever so for you blog.Really looking forward to read more. Will read on…

I appreciate you sharing this blog post.Much thanks again. Awesome.

I value the blog.Thanks Again. Will read on…

I really liked your blog. Great.

Thank you ever so for you article.Really thank you! Really Great.

I loved your blog article.Really thank you! Great.

Thank you for your post.Really looking forward to read more. Cool.

Thank you ever so for you post.Really thank you!

wow, awesome article.Much thanks again. Much obliged.

Very neat blog article.Thanks Again. Will read on…

Im obliged for the post.Really looking forward to read more. Awesome.

I value the blog post.Really thank you! Will read on…

Enjoyed every bit of your blog article.Much thanks again. Cool.

A round of applause for your article post.Really thank you! Cool.

Thanks for the post.Thanks Again. Awesome.

Awesome blog article.Really thank you! Cool.

Fantastic article post.Thanks Again. Great.

Say, you got a nice article post.Much thanks again. Will read on…

I truly appreciate this article post.Really thank you! Want more.

Great blog post.Really looking forward to read more. Really Cool.

Thanks for the blog.Really looking forward to read more. Really Great.

Thank you for your blog post.Really thank you! Want more.

Really appreciate you sharing this blog.Really thank you! Keep writing.

Awesome post.Really looking forward to read more. Really Great.

I truly appreciate this blog post.Much thanks again. Much obliged.

Im thankful for the article post.Thanks Again. Fantastic.

Im grateful for the blog.Much thanks again. Great.

I think this is a real great article post.Much thanks again. Keep writing.

Very informative post.Thanks Again. Great.

I cannot thank you enough for the article post.Really thank you! Great.

I cannot thank you enough for the post.Really thank you! Want more.

Major thankies for the blog article.Much thanks again. Awesome.

Really informative blog post.Really looking forward to read more. Really Cool.

Hey, thanks for the post. Really Cool.

Very informative post.Really looking forward to read more. Keep writing.

I cannot thank you enough for the article post. Really Cool.

I appreciate you sharing this blog.Really thank you! Keep writing.

Enjoyed every bit of your article.Much thanks again.

I truly appreciate this blog article.Thanks Again. Keep writing.

Hey, thanks for the article post.Really thank you! Want more.

Very informative post.Really thank you! Fantastic.

A big thank you for your blog post.Really thank you! Awesome.

Looking forward to reading more. Great blog article.Much thanks again. Much obliged.

I truly appreciate this blog. Want more.

Very neat blog article.Really thank you!

Im thankful for the blog article.Much thanks again. Awesome.

Awesome article post.Really thank you! Keep writing.

I really liked your blog article.Really thank you! Will read on…

Thanks so much for the article post.Really thank you! Fantastic.

Say, you got a nice blog.Thanks Again. Awesome.

Thanks again for the blog article.Much thanks again. Keep writing.

Wow, great article post.Really looking forward to read more. Want more.

Fantastic blog.Really looking forward to read more. Keep writing.

I truly appreciate this blog post.Really thank you! Really Cool.

Really informative article. Awesome.

I value the article.Much thanks again. Really Great.

I really enjoy the article.Really thank you! Fantastic.

Thanks again for the blog. Great.

Thanks-a-mundo for the blog post.Really thank you! Great.

Hey, thanks for the blog article. Cool.

Thanks-a-mundo for the blog post.Really thank you! Great.

Appreciate you sharing, great article post. Will read on…

Thanks again for the article.Thanks Again. Fantastic.

I really enjoy the blog article. Awesome.

Thanks a lot for the blog.Thanks Again. Keep writing.

Very neat blog.Much thanks again. Will read on…

Appreciate you sharing, great article. Really Cool.

Awesome blog.Much thanks again. Really Great.

Really enjoyed this article post.Much thanks again. Really Cool.

Thank you ever so for you post. Will read on…

Very informative article.Much thanks again. Much obliged.

Major thankies for the post.Really looking forward to read more. Awesome.

Thanks a lot for the blog.Really thank you! Want more.

This is one awesome blog.Really thank you! Really Cool.

Great, thanks for sharing this blog post.Thanks Again. Will read on…

Major thankies for the blog post.Much thanks again. Keep writing.

I really liked your article.Thanks Again. Cool.

Muchos Gracias for your blog.Really looking forward to read more. Cool.

Great, thanks for sharing this blog article.Really thank you! Much obliged.

Im thankful for the blog article.Thanks Again. Great.

Muchos Gracias for your article.Much thanks again. Really Cool.

Appreciate you sharing, great post.Much thanks again. Keep writing.

Im grateful for the article post.

Major thankies for the blog.Really looking forward to read more.

I am so grateful for your article.Much thanks again. Keep writing.

A big thank you for your blog. Will read on…

Im thankful for the blog.Much thanks again. Really Great.

Wow, great blog post.Really looking forward to read more. Much obliged.

Thanks for the post.Thanks Again. Much obliged.

This is one awesome blog post. Fantastic.

Thanks-a-mundo for the article.Much thanks again. Much obliged.

Thanks for sharing, this is a fantastic article.Really looking forward to read more. Will read on…

I appreciate you sharing this post. Awesome.

Thanks for sharing, this is a fantastic blog.Much thanks again. Awesome.

I really enjoy the blog article.Thanks Again. Really Cool.

Appreciate you sharing, great blog post.Much thanks again. Awesome.

A round of applause for your article post.Really looking forward to read more. Want more.

I cannot thank you enough for the blog.Thanks Again. Great.

I really liked your post. Much obliged.

Appreciate you sharing, great article.Much thanks again. Much obliged.

I cannot thank you enough for the post.Really looking forward to read more. Really Cool.

Im obliged for the article.Much thanks again. Keep writing.

I truly appreciate this article. Really Great.

Awesome article post.Really looking forward to read more. Want more.

Enjoyed every bit of your post. Will read on…

This is one awesome blog post.Much thanks again. Much obliged.

Very good blog post.Really looking forward to read more. Really Cool.

Enjoyed every bit of your blog post.Thanks Again. Fantastic.

Thanks a lot for the blog post.Really looking forward to read more. Cool.

Thanks for sharing, this is a fantastic article.Really thank you!

A round of applause for your blog article. Cool.

Muchos Gracias for your article post.Really thank you! Really Great.

Thanks-a-mundo for the blog.Thanks Again. Great.

Thank you for your article post.Thanks Again. Fantastic.

Thanks-a-mundo for the blog article. Want more.

Im grateful for the blog.Much thanks again. Great.

Enjoyed every bit of your blog article.Thanks Again. Really Cool.

Very good post. Fantastic.

Really appreciate you sharing this article post.

Thanks for sharing, this is a fantastic post.

Say, you got a nice post.Really looking forward to read more. Keep writing.

Im grateful for the blog.Really looking forward to read more. Really Great.

Appreciate you sharing, great blog article.Much thanks again. Really Cool.

This is one awesome article.Thanks Again. Will read on…

Great blog.Really thank you! Will read on…

Enjoyed every bit of your blog post.Really thank you! Fantastic.