Alert! Comfort Delgro – Multi-month base building & challenges key resistance – Looks bullish (6 Aug 22)

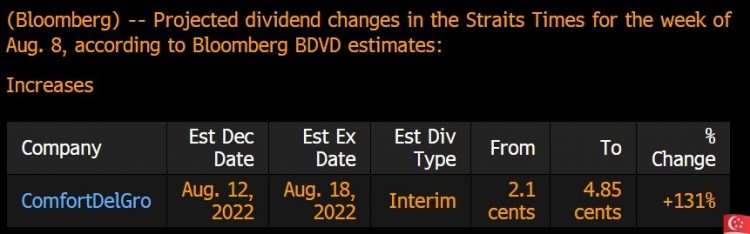

Dear Readers, As you are aware, I usually will do a stock screening using Bloomberg at the start of each month. In the screening, Comfort Delgro (“CD”) pops out on attractive valuations via my metrics. This is not the first time that CD pops out in my screening. However, coupled with some of the points below, it may arguably be a good time to take a closer look in CD. Due to time constraints, this write-up will be brief and I will just raise some pertinent points and risks. For a more complete picture, it is advisable to refer to […]