Comfort Delgro closed at $1.03, lowest last seen on 18 Mar 2004! (9 Jun 23)

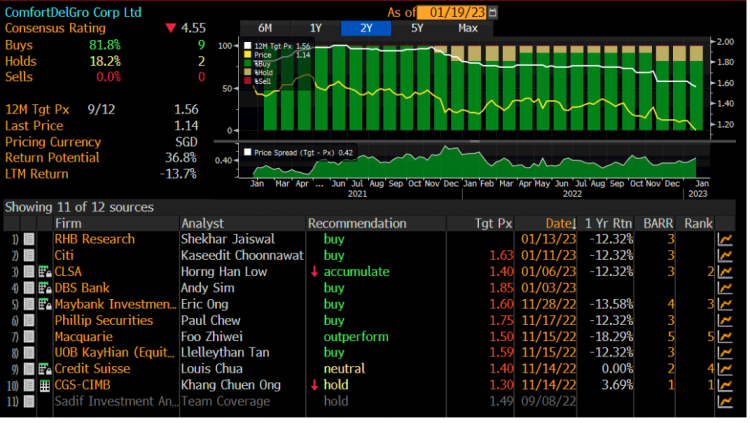

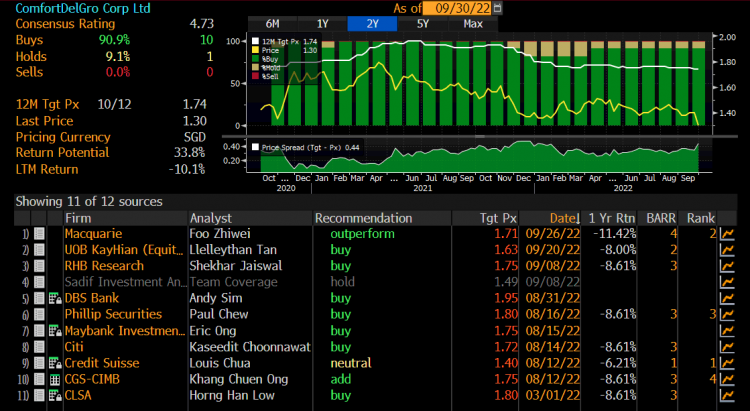

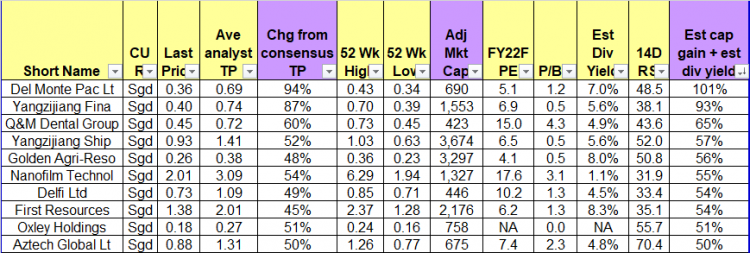

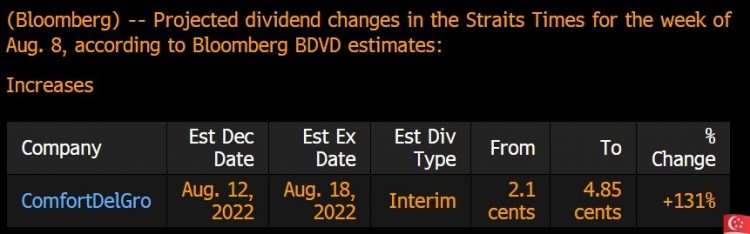

Dear all Comfort Delgro (“CD”) closed at $1.03 today. Based on Bloomberg, this was the lowest close last seen on 18 Mar 2004. The main reason cited for this recent drop was that Citi has reduced its target price for CD from $1.63 (26 Feb 2023) to $1.32 (2 Jun 2023). Nevertheless, they maintained their buy call. Is it all doom and gloom? Should we throw in the towel and just give up on CD? Personally, I find CD interesting at current levels. Before I delve into it, just for record purpose, I have a previous article on CD published […]