Singtel closed -$0.03 to $3.02, the lowest close since Jun 2012. Based on Bloomberg, it is trading at approximately 5.9% estimated div yield. Ave analyst target is around $3.92. Hence total potential upside is around 35.7%.

What has happened to Singtel which hit multi-year lows despite analysts’ buy calls? Is this a buying opportunity? Or is it a falling knife?

Singtel – takeaways from some analyst reports

The recent weakness in Singtel may be attributed to its challenging industry, especially when the industry faces new entrants in both Singapore and Australia. Although Singtel may lack near term catalysts, based on the reports that I have read, many analysts mentioned the following noteworthy points on Singtel for readers to consider:

a) Singtel is going to ex div S$0.107 on 26 Jul 2018. Barring unforeseen circumstances, Singtel has committed its dividend per share at 17.5 cents per share for FY19F and FY20F. At $3.02, this works out to a dividend yield of 5.8%;

b) According to HSBC report dated 19 Jun 2018, although Bharti Airtel’s profit contribution to Singtel has tumbled from 22% in FY10 to 2% in FY18F, HSBC believes that it may rise to 14% by FY21F. DBS Research also cited that Singtel’s earnings may grow in FY20F, as Airtel may be able to gain revenue market share from the ongoing Vodafone-Idea merger, which is fraught with complications caused by vendor and staff issues. Furthermore, DBS Research pointed out that the integration of Tata telecom’s spectrum and subscribers, expected to take place over FY19F, should also bode well for Airtel;

c) Telkomsel profit may rebound in 2HFY18 as it may raise data pricing by 5-10%, which in turn, should benefit Singtel;

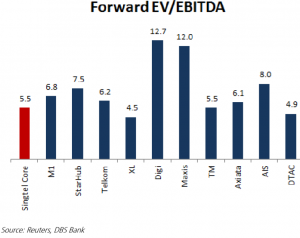

d) According to DBS Research (see Chart 1 below), Singtel trades at 5.5x forward EV / EBITDA, a discount to regional and local peers. This seems unjustified, especially when Singtel should weather the competition better than its local peers M1 and Starhub.

Chart 1: Singtel trades at a discount to regional peers

Source: DBS Research 18 Jun 2018

e) Singtel may unlock value in Amobee either via IPO or strategic partnership in the next 2-3 years after it shows consistent results.

Analysts remain upbeat on Singtel, despite share price fall

Based on Figure 1 below, notwithstanding Singtel hitting multi-year low, analysts continue to be bullish on Singtel with average target price $3.92. This represents a potential 29.8% capital upside. Coupled with 5.9% estimated dividend yield, total potential return may be 35.7%.

Figure 1: Average analyst target $3.92, i.e. 29.8% potential capital upside

Source: Bloomberg 2 Jul 2018

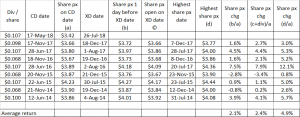

Upcoming dividend may ease selling pressure

Based on Table 1 below, if history were to be any guide, Singtel is likely to trade higher in anticipation of its upcoming dividends. Singtel is going to ex div S$0.107 on 26 Jul 2018. Based on my own compilations, Singtel may trade approximately $3.49 – 3.59 from now to one day before XD i.e. up to 25 Jul 18. I wish to emphasise that past trading results do not guarantee future performance, hence Singtel may not move higher in anticipation of its upcoming dividends. Furthermore, against the backdrop of the weak market sentiment, it is unlikely that Singtel can reach $3.49 – 3.59. However, selling pressure should ease in anticipation of its upcoming dividend.

Table 1: How Singtel’s share price moves from CD to XD date

Source: Ernest’s compilations

Chart outlook

Based on Chart 2 below, Singtel is entrenched in a strong downtrend. All the exponential moving averages (“EMAs”) are trending lower with death cross formations. Singtel has broken the recent range 3.32 – 3.54 with a measured technical eventual target $3.10 which is already attained. In fact, the recent breach below $3.10 points to an eventual technical target of around $3.06. RSI closed 13.9 on 3 Jul 2018. This is the lowest level since 2000. ADX closed at 44.9 amid negatively placed DI. This is indicative of a strong downtrend. However, as oversold pressures build (evidenced by the all-time low RSI), there may be some technical rebound in the near term. The past two days sell-off has been accompanied with lower than average volume. Notwithstanding the above, it is noteworthy that there is no rule that RSI cannot fall below 10 or 5.

Near term supports: $2.99 – 3.01 / 2.91

Near term resistances: $3.10 / 3.14 / 3.17 / 3.21

Chart 2: Singtel falls to multi-year low and reaches all time oversold

Source: InvestingNote 3 Jul 2018

P.S: I am vested in Singtel shares.

Conclusion

Singtel operates in a challenging industry with near-term headwinds. However, most analysts believe that its attractive valuations, coupled with its geographical and business diversification which may bear fruits in the next few years, make it an attractive investment to consider, especially with investors with a long-term horizon. The recent relentless selling has caused oversold pressures to spike which may in turn limit any near-term potential downside in Singtel’s share price.

Notwithstanding the above, it is noteworthy that I am not extremely familiar with Singtel, nor do I have direct access to management. Readers who are interested in Singtel should view Singtel’s announcements on SGX or on their website. Furthermore, they can view the analyst reports HERE.

Disclaimer

Please refer to the disclaimer HERE

Ciao ,How can I block a website ? grazie

Hey There. I found your blog using msn. This is an extremely well written article. I will be sure to bookmark it and come back to read more of your useful info. Thanks for the post. I’ll certainly comeback.

Hey there, You’ve done a great job. I will definitely digg it and individually suggest to my friends. I am confident they will be benefited from this web site.

Everything is very open with a precise clarification of the challenges. It was truly informative. Your site is very useful. Thanks for sharing!

Hi, I check your blog daily. Your story-telling style is witty, keep doing what you’re doing!

Это способствует более глубокому пониманию обсуждаемой темы и позволяет читателям самостоятельно сформировать свое мнение.

You’ve the most impressive websites.

The articles you write help me a lot and I like the topic

Thanks for your help and for writing this post. It’s been great.

It’s going to be finish of mine day, however before ending I am reading this enormous paragraph to improve my experience.

Полезная информация для тех, кто стремится получить всестороннее представление.

I抳e recently started a blog, the info you offer on this web site has helped me tremendously. Thanks for all of your time & work.

Автор представляет аргументы разных сторон и помогает читателю получить объективное представление о проблеме.

Автор статьи поддерживает свои утверждения ссылками на авторитетные источники.

Статья помогает читателю получить полное представление о проблеме, рассматривая ее с разных сторон.

Статья содержит анализ преимуществ и недостатков различных решений, связанных с темой.

Hmm is anyone else experiencing problems with the pictures on this blog loading? I’m trying to find out if its a problem on my end or if it’s the blog. Any feed-back would be greatly appreciated.

Я благодарен автору этой статьи за его тщательное и глубокое исследование. Он представил информацию с большой детализацией и аргументацией, что делает эту статью надежным источником знаний. Очень впечатляющая работа!

As a Newbie, I am constantly exploring online for articles that can benefit me. Thank you

What i don’t realize is in truth how you are no longer actually a lot more smartly-favored than you may be right now. You are so intelligent. You know thus considerably in relation to this subject, made me in my opinion consider it from so many varied angles. Its like men and women are not interested except it is one thing to accomplish with Girl gaga! Your own stuffs outstanding. All the time deal with it up!

I got what you mean , regards for posting.Woh I am thankful to find this website through google. “Delay is preferable to error.” by Thomas Jefferson.