Midas has slumped 14% post a 76% growth in its FY16 results. It closed at $0.225 on 7 Apr 2017 which was near the all-time closing low of $0.210. Some of my high net worth clients have told me their concerns on Midas. I have since met Mr Patrick Chew, CEO of Midas and Mr Liaw Kok Feng, CFO Midas for a 1-1 discussion. Here are my key takeaways.

Key takeaways from my concerns posed to the management

Concern 1: Orders momentum have slowed for its aluminium extrusion segment

According to management, they remain positive for their aluminium extrusion segment. The main reason why they have not announced new contracts recently is because their customers are giving some of their orders in the form of purchase orders. Such orders are smaller in quantum and need to be delivered in a shorter period of time. For example, previously, contracts can be around RMB100m per contract size. However, nowadays, this RMB100m may be split into 3 or 4 purchase orders in different time periods. It does not affect Midas, as it still gets RMB100m in the end. However, it is difficult for them to announce such contracts as the purchase orders are smaller in sizes. To consolidate the orders together and announce is not representative due to the shorter delivery time. Some contracts may have already been delivered by the time they announce.

In addition, management elaborated that besides doing just the aluminium profiles, they are doing more of the downstream fabrication of passenger train car body components or modules. In fact, they are one of the first and amongst the few in the PRC aluminium alloy extrusion industry to possess such capabilities. Fabrication is well received by its customers both locally and overseas as it reduces product risk, inventory and logistic costs from their customers’ perspective.

Concern 2: Orders momentum for its 32.5% owned NPRT may have slowed

It has been three months since the last contract was announced by NPRT. However, management believes that order momentum continues to be good as NPRT is one of the only four licenced metro train assembly companies in China. As of 31 Dec 2016, NPRT has an order book of RMB14b. Going forward, NPRT is likely to be a steady contributor to Midas’ results.

Concern 3: Aluminium alloy plates and sheets division may be delayed

As this aluminium alloy plates and sheets division has been previously delayed before, some clients are concerned that it may be delayed again. However, management believes that this segment is on track to commence commercial production in 2Q, as originally indicated in my earlier write-up (click HERE). The main reason for the previous delay was that management wants to be sure all the processes in this segment are running smoothly before they commence production. Management mentioned that they have already lined up customers for this segment, thus it is likely to be a matter of time before this segment makes a positive contribution to Midas.

Concern 4: Lack of dividends in FY16 may portend a weak FY17F outlook / cash flow problem

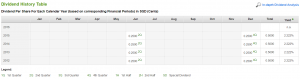

Based on Table 1 below, some clients are bemused by a lack of dividends by Midas in FY16 when its profits hit a 5 year high since FY12. Furthermore, this was the first year since 2007 where Midas did not issue a dividend. As a result, some clients postulate that a lack of dividends may portend a weak FY17F outlook, or cash flow problem.

Management shared that after considering all the aspects from the various stakeholders, they believe it is to the best interests of the company and its shareholders not to declare a dividend in 2016. This is because they recently completed the acquisition of Huicheng with the issuance of approximately 462m shares in July 2016, being the initial consideration for the acquisition. If Midas were to issue dividends, then Huicheng’s owners who received 462m shares would naturally be entitled to a share of Midas’ full year earnings. However, this would not be fair to other shareholders as Huicheng only contributed about five months of profits to Midas.

Notwithstanding the above, management emphasised that they are a strong advocator of the importance of giving dividends to shareholders (whenever suitable and possible). Midas’ track record of giving dividends since FY2007 speaks for itself. It is likely that management will assess the suitability of giving dividends in 1HFY17F.

Table 1: Midas’ dividend history since FY12

Source: Shareinvestor

Concern 5: Strong selling may indicate some potential bad news

As I have previously pointed out in my technical write-up on Midas (click HERE), there seems to be heavy selling pressure with heavy sell queues. Such seemingly strong selling pressure may indicate that there may be some concerns, or bad news on Midas known to the market but unknown to me.

However, based on Chart 1 below, Midas seems to be in an accumulation phase. Although Midas is still on a long-term downtrend, its chart seems generally positive and is in the midst of a multi month base formation. Indicators are strengthening. For example, OBV is at a three-year high which signifies accumulation. MACD and RSI are showing bullish divergences and strengthening. A sustained breach above the strong resistance of $0.240 – 0.260 with volume expansion will be very positive with an eventual technical measured target of around $0.300. A sustained break below $0.220 with volume expansion is bearish for the chart.

Chart 1: Midas seems to be in an accumulation phase

Source: Chartnexus 7 Apr 2017

Concern 6: EPS may not grow y/y due to issuance of shares for Huicheng acquisition

The acquisition of Huicheng involves two tranches of share issuance, namely 462m shares in July 2016, being the initial consideration and approximately 220m shares as the earned-out consideration. Huicheng’s FY16 net profit inclusive non-core income, such as government grants, dividend income etc. has exceeded RMB80m. However, for the interests of shareholders, management has put in a clause in their acquisition of Huicheng to calculate the earned-out target based on adjusted profit after tax less non-core income. Therefore, approximately 220m shares will be issued out as the earned-out consideration, instead of 271m shares.

We have to see the upcoming quarterly results to evaluate whether Midas’ EPS can grow y/y with the issuance of shares. However, I believe Midas management have already carefully evaluated the pros and cons and they believe it is to the best interest of the company to acquire Huicheng via share issuance. (See the rationale of Huicheng acquistion HERE)

Valuation – trades at 0.48x P/BV, vs 5 year average P/BV 0.71x

Based on Figure 1 below, at its last transacted price $0.230 on 10 Apr 2017, Midas trades at 0.48x P/BV ratio. Midas has traded between 0.44x – 1.13x since 30 Apr 2012, with an average P/BV ratio of 0.71x. It is reasonable to say that investors’ expectations for Midas are currently low which result in low historical valuations. This leaves room for potential upside surprise. Based on Midas’ NAV / share of $0.4898 on Shareinvestor, a 0.71x P/BV translates to $0.348.

Figure 1: Midas’ price to book since 2012

Source: Bloomberg (10 Apr 17)

Conclusion

The above concerns can be right, or wrong. Only time will tell. As Mr Benjamin Graham once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Furthermore, when a stock price falls, the market will focus more on the potential negative aspects of a company or its industry and vice versa. In a nutshell, it boils down to whether one believes the management, the business and its industry.

P.S: I am vested. Do note that as I am a full time remisier, I can increase / reduce my positions / holdings fast to capitalize on the markets’ movements. Furthermore, I wish to emphasise that I have a high risk appetite. Please refer to the disclaimer below.

Disclaimer

Please refer to the disclaimer HERE

Wow, awesome blog format! How lengthy have you ever been blogging for?

you make running a blog look easy. The full glance of your web site is magnificent,

let alone the content! You can see similar here sklep internetowy

Heya i am for the first time here. I found this board and I find Itreally useful & it helped me out much. I hope to give something back and aid others likeyou aided me.

whoah this blog is great i love reading your articles. Keep up the great work! You realize, lots of persons are looking round for this info, you could help them greatly.

Appreciate you sharing, great article post.Really thank you! Great.

Major thanks for the blog.Really thank you!

I cannot thank you enough for the blog.Really thank you! Awesome.

A big thank you for your blog article. Want more.

Really enjoyed this article.Much thanks again. Cool.

Great, thanks for sharing this article post.Really thank you! Cool.

ivermectin bed bugs selamectin vs ivermectin

Hello.This article was extremely remarkable, especially because I was browsing for thoughts on this matter last Tuesday.

There as definately a lot to know about this issue. I like all the points you have made.

Amazing! This blog looks just like my old one! It’s on a entirely different topic but ithas pretty much the same layout and design. Wonderful choice of colors!

legitimate canadian pharmacy online – canadian pharmacies canadian pharmacy sildenafil

I’m not sure where you are getting your info, but great topic. I needs to spend some time learning much more or understanding more. Thanks for magnificent information I was looking for this info for my mission.

order tadalafil tadalafil 40tadalafil online 20

Xem Thẳng Viettel Vs Bình Dương Tại V League 2021 Ở Kênh Nào? truyền hình trực tiếp vtv3 hdĐội tuyển chọn Việt Nam chỉ cần thiết một kết quả hòa có bàn thắng nhằm lần thứ hai góp mặt tại World Cup futsal. Nhưng, để thực hiện được điều đó

An intriguing discussion is definitely worth comment. I believe that you should write more about this subject, it might not be a taboo subject but generally people do not speak about such issues. To the next! All the best!!

Outstanding post however , I was wanting toknow if you could write a litte more on this topic? I’d be very gratefulif you could elaborate a little bit more. Kudos!

Thank you for the good writeup. It in fact was aamusement account it. Look complex to more brought agreeablefrom you! However, how can we be in contact?

provigil pill modalert online – provigil side effects

I really like and appreciate your article. Keep writing.

I couldn?t resist commenting. Very well written!Take a look at my blog post – gas patio heater

Yes! Finally someone writes about car rental sacramento.

Its like you read my mind! You seem to know so much about this, like you wrote the book in it or something. I think that you can do with some pics to drive the message home a little bit, but other than that, this is magnificent blog. A great read. I’ll certainly be back.

Aw, this was a very nice post. In concept I wish to put in writing like this moreover – taking time and actual effort to make an excellent article… however what can I say… I procrastinate alot and in no way appear to get one thing done.

Thanks for the good writeup. It in reality used to be a leisure account it. Look complex to far introduced agreeable from you! By the way, how can we keep in touch?

It’s appropriate time to make a few plans for the longer term and it’s time to be happy. I have learn this put up and if I may I wish to counsel you some interesting issues or tips. Maybe you could write subsequent articles regarding this article. I wish to read even more issues approximately it!

I haven’t checked in here for some time as I thought it was getting boring, but the last few posts are great quality so I guess I’ll add you back to my everyday bloglist. You deserve it my friend 🙂

Can I just say what a reduction to find somebody who really knows what theyre speaking about on the internet. You undoubtedly know find out how to deliver a difficulty to mild and make it important. More individuals have to read this and understand this facet of the story. I cant consider youre not more fashionable because you undoubtedly have the gift.

Hiya, I’m really glad I’ve found this information. Today bloggers publish just about gossips and web and this is really irritating. A good blog with interesting content, this is what I need. Thanks for keeping this web-site, I’ll be visiting it. Do you do newsletters? Can not find it.

With havin so much written content do you ever run into any issues of plagorism or copyright infringement? My blog has a lot of completely unique content I’ve either created myself or outsourced but it looks like a lot of it is popping it up all over the internet without my agreement. Do you know any ways to help prevent content from being stolen? I’d truly appreciate it.

I think this is one of the so much vital info for me. And i am satisfied studying your article. However want to commentary on few common issues, The website taste is ideal, the articles is really great : D. Excellent job, cheers

Thanks Enjoyed this blog post, is there any way I can get an alert email when you write a new post?

You completed some good points there. I did a search on the topic and found nearly all people will have the same opinion with your blog.

I’m really impressed with your writing skills as well as with the layout on your weblog. Is this a paid theme or did you modify it yourself? Either way keep up the nice quality writing, it’s rare to see a great blog like this one nowadays..

I truly appreciate this blog article. Cool.

I would like to thank you for the efforts you have put in writing this web site. I am hoping the same high-grade blog post from you in the upcoming also. In fact your creative writing abilities has inspired me to get my own blog now. Actually the blogging is spreading its wings rapidly. Your write up is a great example of it.

Hey!. Such a nice post! I’m really appreciate it. It will be great if you’ll read my first article on mycollegeessaywriter.com)

erectile dysfunction treatments ed pills online pharmacy dysfunction erectile

benzodiazepines online pharmacy canadian pharmacies vipps

When someone writes an article he/she maintains the plan ofa user in his/her mind that how a user can know it.Thus that’s why this piece of writing is outstdanding.Thanks!

I am so grateful for your blog article.Really looking forward to read more. Keep writing.

Aw, this was a really good post. Spending some time and actual effort to make a very good articleÖ but what can I sayÖ I procrastinate a whole lot and never seem to get nearly anything done.

I value the article.Really thank you! Really Cool.

Dead pent content, regards for information .

I loved your post.Really thank you! Really Cool.

Hello there! This post could not be written any better! Looking at this article reminds me of my previous roommate! He always kept talking about this. I’ll forward this article to him. Pretty sure he’ll have a very good read. Thank you for sharing!

Major thankies for the article.Thanks Again. Will read on…

Fantastic blog post.Thanks Again. Cool.