6 concerns investors have with Midas (7 Apr 17)

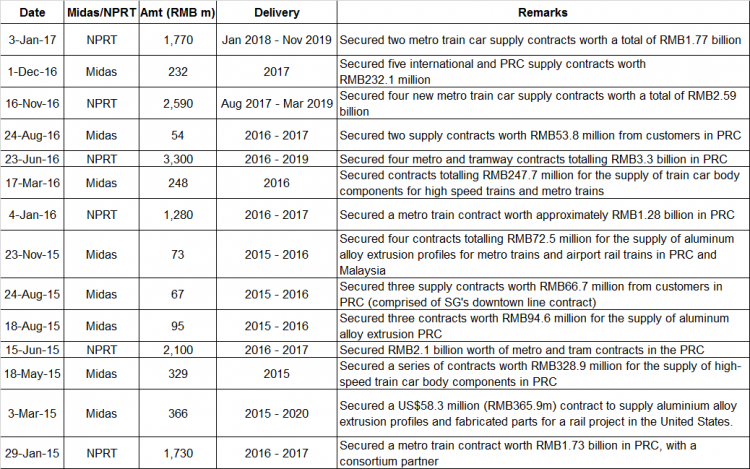

Midas has slumped 14% post a 76% growth in its FY16 results. It closed at $0.225 on 7 Apr 2017 which was near the all-time closing low of $0.210. Some of my high net worth clients have told me their concerns on Midas. I have since met Mr Patrick Chew, CEO of Midas and Mr Liaw Kok Feng, CFO Midas for a 1-1 discussion. Here are my key takeaways. Key takeaways from my concerns posed to the management Concern 1: Orders momentum have slowed for its aluminium extrusion segment According to management, they remain positive for their aluminium extrusion […]