Dear all,

Do you know that Oxley has the largest residential land bank in Singapore by number of dwelling units, based on an article in the Business times dated 23 Jan 2018?

Based on a flash estimate from the Urban Redevelopment Authority, Singapore private home property prices jumped 3.1% in the three months to Mar 2018. This was the fastest since 2010. Notwithstanding such buoyant sentiment in home prices, Oxley’s share price has recently dropped to near six month low levels. Thus, I think it may be worthwhile to take a look at Oxley.

First, a description of Oxley

Based on Oxley’s press release, it is a property developer with a diversified portfolio, including property development, property investment and project management. Oxley is listed on the Main Board of the SGX-ST and has a market capitalisation of approximately S$1.92b. It has business presence across 12 geographical markets such as Singapore, UK, Ireland, Australia, Cambodia, Malaysia, Indonesia, China, Japan and Myanmar. Oxley has stakes in reputable companies such as Galliard Group (UK), Pindan Group (Australia) and United Engineers (Singapore).

Basis for Oxley

Below are some of the points which make me interested in Oxley:

1. One of the key beneficiaries from Singapore property recovery. Oxley has a landbank of approximately 3,800 units with an estimated GDV of SGD$5bn. Inclusive of Verandah Residences, Oxley targets to launch up to 7 projects in Singapore in 2018.

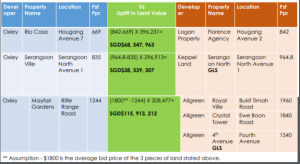

2. Being one of the earliest property players to start replenishing their Singapore landbank in a timely manner, Oxley has acquired sites at competitive prices. Based on Table 1 below, subsequent land acquisitions by other property developers at areas near to Oxley’s purchases were transacted at higher prices. This may be one of the reasons why, Eric Low, deputy CEO of Oxley, in a Feb 2018 interview with The Edge, said that they remain confident that its Singapore projects will still sell well, even if Singapore’s residential market recovers below their expectation.

Table 1: Uplift in land value

Source: Company

3. Oxley announced yesterday that it sold 129 units, or 76% of the 170 units at The Verandah Residences with just two days of sales on 7 Apr and 8 Apr. Average price for the 129 units is S$1,815 psf. Oxley bought this site in July 2017 for S$121m, or $964 psf per plot ratio.

4. Oxley is cognizant of the supply of residential units from the en-bloc wave which may hit the market by 2H18 or 2019. Therefore, Oxley strives for quick turnaround time. The Verandah Residences is a case in point. Oxley has taken a mere eight months from site acquisition to launch the project in Apr 2018. It is noteworthy that Roxy Pacific has taken 18 months from acquiring Harbour View Gardens in Sep 2016 and launching the project last month. Oxley intends to launch more projects such as Rio Casa and Serangoon Ville sites in the next few months.

5. Oxley seems to have a good track record in spotting property market demand. From shoe box units to overseas markets, it has read market demand pretty well.

6. According to a Nextinsight writeup (click HERE), the Oxley led consortium (comprising of Oxley, Min Dharma Co., Ltd and Sino Great Wall Co., Ltd) is the preferred bidder for the Myanmar mega rail project. The Project will occupy a site area of 25.7 hectares, with an intended development gross floor area of 1.09 million square metres i.e. a massive project.

7. Oxley recently placed out 156.8m new shares @$0.510 to institution holders. At the time of this doing this write-up, Oxley is trading at $0.475, below the placement price. Day range $0.470 – 0.480. My personal feel is that these sophisticated investors have done their due diligence and like what they see in Oxley. Click HERE for the press release.

8. Oxley has been doing share buybacks for three consecutive days since 5 Apr. It has been buying between 1M -1.5M shares a day between 0.470- 0.480.

9. Oxley has committed to a dividend policy of paying dividends of >= 25% of the Group’s consolidated profit after tax, excluding non-controlling interests and non-recurring, one-off and exceptional items, in respect of the financial years ending 30 June 2018 (“FY2018”) and 30 June 2019 (“FY2019”).

10. It is going to ex-div S$0.0072 per share on 3 May 2018.

11. Oxley has S$2b of unbilled contracts and GDV of S$15b worth of projects to be launched in their portfolio.

Risks

Very importantly, please note some of the risks below. The list below is not exhaustive.

1. Oxley’s chart looks weak with all its exponential moving averages (“EMAs”) pointing lower. 20D EMA has formed death cross formations with 50D and 100D EMA. Amid the share price decline, ADX has been rising and last traded at 34.8, indicative of a trend. RSI last traded 37.2. Only a sustained breach above $0.525 negates the bearish tinge in the chart. See Chart 1 below.

Near term supports: $0.465 – 0.470 / 0.450 / 0.440

Near term resistances: $0.480 / 0.500 / 0.525

Chart 1: Oxley – in a downtrend

Source: InvestingNote 10 Apr 2018

2. Oxley does not have a wide analyst coverage. There is one initiation report by SCCM dated 4 Apr 2018 with a target price $0.63. UOB has a report last year with a price target of $0.740 but there is no updated report this year to my knowledge. See HERE for a compilation of analyst reports on Oxley.

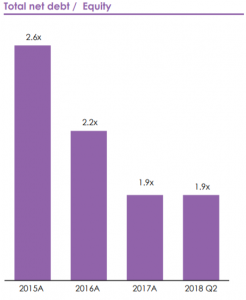

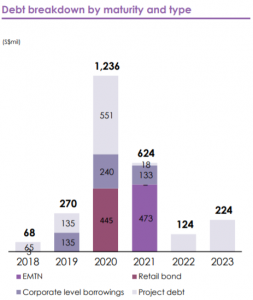

3. It is well known that Oxley’s leverage is high. However, based on Figure 1 below, Oxley’s total net debt to equity has declined from 2.6x in FY15 to 1.9x in 1HFY18. Furthermore, based on Figure 2 below, most of the debt matures in 2020. SCCM believes that Oxley should not have problems with these debt if they successfully sell their Singapore properties.

Figure 1: Oxley’s total net debt to equity

Source: Company

Figure 2: Oxley’s debt breakdown and maturity profile

Source: Company

4. I have no direct access to management and have not met them on a 1-1 basis. What I know is quite limited, based on analyst reports, media articles from Business Times, The Edge, Nextinsight etc.

5. I am not an expert in Singapore property market. However, based on Morgan Stanley, they expect Singapore home prices to rise 8% in 2018 and another 8% in 2019, fuelled by enbloc sales which further increase demand for homes, while reducing the supply of available units in the near term. RHB, in their latest property market report dated today, also expects residential prices to increase by around 5-10% in 2018. A rise in home prices should bode well for Oxley, should it be true.

Conclusion

Oxley has the largest residential land bank in Singapore by number of dwelling units, thus it is likely to be one of the best proxies to ride on an upturn in Singapore property market. Notwithstanding this, readers should be aware of the aforementioned risks. This write-up is merely an introduction to the company. Readers should check out Oxley’s company website (click HERE) and their latest presentation slides HERE for more information. They can also email to Oxley’s investor relations for more information.

P.S: I am vested. I have highlighted to my clients yesterday when Oxley was tradng at $0.470.

Disclaimer

Please refer to the disclaimer HERE

Muchos Gracias for your article.Really looking forward to read more.