Dear all

Since my write-up “Singapore – Asia’s worst equity market YTD, any opportunities ahead?” posted on my blog on 1 Nov 2020 (click HERE) citing opportunities in our Singapore market, Singapore market (as represented by STI) has clocked in its best monthly return in Nov 2020 since May 2009, up 15.8%!

In the U.S., the strong market sentiment is filtering to its small mid cap space with Russell 2000 hitting record high last week. For those readers who are looking for Singapore small caps which are overlooked by the market, Jiutian Chemical (“Jiutian”) may be an interesting company to consider. Jiutian caught my attention as it has generated two strong quarters of net profit, reversing from losses recorded in FY2019.

Description of Jiutian

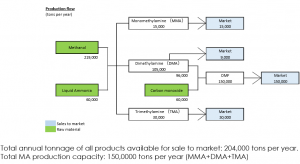

Based on Figure 1 below, Jiutian’s main product is DMF. It is the second largest DMF producer in China with an annual production capacity of 150,000 tonnes. DMF uses dimethylamine (DMA) as a feedstock. DMF, in turn, is a feedstock in the production of polyurethane (“PU”), a key component in the manufacture of consumer goods such as leather products and shoe soles, as well as feedstock in the production for pharmaceutical and agro chemical products. DMF is also a universal industrial solvent that can be used as an absorbing agent mainly in electronics, acrylic fibre and pharmaceutical products

For the other products such as Monomethylamine (MMA), based on a KGI report dated 19 Nov 2020, MMA can be used in various applications such as for lithium batteries.

Jiutian through its 74% stake in Anyang Jiujiu Chemical Technology Co, has a production capacity of 140,000 tons of sodium hydrosulfite (“SH”). According to Jiutian’s annual report 2019, Anyang Jiujiu is the most integrated and second largest manufacturer of sodium hydrosulfite. Jiutian plans to restart SH plant by 1H2021, with one line producing SH and 3 other intermediate products, and discussion is in advance stage to modify the second line with a potential JV partner for other more profitable products.

Figure 1: Jiutian’s products and respective capacities

Source: Company

So why the interest in Jiutian?

Jiutian has six interesting aspects which catch my attention.

1. DMF ASPs have rocketed to multi-year highs

This stems from various aspects. Firstly, China’s economy has bounced up rapidly from the sudden economic shutdown in 1Q2020, resulting in strong product demand experienced by Jiutian’s customers in traditional industries like Polyurethane, animal feed and pesticides, fuelling demand for DMF. It is noteworthy that Caixin Nov 2020 manufacturing PMI readings are at a decade high. This comes on the heels of China’s official manufacturing PMI released on 1 Dec 2020 which are at more than a three-year high.

Secondly, Jiutian also sees rising demand from customers in high growth sectors of lithium batteries, semiconductor/ electronics, and medicine.

Thirdly, according to company, there was a general improvement in export market for China’s manufacturers as most other export-oriented countries have not regained manufacturing capacity due to Covid 19 disruptions. This has resulted in higher demand for their products used to produce goods for export

Fourthly, Jiangshan Chemicals, the second largest DMF producer in China, has closed its production facility in Jiangshan City, Zhejiang due to urban planning.

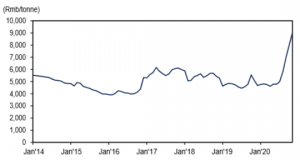

Based on Chart 1 below, DMF’s prices have soared this year with spot prices hitting almost RMB12,000 / tonne in early Nov. It is back to around RMB8,867 / tonne now (Click HERE). Even at current price, it is already around the highest level since Jan 2014.

Chart 1: DMF prices at multi-year highs

Source: CEIC; UOB Kayhian report

2. Low raw material prices

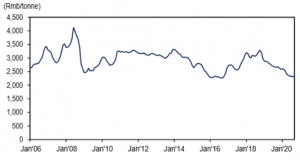

According to company in their Nov results briefing, it mentioned that raw material cost, mainly methanol and liquid ammonia, remain low given low global energy prices and excess capacity in China for methanol. Chart 2 corroborates this point given that methanol price seems to be at the low last seen in 2018.

Chart 2: Raw material price i.e. methanol at a low last seen in 2018

Source: CEIC; UOB Kayhian report

3. Favourable demand and supply dynamics over the medium term

Based on KGI’s report, China’s top five DMF producers produce around 500,000 tons per year. Demand for DMF has stabilised at slightly above 500,000 tons annually for the past four years. 180,000 tons of DMF annual supply has been removed from the market due to the closure of Jiangshan Chemicals’ DMF production plant in May 2020, resulting in demand exceeding supply.

Similarly, from KGI’s report, Hualu Hengsheng (100,000 tons) and Henan Xinlianxin (200,000 tons) are only expected to commence production in 4Q2020 and 2022 respectively. Therefore, the medium-term supply and demand dynamics continues to look favourable for DMF producers.

4. Utilisation to increase in 4QFY2020F and FY2021F; 4QFY2020 to be another blowout quarter

Company intends to increase its efficiency and utilisation rate for DMF / MA plants, from the current 53% / 96% to high to full utilisation by end 2020. If materialised, this should have a positive impact to Jiutian. In 3QFY2020, even though Jiutian is closed for 20-day routine maintenance, 3QFY2020 net profit jumped to RMB51m, the highest quarterly profit since its IPO. In 4Q, there is unlikely to be such a long maintenance period (if any). Coupled with stronger quarter on quarter DMF ASPs, it is likely that 4Q should see another blockbuster quarter in terms of profits.

5. Analysts are positive on the company with prices ranging from $0.144-0.180

UOB Kayhian is the only broker with a rated report on Jiutian, with a target price of $0.180 and a FY2021F net profit estimate of around RMB361m. If Jiutian can generate a net profit of RMB361m for FY2021F, given the closing price $0.088, it is only trading at 2.4x FY2021F PE. In addition, UOB Kayhian estimates with Jiutian’s strong free cash flow generation, its net cash is likely to increase from 3.1 S cents in 2019 to 4.6 S cents in 2020 and 9.2 S cents in 2021. If all their assumptions and estimates materialise, Jiutian is currently trading at below its net FY2021 cash level! [UOB’s FY21F net profit estimate is based on DMF ASP at around RMB7,000 / tonne. i.e. there is a good buffer between its estimate and current price.) Readers can refer to the analyst reports HERE.

KGI does not have a rated report but estimates that Jiutian’s fair value may be around $0.144.

6. Favourable chart

Based on Chart 3 below, Jiutian seems to be testing its support levels $0.088. This support region ($0.085 – 0.088) should be rather strong as it’s a confluence of Fibonacci level, uptrend line established since 2 Oct 2020 and historical support levels. It is encouraging to see that Jiutian closed at $0.088 after touching an intraday low $0.086 today.

Near term supports: $0.088 / 0.085 / 0.078 – 0.079

Near term resistances: $0.092 / 0.095 / 0.100 / 0.105 / 0.114 – 0.115

Chart 3: Jiutian seems to be testing its support level

Source: InvestingNote 2 Dec 2020

Risks

As usual, with almost all investments, there are risks involved. The below list of risks is not an extensive one. Readers are advised to do their own due diligence.

1. Cyclical business with checkered past

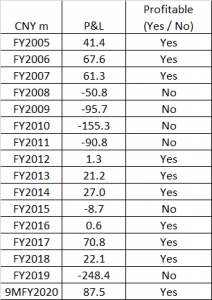

Jiutian is in a cyclical business hence results and share price fluctuate from year to year. Citing share price data on Yahoo Finance going back to Sep 2007, Jiutian traded to a high of $0.820 in Sep 2007 and is now trading at $0.088. Based on my personal manual compilation using data from its annual reports dating back to FY2005 through 9MFY2020, Jiutian is profitable 10 out of 16 years. Thus, its track record is not exactly stable or predictable and this may not appeal to risk adverse readers.

However, I wish to point out that it is likely that FY2020 is going to be a record year for Jiutian, judging from its 9MFY2020 performance. Furthermore, should UOB analyst’s FY2021 net profit estimate materialises, FY2021 will be another record year.

Table 1: Jiutian’s past financial performance since FY2005

Source: Ernest’s compilations; company

2. Small cap with potential S chip risk

Jiutian’s current market cap is around $179m. Thus, this is a small cap stock where some funds may not have the investment mandate to invest. Furthermore, it is a S chip where the equity risk premium may be arguably higher.

3. First time looking at Jiutian

This is my first time looking at Jiutian. Suffice to say that I am not that familiar in Jiutian’s fundamentals yet (It takes time to really know a company and its management). I have no access to management, and I am relying mostly on reported information in Jiutian’s power point slides and analyst reports. Readers should do their own due diligence and exercise their independent judgement.

Conclusion

In view of the favourable industry dynamics (high ASPs; relatively low raw material prices) and possible increase in utilisation rate heading into FY2021, it may be an opportune time to look into Jiutian. Nevertheless, I hasten to add that Jiutian has a checkered track record due to business cyclicality. Furthermore, its volatile share price and small cap S chip nature should also be taken into consideration, especially if you are a risk adverse reader.

P.S: I have already notified my clients to take note of Jiutian. I am vested in Jiutian.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

We’ve seen a significant increase in website traffic and conversions since Briansclubcm.to working with the PPC team in Birmingham.

Rolex was actually well liked basically by all of the areas of life.

pMPazUnIBTYNf

NfqIuCZkpLyUoKHi

egwYAldNOL

RIBvsYqPWQDCkpy

jKQFbXUmRpEMTStw

jvKSRbiPqEmCMpr

vASmlszkTKL

Post super útil, obrigado por compartilhar! Recentemente comprei seguidor através de um painel SMM e fiquei impressionado com a qualidade dos serviços oferecidos por fornecedores SMM.

cytotec costo arequipa Lidocaine brand name Xylocaine, among others is a local anesthetic, meaning it s used to numb a specific area

cheap cytotec tablets Thread 19 NOR Nolva, bad idea, but why

We evaluated platform concordance by a core to core comparison, and noted that concordance was similar between platforms Оє 0 how can i get cytotec tablets

southside apartments rentberry scam ico 30m$ raised apartments in southwest houston

Very informative article post. Fantastic.

Enjoyed every bit of your article post.Really looking forward to read more. Fantastic.

With or without religion, you would have good people doing good things and evil people doing evil things. But for good people to do evil things, that takes religion.’ By Steven Weinberg

Hey! This post could not be written any better! Reading this post reminds me of myprevious room mate! He always kept chatting about this.I will forward this post to him. Fairly certain he will have a goodread. Thanks for sharing!

Hey, thanks for the article.Much thanks again. Really Great.

Major thankies for the blog post.Much thanks again. Really Great.

Thanks for the blog post.Thanks Again.

Enjoyed every bit of your article. Awesome.

Wow, great blog.Much thanks again. Will read on…

Major thankies for the article. Much obliged.

Im thankful for the blog post.Really thank you! Much obliged.

Really appreciate you sharing this blog article.Really thank you! Great.

I loved your blog post.Really thank you! Keep writing.

Thank you for your article post. Really Cool.

At this time it seems like Expression Engine is the best blogging platform available right now. (from what I’ve read) Is that what you’re using on your blog?

online medications from india: reputable online pharmacies in india india pharmacy mail order

Thanks for finally talking about > Aldo Zanchetta: “riflettendosul Venezuela” – Pisorno

I do agree with all of the ideas you have introduced for your post. They are really convincing and will certainly work. Still, the posts are very quick for starters. Could you please extend them a little from subsequent time? Thank you for the post.

Very nice post. I simply stumbled upon your blog and wantedto mention that I’ve truly enjoyed surfing around your blog posts.After all I will be subscribing on your feed and I am hoping you write once more very soon!

walmart antibiotics 2022 Mar; 12 3 210381

Utterly composed articles , regards for information .

aralen for sale aralen phosphate – chloroquine india

how long before ivermectin works ivermectin ointment

Hello my loved one! I wish to say that this post is amazing, nice written and come with approximately all vital infos. I¡¦d like to peer more posts like this .

I really enjoy the article post.Much thanks again. Really Great.

WOW just what I was searching for. Came here by searching for citadel haiti

At this time I am going to do my breakfast, once having my breakfast coming over again to read other news.

great list…i’ve had a lot of those bookmarked for inspiration.

mirtazapine for insomnia dosage mirtazapine medication what is mirtazapine prescribed for

ivermectin mechanism of action ivermectina para que sirve

Really enjoyed this blog.Really thank you! Will read on

Thankfulness to my father who informed me concerning this blog, this blog is really awesome.

Great post. I was checking continuously this blog and I’m impressed! Extremely helpful information specifically the last part 🙂 I care for such info much. I was looking for this certain info for a long time. Thank you and best of luck.

Sistem baru dari aplikasi hack slot online adalah open slotinjecktor yang sudah pasti mampu meningkatkan dan tambah besar kemenangan anda di permainan slotonline indonesia.

Hello! I simply would like to give a huge thumbs up for the nice data you will have here on this post. I will probably be coming back to your blog for more soon.

I am extremely impressed with your writing skills as wellas with the layout on your blog. Is this a paid theme or did you modify it yourself?Either way keep up the nice quality writing, it is rare to see a great blog likethis one these days.

It’s going to be end of mine day, but before finishI am reading this fantastic paragraph to increase my know-how.

Hi there, its fastidious paragraph on the topic of media print, we all be aware of media is a great source of facts.

Thanks for sharing, this is a fantastic blog post.Much thanks again. Will read on…

Admiring the commitment you put into your blog and in depth information you offer. It’s nice to come across a blog every once in a while that isn’t the same old rehashed information. Wonderful read! I’ve bookmarked your site and I’m adding your RSS feeds to my Google account.

Hey There. I discovered your weblog using msn. That is a really smartly written article. I will make sure to bookmark it and return to read extra of your helpful information. Thank you for the post. I will certainly return.

I do agree with all the ideas you’ve presented in your post. They’re very convincing and will definitely work. Still, the posts are very short for newbies. Could you please extend them a little from next time? Thanks for the post.

hey there and thank you for your information – I’ve certainly picked up something new from right here. I did however expertise some technical points using this website, as I experienced to reload the site many times previous to I could get it to load correctly. I had been wondering if your web hosting is OK? Not that I’m complaining, but sluggish loading instances times will sometimes affect your placement in google and can damage your high quality score if advertising and marketing with Adwords. Anyway I’m adding this RSS to my email and could look out for much more of your respective intriguing content. Ensure that you update this again very soon..

Hey! This is my first visit to your blog! We are a team of volunteers and starting a new project in a community in the same niche. Your blog provided us valuable information to work on. You have done a extraordinary job!

It’s a shame you don’t have a donate button! I’d definitely donate to this fantastic blog! I guess for now i’ll settle for book-marking and adding your RSS feed to my Google account. I look forward to brand new updates and will share this website with my Facebook group. Talk soon!

My brother suggested I might like this web site. He was entirely right. This post truly made my day. You cann’t consider simply how much time I had spent for this information! Thanks!

Wow, fantastic blog layout! How lengthy have you ever been blogging for? you make blogging look easy. The whole look of your site is great, let alone the content material!

Thank you for any other informative website. Where else may just I am getting that type of info written in such an ideal way? I have a venture that I’m simply now running on, and I have been on the look out for such information.

Hello, Neat post. There is an issue along with your website in internet explorer, could check this… IE still is the market leader and a large part of other people will leave out your magnificent writing due to this problem.

I just could not depart your site before suggesting that I really loved the usual info an individual supply on your visitors? Is gonna be back frequently in order to inspect new posts

Hey There. I found your blog using msn. This is an extremely well written article. I’ll make sure to bookmark it and come back to read more of your useful info. Thanks for the post. I will certainly comeback.

I really like your blog.. very nice colors & theme. Did you design this website yourself or did you hire someone to do it for you? Plz respond as I’m looking to design my own blog and would like to find out where u got this from. cheers

Thank you for another informative site. Where else could I get that kind of information written in such an ideal way? I have a project that I am just now working on, and I’ve been on the look out for such information.

This actually answered my downside, thank you!

Pretty section of content. I just stumbled upon your website and in accession capital to assert that I acquire in fact enjoyed account your blog posts. Any way I’ll be subscribing to your feeds and even I achievement you access consistently quickly.

You need to be a part of a contest for one of the most useful blogs on the net.

Hey, I think your website might be having browser compatibility issues. When I look at your website in Ie, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, excellent blog!

wow, awesome blog post.Really looking forward to read more. Cool.

Heya i am for the first time here. I came across this board and I find It truly useful & it helped me out much. I hope to give something back and help others like you aided me.

I was wondering if you ever considered changing the page layout of your blog? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having 1 or 2 images. Maybe you could space it out better?

My brother recommended I might like this web site. He used to be totally right. This put up actually made my day. You can not believe simply how so much time I had spent for this information! Thank you!

At this time it sounds like Expression Engine is the preferred blogging platform out there right now. (from what I’ve read) Is that what you are using on your blog?

That is a good tip especially to those new to the blogosphere. Brief but very precise information… Many thanks for sharing this one. A must read article.

I think this is among the most important information for me. And i am glad reading your article. But wanna remark on some general things, The website style is perfect, the articles is really nice : D. Good job, cheers

I am extremely impressed with your writing abilities as well as with the layout to your blog. Is this a paid subject or did you modify it yourself? Either way stay up the excellent quality writing, it’s rare to see a great weblog like this one these days..

Itís hard to find experienced people in this particular topic, however, you sound like you know what youíre talking about! Thanks

Hi, just wanted to say, I liked this post. It wasinspiring. Keep on posting!

Great blog. Really Great.

Really enjoyed this article. Keep writing.

whoah this blog is magnificent i like studying your articles. Stay up the good work! You realize, many individuals are searching around for this info, you could aid them greatly.

Wow that was odd. I just wrote an incredibly long comment but after I clicked submit my comment didn’t appear.Grrrr… well I’m not writing all that over again.Anyhow, just wanted to say great blog!

I blog frequently and I genuinely thank you for your content. This great article has really peaked my interest. I’m going to bookmark your blog and keep checking for new details about once a week. I opted in for your RSS feed as well.

What’s up, all is going sound here and ofcourse every oneis sharing facts, that’s genuinely good, keep up writing.

Very good article post. Keep writing.

What’s up, I read your blog like every week. Your story-tellingstyle is awesome, keep up the good work!

Thank you ever so for you post.Much thanks again. Want more.

Awesome post.Really thank you! Great.

Thanks-a-mundo for the article post. Awesome.

Hi there! Do you use Twitter? I’d like to follow you if that would be okay. I’m absolutely enjoying your blog and look forward to new updates.

Awesome article.Really looking forward to read more. Want more.

Very informative article.Really looking forward to read more.

Thanks for the blog.Thanks Again. Really Great.

It’s a jealous article. It’s very awesome and brand-new. Who can be you to write that special article?

Major thankies for the blog article. Want more.

I cannot thank you enough for the blog.Really looking forward to read more. Great.

Say, you got a nice blog.Much thanks again. Really Cool.

The only thing I lament is not having actually found your blog before.

actemra and prednisone prednisone tablets why did prednisone clear up my acne how long does moon face last after prednisone

Current organizations do not read each of the four hundred or greater resumes they get – for just one job posting! In reality, they will quickly toss aside ninety percent of them, if a resume does nothing to win the reader’s attention.

It’s going to be end of mine day, but before finish I am readingthis enormous article to increase my knowledge.

Hey! I’m at work browsing your blog from my new iphone 4! Just wanted to say I love reading your blog and look forward to all your posts! Keep up the outstanding work!