Dear all

Below is my personal opinion on the market. As previously mentioned to my clients, I aim to reduce my percentage invested in stocks (currently around 130% invested), especially the non-performing stocks, with no immediate near term catalysts. I am cautious on the market in the next 1-2 months because

a) The large market run up year to date. STI has appreciated approximately 12% YTD and 22% for the past one year;

b) June is likely to be a quiet month as most companies have reported results and some of the blue chips have already ex dividend. i.e. limited catalysts for most stocks;

c) Holiday period where fund managers and analysts may be off on holidays;

d) As my performance has been lacklustre compared to the year to date rally in STI, I want to re-evaluate and consolidate some of the positions that I have and the overall market + look at other stocks.

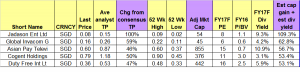

Meanwhile, I have done a personal compilation of stocks from Bloomberg, with estimated dividend yield >3%, sorted by total potential return (i.e. estimated capital gain + estimated dividend yield) for those clients who wish to accumulate stocks with good dividend yields on market weakness. Table 1 shows the top five stocks with the highest estimated total potential returns. [My clients will receive the entire compilation]

Table 1: Top five stocks with the highest estimated total potential returns

Source: Bloomberg as of 19 May 17

However, please take note of the following:

1. Analyst target prices may be subject to change anytime. Also, some analyst target prices such as Asian Pay may not be updated. However, it is fairly accurate to say the average analyst target prices for stocks whose market cap >S$1b are accurate.

2. The above is for reference only. Readers / clients should exercise their independent judgement and take into account of their percentage invested, returns expectation, risk profile and current market developments.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider to leave their contacts here http://ernest15percent.com/index.php/about-me/

Lastly, many new clients have asked me how I screen and decide which companies to take a closer look / write. To understand more about my basis of deciding which companies to write, you can download a copy of my eBook available on my website HERE.

P.S: Do note that as I am a full time remisier, I can change my equity allocation fast to capitalize on the markets’ movements.

Disclaimer

Please refer to the disclaimer HERE

Wow, awesome weblog format! How long have you been blogging for?

you make running a blog look easy. The total glance of your site is

great, as smartly as the content! You can see similar here e-commerce