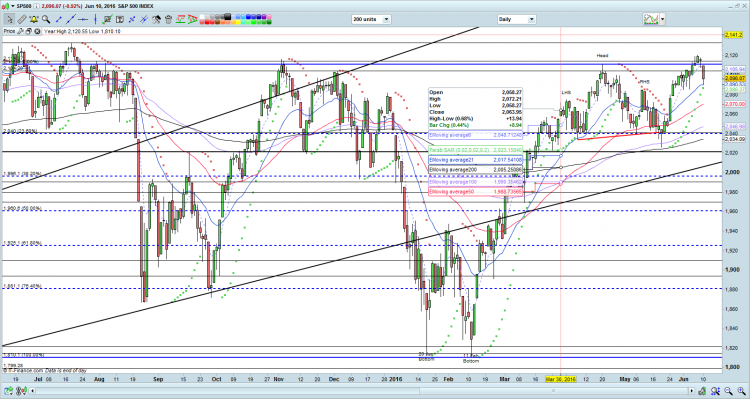

Ernest’s market outlook (24 Jun 16)

Dear readers, Are you burnt in the aftermath of THE BREXIT? What should you do now? To cut loss, hold or buy more? Before you make the decision, it is good to consider the various markets and how they are likely to fare in the next two weeks. S&P500 Index Just to recap what I have mentioned on 10 Jun 2016 (see HERE), I wrote “Given the low ADX, S&P500 may trade between 2,034 – 2,106 (barring Brexit on 23 Jun 2016).” –> Although Brexit happens, S&P500 reached an intraday low of 2,033 on last Fri, just 1 point […]