This write-up was reproduced with permission from Ray’s Estate Clinic, written by Founder, Raymond Chng. Please refer to the end of the article for more information on Raymond.

The decision to upgrade from a HDB to a private property whether a condominium or landed property is a big decision to many, over the past few years, I have had many clients ask me for my opinions and particularly if they should upgrade.

Many HDB owners upgrade because they are fearful of their HDB price being stagnant. The worst thing that can happen is a HDB owner to upgrade into a private property that also remains stagnant. Having a more expensive asset that remains stagnant can set you back by years, if not at least decade, according to historical data and experiences.

In this article, I hope to share some of the discussions that I find useful in helping HDB upgraders to make well informed decisions.

1.Avoid buying over priced properties

In my previous article “10 things you need to know before buying a new launch”(click HERE), I wrote about the new launch price premium in 2019. Homebuyers should seriously consider this in order not to buy an over priced property.

Buying a property that is over priced can set you back years or even decades. In 1997, if you bought a new launch from developer that was over priced, it would have taken 15 years to breakeven. Factoring inflation of 2.5% p.a, interest rates of an average of 2% and your CPF accrued interest, the opportunity cost of taking 15 years to breakeven is HUGE! Assuming that the average opportunity cost is 3% p.a, a 15 year period would set you back by 45%, which is a challenge to recover.

2.Avoid over-stretching your budget

When upgrading from a HDB to a private property, most upgraders move from one property to another property that costs at least double the price of the HDB. Specifically, majority of HDB owners are moving from a S$500,000 property to S$1,200,000 or higher. Therefore, it is important to work within a comfortable budget because property is purchased on leverage (at least for most people).

Over-stretching your budget can make you a slave to the property instead of the property being an asset to you. Over the last decade, I have seen many such cases and the property owners become very depressed for long periods.

There are many consequences of over-stretching your budget which I will not go through in detail. Property buyers should consider if they will have issues during a financial downturn when the bank may ask for a margin call or top up, also if there is a loss of income, how long can their savings last and whether they have some buffer in their CPF to make such payments.

3.When buying a resale private property, check the Property Wellness Index

I realized that whenever I bring buyers to view resale properties, they would request that I show certain developments which have properties at a very inexpensive price.

There are always good deals in the market, there are also those properties that just have very low demand because their Property Wellness Index standings are very low. For example, some of these properties have a very bad smell all around, or are very badly maintained. The only saving grace for these properties would be an en-bloc sale and the next most obvious consideration would be when the en-bloc sales can happen.

Image 2: Old apartments in Tiong Bahru

What is Property Wellness Index?

This index consists of a series of factors that I have created for my clients to identify good resale properties that are likely to maintain and hold their value for a long time. These older condos also should be desirable by most buyers. HDB upgraders who are buying resale properties should look for a property that has a good property wellness index while also making sure it is value for money.

4.Understand where we are in the current HDB market cycle

By understanding where we are in the HDB market cycle it can help you make a better decision whether upgrading makes sense. The ability to upgrade is always dependent on the HDB to private price gap.

For example, if the average HDB price is $500k, while the average comparable condo price is $1.8mil, it would be extremely difficult to upgrade.

While if the average HDB price is $500k, while the average comparable condo price is $1.2mil, it would be a fair price to upgrade to.

As of September 2019, my personal view is that the government is artificially suppressing the private residential market, in particular the condo market to prevent runaway prices. This keeps condo prices within reach of HDB upgraders. On the other hand, the government had most recently made HDB resale prices more attractive for people to buy, this allows HDB sellers who had difficulty selling previously to be able to find a buyer.

What I personally think is that HDB owners can take this opportunity to offload their HDB and upgrade to a private property which prices are currently artificially suppressed (proper property selection is still important here).

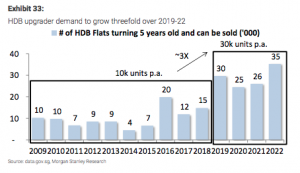

It is noteworthy to know that the number of HDB units achieving their Minimum Occupation Period (MOP) has increased three fold in 2019 (as seen in Image 3 below) and the trend is likely to continue. The assumption here is that there will be more HDB owners looking to upgrade. This will likely translate to higher demand for resale condos and higher competition when selling your HDB flat.

Image 3: Number of HDB flats receiving MOP / Source: Morgan Stanley Research

It would pay off to be realistic when selling off your HDB flat and as mentioned earlier and in my other articles (click HERE), it is essential that private property buyers take time to select a good unit, which is what I emphasize and help my clients to do.

5.Consider what future trends may prevail, especially for re-selling your property

Do you remember a time where Joo Chiat, Tiong Bahru and old properties were not in demand? Today, they are in demand and are considered in trend!

On the back of trend changes, people’s preferences change too. Especially with the next generation of buyers now entering the work force and preparing to buy their homes. In the next 10 years, preferences may change due to technological advancement.

With the rise of mobility service providers like GRAB, SG Bike and potentially driverless cars in the future, could property buyer’s preferences change? For a long time, buyers have always loved buying properties near the MRT.

The rise of mobility service providers could reduce transportation costs and hence a condo that is 12mins walk to the MRT may still be in demand or even more in demand in the future.

Lets consider this example:

If a condo is 5mins from the MRT and cost $1.2mil while a condo that is 13mins from the MRT cost $1mil. The difference is $200k for an additional 8mins walk, with a savings of $200k, a family could buy one car and still have some money left!

This has been a common conversation that I have with my clients, buying preferences could change in the future and we need to consider future trends in order to identify what types of property will remain profitable.

6.What is the minimum cash outlay required

For HDB owners who intend to upgrade to a private property, it would be good to know that you need to prepare a minimum of 5% of the purchase price in cash, and also the stamp duties of 4% minus $15,400.

For a resale property purchase, you can utilize CPF to pay for stamp duties, but due to the nature of the transaction, you will need to pay cash first and “claim” from CPF only after the completion of the transaction.

7.Find a unit that may hold its value well during an economic downturn

Upgrading from a HDB to a private property could be stressful to some property owners. Some property owners worry about loss of income and uncertainties in an economic downturn. If your property can hold its value, you are likely to feel more at ease in a crisis.

Image 4: Supporting blocks

There are a few factors that help a property to maintain or hold its value well during an economic downturn. One of it would be the rentability of the condo, so that owners who bought their units for investment in the condo can still have rental income and would be unlikely to need to sell their units in a hurry (firesale).

8.Unit’s orientation is the only thing fixed, but also the most important

A private property would be one of the most, if not, the most expensive purchase that anyone of us will be transacting. Hence a lot of thought will be placed into the purchase decision. For every property unit, the only thing fixed is the facing and orientation of the unit because the interior can be changed easily.

While this may sound like common sense, the reason why some property owners do not make profits is because they do not consider this fact. Buying a unit with a bad orientation can mean the unit is less desirable and hence when you want to sell in the future, it may take a long time, or you may not see much profits, if any. Many private property owners treat their property as a retirement plan, essentially to have the option to sell their property upon retirement and down size to a HDB or smaller unit. Buying a unit with a desirable orientation could be the differentiating factor between a S$200k profit and no profit.

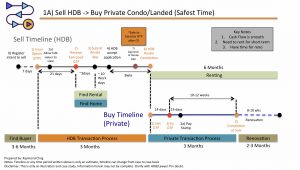

9.Know what timeline is suitable for you

There are 4 different timeline that HDB upgraders can consider depending on their own situation and needs. Below is an example of a timeline for selling a HDB and buying a resale condo.

Image 5: Sample HDB upgrading timeline / Source: RaysEstateClinic

This sample timeline is one of the most common HDB upgrading timeline schedule used. It is also the safest timeline whereby the risk of complication is almost zero. This timeline will require you to move to a temporary home, and then when your new home is ready, to move again. To some this may be a hassle, but to most HDB upgraders, this could be an opportunity to clear out excess items they have.

In my opinion, a smooth transaction is the key to upgrading successfully. When there are hiccups or high risks of complication, it is difficult to think calmly and it tends to affect your family’s mood and potentially your work.

10.Holding a private property can be a rewarding retirement plan

Image 6: Retirement

While you enjoy staying in your property, a good private property that has capital growth will help you build your nest egg for retirement. As seen during the 2017-2018 en-bloc boom, many of the property owners who got the windfall kept a bulk of their cash and down sized into larger HDB flats. Essentially having the ability to be financially free.

For private property owners who do not get en-bloc can still down-size into a HDB flat and still have leftover cash as their extra retirement fund. The beauty of MAS’s policy guidelines for loans is that for the first property loan, you can only take a 75% loan if your loan tenure stops at age 65 (which is the retirement age). This means that majority of property owners will have fully paid their property at age 65 or earlier (through partial re-payments). This then allows the private property owner at the worst case to sell their property and down size.

Case Study 1 (Right-size from Private to HDB):

Lets assume that the HDB upgrader buys a private property at age 40 for $1.2mil. At age 65, he sells the private property for the same price at $1.2mil. Without taking into account holding costs, you would have benefitted from having free stay for 25 years, and can now right-size to a 4-room HDB flat (assuming that it is sufficient for your lifestyle) for an estimated figure of $500k or less.

You would still have close to $700k as your retirement fund. Of course, this is just an estimate for illustration purpose only. Everyone will have different figures based on the property purchased and other source of income or gains.

About the Author

Ray’s Estate Clinic (REC), founded by Raymond Chng, is a platform for Investors’ and homeowners to have a Property Portfolio Health Check by utilizing data analytics, ensuring that their portfolio remains healthy providing optimized returns.

“Health is Wealth” is what Raymond believes in, and it is not related only to your own body’s health, but it also refers to one’s financial health. Having a Property Portfolio that is not performing does not help improve an investor’s wealth. Hence, converting non-performing assets into optimized performing assets is essential to portfolio’s health improvement.

Raymond can be reached at raysestateclinic@gmail.com. Do visit his blog HERE for more information.

Disclaimers

Please refer to Raymond’s blog for the disclaimer HERE

Also, please refer to my disclaimer HERE

Your articles are extremely helpful to me. Please provide more information!

I am so grateful for your blog article.Thanks Again. Fantastic.