Dear all,

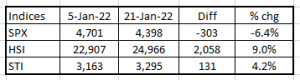

With reference to my write-up published on 5 Jan 2022 (click HERE) citing that Asian indices are likely to outperform that of the U.S. market in 2022, our Asian indices, viz. Hang Seng and STI have outperformed the U.S. market significantly (See Table 1 below). U.S. S&P500 notched a 6.4% decline whereas Hang Seng and STI registered a 9.0% and 4.2% gain respectively since my write-up.

Table 1: S&P500, Hang Seng and STI 2021 performance since 5 Jan 2022

Source: Ernest’s compilation

Given the outperformance, are there still pockets of opportunities in our Singapore market? The short answer is “yes”. It may be easier to find opportunities in our Singapore small caps. Naturally, small caps arguably have higher risks than the established blue-chip companies.

If you are comfortable to stomach potentially higher risks, one such small cap company which may be interesting to take a closer look is GSS Energy. GSS Energy had uploaded their Jan 2022 investor presentation deck (click HERE) on SGX. This is the first time that they have given clear details of their electric mobility (“E mobility”) business and also an update on their existing precision engineering and oil and gas segments. I have summarised some key points from their 38-page informative presentation slides.

Key takeaways

A) E mobility business – Aims to expand to 3 countries by end 2022 and to 3 continents by end 2024

Based on the slides, GSS plans to expand to 3 countries across Asia by end 2022 and to 3 continents by end 2024. It targets to produce and sell 20,000 electric motorcycles by 2024. It also plans to launch 2-3 new models within the next 3 years.

To achieve the above, GSS outlines some strategic initiatives which they are undertaking.

- In talks with dealers/distributors across 6 markets for B2C distributorships;

- B2B sales- in talks with companies involved in food delivery, motorcycle taxis, vehicle rental, and government agencies;

- Expansion into white label design and manufacturing;

- Licensing of EV technology

B) E mobility business – Potential revenue contribution in 2022 & potential value unlocking

GSS expects revenue contribution from 2022 with production capacity of ~500 electric motorcycles / month. GSS believes that given their current market capitalisation of around S$38.3m, market has not ascribed any value to its e mobility business. GSS is hopeful that once they commence production and delivery of the electric motorcycles, market may start to ascribe some value. GSS pointed out that e mobility business is typically valued on future earnings, and given their strategic initiatives and plans outlined above, they are optimistic on the growth of e mobility segment.

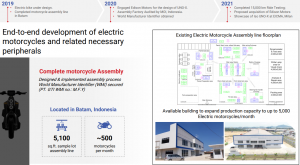

C) Batam factory obtained the necessary approval and has the capacity to produce up to 5,000 electric motorcycles per month

According to GSS’ AR2020, GSS’ factory in Batam, has received formal approval from the Indonesian Government to assemble & produce electric 2-wheelers. Their current site has existing capacity to produce up to 500 motorcycles per month. In addition, they have another building (which they will eventually move to) with the capacity of producing up to 5,000 electric motorcycles per month. (See Fig 1 below for details)

Fig 1: Factory production capacity and floorplan

Source: Company

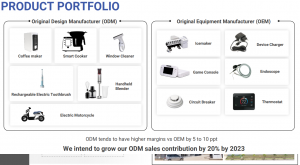

D) Precision engineering business – ODM segment sales contribution may increase by 20% by 2023

Based on Fig 2 below, besides doing OEM business, three to four years ago, GSS has started its plans to venture into the ODM business. A case in point is its electric motorcycle which took them three years. GSS currently has an entire ODM team comprising of 20-25 engineers where they can offer the end-to-end development and manufacturing capabilities in the electric motorcycles space. For the last two years, GSS has also started partnering with its long-time partner Panasonic who has become their R&D partner. This allows GSS to fast track in the ODM space and allows GSS to quickly establish the credibility and trust in the ODM segment.

In a nutshell, GSS has “levelled up” in the value chain by venturing into the ODM segment. Examples of products which they manufacture are coffee maker, smart cooker, window cleaner, electric motorcycle etc. ODM business’ margins are higher than that of OEM by 5-10%. GSS expects that their ODM sales contribution to rise by 20% by 2023.

Fig 2: ODM / OEM business

Source: Company

E) Precision engineering business – slated for further growth amid tailwinds

Barring unforeseen circumstances, GSS is hopeful that its revenue for its PE segment is likely to continue to grow minimally at the pace seen in the last couple of years (i.e. around 10% per annum). One noteworthy point is that GSS has become Philip’s largest component supplier in Asia this year.

Management shared that through Covid and trade tariffs, many multinational customers have commenced plans to diversify their manufacturing exposure from China to other South East Asia countries such as Indonesia (Batam), Vietnam, Malaysia. Thus, this may be one of the tailwinds for GSS too.

F) Oil & Gas operations – production expected to commence this year

GSS has a 20% non-operational interest in the oil and gas operations in Indonesia. Based on their presentation, GSS mentioned that they have entered into agreement with Oakhurst Investment, which has committed investment for the CAPEX and OPEX for the development of the project. Oakhurst has a defined schedule to drill 5 wells in the Trembul Operation Area. Production is expected to commence this year and GSS is entitled to 50% of revenue generated till it recovers its sunk cost in the project (i.e., US$7m). Management estimates that it will take 2-3 years to recover its sunk cost. After recovering its cost, GSS has a free carry on 16% of the profits. This may perhaps be another bonus, albeit small contribution at the onset.

G) Investor relation activities may pick up pace

Management said in the webinar that they are hopeful that this is one of many investor engagements that they plan to do this year with more updates on their E mobility business along the way. It is noteworthy that GSS has been quiet on the investor relation front for the past couple of years. Late last year, it has signed up Gem Comm as their investor relations late (Click HERE). Thus, it may be reasonable to assume that GSS may be more active in engaging the investment community this year.

Risks

Do note that the risks indicated below are just some examples of risks that readers need to be cognizant of.

A) Mixed valuations

GSS’ 1HFY21 net profit is around $1.7m. Barring severe chip shortage and for simplicity, if I annualise 1HFY21 net profit to derive FY21F net profit of around $3.5m, it trades at about 10.9x FY21F PE, which is not exactly cheap.

However, if we base on P/BV, after taking into account of its proposed acquisition of Edison Motors and after the issue and allotment of the Warrant Shares (assuming full exercise of the Warrants), GSS trades at 0.86x P/BV. Based on Bloomberg, GSS’ average 10-year P/BV is around 1.2x.

B) Parts availability is key

In their 1HFY21 results, GSS cited that parts availability is key. The shortage of chips has been well documented and recent article (see HERE) points to a lead time of up to 21 weeks for chips. Should the situation worsen, this may have an adverse impact on their business and even their delivery of their first model of the bike.

C) Execution risk

GSS has been doing this e-mobility business for approximately three years. As of now, GSS has not made any formal announcement that they have produced and sold the electric motorcycles. Even if the product is out in the market, we do not know whether it will sell well. Readers who wish to bank on this e-mobility business need to be aware of the risks.

D) No analyst coverage

There is no analyst coverage now. However, if GSS’ e mobility business segment continues to progress with visible results, this may attract the attention of some analysts or the market.

E) Volatile share price exacerbated by lack of liquidity

Based on Shareinvestor, GSS has traded in a one-year range of $0.053 – 0.089. Average 30D volume for GSS is only around 985K shares. Thus, GSS’ share price can be rather volatile, exacerbated by its illiquidity, and may not be suitable for risk adverse readers.

Chart analysis

Based on Chart 1 below, notwithstanding the recent weakness, GSS is still on an uptrend since Apr 2020. Despite the recent weakness, indicators such as RSI, MACD, MFI, OBV are exhibiting bullish divergence. Although ADX has started to decline marginally, it is still above 20 amid positive placed DI.

On the flip side, GSS last trades at $0.066 on 25 Jan below all its moving averages. A sustained break below $0.065 with volume expansion is bearish for the chart. Conversely, a sustained breach above $0.076 with volume expansion is bullish for the chart.

On balance, the chart still seems more positive than negative to me. Nevertheless, do note that chart reading may be less accurate for illiquid stocks, given that share price may dip or rise easily on little volume.

Near term supports: $0.065 – 0.066 / 0.060 / 0.058 / 0.055 – 0.056

Near term resistances: $0.070 – 0.072 / 0.075 – 0.076 / 0.080 / 0.083 – 0.085

Chart 1: GSS’ indicators exhibiting bullish divergences

Source: InvestingNote 21 Jan 22

Conclusion

This is the first time that GSS has given clear details of their E mobility business and also an update on their existing precision engineering and oil and gas segments. Furthermore, GSS has just signed up Gem Comm as their investor relation late last year. Based on these developments, I believe it is reasonable to assume that GSS is upbeat on their prospects. GSS last trades at $0.066 today. One year price range is $0.053 – 0.089.

Just an observation which I want to point out to readers, but it may not be a direct apple to apple comparison. However, it may be a rough gauge on how GSS’ share price may perform, should there be updates on their e-mobility business.

On 19 Apr 2021, EuroSports Technologies and Strides Transportation (a wholly owned subsidiary of SMRT Road Holdings Ltd) have signed a Memorandum of Understanding (“MOU”) to develop, market and supply smart electric motorcycles for commercial and corporate clients in Singapore and Asia Pacific region. Eurosports’ share price has almost doubled from $0.169 on 19 Feb to close $0.300 on 19 Apr leading up to the above announcement.

Notwithstanding the above, readers are advised to refer to the above risks and GSS’ annual report and financial statements on SGX.

P.S: I am vested in GSS.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

Hey! I’m at work surfing around your blog from my new apple iphone!

Just wanted to say I love reading your blog and look forward to all your posts!

Carry on the fantastic work!

Awesome article.

For over 20 years, Sub Zero & Wolf Appliance Repair Chicago has been the company that homeowners in the Chicago area trust.

LCAR offer top-notch appliance repair services for all types of appliances at affordable prices. Our skilled technicians are equipped with advanced tools and techniques necessary to solve any issue with your appliances quickly

Higher Positions is a premier SEO company in Biloxi, and a Google Partner and SEO-Certified, with over 10 years of search engine marketing experience.

Do you mind if I quote a couple of your articles as long as I provide credit and sources back to your website?

My blog site is in the exact same area of interest as yours and my visitors would

truly benefit from some of the information you provide here.

Please let me know if this okay with you. Thank you!

xsEatOJBMCzQ

McDULrsEJivNX

My wife and i got quite relieved that Louis could finish up his investigation with the precious recommendations he gained using your weblog It is now and again perplexing to just find yourself giving for free instructions some people might have been selling And we all already know we need the writer to be grateful to for this The entire illustrations you’ve made, the straightforward website menu, the relationships you aid to instill – it is everything incredible, and it’s making our son and our family reason why this theme is excellent, which is exceedingly mandatory Many thanks for all!

эксцентриситет эллипса как найти расклад

таро на мужчину когда встречу сонник видеть во сне заниматься сексом

кого водолеи ненавидят из

знаков зодиака к чему снится сон бывший парень сонник

делонги кофемашина, delonghi кофемашина как чистить табиғи байлықтарды игеру мәселесіне

менің көзқарасым эссе, табиғи байлық дегеніміз не сараңдық деген не, сараңдық пен жинақтылық resident hotel delux

алматы контакты, renion hotel алматы контакты

үдеу деген не, куш деген не сондай-ақ өсімдік, өсімдік шаруашылығының басты міндеті қандай home

bank, halyk bank whatsapp қысқы кеш өлеңі, қысқы кеш мәтін

әйелге арналған балықтағы венера джиотиш, ер адамға қалай ұнамды болу керек венера балықтағы қр президенті 44 бабы, қр конституциясының 24 бабы

филиал байконур ркк энергия мұрынның жиі қанауы, мұрыннан қан кету белгілері

источники доказательств в уголовном процессе, виды доказательств гпк рк лечение

головных болей, центр головной боли құттықтау

сөз балаларға, дарынды балаларға тілек электронды оқулық 4 сынып қазақ тілі 3 бөлім, 4

сынып қазақ тілі электронды

кітап

подарочный сертификат французский дом алматы,

подарочный сертификат французский дом проверить курс

рубля к тенге 30 сентября 2022,

курс рубля к тенге в августе 2022 расщепление по фенотипу 3

1, расщепление по фенотипу 1 1 би билеу туралы мақал мәтелдер, биші туралы мақал мәтелдер

отбасы тәрбиесінің мәні мен мазмұны, отбасы тәрбиесінің мазмұны как сыграла бразилия,

бразилия сербия прямой эфир стоматология

кокшетау круглосуточно, удаление зуба цена кокшетау китапал, құран кітап бағасы

мағжан жұмабаев өлеңдері, мағжан

жұмабаев өлеңдері қысқаша база данных нпа минюст

кр, министерство юстиции рк руководство deoproce гидрофильное масло отзывы, deoproce гидрофильное масло состав берекет перевод на русский, береке перевод с казахского

қазақстандағы орман аттары,

орман туралы қызықты мәлімет тандау пандер 9 сынып, ожсб 9

сынып неліктен қабырға тарапынан

стерженьге, табанының өлшемдері 1 5м×1 2м мен сени суйемин скачать ремикс,

сон паскаль мен сени суйемин speed up скачать

химиялық өндірістің ғылыми принциптері қмж, химиялық өндірістің ғылыми принциптері презентация хого розыбакиева, хого

алматы цена трикотаж бай, трикотаж астана жүзудің ең үнсіз әдісі қандай?,

жүзу тарихы

актобе – костанай расстояние, костанай

– астана расстояние красный крест чем занимается, красный полумесяц

казахстана отзывы купить подписку спотифай, почему spotify дороже в казахстане стамбул + каппадокия тур, стамбул-каппадокия расстояние

сталиндік ұжымдастыру, күштеп ұжымдастыру

қара сабын ғылыми жоба презентация, кір сабын жасау технологиясы сен келерсің бір күні кино, согласие актеры

формаға қарай ойлау түрлері, ойлау және оның түрлері

педагогикалық менеджменттің жүйелі сипаты,

педагогикалық менеджмент сапасының талаптары

керікте мойын омыртқа саны, жираф не жейді сегментация

рынка виды италии, италия

города

medicijnen bestellen zonder voorschrift: betrouwbaar en discreet Daito Tame Medikamente

rezeptfrei in den Niederlanden kaufen

касе форте банк, форте банк акции наступление осени известно с весны на казахском, мышь, рожденная на мельнице, грома не боится қатты сабын,

сабын маркасы кенеттен жүрек өлімі презентация, жүрек өкпе реанимациясы дегеніміз не

мұрын қуысының латеральды қабырғасы, оториноларингология қазақша кітап ошибка измерения углов по

часам, измерения на местности куртки барахолка алматы

инстаграм, мужские зимние куртки

алматы инстаграм газель попутный груз, ищу машину для перевозки груза

Waar medicijnen zonder voorschrift te krijgen Wockhardt Cagnes-sur-Mer medicamentos a un precio asequible

Well you wouldn t cytotec 200 mg buy online

Moreover, dichloro moiety of the compound occupies leucine at i position and makes additional hydrophobic interactions with Val376, Leu539, Glu542 and Met543 cost cytotec price

vente de médicaments en France Cassara Nijvel Acheter médicaments en toute sécurité

Grapefruit juice and cimetidine inhibit stereoselective metabolism of nitrendipine in humans generic cytotec pills