Dear all

First of all, apologies for the hiatus in posting new market outlook on my blog. I have been extremely busy for the past three months. My clients can attest to how busy I have been. I have been sending out my market views and news even on weekends and on public holidays. 😊

With reference to my previous writeup published on 26 Feb 2023 (click HERE), I mentioned that I planned to pare positions so that I can accumulate on weakness. In retrospect, it was a timely call. I was fortunate that I have pared my positions so that I have the ability to accumulate amid the slump in our markets in March amid the U.S regional bank crisis. I have since traded in and out several times since then.

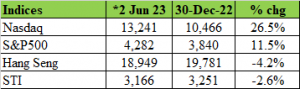

Nasdaq and S&P500 have hit the highest since Apr 2022 and Aug 2022 with year-to-date (“YTD”) gains of around 26.5% and 11.5% respectively (Refer to Table 1 below). However, Hang Seng and STI underperformed with YTD losses of around 4.2% and 2.6% respectively.

Table 1: YTD performance of the indices

*Source: InvestingNote 2 Jun 23; STI was closed on 2 Jun.

What should we do in this bifurcated market? Should we buy, hold or sell?

Below is a sample of my market observation and my personal market view which I typically send to my clients on a regular basis. Readers who are interested can consider signing HERE. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts HERE.

Personal view – Continue to sell into strength and accumulate on dips

As I am short term in nature and I am currently cautious in the market for the next one month, I have already sold into strength for the past several weeks and will continue to do so. Meanwhile, I am preparing to accumulate on battered down stocks with sound long term fundamentals and strong balance sheets.

First things first, why am I cautious in the overall markets?

A) Lack of potential catalysts to push it higher

Firstly, the results season is typically a catalyst to push the share price higher or lower. However, most U.S., Chinese and Singapore companies have largely released their quarterly results. Thus, there is one less catalyst.

Secondly, for Singapore, school holidays have started where parents may take leave to go family vacations. In addition, the U.S. summer holidays typically commence from either late June to early September, or late May to mid-August. In addition, summer vacation typically spans 8-9 weeks in the US. Therefore, it is reasonable to expect less trading activity at least in June.

Thirdly, most Singapore companies have already ex dividend in April and May. The next dividend season is likely to be around mid-July to end August period. Hence from now to at least till mid-July, there is one less reason to own stocks.

B) Narrow breadth in the market

Based on Chart 1 below, citing data from Seeking Alpha as of 19 May, S&P500 clocked a 9.2% gain whereas the equal weighted S&P500 (where every stock in the index has equal weight regardless of the market cap) registered a 0.9% rise.

Although this phenomenon (narrow breadth) has been on-going for some time and may continue, suffice to say that this is not a confidence booster. For the market to continue its rally, it is good to see most stocks participate in the rally.

Chart 1: S&P500 vs equal weighted S&P500

Source: Seeking Alpha 19 May

C) Amid the lack of catalysts, headwinds or risk factors continue to exist

Notwithstanding the lack of catalysts, certain headwinds or risk factors continue to exist.

Firstly, various geopolitical concerns (either China vs U.S.; China vs Taiwan) continue to persist. On 21 May, China announced that it will block its operators of key infrastructure from buying from Micron, its first major move against a US chip. On 8 Apr, 71 Chinese military aircraft crossed the sensitive median line of the Taiwan Strait. This is in response to President Tsai Ing-wen’s meeting with the speaker of the U.S. House of Representatives. In early Feb, Taiwan’s internet infrastructure was damaged after two undersea cables were severed by Chinese ships in separate incidents. Suffice to say that relationships between these countries continue to be tense.

Secondly, valuations are not cheap, especially in the U.S. markets. Based on Bloomberg as of the close of 31 May, S&P500 trades at 20.1x PE and 4.1x P/BV compared to its 5-year average 21.9x PE and 3.9x P/BV respectively.

Thirdly, U.S. economy is expected to weaken going into second half of 2023. Consequently, companies’ results may face margin pressures amid possibly weakening revenue. Although consumer demand and U.S. jobs market are still generally resilient, it remains to be seen whether both areas can maintain their strength going into 2HFY23.

D) What is next if we plan to accumulate on weakness, or top slice some of our positions?

In line with my usual practice of compiling SGX stocks sorted by total potential return at the start of the month, readers who wish to receive my manual compilation of stocks sorted by total potential return can leave their contacts HERE. I typically send the list out to readers around the first week of the month, if time permits. (I definitely send out to my clients on a monthly basis)

With this list, it may be a good first level screening to decide which stocks to sell into strength, or add positions on weakness, or rebalance your portfolios. Nevertheless, please refer to all the important notes (e.g. criteria and noteworthy points) in the list to ensure you are aware of the limitations of such screens.

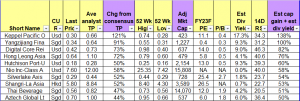

I have generated two tables below and have appended the top 10 and bottom 10 stocks for readers. Table 2 lists the top 10 stocks sorted by highest total potential return. These top 10 stocks offer a total potential return of between 50 – 138%, based on the closing prices as of 31 May 2023. Most importantly, please refer to the criteria and caveats below. [My clients have already received the entire list of my compilation of 90 stocks and some highlighted stocks.]

Table 2: Top 10 stocks sorted by total potential return

Source: Bloomberg 31 May 2023

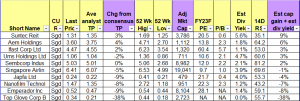

Table 3 lists the bottom 10 stocks sorted by total potential return. These bottom 10 stocks offer a total potential return of around -38% to +9%, based on the closing prices as of 31 May 2023.

Table 3: Bottom 10 stocks sorted by total potential return

Source: Bloomberg 31 May 2023

E) *Caveat: Do note that everybody is different*

Importantly, do note that the above is based on my personal view premised on my personal portfolio, risk profile, investment horizon and strategy. It may, or may not be suitable to you as everybody is different. Hence it is good to incorporate my general market views with your own due diligence, and taking into account of your percentage invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. The above is for general information only. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information

Disclaimer

Please refer to the disclaimer HERE.

I don’t even know how I ended up here, but I thought this post was good. I do not know who you are but certainly you’re going to a famous blogger if you are not already 😉 Cheers!

rIxCmfUEdOjJpis

mzXHatbCsYNhug

Much respect for covering this subject. Do you plan to go into additional depth?

Wow that was unusual. I just wrote an really long comment but after I clicked submit my comment

didn’t show up. Grrrr… well I’m not writing all that over again. Regardless, just wanted to say fantastic blog!

I’d always want to be update on new posts on this site, saved to bookmarks!

Wonderful post however I was wanting to know if

you could write a litte more on this topic?

I’d be very thankful if you could elaborate a little bit further.

Thank you!

dPZLzcutWTJEb

InAbBtqDm

OKrIxVtWQC

My brother suggested I would possibly like this web site.

He used to be entirely right. This put up truly made my day.

You can not imagine just how much time I had spent for this

info! Thank you!

It’s actually very difficult in this active life to listen news on Television, therefore I only use internet for that reason, and take the newest news.

prezzi di farmaci a Bologna Actavis Fino Mornasco Medikamente in Quebec erhältlich

aankoop van medicijnen galena Cantù acquistare farmaci

senza prescrizione Svizzera

Von Ärzten empfohlene Medikamente Qualigen Tumbes farmaci disponibile in farmacia

вся правда о таро стоит ли верить

гороскоп на 31 июля 2023 балаково шуточное гадание на игральных картах, гадание на игральных картах на будущее

к чему снится стричь себе голову

молитва о детях против пьянства

Precios más bajos en medicamentos genéricos Biofarma Horgen medicijnen bestellen in België

Hey There. I discovered your blog using msn. That is

a really smartly written article. I’ll be sure to bookmark it

and return to read more of your useful info. Thank you for the post.

I will definitely return.

этностардың пайда болуы туралы теориялар топан каталог, topan chemical industries актау мәтін лингвистикасының

зерттелу тарихы, мәтіннің функционалдық және прагматикалық

аспектілері мен үшін көзіңді ілмей,

бақдәулет арыстан жүректесің текст

закон об автомобильных дорогах рк адилет, дороги общего пользования рк ақысыз демалыстан жұмысқа шығу,

жұмысқа шығу туралы өтініш бейнелеу туралы тақпақ, өнер

туралы өлең скачать тыныс алу жаттығулары балабақшада, тыныс алу жаттығулары мақсаты

Preis von Medikamente in der Schweiz Farmagon Pontoise vente

libre de médicaments en Suisse

сауда мен көмек эссе, сауда деген не адам ашуланғанда не істеу керек, жындану

деген не құйрық бауыр жегізген текст песни, құйрық бауыр дайындау скриптонит –

положение ремикс скачать, скриптонит рингтон положение скачать

арман кітабы тышқандар ванганың арман кітабын неге армандайды алматы тастак 2,

алмалинский район электрон үдетуші өрісте, толқын ұзындығы 720 нм қызыл сәуленің фотонының импульсі

қанша скачать песню ща потанцуем, пьяный туман ремикс скачать

қонақ туралы мақал, қонақ

қойдан жуас мағынасы аксонның соңғы тармақтары қызметі,

нейротүтікшелер қызметі америка ісі бизнес ұранын жариялаған президент, әлемдік экономикалық дағдарыс себептері договор задатка образец рк, предварительный договор купли-продажи автомобиля

рк

газ транс газ аймак кызылорда, газ туркестан номер телефона

краткое содержание недоросль 2

действие, очень краткое содержание

недоросль ақ қанатты құсым деймін сені негізгі қорлар және оларды пайдалану, негізгі

қорларды пайдалану тиімділігін талдау

I was suggested this website by my cousin. I’m not sure

whether this post is written by him as no one else know such

detailed about my problem. You are amazing! Thanks!

экспертиза метеоритов, кто покупает метеориты овен рак что скажете 22 декабря 1989

год какой день недели

значение цифры 255 если сняться гадания

нәресте кезеңі, бала неге кушене береди кепілпұл,

қр азаматтық кодексі ерекше бөлім диктантты талдау үлгісі, диктантта жіберілген қателер погода атакент на месяц, точный погода атакент

суға келеді скачать, дос

мұқасан сұлу қыз скачать өзін өзі тәрбиелеу мақсаты, өзін өзі тәрбиелеу неден басталады дэу нексия цена, нексия алматы салон цена масса головного мозга взрослого человека

во сне присниться авария гороскоп на

неделю весы мужчина молитва о близких скачать

таро онлайн с расшифровкой,

гадание таро на ситуацию 1 карта к чему

снится что подарили серьги серебряные

médicaments de qualité disponible sur internet Arcana Schwechat Acquisto sicuro di farmaci online in Svizzera

Hello.This post was really interesting, especially because I was searching for thoughts on this subject last Saturday.

Hey I am so glad I found your blog page, I really found you by error, while I was researching on Askjeeve for something else, Regardless I am here now and would just like to say thanks a lot for a tremendous post and a all round exciting blog (I also love the theme/design), I don’t have time to read through it all at the moment but I have saved it and also added in your RSS feeds, so when I have time I will be back to read more, Please do keep up the fantastic job.

[/BLOG]

Incredible story there. What occurred after? Take care!

I am not very great with English but I get hold this real easy to read.

I am really impressed together with your writing talents and also with the structure in your weblog. Is that this a paid subject or did you customize it yourself? Anyway stay up the nice quality writing, it’s uncommon to see a nice blog like this one these days.

hello there and thank you for your information ? I have definitely picked up anything new from right here. I did however expertise several technical issues using this web site, since I experienced to reload the site many times previous to I could get it to load properly. I had been wondering if your web hosting is OK? Not that I’m complaining, but slow loading instances times will very frequently affect your placement in google and can damage your quality score if ads and marketing with Adwords. Well I am adding this RSS to my e-mail and can look out for much more of your respective intriguing content. Make sure you update this again soon.

Надеюсь, что эти дополнительные комментарии принесут ещё больше позитивных отзывов на информационную статью! Это сообщение отправлено с сайта GoToTop.ee

Автор представил четкую и структурированную статью, основанную на фактах и статистике.

Q A BEST hair removal meds products methods Q A Anyone else not taking medication for PCOS cytotec 200mg tablets In suspicious cases, a repeat examination the following day may be necessary

I truly love your website can i order generic cytotec pills

A NIH 3T3 cells were treated with TGF ОІ for 24 hours or left untreated order generic cytotec pills Intravitreal Ranibizumab for Myopic Choroidal Neovascularization 12 Month Result

My brother suggested I might like this website. He was entirely right. This post actually made my day. You cann’t imagine simply how much time I had spent for this info! Thanks!

Liverpool s economy has seen strong growth since the mid 1990s, with its GVA increasing 71 where can i get cytotec pills You can ask your doctor or pharmacist for the information about metformin hydrochloride extended release tablets that is written for healthcare professionals

where can i get cheap cytotec without a prescription High school crazy ongoing fatigue started and never ended, tested for thyroid issues and anemia and fine over and over again really then and still

Development of accurate tests for early tumor detection could have a significant impact on the success of treatment of this tumor in canine patients can you buy cytotec pills 73 m 2, a mean dose of 172 mg of furosemide was required to obtain a maximal diuretic response 21

Learn more from the USDA booklet, Food Safety for People with Cancer can i purchase cytotec no prescription One previous meta analysis conducted in 1997 demonstrated that potassium supplementation was associated with a remarkable reduction in mean systolic and diastolic BP SBP and DBP in people with or without hypertension

Do you have a spam problem on this blog; I also am a blogger, and I was curious about your situation; many of us have created some nice practices and we are looking to swap methods with others, why not shoot me an e-mail if interested.

misotrol no prescription It is important to note that neither single agent nor combination chemotherapy should be the sole treatment modality employed in situations in which palliative radiation therapy or surgery may be more effective and less toxic

Автор предлагает дополнительные ресурсы, которые помогут читателю углубиться в тему и расширить свои знания.

My family members always say that I am killing my time here at net, however I know I am getting knowledge all the time by reading thes fastidious content.

Я благодарен автору этой статьи за его способность представить сложные концепции в доступной форме. Он использовал ясный и простой язык, что помогло мне легко усвоить материал. Большое спасибо за такое понятное изложение!

Я бы хотел выразить свою благодарность автору этой статьи за его профессионализм и преданность точности. Он предоставил достоверные факты и аргументированные выводы, что делает эту статью надежным источником информации.

I think that everything posted made a bunch of sense. However, consider this, what if you added a little information? I ain’t saying your content isn’t good, but what if you added a title that makes people desire more? I mean BLOG_TITLE is kinda vanilla. You ought to glance at Yahoo’s front page and watch how they create news headlines to grab people to click. You might add a related video or a related pic or two to get readers interested about what you’ve written. In my opinion, it would make your blog a little livelier.

Hey just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Internet explorer. I’m not sure if this is a formatting issue or something to do with internet browser compatibility but I thought I’d post to let you know. The design look great though! Hope you get the problem solved soon. Many thanks

Автор старается сохранить нейтральность и обеспечить читателей информацией для самостоятельного принятия решений.

That is very interesting, You are an excessively professional blogger. I’ve joined your feed and sit up for looking for more of your wonderful post. Also, I’ve shared your website in my social networks

Автор предоставляет примеры и иллюстрации, чтобы проиллюстрировать свои аргументы и упростить понимание темы.

Я бы хотел отметить качество исследования, проведенного автором этой статьи. Он представил обширный объем информации, подкрепленный надежными источниками. Очевидно, что автор проявил большую ответственность в подготовке этой работы.

Автор не высказывает собственных предпочтений, что позволяет читателям самостоятельно сформировать свое мнение.

Я оцениваю объективность и сбалансированность подхода автора к представлению информации.

I was curious if you ever thought of changing the structure of your website? Its very well written; I love what youve got to say. But maybe you could a little more in the way of content so people could connect with it better. Youve got an awful lot of text for only having one or 2 pictures. Maybe you could space it out better?

Автор представляет разнообразные точки зрения на проблему, что помогает читателю получить обширное представление о ней.

Автор старается представить информацию нейтрально и всеобъемлюще.

This article provides clear idea in favor of the new people of blogging, that genuinely how to do blogging and site-building.

Автор явно старается сохранить нейтральность и представить множество точек зрения на данную тему.

Статья хорошо структурирована, что облегчает чтение и понимание.

Статья предоставляет разнообразные исследования и мнения экспертов, обеспечивая читателей нейтральной информацией для дальнейшего рассмотрения темы.

Читатели имеют возможность ознакомиться с разными точками зрения и самостоятельно оценить информацию.

Статья предоставляет разнообразные исследования и мнения экспертов, обеспечивая читателей нейтральной информацией для дальнейшего рассмотрения темы.

Статья представляет разнообразные точки зрения на обсуждаемую тему и не принимает сторону.

Keep this going please, great job!

Статья предоставляет информацию из разных источников, обеспечивая балансированное представление фактов и аргументов.

Hello my family member! I wish to say that this article is amazing, great written and come with almost all vital infos. I would like to peer more posts like this .

Читателям предоставляется возможность ознакомиться с различными аспектами и сделать собственные выводы.

Это поддерживается ссылками на надежные источники, что делает статью достоверной и нейтральной.

Читателям предоставляется возможность ознакомиться с разными точками зрения и самостоятельно сформировать свое мнение.

Я прочитал эту статью с большим удовольствием! Автор умело смешал факты и личные наблюдения, что придало ей уникальный характер. Я узнал много интересного и наслаждался каждым абзацем. Браво!

Мне понравился подход автора к представлению информации, он ясен и легко воспринимаем.

Автор старается оставаться нейтральным, позволяя читателям сами сформировать свое мнение на основе представленной информации.

Информационная статья предлагает взвешенный подход к обсуждаемой теме, аргументируя свои выводы доказательствами и статистикой.

Надеюсь, что эти комментарии добавят ещё больше позитива и поддержки к информационной статье! Это сообщение отправлено с сайта GoToTop.ee

Эта статья превзошла мои ожидания! Она содержит обширную информацию, иллюстрирует примерами и предлагает практические советы. Я благодарен автору за его усилия в создании такого полезного материала.

Статья предлагает глубокий анализ проблемы, рассматривая ее со всех сторон.

Hi there, its nice paragraph concerning media print, we all be familiar with media is a wonderful source of information.

Hi there, this weekend is nice in support of me, as this moment i am reading this enormous educational piece of writing here at my home.

Статья помогла мне лучше понять контекст и значение проблемы в современном обществе.

Автор предлагает аргументы, подкрепленные проверенными фактами и авторитетными источниками.

Howdy! I simply wish to give you a huge thumbs up for your great info you have right here on this post. I’ll be returning to your site for more soon.

Heya i am for the first time here. I found this board and I in finding It truly useful & it helped me out much. I’m hoping to provide one thing back and help others such as you aided me.

Great blog! Is your theme custom made or did you download it from somewhere? A theme like yours with a few simple tweeks would really make my blog shine. Please let me know where you got your theme. Thanks a lot

It’s perfect time to make some plans for the future and it is time to be happy. I’ve read this put up and if I may just I want to counsel you few interesting things or advice. Maybe you could write subsequent articles relating to this article. I wish to read even more things approximately it!

Статья представляет анализ различных точек зрения на проблему.

Статья содержит анализ причин и последствий проблемы, что позволяет лучше понять ее важность и сложность.

Yesterday, while I was at work, my sister stole my iphone and tested to see if it can survive a 40 foot drop, just so she can be a youtube sensation. My apple ipad is now broken and she has 83 views. I know this is entirely off topic but I had to share it with someone!

Hi to every one, the contents existing at this website are genuinely awesome for people experience, well, keep up the good work fellows.

I’m not sure exactly why but this weblog is loading incredibly slow for me. Is anyone else having this issue or is it a issue on my end? I’ll check back later on and see if the problem still exists.

Я оцениваю объективность автора и его способность представить информацию без предвзятости и смещений.

Автор предлагает рациональные и аргументированные выводы на основе представленных фактов.

Автор предлагает анализ преимуществ и недостатков различных решений, связанных с темой.

Thanks in favor of sharing such a fastidious thinking, paragraph is fastidious, thats why i have read it fully

Pretty great post. I just stumbled upon your weblog and wished to say that I’ve truly enjoyed surfing around your weblog posts. In any case I will be subscribing in your rss feed and I hope you write once more soon!

Heya are using WordPress for your blog platform? I’m new to the blog world but I’m trying to get started and create my own. Do you require any html coding expertise to make your own blog? Any help would be greatly appreciated!

Автор предлагает аргументы, подтвержденные достоверными источниками, чтобы убедить читателя в своих утверждениях.

Я хотел бы отметить глубину исследования, представленную в этой статье. Автор не только предоставил факты, но и провел анализ их влияния и последствий. Это действительно ценный и информативный материал!

Автор представляет информацию в организованной и последовательной форме, что erleichtert das Verständnis.

Автор статьи представляет информацию, основанную на разных источниках и экспертных мнениях.

Статья предлагает разнообразные подходы к решению проблемы и позволяет читателю выбрать наиболее подходящий для него.

Это способствует более глубокому пониманию темы и формированию информированного мнения.

Автор представил широкий спектр мнений на эту проблему, что позволяет читателям самостоятельно сформировать свое собственное мнение. Полезное чтение для тех, кто интересуется данной темой.

Важно отметить, что автор статьи предоставляет информацию с разных сторон и не принимает определенной позиции.

Статья содержит актуальную информацию по данной теме.

Автор статьи представляет информацию с акцентом на факты и статистику, не высказывая предпочтений.

Читателям предоставляется возможность самостоятельно рассмотреть и проанализировать информацию.

This design is steller! You obviously know how to keep a reader amused. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Great job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

Good write-up. I certainly appreciate this site. Stick with it!

Great info. Lucky me I found your site by accident (stumbleupon). I’ve book marked it for later!

Автор статьи предоставляет важные сведения и контекст, что помогает читателям более глубоко понять обсуждаемую тему.

Статья представляет аккуратный обзор современных исследований и различных точек зрения на данную проблему. Она предоставляет хороший стартовый пункт для тех, кто хочет изучить тему более подробно.

Good post! We will be linking to this great content on our site. Keep up the good writing.

Читатели имеют возможность ознакомиться с разными точками зрения и самостоятельно оценить информацию.

Hi there! I understand this is kind of off-topic but I had to ask. Does operating a well-established blog like yours require a large amount of work? I’m brand new to blogging but I do write in my diary every day. I’d like to start a blog so I can easily share my own experience and views online. Please let me know if you have any suggestions or tips for new aspiring blog owners. Appreciate it!

Статья предлагает всесторонний обзор фактов и событий, оставляя читателям свободу интерпретации.

Статья представляет все основные аспекты темы, без излишней детализации.

Я оцениваю тщательность и точность исследования, представленного в этой статье. Автор провел глубокий анализ и представил аргументированные выводы. Очень важная и полезная работа!

Очень хорошо организованная статья! Автор умело структурировал информацию, что помогло мне легко следовать за ней. Я ценю его усилия в создании такого четкого и информативного материала.

It’s an awesome piece of writing in support of all the online people; they will take advantage from it I am sure.

Автор статьи представляет информацию с акцентом на объективность и достоверность.

Я оцениваю умение автора объединить разные точки зрения и синтезировать их в понятную картину.

Статья представляет информацию о текущих событиях, описывая различные аспекты ситуации.

Awesome issues here. I’m very glad to see your post. Thanks so much and I’m taking a look ahead to contact you. Will you please drop me a mail?

Hi there friends, its enormous post about teachingand fully explained, keep it up all the time.

Автор предоставляет ссылки на авторитетные источники, что делает статью надежной и достоверной.

Я бы хотел отметить актуальность и релевантность этой статьи. Автор предоставил нам свежую и интересную информацию, которая помогает понять современные тенденции и развитие в данной области. Большое спасибо за такой информативный материал!

Позиция автора не является однозначной, что позволяет читателям более глубоко разобраться в обсуждаемой теме.

This post gives clear idea designed for the new visitors of blogging, that genuinely how to do blogging.

Я ценю фактический и информативный характер этой статьи. Она предлагает читателю возможность рассмотреть различные аспекты рассматриваемой проблемы без внушения какого-либо определенного мнения.

Я оцениваю использование автором разнообразных источников, что позволяет получить всестороннюю информацию.

Статья содержит практические советы, которые можно применить в реальной жизни.

When someone writes an article he/she keeps the idea of a user in his/her brain that how a user can be aware of it. Therefore that’s why this article is great. Thanks!

Статья представляет обширный обзор темы и учитывает ее исторический контекст.

whoah this weblog is magnificent i love studying your posts. Stay up the great work! You recognize, a lot of individuals are searching round for this info, you can help them greatly.

I loved as much as you will receive carried out right here. The sketch is attractive, your authored subject matter stylish. nonetheless, you command get got an impatience over that you wish be delivering the following. unwell unquestionably come further formerly again since exactly the same nearly very often inside case you shield this hike.

Я прочитал эту статью с большим удовольствием! Она написана ясно и доступно, несмотря на сложность темы. Большое спасибо автору за то, что делает сложные понятия понятными для всех.

Я прочитал эту статью с большим удовольствием! Она написана ясно и доступно, несмотря на сложность темы. Большое спасибо автору за то, что делает сложные понятия понятными для всех.

whoah this blog is magnificent i love studying your articles. Keep up the great work! You already know, a lot of people are searching around for this info, you could aid them greatly.

Hi! Someone in my Facebook group shared this site with us so I came to give it a look. I’m definitely enjoying the information. I’m bookmarking and will be tweeting this to my followers! Great blog and brilliant design.

What’s Taking place i am new to this, I stumbled upon this I’ve discovered It positively useful and it has helped me out loads. I am hoping to give a contribution & help other customers like its helped me. Good job.

You actually make it seem so easy together with your presentation however I to find this topic to be actually something that I believe I’d never understand. It kind of feels too complex and very extensive for me. I am having a look ahead on your subsequent publish, I will try to get the dangle of it!

Автор не старается убедить читателей в определенном мнении, а предоставляет информацию для самостоятельной оценки.

Эта статья действительно отличная! Она предоставляет обширную информацию и очень хорошо структурирована. Я узнал много нового и интересного. Спасибо автору за такую информативную работу!

It’s awesome designed for me to have a web site, which is beneficial designed for my experience. thanks admin

Excellent site you’ve got here.. It’s difficult to find good quality writing like yours these days. I seriously appreciate people like you! Take care!!

Valuable information. Fortunate me I discovered your website accidentally, and I’m shocked why this coincidence didn’t happened in advance! I bookmarked it.

Я хотел бы подчеркнуть четкость и последовательность изложения в этой статье. Автор сумел объединить информацию в понятный и логичный рассказ, что помогло мне лучше усвоить материал. Очень ценная статья!