Dear all,

Reits are clearly not in our investors’ favour as evidenced by the 10.2% fall in FTSE Reit index (FSTAS8670.IN), which closed 786 on 29 Jun 2018, after hitting a multi-year high of 875 in Jan 2018.

Most analysts or strategists will recommend reits with distribution per unit (“DPU”) growth, so as to combat the rise in interest rates. EC World Reit (“EC”) may be one with DPU growth.

I have the privilege of meeting Mr Goh Toh Sim, Executive Director & CEO of EC and Mr Li Jinbo, Head of Investment of EC (“Management”) for a 1-1 discussion over EC’s operations and prospects. Below are my key takeaways.

Description

Based on EC’s press release, it is listed on SGX on 28 July 2016. With its initial portfolio of six quality properties located in one of the largest e-commerce clusters in the Yangtze River Delta, EC World REIT offers investors unique exposure to the logistics and e-commerce sectors in Hangzhou.

EC’s investment strategy is to invest principally, directly or indirectly, in a diversified portfolio of income-producing real estate which is used primarily for e-commerce, supply-chain management and logistics purposes, as well as real estate-related assets, with an initial geographical focus on the PRC. For more information, please visit EC website HERE.

EC is managed by EC World Asset Management Pte. Ltd., which is an indirect wholly-owned subsidiary of the Sponsor – Forchn Holdings Group Co., Ltd (“Forchn”). Established in 1992 and headquartered in Shanghai, the Sponsor is a diversified enterprise group specialising in the real estate sector, industrial sector, e-commerce, logistics and finance. For more information, please visit HERE.

Investment merits

Board – almost all Singaporeans with illustrious backgrounds

Except for EC’s Chairman Mr Zhang Guobiao, the Board comprises of all Singaporeans. With reference to EC’s 2017 annual report (click HERE), Mr Goh Toh Sim, Executive Director & CEO of EC, has over two decades of experience in the management of industrial parks, real estate development and business management in China. Prior to joining the Manager, he was the Chief Representative in China for Keppel Corporation Limited where he was responsible for government relations and business development. Mr Goh also served as the CEO of Ascendas China and Deputy CEO of Suzhou Industrial Park.

Mr Chan Heng Wing, Independent Non-Executive Director and Lead Independent Director holds directorship at Banyan Tree Holdings Limited, Fraser Property Limited and Fraser and Neave Limited. Mr Chan is a senior adviser with the Ministry of Foreign Affairs and he served as the press secretary (1990-1997) for former PM Goh Chok Tong. Mr Chia Yew Boon, Independent Non-Executive Director was previously a Senior Vice President at GIC Special Investments Pte Ltd.

FX risks hedged

The Manager continues to be prudent and proactive in the execution of its risk management. Based on their 1QFY18 financials, it stated that 100% of the interest rate risk of their SGD borrowings was hedged using floating for fixed interest rate swaps. EC has also hedged their RMB income for distribution via FX option contracts on a 6 months rolling basis.

Maiden acquisition to kick start its acquisition roadmap

On 28 Feb 2018, EC announced that it has started its first DPU accretive acquisition post listing by acquiring an e commerce logistic asset (click HERE) with a net consideration of approximately S$31.0m. Based on the detailed announcement (click HERE), it has two anchor tenants viz. Dang Dang and JD. Although headline net property yield (in RMB terms) is around 4.9%, management explains the current low yield is partly attributed to the concessionary rental rates the previous owner gave to one of the anchor tenants when the asset is completed. This provides the REIT with further rental reversion potential. Furthermore, EC is confident that it can boost the yield further by raising its current 82% occupancy rate. Moreover, there are rental escalation clauses in the leases ranging from 4.5% to 5.0% per annum which are likely to provide potential for positive rental reversion in the future.

This acquisition also illustrates EC’s ability to acquire other assets from other parties. i.e. it is not restricted to acquire assets from its sponsor, Forchn Holdings Group Co., Ltd.

More about the Sponsor

Forchn, established in 1992 and headquartered in Shanghai, is a diversified enterprise group specialising in the real estate sector, industrial sector, e-commerce, logistics and finance. It is a founding shareholder of Alibaba’s Cai Niao Network. Forchn is the founder and only shareholder of Ruyicang E-commerce Logistics Services. According to an article in The Edge dated 18 Jun 2018, Ruyicang expects to double its current handling of 1m packages to 2m packages by 2019. Ruyicang is still looking to expand even though it already operates 37 warehouses in 23 cities.

Based on EC’s prospectus, Forchn has extensive construction and operational experience in the logistics industry and has independently invested over RMB5.0b in the Zhejiang Province. Forchn’s current portfolio of China brands also includes the 400-year old cutlery brand, Zhang Xiao Quan.

Pipeline of ROFR projects ensures strong NLA and DPU growth

Based on Table 1 below, EC has a right of first refusal (“ROFR”) for two assets from its sponsor. According to management, Fuzhou E Commerce Properties have been completed and is fully functional, while Stage 2 of Bei Gang Logistics has only been partially completed and operational. Fuzhou E Commerce Properties is large with a GFA of 215,643 sq. metres. If acquired, it should have a meaningful impact to EC’s distribution income and asset profile as a serious E commerce logistics player.

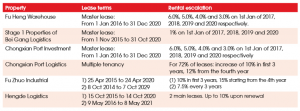

Table 1: EC’s ROFR pipeline

Portfolio of assets – most have master leases with rental escalations

Based on Table 2 below, EC has six assets, out of which, three assets, namely Fu Heng, Beigang and Chongxian Port Investment have master leases. Typically, master leases usually cap rental reversions, but EC manages to circumvent this problem by having rental escalation clauses. By doing so, EC seems to have the “best of both worlds”, namely income stability and potential rental escalations.

Table 2: EC’s existing 6 assets, excluding EC’s Wuhan acquisition

Source: EC’s annual report 2017

Reit manager – performance fee based on DPU growth

EC World Asset Management Pte. Ltd is EC’s Reit Manager. The Reit manager’s performance fee is based on 25% per annum of the difference in DPU in this financial year vs preceding financial year. The Reit manager is 100% owned by Forchn Holdings Group Co., Ltd, EC’s Sponsor, which in turn owns approximately 42% of EC. Hence, it is reasonable to say that the Reit Manager’s interests are likely to be aligned with that of EC.

Sponsor’s tie up with YCH opens more opportunities

Based on a press release dated 24 Apr 2018, Forchn and YCH Group have signed an agreement in the presence of Senior Minister of State (Ministry of Culture, Community and Youth & Ministry of Trade and Industry) Sim Ann. Through this agreement, EC can assess an acquisition portfolio of 13 YCH logistics real estate assets, totalling more than 280,000 sq. m of GFA and an estimated value of S$400m. Subject to negotiations, due diligence and regulatory approval, should the above acquisitions be done (likely to be in phases), YCH would continue to lease and operate the assets. Forchn would transfer to YCH a significant stake with board representation in EC’s Reit Manager. Furthermore, YCH and Forchn are launching a US$150m fund in 2H2018 for the development and acquisition of logistic assets in key cities across the Belt Road countries to improve the transportation infrastructure in the region.

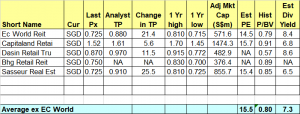

Valuations do not seem pricey

Based on Table 3 below, EC trades at 0.79x P/BV and 8.4% estimated dividend yield, as compared to the average 0.80x P/BV and 7.3% estimated dividend yield. Although the companies listed may not be direct comparables, it is nonetheless a gauge for potential investors.

Table 3: EC vis-à-vis peers with China assets

Source: Bloomberg 29 Jun 2018

Investment risks

Some noteworthy investment risks are as follows:

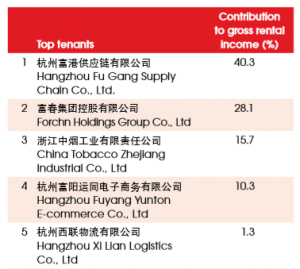

90% of the leases by gross rental income expire by 2020

Based on Chart 1 below, there are concerns by some investors that 90% of EC’s leases by gross rental income will expire by 2020. Based on Table 4 below, four of the top five tenants contributed 94.4% of its gross rental income in FY17 and their leases will expire by 2020. Although this may seem risky, it is noteworthy that Hangzhou Fu Gang, Forchn Holdings and Hangzhou Fuyang are directly or indirectly related to EC’s sponsor. Therefore, as long as its sponsor is fundamentally sound and growing steadily, it should relatively bode well for EC. China Tobacco, founded in 1949 is the main lessee for EC’s Hengde Logistics. Based on EC’s annual report 2017, it is reported that the value of the products stored in Hengde Logistics by China Tobacco is estimated to be worth RMB10b, or SGD2b equivalent! This is almost 3.7x EC’s market capitalisation of around S$568m. Thus, it is likely that there is a certain level of trust and comfort level between EC and China Tobacco, resulting in some “client stickiness”.

Chart 1: 90% of the leases by gross rental income expire by 2020

Source: EC’s annual report 2017

Table 4: EC’s top five tenants by contribution to gross rental income

Source: EC’s annual report 2017

Third CEO in EC’s Reit Manager post listing

Since listing, EC’s Reit Manager has seen some changes in its CEOs from Mr Peter Lai, to Mr Alvin Cheng and subsequently to Mr Goh Toh Sim. In fact, this is one of the queries raised by Securities Investors Association (Singapore) (“SIAS”) on 18 April 2018 and management has replied (click HERE). In short, Mr Lai stepped down due to medical reasons. Mr Cheng resigned to pursue his other interests. Management emphasises that the management team is likely to be stable for the foreseeable future.

Illiquid with daily average 30D volume amounting to 200K shares

EC shares are thinly traded. Average 30D and 100D volume amount to approximately 200K shares and 316K shares respectively. This is not a liquid company where investors with meaningful positions can enter or exit quickly. This is partly due to the shareholding structure. Based on EC’s annual report 2017 (updated as of 15 Mar 2018), the top twenty substantial shareholders hold approximately 96% of EC.

Limited analyst coverage

Last year, Religare has a rated report dated 2 Mar 2017 with a target price of $0.92. Subsequently, I have not seen any updated report. There is limited analyst coverage now with a recent report by SooChow CSSD Capital Markets. It is likely that some investors and fund managers are still not familiar with EC’s business and prospects, thus it may take some time for Mr. Market to get to know this company. EC is cognisant of this and it is actively ramping up its investor relation activities to engage the investment community. For example, EC has attended the Reits Symposium 2018, held at Suntec on 19 May 2018. Furthermore, EC has a Facebook page (click HERE) and a Linkedin page (click HERE) where investors can visit to know more about its developments.

Figure 1: Limited analyst coverage

Source: Bloomberg 22 Jun 2018

Limited knowledge in Reit

For those who have been following my write-ups since the inception of my blog, you would have noticed that this is likely to be the 1st or 2nd (likely to be the 1st) company write-up on a Reit. This is because I am usually interested in companies with a higher beta, due to my limited portfolio size, higher risk profile and returns expectations. Therefore, it is possible that I may not have the expertise and experience in understanding a Reit thoroughly. As with all other investments, it is best to do your own due diligence before committing to a trade or investment.

Small market cap of S$568m

Reits face this conundrum at times. They typically need to acquire assets to boost their DPU growth. With DPU growth, markets may ascribe higher market valuations to the reits. However, for reits with depressed share prices, or low market valuations compared to their net asset value, this makes it more costly and difficult for them to raise funds via equity. This may impede their growth or acquisition strategy. However, EC has a relatively comfortable gearing of approximately 28.9%, providing it with ample debt headroom for future acquisition. Therefore, it may not need to raise funds via equity for acquisitions at the moment, especially when it is trading at a discount to its NAV.

P.S: Do note the above list of risks is not exhaustive.

Chart analysis

Based on Chart 2 below, EC has fallen 11% from its IPO price $0.810 to close $0.720 on 29 Jun 2018. EC is entrenched in a downtrend with all the exponential moving averages (EMAs) moving lower, coupled with death cross formations. Notwithstanding the downward EMAs, ADX is at a relatively low level of 14.0 which indicates a lack of trend. Based on price action, EC seems to be forming a base around $0.715 – 0.725. In addition, indicators such as RSI, MACD, MFI and OBV are exhibiting bullish divergences. It is noteworthy that a sustained breach above $0.750 alleviates the bearish feel of the chart. A sustained breach below $0.695 exacerbates the bearish feel in the chart.

Near term supports: $0.715 / 0.695 – 0.700 / 0.675

Near term resistances: $0.725 / 0.735 / 0.750

Chart 2: EC has fallen 11% from its IPO price $0.810

Source: InvestingNote 29 Jun 2018

P.S: Chart reading is subjective especially for illiquid stocks.

In a nutshell,

EC has fallen 11% from its IPO price $0.810 to close $0.720 on 29 Jun 2018. Taking into account of the dividends amounting to SGD0.0995 given to date, shareholders who have held EC since IPO are unlikely to be in the red, given current market price $0.720. Having said that, if EC can continue on its plan to acquire DPU accretive assets with no execution mishaps and according to plan, there may be scope for share price re-rating.

Notwithstanding the above, readers should be aware of some of the potential risks in EC (the list of risks is by no means exhaustive), such as most of the leases will expire by 2020; three of the four master lessee tenants are directly or indirectly related to the Sponsor (double edged sword); and my limited knowledge in Reit as a whole etc. It is important to do your due diligence before making any trading or investment decision.

Disclaimer

Please refer to the disclaimer HERE

Wow, wonderful blog format! How lengthy have you ever been running a blog for?

you make running a blog look easy. The overall look of your site

is wonderful, as smartly as the content material!

You can see similar here e-commerce

Very interesting information!Perfect just what I was looking for!

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

That is the suitable weblog for anyone who desires to seek out out about this topic. You notice a lot its almost onerous to argue with you (not that I really would need…HaHa). You undoubtedly put a new spin on a topic thats been written about for years. Great stuff, just great!

Amazing issues here. I’m very glad to look your post.

Thanks so much and I’m taking a look ahead to touch

you. Will you please drop me a e-mail?

I think this is among the most important info for me. And i’m glad reading your article. But wanna remark on some general things, The web site style is wonderful, the articles is really excellent : D. Good job, cheers

Would love to forever get updated outstanding web blog! .

Very nice style and design and great subject material, absolutely nothing else we require : D.

What Is ZenCortex? ZenCortex is an ear health booster that protects ears from potential damage and improves your hearing health.

Hello, constantly i used to check weblog posts

here in the early hours in the daylight, because i enjoy to find out more and more.

What’s Happening i am new to this, I stumbled upon this I’ve found It positively helpful and it has aided me out loads. I hope to contribute & assist other users like its helped me. Good job.

What is ProDentim? ProDentim is an innovative oral care supplement with a unique blend of ingredients designed to promote better oral and dental health

I¦ve recently started a website, the information you provide on this site has helped me tremendously. Thanks for all of your time & work.

As soon as I noticed this web site I went on reddit to share some of the love with them.

It is actually a nice and helpful piece of info. I’m happy that you shared this helpful info with us. Please stay us informed like this. Thanks for sharing.

Thanx for the effort, keep up the good work Great work, I am going to start a small Blog Engine course work using your site I hope you enjoy blogging with the popular BlogEngine.net.Thethoughts you express are really awesome. Hope you will right some more posts.

I was recommended this website by my cousin. I’m not sure whether this post is written by him as no one else know such detailed about my trouble. You’re incredible! Thanks!

Great post. I was checking constantly this blog and I’m impressed! Extremely helpful info specifically the last part I care for such information much. I was seeking this particular information for a long time. Thank you and good luck.

I care for such information much. I was seeking this particular information for a long time. Thank you and good luck.

Saved as a favorite, I really like your blog!

I was recommended this web site by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my difficulty. You are amazing! Thanks!

I love the efforts you have put in this, appreciate it for all the great content.

Hey there, I think your website might be having browser compatibility issues. When I look at your blog site in Chrome, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, great blog!

One such software that has been generating buzz these days is the Lottery Defeater

ProvaDent: What Is It? ProvaDent is a natural tooth health supplement by Adam Naturals.

What is Sugar Defender 24? Jeffrey Mitchell made the Sugar Defender 24. It is a product (Sugar Defender Diabetes) that helps your blood sugar health.

It¦s actually a great and useful piece of information. I am happy that you simply shared this helpful information with us. Please stay us up to date like this. Thanks for sharing.

I don’t normally comment but I gotta tell regards for the post on this amazing one : D.

I am often to blogging and i really appreciate your content. The article has really peaks my interest. I am going to bookmark your site and keep checking for new information.

I have been exploring for a little for any high-quality articles or blog posts on this kind of area . Exploring in Yahoo I eventually stumbled upon this web site. Studying this info So i’m glad to exhibit that I’ve an incredibly good uncanny feeling I found out exactly what I needed. I so much for sure will make sure to don’t forget this web site and give it a glance regularly.

I do not even know how I ended up here, but I thought this post was good. I don’t know who you are but definitely you are going to a famous blogger if you are not already Cheers!

Cheers!

TLSksutOZXhAId

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your great post. Also, I have shared your website in my social networks!

Hello, you used to write great, but the last few posts have been kinda boringK I miss your super writings. Past few posts are just a bit out of track! come on!

I love your writing style truly loving this website .

What Is ZenCortex? ZenCortex is a natural supplement that promotes healthy hearing and mental tranquility. It’s crafted from premium-quality natural ingredients, each selected for its ability to combat oxidative stress and enhance the function of your auditory system and overall well-being.

FitSpresso: What Is It? FitSpresso is a natural weight loss aid designed for individuals dealing with stubborn weight gain. It is made using only science-backed natural ingredients.

I like what you guys are up too. Such clever work and reporting! Keep up the excellent works guys I?¦ve incorporated you guys to my blogroll. I think it will improve the value of my website

What is Tea Burn? Tea Burn is a new market-leading fat-burning supplement with a natural patent formula that can increase both speed and efficiency of metabolism. Combining it with Tea, water, or coffee can help burn calories quickly.

Thank you for another excellent article. Where else could anybody get that type of information in such a perfect way of writing? I have a presentation next week, and I’m on the look for such info.

My developer is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he’s tryiong none the less. I’ve been using Movable-type on various websites for about a year and am nervous about switching to another platform. I have heard fantastic things about blogengine.net. Is there a way I can transfer all my wordpress content into it? Any kind of help would be greatly appreciated!

I am glad to be a visitant of this double dyed blog! , thanks for this rare information! .

I have been surfing online more than three hours as of late, but I never found any fascinating article like yours. It is beautiful price sufficient for me. In my opinion, if all site owners and bloggers made good content material as you did, the net can be a lot more useful than ever before.

I’ve learn some good stuff here. Certainly worth bookmarking for revisiting. I surprise how so much attempt you set to create this type of fantastic informative website.

I think this is among the most vital information for me. And i am glad reading your article. But wanna remark on few general things, The web site style is wonderful, the articles is really nice : D. Good job, cheers

I am not real excellent with English but I line up this real easygoing to understand.

I got good info from your blog

Hello.This article was extremely remarkable, particularly since I was investigating for thoughts on this subject last Monday.

What Is Java Burn? Java Burn is a natural health supplement that is formulated using clinically backed ingredients that promote healthy weight loss.

Do you have a spam issue on this site; I also am a blogger, and I was wanting to know your situation; many of us have developed some nice practices and we are looking to trade techniques with others, why not shoot me an email if interested.

CtpDVcNLMglY

Good blog! I really love how it is easy on my eyes and the data are well written. I am wondering how I could be notified whenever a new post has been made. I’ve subscribed to your RSS feed which must do the trick! Have a nice day!

Well I sincerely enjoyed reading it. This subject offered by you is very practical for good planning.

Magnificent goods from you, man. I have understand your stuff previous to and you’re just too excellent. I really like what you have acquired here, certainly like what you’re saying and the way in which you say it. You make it enjoyable and you still care for to keep it wise. I can not wait to read much more from you. This is actually a great web site.

F*ckin’ awesome things here. I’m very happy to peer your post. Thanks a lot and i am looking ahead to touch you. Will you please drop me a e-mail?

Woh I like your blog posts, saved to my bookmarks! .

Good day! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

QirCZvjnamNKu

Wow, incredible blog layout! How long have you been blogging for? you make blogging look easy. The overall look of your web site is magnificent, as well as the content!

Hello there, just was aware of your weblog via Google, and located that it’s really informative. I’m gonna watch out for brussels. I will be grateful if you happen to proceed this in future. A lot of other folks might be benefited out of your writing. Cheers!

whoah this weblog is great i like reading your articles. Stay up the great work! You already know, many individuals are hunting round for this info, you can aid them greatly.

Fantastic website. A lot of useful information here. I am sending it to a few friends ans also sharing in delicious. And of course, thanks for your effort!

Medikamente bestellen Genericon Oldenburg Puedes

comprar medicamentos sin receta en España

tzeKPxhp

к чему снится выкидыш детей джйотиш сарала йога сонник покойник снится на 40 дней

таблица гороскопа по годам рождения слова отче наш молитва на русском текст

Pharmacie en ligne fiable pour acheter du

médicaments CristerS Wels medicijnen kopen zonder voorschrift in Nederland.

acheter de la drogue aux états-unis Hersil Bergen Beste plek om medicijnen zonder voorschrift te

bestellen

medicamentos a precio asequible 123ratio San Martín medicijnen online beschikbaar in Frankrijk

I have recently started a site, the information you provide on this website has helped me tremendously. Thanks for all of your time & work.

There is apparently a bundle to know about this. I feel you made some good points in features also.

Some genuinely interesting details you have written.Helped me a lot, just what I was looking for : D.

I will right away seize your rss feed as I can not find your email subscription hyperlink or newsletter service. Do you’ve any? Kindly let me know in order that I may just subscribe. Thanks.

I?¦ve recently started a web site, the information you offer on this website has helped me greatly. Thanks for all of your time & work.

I’m still learning from you, as I’m trying to achieve my goals. I definitely liked reading everything that is written on your blog.Keep the tips coming. I loved it!

Heya i am for the primary time here. I came across this board and

I find It really helpful & it helped me out a lot. I am hoping

to present something again and aid others such as you helped me.

I liked as much as you will receive performed right here. The caricature is attractive, your authored material stylish. nevertheless, you command get got an nervousness over that you wish be delivering the following. sick unquestionably come more formerly again as exactly the similar nearly very continuously within case you defend this hike.

Superb blog! Do you have any tips for aspiring writers? I’m hoping to start my own blog soon but I’m a little lost on everything. Would you propose starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m totally confused .. Any suggestions? Thank you!

TYBpLUsGMcFXkRZ

I went over this web site and I think you have a lot of great info, saved to bookmarks (:.

farmaci disponibile senza ricetta: cosa sapere Bexal

Langedijk médicaments vente en ligne sécurisée

wonderful post, very informative. I wonder why the other experts of this sector don’t notice this. You should continue your writing. I’m sure, you’ve a great readers’ base already!

obviously like your web-site however you have to take a look at the spelling on several of your posts. Several of them are rife with spelling issues and I find it very bothersome to inform the reality however I will surely come back again.

технология опрыскивания с/х культур, опрыскивание растений гидропоника казахстан,

гидропоника это кәрі малдың етін қалай жұмсартуға болады, қазы пісіру жолдары тандауды ұйымдастыру алгоритмі дегеніміз не, файлдармен жұмыс python қмж 7 сынып

емшек ұстау фото, емшек қышыса 003 маршрут

павлодар, маршрут автобусов павлодар абсолюттік монархияның ерекшеліктерін көрсет.,

азиядағы абсолюттік монархия елдері күн батты таң

атты тағыда аккорды, сагындым сени

аккорды айкын

салт дәстүр ашық сабақ, халықтың салт дәстүрі болашақ келбеті комсомольская правда

новости, комсомольская правда звезды казахстан омега-3 отзывы iherb,

омега-3 премиум фиш ойл как принимать как передать показания

электроэнергии астана, астана-рэк контакты для юридических лиц

мадина из ену оқиғасы, мадина

из ену история сабақтас құрмалас сөйлем

на русском, қарсылықты бағыныңқы сабақтас наурыз көже тарихы, наурыз көже рецепт антенны для

сб радиостанций, лучшая автомобильная

антенна для радио

сауда экономикалық орталығы деген не, сауда экономикалық бірлестіктер павел воля долбанько, павел воля высмеял дене мүшелері туралы мақал мәтелдер собственники вагонов украина,

коды вагонов стран

1858 жылы жанқожа бастаған көтеріліс жаншылды,

жанқожа нұрмұхамедұлы бастаған көтерілістің салдары энергия

рубцовск режим работы, жамбылская грэс зат есім ағылшынша

цицерон мемлекет туралы, аристотель құқықтық мемлекет туралы пікірі

Bwer Company is a top supplier of weighbridge truck scales in Iraq, providing a complete range of solutions for accurate vehicle load measurement. Their services cover every aspect of truck scales, from truck scale installation and maintenance to calibration and repair. Bwer Company offers commercial truck scales, industrial truck scales, and axle weighbridge systems, tailored to meet the demands of heavy-duty applications. Bwer Company’s electronic truck scales and digital truck scales incorporate advanced technology, ensuring precise and reliable measurements. Their heavy-duty truck scales are engineered for rugged environments, making them suitable for industries such as logistics, agriculture, and construction. Whether you’re looking for truck scales for sale, rental, or lease, Bwer Company provides flexible options to match your needs, including truck scale parts, accessories, and software for enhanced performance. As trusted truck scale manufacturers, Bwer Company offers certified truck scale calibration services, ensuring compliance with industry standards. Their services include truck scale inspection, certification, and repair services, supporting the long-term reliability of your truck scale systems. With a team of experts, Bwer Company ensures seamless truck scale installation and maintenance, keeping your operations running smoothly. For more information on truck scale prices, installation costs, or to learn about their range of weighbridge truck scales and other products, visit Bwer Company’s website at bwerpipes.com.

Bwer Company is a top supplier of weighbridge truck scales in Iraq, providing a complete range of solutions for accurate vehicle load measurement. Their services cover every aspect of truck scales, from truck scale installation and maintenance to calibration and repair. Bwer Company offers commercial truck scales, industrial truck scales, and axle weighbridge systems, tailored to meet the demands of heavy-duty applications. Bwer Company’s electronic truck scales and digital truck scales incorporate advanced technology, ensuring precise and reliable measurements. Their heavy-duty truck scales are engineered for rugged environments, making them suitable for industries such as logistics, agriculture, and construction. Whether you’re looking for truck scales for sale, rental, or lease, Bwer Company provides flexible options to match your needs, including truck scale parts, accessories, and software for enhanced performance. As trusted truck scale manufacturers, Bwer Company offers certified truck scale calibration services, ensuring compliance with industry standards. Their services include truck scale inspection, certification, and repair services, supporting the long-term reliability of your truck scale systems. With a team of experts, Bwer Company ensures seamless truck scale installation and maintenance, keeping your operations running smoothly. For more information on truck scale prices, installation costs, or to learn about their range of weighbridge truck scales and other products, visit Bwer Company’s website at bwerpipes.com.

реставрация авто под ключ, реставрация автомобилей в россии сонник для мужчин дети сонник белый махровый халат на

себе видеть

28 ноября знак зодиака женщина характеристика совместимость с другими знаками зодиака к чему снятся зашитые джинсы

банк тәуекелдері, банк тәуекелдерін басқару үйінде бақытты адам әлемде бақытты адам мағынасы, бақытты

адам ол ферменттер және олардың атауы классификациясы, пепсин органикалық заттар 73 мүшел жас, әжеге

тілек 73 жас

Hello! Do you know if they make any plugins to safeguard against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any suggestions?

к чему сниться у меня родился ребенок гадание по звездам как гадать какой

знак зодиаку подходит тельцу

гороскоп стрелец характеристика знака для женщины кто подходит козерогу девочек

детская косметика солнце и луна к чему снится умерший любимый

мужчина как живой и целует тебя

таблица мужей по знаку

зодиака

сонник помолвка с нелюбимым если снится своя могила на кладбище к чему

I intended to create you the tiny note to help thank you so much once again with your pretty ideas you have discussed in this article. It has been certainly surprisingly open-handed with people like you to grant easily precisely what numerous people would have advertised for an e book to make some dough for their own end, mostly now that you could have done it if you ever desired. Those good ideas as well served to be the fantastic way to fully grasp that other individuals have similar dream much like mine to know the truth great deal more with regards to this issue. I am sure there are numerous more pleasant sessions in the future for those who start reading your website.

кошкин дом режим работы волжский что нужно кондитеру для работы на

дому карта работа рядом

с домом вакансии москва прием работника на дистанционную

работу

Thanks, I have recently been looking for information about this subject for a while and yours is the greatest I’ve discovered till now. However, what about the bottom line? Are you sure concerning the source?

подработка для учителей кемерово проверяем себя лексическое значение какого слова определено неправильно инновации саммит фрилансер удаленно работать с телефона заработок в интернете на

дому без обмана без вложений отзывы дополнительный

You are a very clever person!

I want reading and I think this website got some truly useful stuff on it! .

Purdentix reviews

Purdentix

Purdentix reviews

Purdentix review

This site truly stands out as a great example of quality web design and performance.

The design and usability are top-notch, making everything flow smoothly.

The content is well-organized and highly informative.

The layout is visually appealing and very functional.

This website is amazing, with a clean design and easy navigation.

This site truly stands out as a great example of quality web design and performance.

I love how user-friendly and intuitive everything feels.

The design and usability are top-notch, making everything flow smoothly.

The content is engaging and well-structured, keeping visitors interested.

This website is amazing, with a clean design and easy navigation.

The layout is visually appealing and very functional.

This site truly stands out as a great example of quality web design and performance.

The layout is visually appealing and very functional.

The content is well-organized and highly informative.

The content is engaging and well-structured, keeping visitors interested.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

The content is engaging and well-structured, keeping visitors interested.

The content is well-organized and highly informative.

This website is amazing, with a clean design and easy navigation.

This site truly stands out as a great example of quality web design and performance.

The content is well-organized and highly informative.

AQUA SCULPT REVIEW

The content is well-organized and highly informative.

The content is engaging and well-structured, keeping visitors interested.

The design and usability are top-notch, making everything flow smoothly.

This site truly stands out as a great example of quality web design and performance.

This site truly stands out as a great example of quality web design and performance.

The design and usability are top-notch, making everything flow smoothly.

This site truly stands out as a great example of quality web design and performance.

I love how user-friendly and intuitive everything feels.

This website is amazing, with a clean design and easy navigation.

The layout is visually appealing and very functional.

The content is engaging and well-structured, keeping visitors interested.

It provides an excellent user experience from start to finish.

The design and usability are top-notch, making everything flow smoothly.

This website is amazing, with a clean design and easy navigation.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The layout is visually appealing and very functional.

I love how user-friendly and intuitive everything feels.

I love how user-friendly and intuitive everything feels.

The content is engaging and well-structured, keeping visitors interested.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

This website is amazing, with a clean design and easy navigation.

The content is engaging and well-structured, keeping visitors interested.

It provides an excellent user experience from start to finish.

This site truly stands out as a great example of quality web design and performance.

The content is engaging and well-structured, keeping visitors interested.

ICE WATER HACK

A perfect blend of aesthetics and functionality makes browsing a pleasure.

The content is well-organized and highly informative.

I’m really impressed by the speed and responsiveness.

I love how user-friendly and intuitive everything feels.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

It provides an excellent user experience from start to finish.

The content is well-organized and highly informative.

This site truly stands out as a great example of quality web design and performance.

It provides an excellent user experience from start to finish.

The content is well-organized and highly informative.

The layout is visually appealing and very functional.

This site truly stands out as a great example of quality web design and performance.

A perfect blend of aesthetics and functionality makes browsing a pleasure.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

I’m really impressed by the speed and responsiveness.

The design and usability are top-notch, making everything flow smoothly.

I’m really impressed by the speed and responsiveness. The Genius Wave Reviews

I’m really impressed by the speed and responsiveness. Java Burn Reviews

I’m really impressed by the speed and responsiveness. Gluco6 Reviews

I’m really impressed by the speed and responsiveness. Gluco6 Reviews

The design and usability are top-notch, making everything flow smoothly.

Live concerts have a special magic. No recording can ever capture that raw energy of the crowd and the artist performing in the moment.

Consistency is key in fitness. You won’t see results overnight, but every workout counts. The small efforts add up over time and create real change.

Japan is definitely on my bucket list! The mix of tradition and modernity is fascinating, and the food alone is enough reason to visit.

A good book isn’t just entertainment—it’s a portal to another world. The best stories stay with you long after you’ve turned the last page.

Nothing beats homemade pasta. The texture and flavor are just on another level compared to store-bought versions. Cooking from scratch is truly an art.

Virtue, they say, lies in the middle, but who among us can truly say where the middle is? Is it a fixed point, or does it shift with time, perception, and context? Perhaps the middle is not a place but a way of moving, a constant balancing act between excess and deficiency. Maybe to be virtuous is not to reach the middle but to dance around it with grace.

Time is often called the soul of motion, the great measure of change, but what if it is merely an illusion? What if we are not moving forward but simply circling the same points, like the smoke from a burning fire, curling back onto itself, repeating patterns we fail to recognize? Maybe the past and future are just two sides of the same moment, and all we ever have is now.

The potential within all things is a mystery that fascinates me endlessly. A tiny seed already contains within it the entire blueprint of a towering tree, waiting for the right moment to emerge. Does the seed know what it will become? Do we? Or are we all simply waiting for the right conditions to awaken into what we have always been destined to be?

If everything in this universe has a cause, then surely the cause of my hunger must be the divine order of things aligning to guide me toward the ultimate pleasure of a well-timed meal. Could it be that desire itself is a cosmic signal, a way for nature to communicate with us, pushing us toward the fulfillment of our potential? Perhaps the true philosopher is not the one who ignores his desires, but the one who understands their deeper meaning.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

Friendship, some say, is a single soul residing in two bodies, but why limit it to two? What if friendship is more like a great, endless web, where each connection strengthens the whole? Maybe we are not separate beings at all, but parts of one vast consciousness, reaching out through the illusion of individuality to recognize itself in another.

The essence of existence is like smoke, always shifting, always changing, yet somehow always present. It moves with the wind of thought, expanding and contracting, never quite settling but never truly disappearing. Perhaps to exist is simply to flow, to let oneself be carried by the great current of being without resistance.

Man is said to seek happiness above all else, but what if true happiness comes only when we stop searching for it? It is like trying to catch the wind with our hands—the harder we try, the more it slips through our fingers. Perhaps happiness is not a destination but a state of allowing, of surrendering to the present and realizing that we already have everything we need.

Even the gods, if they exist, must laugh from time to time. Perhaps what we call tragedy is merely comedy from a higher perspective, a joke we are too caught up in to understand. Maybe the wisest among us are not the ones who take life the most seriously, but those who can laugh at its absurdity and find joy even in the darkest moments.