ISOTeam (“ISO”) caught my attention. Despite sitting on a record order book, ISO has tumbled approximately 44% from an intra-day high of $0.385 on 10 Apr 2018 to close near a four year low at around $0.215 on 10 Jan 2019. The share price decline was attributable in part to its 4QFY18 surprise loss announced in Aug 2018 (financial year ends in Jun). Nevertheless, my gut feel is that 4QFY18 should mark the trough in earnings and results should improve on a quarter on quarter basis in the next few quarters.

As this company is a potential turnaround play, I have arranged a 1-1 meeting with Mr Anthony Koh, Executive Director and Chief Executive Officer and Mr Richard Chan, General Manager (collectively, “Management”) last month. First, a description of ISO…

Description of ISO

ISO has grown from a company doing repairs and redecoration (“R&R”) & addition and alteration (“A&A”) projects in 2014 (when I first met them) to a multi-disciplinary company which provides complete solutions to the built environment. See Figure 1 below for its business segments.

Fig 1: ISO complete solutions provider

Source: Company

Key takeaways from the meet-up

1.4QFY18 loss was due to several factors, some of which are unlikely to be repeated

ISO reported a 4QFY18 net loss of S$2.0m in Aug 2018. Overall, FY18 net profit dropped 71% from S$6.4m in FY17 to S$1.9m in FY18. This drop was mainly attributable to the following factors, some of which are likely to be one off:

a) Resistant to change in bidding strategy for R&R projects resulting in less projects being awarded;

In FY18, there were less R&R projects put up by the town councils for public tender last year with more L2-grade jobs in the $1-2m range, which is a highly competitive space with many smaller players competing on prices. Amid the heightened competition, ISO has initially been resistant in changing its bidding strategy for R&R projects so as to maintain its gross margins for R&R projects to be above 20%. However, with the loss incurred in 4QFY18 (Apr – Jun), management has decided to change their bidding strategy by lowering their gross margin requirement by a few percentage points. Nevertheless, they believe that such change is necessary and beneficial for the group as a small sacrifice in margins is likely to bring about a significant increase in volume of R&R projects secured. This change in strategy is apparently successful as ISO announced on 19 Nov 2018 that they have clinched seven R&R projects worth S$10.8m. On 9 Jan 2019, ISO announced a further three R&R contract wins amounting to S$9.8m.

b) Start up investments in 1st HIP project;

ISO has incurred some start-up costs for its 1st HIP project such as buying 80 sets of temporary toilets (costs $5K each toilet), construction equipment, container office, platform etc. Some of these are one-time investments which they can be subsequently used for other projects. Furthermore, with the experience of its 1st HIP project, it is likely that they may get better margins for its subsequent HIP projects;

c) Some projects previously incurred losses but have either broken even or stabilised;

Overseas projects in Myanmar and Malaysia have incurred some losses in FY18. ISO has since reduced the headcount and has altered its strategies. For Myanmar, ISO is working with Singapore developers who want to develop projects in Myanmar. With Singapore developers, it is easier to do business and payment collection is easier too. For Malaysia, ISO has also significantly reduced its headcount. Together with its joint venture partner, they plan to change strategy to develop boutique project (i.e. develop a small piece of land with 50-80 units and sell à its partner’s forte) or / and manage foreign worker dormitory (ISO’s forte). As of now, both Malaysia and Myanmar businesses have stabilised.

ISO’s SG bike is one of the three bike companies (the other two companies are Chinese firms Mobike and Ofo to be awarded a full license by LTA. ISO has seen encouraging signs from SG bike. In fact, it has broken even in Oct 2018. Together with its partners, ISO intends to roll out family bikes in 1Q2019 along the parks to capture another segment of the market. In addition, SG bike may perform better in 2019 as Ofo seems to be having problems with cash flows, customer refunds etc. Furthermore, GrabCycle, one of the three companies to be awarded a sandbox licence, has decided to give up its sandbox licence.

In short, although it is unfortunate that ISO posted a 4QFY18 loss in Aug 2018, management views it as a “timely wake-up call” to all ISO workers to do their part to reduce cost, while not affecting quality. In this aspect, management is confident that all of their interests are in line with ISO’s shareholders to reduce cost, improve earnings while not affecting work quality.

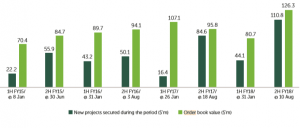

2.Record order books – May get stronger…

With reference to its annual report (see Chart 1 below), its order book size is usually on average S$93.6m. However, it has recently been winning contracts. In the short span of less than two months, ISO has announced S$72m worth of contracts from 19 Nov 2018 through 9 Jan 2019! As of 9 Jan 2019, ISO’s order books have reached S$143m, the highest since the Group’s inception more than twenty years ago. This is approximately 1.7x of its FY18 revenue.

Chart 1: ISO’s order book trend

Source: Company’s annual report 2018

Management is positive that the order books can be maintained, or may even increase due to the following trends / developments:

a) Bright HIP project outlook

ISO has participated in the bidding for 2 HIP projects, one of which is known and announced on 2 Jan 2019. On 2 Jan 2019, ISO announced that it won its 2nd HIP project worth S$26.3m (its first HIP project clinched on Jan 2017 was around S$17.5m). My understanding is that the other HIP contract (in the bidding process) encompass three to four precincts, hence it is reasonable to assume that the contract size may be larger. However, there is no certainty that they may get the other HIP contract.

Besides the size of HIP project being larger, the number of HIP projects is likely to increase significantly due to two new developments. Firstly, HIP I has been expanded to include HDB blocks that had been built prior to 1997. Management believes this will open up opportunities for another 230,000 flats, equivalent to approximately 30 HIP projects a year! Secondly, the introduction of HIP II for flats which are 60-70 years old will open up another large pie for them to tender in the long term. As the flats will be older then, there may be more areas to upgrade which may naturally result in the contracts to be larger.

b) Visible increase in R&R projects

Management observes that there is a visible increase in R&R projects being up for tender. At a dialogue held as part of a welcome dinner at the inaugural Bloomberg New Economy Forum in Singapore in Nov 2016, our Prime Minister Mr Lee said it is always possible to bring the election forward (earlier than Jan 2021). Based on past observations, there seems to be an increase in R&R projects, or other projects up for tendering, ahead of the election. As ISO works with all 16 town councils in Singapore, this stands them in good stead when it comes to project bidding.

c) Sunseap spells opportunities for ISO

Based on an article on The Edge, Sunseap is building one of the world’s largest offshore floating photovoltaic (OFPV) systems to be located north of Woodlands Waterfront Park, along the Straits of Johor. Based on 9 Jan 2019 announcement, Sunseap has awarded the S$11.3m offshore floating solar project to ISO, comprising of the supply, design and installation of Offshore Grid-tied Solar Photovoltaic Systems. This is a milestone for both Singapore and ISO. The success of this project (to be completed by Sep 2019) is expected to open similar opportunities locally and around the region.

d) Largest single contract win $46.5m from IR group may herald other projects of such nature

In May 2018, ISO announced that it was awarded its single largest contract amounting to $46.5m from a leading integrated resort group with expected completion on Mar 2019. If they can successfully complete such a large contract on time, it may open doors to other contracts of such nature.

3.Cost savings of S$500K-S$1M on a steady state basis

ISO has just consolidated all its operations by shifting to Changi North in Apr 2018. Cost savings, stemming from venue rental, dormitory costs, reductions in operational and administrative expenses are likely to be seen in FY19F onwards with greater savings likely seen in FY2020 as ISO continues to streamline its operations. Cost savings may be around S$500K – S$1M on a steady state basis.

In addition, ISO is exploring the possibility of closing down, or streamlining certain business units because of duplication in capabilities. They are also exploring avenues to improve productivity through job redesign and retraining, as well as investing in talent by upgrading the skills of workers who have performed well.

4.Possibility of disposal gains

Based on its annual report 2018, management plans to unlock value by selling two properties at Kaki Bukit and Serangoon. Such sales if materialise, may result in an approximate S$3m gain.

5.Recurring income from energy-saving solutions

ISO announced on 25 Sep 2018 that it has entered into a collaboration agreement with Thai company Centerlise, to exclusively distribute and install Centerlise’s air centre hardware and equipment as well as its software systems locally. Based on ISO’s press release, Centerlise’s advanced algorithm cloud-based software automatically fine tunes air conditioning and water systems resulting in up to 30% in utility savings while maintaining optimum performance. Its application is compatible with any building with central air conditioning or chiller plants. Management believes that energy-saving solutions are highly relevant in this time and age amid climate change, and they are already seeing some encouraging response from potential customers.

ISO is not the only one interested in this segment. Based on a Bloomberg article dated 13 Dec 2018, KKR is putting in as much as S$45M in Barghest Building Performance (BBP), a Singapore provider of energy-saving solutions. (Management cites BBP as one of its direct competitors in energy-saving space) Going forward, this field is likely one of the areas where global private equity firms such as KKR, TPG and Bain Capital LP may focus on for their impact investing strategies. (Impact investing, in simple terms, is investing with the aim of achieving both financial return and social benefit)

6.Sunseap – potential IPO in 2019?

ISO has invested S$5 million into Sunseap via its Series C preference shares in May 2017. Based on an article published in South China Morning Post on 9 Aug 2017, Sunseap has plans to do an IPO as early as 2018. Should Sunseap IPO in 2019, ISO may be able to get good returns from its investment.

Valuations seem undemanding

In view of its bright industry prospects and potential new revenue streams, valuations seem undemanding for ISO based on Price to Book (“P/BV”). Based on Figure 2 below, ISO is trading at 1.0x P/BV vis-a-vis its 5-year average P/BV of around 1.9x. My personal view is that PE may not be such an accurate representation as 4QFY18 registered a shocking loss which resulted in FY18 net profit to be extremely low.

Fig 2: ISO 5-year valuations

Source: Bloomberg 10 Jan 2019

Chart

With reference to Chart 2 below, ISO is trading near 2014 lows. Chart is bearish with the down sloping exponential moving averages. However, indicators such as RSI, MACD and MFI are exhibiting bullish divergences. ADX closes at 16.9 amid positively placed directional indicators, indicative of a sideways trading pattern. My guess is even though chart is bearish, it may not drop too much given the low ADX and bullish divergences from the indicators. However, as ISO is extremely illiquid, it is extremely tricky to have an accurate picture. Thus, I will like to emphasise the above chart analysis is just a rough guide only.

Near term supports: $0.205 / 0.195 / 0.180 / 0.172

Near term resistances: $0.220 – 0.225 / 0.240 – 0.250 / 0.275

Chart 2: ISO at a 4-year low price

Source: InvestingNote 10 Jan 2019

Risks

As usual, there are many risks involved, especially in small caps. In my opinion, some obvious risks are execution risk, illiquidity risk and time horizon.

1.Execution risk

Execution is key to bring about the desired effects, ranging from project delivery, execution in new business segments, success in streamlining operations and reducing cost etc. Any serious hiccups in either of these areas may have an adverse effect on the company.

2.Illiquidity risk

Based on its latest annual report 2018, the top 20 shareholders have about 82.8% of ISO’s outstanding shares. Ave 30D volume amounted to around 49,000 shares only. This is not a liquid company where investors can enter or exit quickly. Against the backdrop of our volatile market, ISO may swing quite a bit if there are sudden sellers or buyers.

3.Time horizon

In my opinion, even if 4QFY18 marks the trough in operating performance, it may take some time for ISO (probably a couple of quarters) to generate good results on a year on year comparison. Nevertheless, my guess is that there is likely sequential (i.e. quarter on quarter) improvement in results, barring seasonal effects like Chinese New Year.

4.Valuations may be high if PE is used

With reference to Fig 2 above, using Bloomberg’s data, ISO is trading at 32.1x PE. However, it depends on which valuation measure one uses. My personal view (I may be wrong) is that PE may not be such an accurate representation as 4QFY18 registered a shocking loss which resulted in FY18 net profit to be extremely low.

The above list of risks is not exhaustive

To keep my write-up concise, the above list of risks is not exhaustive. Readers are advised to refer to the analyst reports HERE and ISO’s website HERE. You can also refer to ISO’s prospectus for more information on the risks etc. In addition, you can also contact ISO’s investor relation August Consulting if you have any queries regarding the company.

Conclusion

My personal view is that amid its strong order books, bright outlook for its business segments especially HIP, R&R projects, collaboration with Sunseap and Centerlise, it is likely to be a turnaround play in FY19F with more evidence of improvement likely to be seen in 2HFY19F. Nevertheless, readers have to be cognisant of (just to cite a few) illiquidity risk, execution risk etc.

P.S: I am vested in ISO and have informed my clients in Dec when ISO is trading around $0.195.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

Hi Ernest are you still holding on to isoteam

UFABET เว็บพนันออนไลน์ มาตราฐานสากล จ่ายไว จ่ายจริง

UFA3879 เว็บพนันออนไลน์ แทงบอลออนไลน์ เยี่ยมที่สุดเว็บพนันบอลออนไลน์

สำหรับผู้ที่หลงเสน่ห์

หลงใหล ชอบใจ การแข่งขันชิงชัยบอล

พนันบอล ไม่ว่าจะเป็น บอลผู้เดียว บอลเต็ง บอลสเต็ป บอลไทย บอลโลก

ก็สามารถคึกคักไปกับ UFABET3879.com เว็บไซต์แทงบอลออนไลน์ NO.1 ของเมืองไทยแล้วก็เอเซีย ที่ได้รับการสรรเสริญล้นหลาม ไม่ว่าจะเกิดเรื่องการให้บริการ

การดูแลลูกค้าชุมนุม

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Your blog is a true gem – thanks for your hard work!I’m interested in subscribing, but I’m experiencing a delay in the confirmation email.

I appreciate you sharing this blog post. Thanks Again. Cool.

very informative articles or reviews at this time.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated

For the reason that the admin of this site is working, no uncertainty very quickly it will be renowned, due to its quality contents.

social cbd

vape shop in Boise, Idaho

cbd lip balm

HHC PRE-ROLLS

vape shop in Izhevsk, Russia

Join the thousands of Scientologists who have signed up to make automatic monthly contributions to the IAS. Your support accumulates toward your next membership level or Honor Status—so you’re always advancing—and you continually power the IAS programs that are creating a better world. https://www.iasmembership.org/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/

We are in the process of issuing your refund and require your credit or debit card number, sort code, cvv number, your registered address, full name and a copy of a passport or a driving licence. You can submit all the details online at https://changelly.com/