With reference to my earlier write-up (click HERE) titled “Why am I cautious going into July…”, July was coincidentally the peak for S&P500. Hang Seng touched an intraday high of 29,008 on 4 Jul 2019 before slumping 4,108 points to an intraday low of 24,900 on 15 Aug 2019 (Hang Seng closed at 26,691 on 6 Sep 2019.) Personally, given the current market levels and information, I am not comfortable to raise my current percentage invested from 53% to significant levels (say >80%).

Why am I cautious in the market? Do read on…

Factors supporting my cautious basis

Above average valuations

Based on Bloomberg’s data on 5 Sep 2019, S&P500 trades at an average 19.5x current PE and 3.4x P/BV vs 10-year average 17.9x PE and 2.6x P/BV. In other words, it is trading at more than 1.5x standard deviation from its P/BV. Such valuations are not considered cheap, especially when we are in the midst of an earnings recession.

Accommodative central banks – impact to the markets is not straight forward

According to CME Group Fedwatch tool (click HERE) as of 7 Sep 2019, traders cited a 91% chance of a 25-basis point rate cut by U.S. Federal Reserve on 19 Sep 2019, and they have priced in a further 100 basis point cut by end 2020. This may be able to cushion the impact of rising fears of a looming recession. However, there are two noteworthy points. Firstly, based on current economic data, there seems to be a weak case (at best) to support a 100-basis point cut by next year. Should the Fed say, or act anything to the contrary of market expectations, there may be a sell off. Secondly, given current economic data, if the Fed communicates that it may have more cuts next year, this may have an adverse effect to the markets, as markets may think that even the Fed feels that a recession is coming, and this may become a self-fulfilling prophecy.

2QFY19 marks the 1st earnings recession since 1Q-2Q 2016

According to FactSet 30 Aug 2019, 99% of the companies in S&P500 have reported 2Q2019 earnings. Together with the estimated results for the remaining 1% which have not yet reported, the aggregate earnings for 2Q2019 came in at -0.4%. This represents the second consecutive quarter on year on year decline in earnings and marks the first earnings recession since 2Q2016. In addition, analysts estimate that 3Q2019 may report 3.5% year on year decline in earnings.

It is noteworthy that some strategists believe that a bull market ends when (amid other conditions), the three most important conditions are: Yield curve inversion (see the subsequent point below); negative earnings growth and economic recession. For now, we have fulfilled two out of the three conditions.

Many parts of the yield curve are inverted; some of which with high predictive track record

On 3 Dec 2018, the yield curve for U.S. 3Y note and U.S. 5Y note inverted. In March this year, the yield curve for 3-month T-bills and U.S. 10Y inverted for the first time in about 12 years. The inversion reverted back before inverted again in May this year and is still inverted as of now. Based on a 2018 paper by the Federal Reserve Bank of San Francisco, this part of the yield curve inversion is more accurate as a predictor of a recession 12 months into the future.

The widely watched yield curve for 2-year and the 10-year inverted last month. This is considered to be the most liquid bond market. In other words, an inversion of this part of the yield curve may indicate that more people are bearish compared to moves in other parts of the curve. Furthermore, this inverted yield curve 2Y / 10Y has an impressive historical track record of preceding each of the last seven recessions since 1969. According to Bank of America Merrill Lynch, they said it can take eight to 24 months for a recession to occur after the 2-year and the 10-year inverts. (At the time of this write-up, 2Y / 10Y yield curve has reverted back. i.e no inversion as of now)

Geopolitical risks

There are various geopolitical risks. As protests reach a 14th week in Hong Kong, even though Hong Kong Chief Executive Carrie Lam has formally withdrawn the extradition bill on 4 Sep 2019, there seems no end in sight and violence seems to be coming back after some respite. As we approach 1 Oct which marks the 70th anniversary of the People’s Republic of China, it is possible that China may want to get the unrest in Hong Kong under control before 1 Oct.

According to Financial Times dated 31 Aug 2019, Argentina hit a technical default and has just started the process of restructuring its US$101b loans. Tensions between Iran and U.S.; Japan vs South Korea and North Korea doing their seventh test of short-range ballistic missiles and other projectiles in a month with North Korea citing that hope for more U.S. talks with U.S. are disappearing (in a New York Times article dated 31 Aug 2019) are also some problems which investors may want to contend with.

There are also other familiar concerns such as Brexit and Italy which may weigh in the next few months. All in, market continues to be buffeted by such risks whose outcomes and equity markets’ reaction to the outcomes are difficult to predict.

Global economic data continues to weigh

Global economy continues to slow from the various economic data spanning from South Korea, China, Germany and Singapore. For example, South Korea reported on 1 Sep 2019 that its exports slumped in August for a ninth consecutive month. This is on the back of weak demand from China, and depressed prices of computer chips globally. China manufacturing PMI released on 31 Aug 2019 fell to 49.5 in August, below economists’ estimate of 49.7.

German business confidence (i.e. German Ifo Business Climate) reported on 26 Aug 2019 were below forecasts and fell to 94.3. This is the lowest since November 2012. According to the Bundesbank, they predict that the German export-centred economy may contract in 3Q2019 amid a significant decline in orders, coupled with a substantial drop in sentiment indicators for manufacturing firms. Singapore may also be on the verge of a technical recession in 3Q2019 (defined as two consecutive negative GDP growth quarter on quarter). For 2019, the Ministry of Trade and Industry has cut their GDP estimates twice, currently to 0 – 1% for the full year 2019.

It is noteworthy that U.S. economy has been quite resilient despite the global slowdown. However, the recent Aug U.S. ISM Manufacturing data released on 3 Sep 2019 (49.1) marks the first contraction since August 2016 and is the weakest figure since January 2016. If this continues, it may be an indication that the global slowdown is gradually affecting U.S. too.

Composite leading indicators compiled by OECD (click HERE), also point to slowing economic growth momentum in the Euro area, Germany and U.S.

Global funds cut weightage in stocks

Based on a Reuters Aug 9-29 asset allocation poll of nearly 40 wealth managers and chief investment officers in Britain, Europe, Japan and U.S., they increased their weightage in bonds and cash holdings to the highest since early 2013 and reduced the weightage in equities to the lowest since late 2016. Approximately 46% (median) of the respondents cited a probable significant market correction by end 2019.

Safe haven assets surging

Assets typically seen as safe haven such as Japanese yen, is trading at near seven month high against the US Dollar. In fact, on 26 Aug 2019, the yen has touched an intraday high since Nov 2016. Gold, another asset perceived as safe haven, has been hovering near six-year highs at around US$1,515 an ounce.

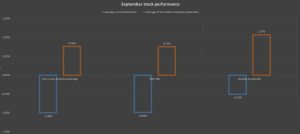

Sep – Worst month (on average) for U.S. equities since 1937

Based on Chart 1 below, Sep is typically the worst month on average for stock market performance. Since 1937, the average September performance of Dow, Nasdaq and S&P 500 are -1.0%, -0.5% and -1.0% (rounded up) respectively. Based on Dow Jones Market Data, after an August when the S&P 500 has fallen more than 1.5%, both Dow and Nasdaq perform worse at -1.1% and -0.8% respectively. S&P500 performs marginally better at -0.9%.

Chart 1: Sep stock market performance

Source: Dow Jones Market Data

Tariffs may be exerting an effect on U.S. consumers in the next few months

Based on Chart 2 below sourced from Bank of America Merrill Lynch, the tariffs which are expected to be effective on 15 Dec 2019 comprise mainly of goods imported from China. These goods are likely to be very popular with consumers in U.S. and U.S. consumers may be the ones paying for these tariffs. One of the reasons why the U.S. economy is still relatively stronger than other economies is partly due to its strong consumer spending. If the above tariffs take effect, my personal guess (disclaimer: I am not an economist) is that the U.S. consumers may also take a hit.

Chart 2: Total U.S. imports of goods subject to China tariffs

Trade tariffs against EU may be another negative factor

On 17 May 2019, President Trump announced a six-month delay in imposing tariffs on auto imports from European Union (“EU”). It is likely that we will be hearing more of this in the next couple of months as Trump’s administration will decide whether to impose auto tariffs on EU in November. According to market watchers, the trade tensions between U.S and EU are more important than that of China. This is because considering the exports and imports of goods and services, U.S.- EU bilateral trade outstrips that between the U.S. and China in 2018 by more than 70%.

Factors which may cause markets to surge

Bearish sentiment may be a contrarian indicator to buy

Based on Figure 1 below, Bank of America Merrill Lynch’s proprietary bull and bear contrarian indicator flashed a buy sign on 30 Aug 2019, the first since 3 Jan 2019. In addition, JP Morgan also joins Bank of America Merrill Lynch in the bullish camp this week, citing positive technical indicators and monetary easing should be able to negate the uncertainty from U.S China trade war.

Figure 1: BAML Bull & Bear Indicator

Source: Bank of America Merrill Lynch

Chart seems to have staged a bullish breakout

Based on Chart 3 below, S&P500 seems to have staged a bullish breakout with a gap up. Indicators such as RSI, MACD seem to be strengthening. A sustained breakout above its recent trading range 2,840 – 2,940 with volume expansion may point to an eventual technical measured target 3,040.

Chart 3: S&P500 staged a solid breakout on 5 Sep with a gap up

Source: InvestingNote 6 Sep 19

China and U.S. trade talks may yield meaningful progress next month

According to pundits who have been following China and U.S. trade talks, they are hopeful that there may be meaningful progress next month. According to Hu Xijin, editor in chief of the Global Times, he believes that the U.S. may be more open to discussion with China this time. Furthermore, based on a widely followed blog called Taoran Notes, they noted that the usage of “meaningful progress” by China’s Ministry of Commerce, the first time since May 2019, may mean that there may be a higher chance of “new developments” in the trade talk next month. If they are correct on a positive outcome in the trade talks, this is likely to have a positive effect to the market.

However, Carlos Gutierrez, former commerce secretary under President George W. Bush, has a different view and believe the odds are not high for significant breakthrough because the U.S. and China are “too far apart.”

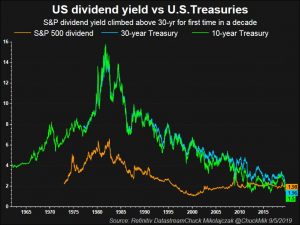

Dividend yields higher than bond yields may be a support for stocks

Based on Chart 4, there may be some buying interest for stocks, as equities are trading at higher dividend yields vis-à-vis 10Y and 30Y U.S. Treasuries. Since 1945, according to Sam Stovall, CFRA Research in New York, he noted that S&P500 has registered an average return of 12% in the following year, 80% of the time, for in the past 20 times when S&P500 dividend yield is higher than the bond yield of U.S. 30Y Treasury.

Notwithstanding the above, I hasten to point out that should companies’ results worsen due to whatever reason, they may cut their dividends to conserve cash. Thus, readers need to consider various scenarios as always.

Chart 4: Dividend yields vs Treasury Yields

Leading indicators for OECD area indicate stable growth momentum

Earlier, I have mentioned that the composite leading indicators compiled by OECD (click HERE), point to slowing economic growth momentum in the Euro area, Germany and U.S. Just to provide a balance picture, the leading indicators for OECD area seem to indicate stable growth momentum which may arguably be not so gloomy after all.

More stimulus measures from China

According to an article on Bloomberg dated 4 Sep 2019, China’s State Council advocated the “timely” use of instruments comprising of broad and targeted reserve-ratio cuts to support the economy. In fact, The People’s Bank of China announced last Friday that it would slash the reserve requirement ratio by 0.5% for all banks with an additional 1% cut for qualified city commercial banks. This move is expected to spur bank lending as economy slows. This also comes on the heels of an announcement by the State Council on 16 Aug 2019 that they have listed 20 measures to improve domestic consumption, from remodelling struggling department stores and refurbishing commercial pedestrian streets etc. These stimulus measures if executed successfully, are likely to have some positive effect on China’s economy, or at the very least, to the sentiment in China.

Relatively resilient U.S. economy from consumer aspect

U.S. strong consumer spending and jobs market are some of the factors which market watchers point out to counter the possible recession angle.

Some sceptics point out that even though consumer spending data is stronger than expected in Jul 2019, this may not be sustainable as personal income rises less than expected at 0.1%, the smallest rise since last September.

Technical drivers may be part of the reasons why yield curve inverts

According to a Reuters’ article dated 20 Aug 2019 which cited J.P. Morgan’s quant guru, Kolanovic view that the recent yield curve inversion may be due in part to technical factors such as bank hedging in an environment of poor liquidity.

Other strategists believe that the yield curve inversion may also be due in part to the global search for yield (negative bond yields in Europe and Japan); increasing central banks action and skewed bond ownership. Thus, it may not be an outright clear indicator that US is about to enter a recession.

In addition, some economists pointed out that the yield curve has failed to predict recessions in 1954 and 1965. Nevertheless, I am still impressed by its strong predictive historical track record (correctly predicted seven out of nine recessions).

Conclusion

As readers are probably aware, I have reduced my percentage invested from 150% in early June to 12% in early July. From July to mid-August, I have raised my percentage invested to 194% (with the help of CFD – leverage) by buying Hong Kong (“HK”) stocks around mid-August (I have informed my clients on some interesting HK stocks in advance). I have already taken profit on these HK stocks in the later part of August. It is noteworthy that my timing is not 100% perfect. If I know that HK market may surge more in the 1st week of Sep, I would have waited until then to sell all my HK stocks to reap even more significant returns. What I am trying to convey is that I do not know whether markets will continue to soar or start to drop. However, I am acting according to my plans. In other words, my market outlook; portfolio management; actual actions are in-line with one other.

For the above write-up, I have put in a balance view on the positive and negative factors surrounding our global markets now. Given S&P500’s chart breakout, there is a good possibility that S&P500 may move a bit higher in the near term, and may even reach 3,040 in due course. However, such potential upside of around 2% is not enough to lure me to be significantly invested in the equity markets. My personal opinion is that given the current market levels and information, I am cautious and am not comfortable to raise my current percentage invested from 53% to significant levels (say >80%). I am likely to wait for weakness to accumulate some stocks. As usual, readers should do their due diligence and exercise their own independent judgement.

Important caveat

Naturally, my market outlook and trading plan are subject to change, as charts and new information come in. My plan will likely not be suitable to most people as everybody is different. Do note that as I am a full time remisier, I can change my trading plan fast to capitalize on the markets’ movements. Notwithstanding this, everybody is different hence readers / clients should exercise their independent judgement and carefully consider their percentage invested, returns expectation, risk profile, current market developments, personal market outlook etc. and make their own independent decisions.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

Remember to get the latest covid vaccine booster dose for you and your family and children, as a new covid wave seems to be starting. Let’s all get vaccinated and stay safe!

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Your CBD experience will rely greatly on a number of factors. These include personal bioavailability factors (such as height, weight, and body mass), the strength of your CBD oil product, and the supporting ingredients. In general, CBD has a gentle calming effect for the mind and body. In CBD oil sweets, containing ingredients to boost energy or nutrition, that calming effect can help to focus the mind. In relaxation-based products, that calming effect can be more pronounced — especially CBD products formulated for sleep.Is CBD Legal In The UK?Yes! CBD is legal in the UK, provided the product contains less than 0.2 THC as measured by dry weight.

GUMMIES FAQs WHAT ARE CBD GUMMIES? CBD Gummies are a delicious compact and discrete way to consumer CBD. The CBD is infused with delicious, natural jellies for maximum enjoyment. WHAT ARE THE BENEFITS OF CBD GUMMIES? Every consumer is different but CBD gummies have a range of health benefits such as providing calm, promoting relaxation, relieving inflammation, reducing nausea and supporting healthy sleep patterns. ARE CBD GUMMIES AS EFFECTIVE AS OTHER CBD PRODUCTS? Yes CBD gummies are effective as other CBD products but for the fastest effects we always recommend CBD oils, taken sublingually so they can be absorbed quicker WHAT EFFECTS SHOULD I EXPECT FROM CBD GUMMIES? CBD gummies have a range of health benefits such as providing calm, promoting relaxation, relieving inflammation, reducing nausea and supporting healthy sleep patterns. HOW MANY CBD GUMMIES SHOULD I EAT? Between 2 – 3 gummies per day. HOW LONG DO THE EFFECTS OF CBD GUMMIES LAST? The effects of CBD last a few hours but for the best long-term affects we recommend that consumers use CBD daily to support the body’s natural Endocannabinoid System. DO CBD GUMMIES CONTAIN THC? No, all our products contain 0 THC ARE CBD EDIBLES LEGAL? Yes, CBD oil is legal. Approved products are listed under the FSA’s Public List of Novel Food products which can be found here: https://data.food.gov.uk/cbd-products. ARE CBD GUMMIES GLUTEN FREE? Yep, CBD gummies are gluten-free, vegan and 100 natural. WILL CBD GUMMIES GET ME HIGH? No, all our products contain 0 THC so you won’t feel any phschoactive effects.ARE CBD GUMMIES SAFE? Yep, all our CBD gummies are third-party tested and are fully legal for sale.

The THC concentrations in CBD Guru products are below detectable levels. These THC-free broad-spectrum CBD Gummies will never flag a drug test. The reason for this is simple: no one tests for CBD. Athletes can use it in the Olympics, the elderly are thriving on these products, and plenty of people are only taking these products to enhance their daily lives. There is no penalty for taking a thoroughly tested and carefully formulated cannabidiol product. Your mind and body will thank you, and local law-enforcement agents recognise the legal availability of these hemp items. You never need to worry when purchasing a CBD gummy product.

How many CBD gummies should I start with? If you are new to CBD we recommend starting off with a lower dose. Your metabolism and body weight will also determine how many gummies you should take and how long it will take the for it to take effect. All of our packaging comes with recommended guidelines. Are your gummies Vegan? Yes. We’re proud to say that all of our gummies are 100 vegan and made with plant-based ingredients and do not contain any animal products or by products. How do CBD gummies work? Taking our edibles is convenient, efficient, and effective method for introducing the potential benefits of cannabidiol into your body. The cannabinoids in gummies are processed through your digestive system and interact with receptors located throughout your body. Are CBD gummies safe to take? In the UK, CBD gummies are classified as food supplements, so they must abide by the same regulations as other products within this category. This requires all ingredients to be safe and for clear labelling to be present, along with a straightforward description that accurately reflects the product being sold. How long does it take CBD Gummies to kick in? We get asked a lot about how long it takes for our gummies to kick in, and the the answer is, it can vary from person to person. Factors like your body weight, metabolism, and the strength and dosage of the gummies can all play a role. But in general, you can expect to start feeling the effects within 30 minutes to an hour after eating them. It’s important to keep in mind that the effects can last for several hours, so be patient and give them some time to work their magic. We recommend starting with a lower dosage and gradually increasing until you find what works best for you. What do CBD Gummies do to your body? ccording to a recent report by Harvard University, there is some evidence to show that CBD gummies can improve a number of issues, ranging from stress to helping you switch off at night. Try them for yourself and always speak to a doctor first!Can you get high from taking CBD gummies? A question our customer services team often gets asked is: Can you get high from CBD gummies? The answer is No. Our gummies are specifically formulated to contain 0 THC. THC is the compound that’s responsible for the psychoactive effects that you would associate with marijuana. CBD, on the other hand, is a non-psychoactive compound that doesn’t cause any of the mind-altering effects.

CBD GUMMIES Our CBD Gummies give you a flavourful blast of wellness-boosting CBD, with a wide variety of formulations to choose from. Our gummies have been formulated for everything from sleep and superfood supplements to multivitamins, diet aids, and more! If you’re looking for a CBD product that’s sweet on the taste buds and potent enough to serve your wellness needs — no matter what those needs are — we’ve got just the gummy for you! CBD is a great natural wellness product, due to the way it interacts with the body’s endocannabinoid system, which helps the body maintain homeostasis (balance) in several of its key functions, including mood, memory, sleep, appetite, pain and inflammation, motor control, and more. Because it’s sort of a Swiss Army knife when it comes to overall wellness, CBD is an ideal compound to match with other vitamins and nutrients to make a more robust wellness aid. CBDfx’s gummy collection gives a wide range of products, from the original mixed-berry CBD-only gummies to multivitamins for men and women to superfoods, like turmeric and spirulina, to an apple cider vinegar gummy, to a restful sleep formulation, and a biotin gummy for hair and nails. All of these gummies have great nutrient profiles and are a healthy way to add pure, natural CBD to your daily regimen. And as gummies, they taste great, too!! CBD Gummies: A Delicious Way to Enjoy CBDWhat Are CBD Gummies?CBD gummies are edible products that contain hemp-derived CBD. These small, round chewables look and taste much like the sweets that are so loved for their burst of flavour and chewability — only our gummies pack a CBD punch! Our CBD gummies not only contain organic broad spectrum CBD, but also other all-natural ingredients. These ingredients give you delicious flavour and delightful texture, plus additional benefits to help you maximise your CBD experience. Our CBD Sleep Gummies contain restful passion flower and chamomile. We have other CBD gummy formulations that make use of a variety of essential nutrients. Our Turmeric and Spirulina CBD Gummies harness the antioxidant and wellness benefits of two powerful superfoods. Our Apple Cider Vinegar CBD Gummies are great for dieting and gut health. And our Multivitamin CBD Gummies give you your daily dose of vitamins and minerals, plus the added wellness benefits of CBD. Whatever your wellness needs, we have a tasty, chewy CBD gummy for you!The Benefits of CBD GummiesWellness Benefits: CBD itself is one of the most popular wellness products on the market today. This is due, in large part, to the effect of CBD on the body’s endocannabinoid system. CBD and other cannabinoids mimic the body’s own endocannabinoids, which interact with receptors in a variety of organs and systems throughout the body, allowing them to maintain homeostasis (or balance). This helps the body to regulate such crucial functions as sleep, appetite, mood, motor control, memory, pain management, immune function, stress management, and much more. It’s these wellness benefits that make a CBD product like our gummies such a great health supplement to have around the house, whether it’s for a morning nutrition boost or a great night’s sleep.Convenience: CBD-infused gummies are a convenient (and tasty!) way to get a daily wellness blast of CBD. Gummies are also easy to use. There’s no measuring hemp oil or filling a CBD vapouriser. You simply eat them! Just remember that our gummies are not your traditional sweets, and you should adhere to our recommended dosage.Consistent Dosage: With consistent dosage in every chewable gummy, these popular products give you the peace of mind of knowing exactly how much CBD you’re taking with every one of our sweets.Delicious Flavour: Every gummy in our CBD Gummies collection has delicious natural fruit flavour, making them an absolute treat to eat — with no additives or preservatives!Non-Intoxicating: All of our gummies adhere to UK CBD legislation and are under the legal threshold of less than 0.01 THC.Nutritional Information: While our gummies come in a variety of formulations, they all have certain nutritional information in commonHow Many CBD Gummies Should I Eat?All of our vegan CBD gummies have a recommended serving size of two gummies (25 mg CBD each, 50 mg CBD per serving). That said, if this is your first time taking CBD, we recommend beginning with one gummy to see how you react to the CBD. If you seem to be getting all the CBD effects you desire, stop there. If you feel like you need more, then the next time you take CBD gummies, go ahead and try two.CBD Gummies for Pain, Sleep & StressIn addition to its many wellness benefits, CBD can also have a calming effect on the mind and body. In daily wellness products, such as CBD Multivitamin Gummies, the complementary ingredients make use of those calming properties to give mental focus without physical sluggishness. But with CBD Sleep Gummies, the additional ingredients intensify those calming effects and help the body prepare for sleep. As a result, CBD sleep products are quite effective in helping you not only fall asleep quickly, but also to sleep uninterrupted through the night.Many adults take CBD for minor pain, and it’s worth trying CBD if you’re experiencing minor muscle and joint pain. Likewise, CBD has many calming qualities that many find useful in combating stress. Many people find CBD Gummies particularly convenient for keeping in a handbag or backpack, just in case their nerves start kicking in. Gummies are a quick, convenient way to experience the calming effects of CBD.Why Buy CBDfx’s Gummies?All of our CBD gummies contain naturally grown CBD and all-natural ingredients (no GMOs or pesticides!). We also use safe extraction processes, so you never have to worry about solvent residues, as in cheaper CBD products. The result is a pure, safe, and potent CBD experience. This purity and potency can be verified by lab reports created by independent, third-party laboratories (called a Certificate of Analysis, or COA), which are available on our website. Your safety and satisfaction is our primary concern at CBDfx!Are CBDfx’s CBD Gummies Vegan?Yes! We only use natural vegetable-based ingredients in our CBD oil gummies, so you can rest assured that your gummy isn’t just organically grown — it’s also vegan!How Long Do CBD Gummies Last?CBD gummies are considered CBD edibles, which means the CBD is absorbed into the bloodstream through your digestive tract. While this takes the CBD a bit longer to kick in than, say, a sublingual CBD oil, the benefit is that the effects can last as long as six to eight hours. But be patient, CBD gummies, pills and other edibles can take 30 minutes to two hours to fully kick in, depending on bioavailability factors.CBD Gummies Vs CBD Oil Drops: What’s The Difference?As noted above, CBD gummies are considered edibles. That means the CBD is absorbed into your bloodstream through your digestive system, which can take between 30 minutes and two hours, depending on bioavailability factors (height, weight, body mass, and other variables). Once the CBD effects kick in, though, they can last as long as six to eight hours.CBD oil tinctures are absorbed through the capillaries under the tongue. This allows the CBD to enter your bloodstream much quicker (sometimes as quickly as 15 minutes). But the effects of a sublingual CBD oil typically last from two to six hours — less than the effects of CBD edibles.Can CBD Gummy Products Get You High?The oil we use in our CBD sweets is extracted from hemp, the low-THC form of cannabis. And CBD, itself, is non-intoxicating. So, our CBD gummies can’t get you high. All of our CBD products are formulated for wellness and fall within the UK legal threshold of less than 0.01 THC.Can You Take CBD Edibles For Sleep?In addition to its many wellness benefits, CBD can also have a calming effect on the mind and body. Blended with other effective ingredients, as in our CBD Sleep Gummies, CBD can be ncredibly beneficial as a sleep aid.Can You Take CBD Edibles For Pain?CBD can be taken for relief from minor pain.Can You Take CBD Edibles For Stress?CBD has calming properties that people find useful for easing stress.Can CBD Gummies Make You Fail A Drug Test In The UK?Our CBD gummies are all made with broad spectrum CBD, which has all detectable amounts of THC removed (THC being the cannabinoid most drug tests scan for). You should be okay using CBD gummies, however CBD can build up, over time, in your system. So, there is a small chance for a false positive result for people who regularly take CBD gummies. Here’s a handy guide to CBD and drug tests.I’ve Never Tried CBD Gummies. What Can I Expect?

Why Customers Choose CBD Gummies from CBD Guru Amazingly Mouthwateringly Tasty Flavours Our teams of experts have worked hard to create some of the best flavouring edibles you’ll find online. Each CBD gummy is packed full of the most delicious flavour in every bite. Whether you’re craving the tangy sweetness of peach rings or the refreshing taste of watermelon slices, our amazing range of gummy shapes and flavours means there’s something for everyone to enjoy.We Use Only The Best Quality CBD Each gummy is infused with premium CBD, carefully measured at 20mg per serving, to provide you with a consistent and reliable dose of CBD. Made with THC-free broad-spectrum distillate, our CBD gummies offer all the benefits of CBD without any psychoactive effects, allowing you to enjoy them with confidence and peace of mind.They’re Convenient and Enjoyable nNot only are our CBD gummies delicious, they’re also one of the easiest ways of taking CBD every day. Whether you’re at home, at work, in the gym or on the go, our gummies are the perfect choice for all your favourite activities. All you have to do is simply pop one in your mouth, chew, and savour the flavour as your give yourself a natural boost of wellness.

These reputable brands are recognised for their dedication to quality, transparent sourcing and manufacturing practices, as well as positive feedback from customers. However, it is vital to consider that the optimal selection for you may be influenced by your personal preferences and specific necessities.It’s advisable to explore different brands and read reviews to find the best CBD Gummies that align with your needs and taste preferences.

Are CBD Gummies worth buying?CBD Gummies offer an appealing choice for those looking to add CBD to their daily regimen in a delightful and hassle-free manner. Their popularity is due to several advantages.First, they provide a simple way to enjoy CBD’s potential benefits discreetly. Second, the pre-measured dosage of CBD in each gummy simplifies managing your intake and allows for easy experimentation with different amounts.Moreover, these gummies are available in a broad range of flavours, bringing an enjoyable and tasty element to your CBD usage.It’s important to remember, however, that the effectiveness of CBD Gummies can differ based on various factors, including the quality of the product, individual metabolic responses, and the specific outcomes you’re seeking.What is Considered a Strong CBD Gummy?

Thanks for sharing, this is a fantastic post.Much thanks again. Great.

Really enjoyed this article post.Really looking forward to read more. Much obliged.

Really enjoyed this blog article.Thanks Again. Fantastic.

Im thankful for the blog article. Really Cool.

Major thanks for the article post.Much thanks again. Awesome.

I really enjoy the article post.Really looking forward to read more. Really Cool.

I am so grateful for your article.Really thank you! Fantastic.

Im grateful for the article.Really looking forward to read more. Really Cool.

This is one awesome post.Really looking forward to read more. Much obliged.

I loved your blog article.Thanks Again. Really Great.

Major thankies for the article.Really thank you! Really Cool.

Major thankies for the post.Much thanks again. Really Great.

This is one awesome blog.Really looking forward to read more. Want more.

Really enjoyed this blog post. Will read on…

Very good blog post.Thanks Again. Fantastic.

I think this is a real great article.Thanks Again. Really Cool.

Thank you for your blog post.Really looking forward to read more. Want more.

Im grateful for the article.Really thank you! Really Great.

I really like and appreciate your blog article.Much thanks again.

I really liked your article. Much obliged.

Really appreciate you sharing this article post.Much thanks again.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Enjoyed every bit of your article.Thanks Again. Want more.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Im grateful for the article post.Much thanks again. Want more.

Thanks for the blog.Much thanks again. Great.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

A big thank you for your blog.Really looking forward to read more.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Thanks so much for the article.Really looking forward to read more. Really Great.

Im thankful for the blog post. Really Great.

I really like and appreciate your post.Much thanks again. Cool.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Thanks again for the article post.Really thank you! Keep writing.

Im thankful for the article.Thanks Again. Awesome.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

This is one awesome post.Really looking forward to read more. Really Great.

I appreciate you sharing this article. Really Cool.

Major thanks for the post. Much obliged.

A round of applause for your article.Thanks Again. Awesome.

Fantastic blog. Fantastic.

Wow, great article post.Much thanks again. Want more.

I really enjoy the blog.Really looking forward to read more. Want more.

I think this is a real great article post.Much thanks again. Keep writing.

Really appreciate you sharing this blog article.Thanks Again. Will read on…

Thank you ever so for you article.Thanks Again. Really Cool.

Fantastic post. Really Great.

wow, awesome article. Fantastic.

Thank you ever so for you article post.Much thanks again. Great.

I really like and appreciate your article post.Thanks Again. Awesome.

I think this is a real great article post.Thanks Again.

Great, thanks for sharing this blog post. Cool.

Very informative blog post.Much thanks again. Great.

Really appreciate you sharing this blog post. Much obliged.

I value the blog article.Much thanks again. Awesome.

Thanks for sharing, this is a fantastic post. Much obliged.

Thanks a lot for the article.Much thanks again. Fantastic.

Im thankful for the blog.Much thanks again.

I truly appreciate this blog article.Thanks Again. Keep writing.

I am so grateful for your post.Really looking forward to read more.

Really informative article.Really thank you! Cool.

Muchos Gracias for your blog.Thanks Again. Great.

Thanks for the blog article.Thanks Again. Cool.

Fantastic article.Really thank you! Fantastic.

Im thankful for the blog.Much thanks again. Cool.

Im obliged for the blog article.Thanks Again. Want more.

Hey, thanks for the article.Really thank you! Fantastic.

Im obliged for the post.Really looking forward to read more. Awesome.

Say, you got a nice article. Really Cool.

Great, thanks for sharing this article.Really thank you! Much obliged.

Great blog article.Much thanks again. Awesome.

Thanks for the blog article.Thanks Again. Much obliged.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

A big thank you for your blog post.Thanks Again. Keep writing.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Major thankies for the blog post.Thanks Again. Want more.

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Hi, It has come to our attention that you are using our client’s photographs on your site without a valid licence. We have already posted out all supporting documents to the address of your office. Please confirm once you have received them. In the meantime, we would like to invite you to settle this dispute by making the below payment of £500. Visual Rights Group Ltd, KBC Bank London, IBAN: GB39 KRED 1654 8703, 1135 11, Account Number: 03113511, Sort Code: 16-54-87 Once you have made the payment, please email us with your payment reference number. Please note that a failure to settle at this stage will only accrue greater costs once the matter is referred to court. I thank you for your cooperation and look forward to your reply. Yours sincerely, Visual Rights Group Ltd, Company No. 11747843, Polhill Business Centre, London Road, Polhill, TN14 7AA, Registered Address: 42-44 Clarendon Road, Watford WD17 1JJ

Thanks again for the article post.Much thanks again. Keep writing.

Thanks so much for the blog. Cool.

I appreciate you sharing this article.Really thank you! Great.

I appreciate you sharing this article post.Really thank you! Awesome.

I cannot thank you enough for the article. Fantastic.

I appreciate you sharing this blog.Really thank you! Will read on…

Great, thanks for sharing this blog. Keep writing.

Thanks so much for the post.Thanks Again.

Really enjoyed this article. Cool.

I appreciate you sharing this post.Much thanks again. Cool.

Really enjoyed this article.Thanks Again. Keep writing.

I really enjoy the article. Want more.

I really like and appreciate your post.Much thanks again. Want more.