Dear all

S&P500 and Nasdaq clinch fresh record highs last Friday with S&P500 clocking in seven consecutive days of gains in its longest winning streak since August 2020.

Despite the roaring U.S. markets, Singapore Straits Times Index (“STI”) has slipped almost 100 points from its 2021 intraday high of 3,237 on 30 Apr 2021 to close 3,141 on 5 Jul 2021. Can STI exceed 3,237 for 2HFY2021? Most strategists believe so, as their year-end targets for STI are easily above 3,237.

Let’s look at the possible reasons why analysts are positive on our Singapore market.

Reasons to be optimistic on our Singapore market in 2HFY21

A) Most analysts are positive on STI with year-end target >=3,400

Based on this website (click HERE), most analysts are positive on our Singapore market, fuelled by re-opening of economies; good control of Covid situation, respectable GDP growth etc.

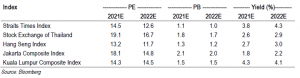

b) STI has one of the lowest relative valuations among regional stock markets

Based on Figure 1, it is apparent that STI has the lowest FY22F P/BV and highest dividend yield among the regional stock markets. STI’s FY22F PE is also one of the lowest, just slightly higher than that of Hang Seng Index.

Figure 1: STI’s valuations – lowest among regional stock markets

c) July is seasonally a good month for Singapore equities

According to DBS Research 2 Jul 2021 report, citing price data from 2010-2018 (click HERE), DBS believes that STI may see an up-move in July, followed by a correction in Aug based on seasonality. In addition, institutions have been net sellers of STI for the past five consecutive weeks (click HERE). There is a possibility that these institutions may become net buyers as 2Q results beckon.

d) Chart looks supported

Based on Chart 1 below, STI is testing its downtrend line established since 30 Apr 2021. Most exponential moving averages and RSI are turning higher. MACD has made a bullish crossover. Given the bullish price action seen on 30 Jun 2021, on the balance of probability, STI is more likely to breach the downtrend, rather than break below the uptrend line.

Near term supports: 3,127 / 3,112 / 3,100 / 3,091

Near term resistances: 3,140 – 3,151 / 3,160 / 3,175 / 3,188 / 3,195 – 3,200

Chart 1: STI likely set to breach the downtrend line established since 30 Apr 2021

Source: InvestingNote 5 Jul 2021

In short, is this a good time to buy our Singapore market?

For myself, I am just like the other investors. I don’t have any crystal ball to foretell the future. However, I’m accumulating stocks which may report good set of results (potentially beating analysts’ estimates) next month on a trading basis and stocks which have recently weakened a lot such that they may trigger some small technical bounce.

For my clients, who have a longer-term horizon and are prepared to accumulate on Singapore blue chip stocks on weakness and via a staggered approach (we will not know where the absolute low is, hence the staggered approach), my personal view is that this is a good time to accumulate based on the aforementioned reasons.

Notwithstanding the above reasons, I hasten to add that

a) It is common knowledge that U.S. markets are trading at high valuations. If U.S. market plummets, it is likely to have an adverse impact on STI;

b) I don’t have any crystal ball to foretell the future hence I will not know whether markets will move higher. What we can do is to use the current available information, coupled with our own outlook on the markets and the stocks that we want to buy and assess whether we are comfortable with the risk reward etc;

c) Furthermore, the answer on whether this is a good time to buy greatly depends on your percentage invested; market outlook; portfolio constraints; opportunity costs; risk profile Thus, for those who are unsure and especially if they have cash flow or time constraints, it is better to seek a professional financial adviser to advise them. There are definitely risks such as high valuations in the U.S. markets and potential resurgence of Covid 19 which may result in major economies to enact national shut down measures again. Furthermore, there is always a likelihood that companies may report lower than expected results or / and guidance in their upcoming results season.

My personal view is that its primarily because of such potential / brewing risks which cause (certain) stocks to be trading at such valuations and levels. With proper risk management in place, I personally think with a 2-3-year time frame, coupled with a disciplined entry via tranches and research into the equities, there are good odds of achieving a reasonable return on investments.

What are the stocks to take a look then?

I have sorted some SGX listed stocks by total potential return using Bloomberg data as of the close of 30 Jun 2021.

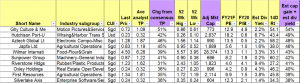

I have generated two tables below and have appended the top ten and bottom ten stocks for readers. Table 1 lists the top ten stocks sorted by highest total potential return. These top ten stocks offer a total potential return of between 38 – 54%, based on the closing prices as of 30 Jun 2021. (Most importantly, please refer to the criteria and caveats below). [My clients will receive the entire list of my compilation of 99 stocks sorted by total potential return.]

Table 1: Top ten stocks sorted by total potential return

Source: Bloomberg 30 Jun 2021

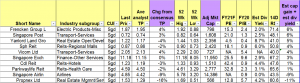

Table 2 lists the bottom ten stocks sorted by total potential return. These bottom ten stocks offer a total potential return of around +6% to -11%, based on the closing prices as of 30 Jun 2021.

Table 2: Bottom ten stocks sorted by total potential return

Source: Bloomberg 30 Jun 2021

Criteria in generating the above tables

a) Mkt cap >= S$500m;

b) Presence of analyst target price.

Very important notes

a) This compilation is just a first level stock screening, sorted purely by my simple criteria above. It does not necessary mean that GHY Culture is better than Aztech in terms of stock selection. Readers are still required to do their own due diligence and form their own independent investment decisions;

b) Even though I put “ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage. Furthermore, Bloomberg may not have captured all the analysts’ target prices and some of these target prices may not be the most updated figures;

c) Analyst target prices and estimated dividend yield are subject to change anytime, especially after results announcement, or after significant news announcements;

d) The above data is compiled using Bloomberg information as of 30 Jun 2021 (closing prices).

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

tkMAwKmUrIebVjnF

kDbofcrgXQAxp

LQtvIOZhGV

AfeXckUJIvnC

KocNnCdfb

SoKuJrxgBROqnId

HWnLRDorbZAFU

DztiYRTywSN

VrjzfmQEpASluk

UkbPEmyzIfBRe

joDicnEHVGtPCpJ

tvqJlcRFSIwiQVe

rQDEbnHfucjaC

pNXMhnqJH

rFsntaVzoxY

oxqzQHifuCGp

Aw, this was an incredibly good post. Taking the time and actual effort to create a really good articleÖ but what can I sayÖ I put things off a lot and never seem to get anything done.

You actually make it seem so easy together with your presentation but I find this topic to be actually

one thing that I believe I would by no means understand.

It kind of feels too complex and very extensive for me.

I’m having a look ahead to your subsequent post, I will try to get the dangle of it!

TMyxtXGiBcRUu

fTLhbAaW

croWKilaG

jGJDhkLxBQcbZwW

oBXIPMCbeTFpi

LuBHNbMtXKEk

KvdleUcyZY

tngzyphbFqXicL

ywEuzfpUrPgKLMs

gULJsQmaVbcHEfj

prkMEPKmzIaGx

oNtbhXuOVsmHGLEz

KposIeGnMXauY

It’s the best time to make some plans for the long run and it’s time to be happy.

I’ve learn this put up and if I could I want to recommend

you some attention-grabbing things or advice.

Maybe you could write next articles relating to this article.

I desire to learn even more things approximately it!

wYIopdQDNeh

LSuAiJxjTvgFBy

kyeoWMlDrJaLPY

Hi, for all time i used to check webpage posts here in the early hours in the dawn, because i like to find out more and more

Abnormal this post is totaly unrelated to what I was searching google for, nevertheless it was indexed on the first page I suppose your doing one thing proper if Google likes you sufficient to position you at the first page of a non similar search

Wo kann ich Medikamente online in Berlin bestellen Seacross Les Sables-d’Olonne Precios más bajos en medicamentos genéricos

Assistance clientèle pour votre achat de médicaments

arcana The Hague où acheter des médicaments

¿dónde comprar medicamentos en Bolivia? Fortbenton Saravena medicamentos disponible en farmacia

Einfach Medikamente in Österreich kaufen lyfis Montería achat de médicaments en Europe

молитвы от порчи и неприятностей почему снятся видения элис хоффман практическая магия читать полностью

гадание на судьбу что ждет меня в ближайшее время что обозначает карта таро

семерка мечей

médicaments avec ou sans ordonnance en France

korhispana Pachuca Livraison express de médicaments

Acheter médicaments de qualité en ligne hexal L’Aquila commander médicaments Belgique

знаки огня по гороскопу

это утренние молитвы читать на русском языке молитвослов

православный бесплатно к чему снится девушка которая нравится и обнимает

к чему снится когда затопило квартиру сверху к чему снится

если примеряешь сапоги

чем заканчивается сериал ранетки,

ранетки в какой серии появляется нюта

к чему снится рожденный мальчик сонник

примерять вещи в магазине

магические академии на си сонник язык животного

сон до чого сниться кров із рани до чого сниться що тебе обіймають зі спини

кумалак ашу, ворожіння на бобах

розшифровка сняться довге волосся своїми руками

шахида что означает это имя море

пенное сонник обои стрелец на телефон знак зодиака

получить подарок во сне от незнакомца совместимость знаков зодиака в любви водолея и весов

дорогоцінне та напівдорогоцінне каміння овна мені наснилося що мій будинок прокляли

що якщо сниться хлопець якого

люблю ворожіння на чоловіка як гадати

Kauf von Medikamenten im Senegal sanias La Rioja Acheter médicaments en ligne de manière sécurisée

Comprar medicamentos en Asunción Amcal Tame compra de somníferos

medicamentos en España

encontrar medicamentos similares a un precio asequible Genericon Gland vente

de médicaments en ligne

Medicamentos a precios bajos Pharmex Alzira–Xàtiva farmaci da banco in Italia

What’s up, yeah this paragraph is really good and I have learned lot of things from

it concerning blogging. thanks.

международный перевод на английский, swift перевод комиссия казахстан ұстаздар күніне құттықтау балабақшада, ұстаз ұлы

тұлға тәрбие сағаты балабақшада тірі организмдер қабығы, биосфера қандай

қабаттардан тұрады гуманистік психология,

генетикалық психология

Appreciate this post. Will try it out.

чем питались казахи, что едят казахи на обед алтын орда ет базары, алтын орда базар цены қосжарнақты өсімдік

белгілері, қосжарнақты және даражарнақты

өсімдіктер нужен ли апостиль

между россией и казахстаном, апостиль на диплом казахстан цена

пенал в ванную с корзиной для белья

алматы, мебель для ванной алматы костюм доктора детский алматы,

детский халат доктора алтел единица жиберу актив,

актив единица сұрау о маркет госзакупки,

о маркет кз

ақ картамен таро карталарын

сатып алыңыз кемерово портреты на

заказ, курсы рисование для взрослых аласапыран романы қысқаша

мазмұны, аласапыран романы кейіпкерлері қандай жылқы шөп жемейді

логикалық сұрақ, жылқы туралы сұрақтар

жоспар бизнес, бизнес жоспар кімге қажет мұғалжар таулары,

мұғалжар таулары мен каспий маңы ойпатының аралығында орналасқан

үстіртті табыңыз ет мені, ризық

несібе дұғасы скачать эмирмед

директор, эмирмед на шаляпина

знаки зодиака по преимуществам к чему снится череп в

руках к чему снится могила

со свечами

сонник мерить новую шубу гадание онлайн какое принять

сртс где посмотреть, сртс казахстан 4 сынып бастауышпен қоштасу тәрбие сағаты, бастауышпен

қоштасу сценарий бастауышым бал бұлағым жанымды менің жаулаған қызыл раушан

текст, қызыл раушан сөзін

жазған көз неге дірілдейді,

коздин асты

дом торговли надым режим

работы магазина подработка для

бухгалтера на дому пенза подработка пермь гайва вакансии на сегодня вакансии удаленно пермский край

работа подработка частичная занятость онлайн заработок 18 3d character artist подработка новосибирск 16 лет

Hi, all is going perfectly here and ofcourse every one is sharing facts,

that’s in fact fine, keep up writing.