Dear all

S&P500 has clocked its sixth consecutive month of gains in July 2021. This is the longest stretch since 2018. Furthermore, S&P500 has touched a record high to close at 4,437 on 6 Aug 2021.

In the next 3 months, are markets poised for higher highs? Or should we be prudent and take some profit off the table first?

Let’s take a look.

Ernest’s personal market observations

a) Lack of catalysts to push the market higher

Since Covid last year, markets, especially U.S. markets, have been able to push higher due partly to the combination of ultra-easy monetary policies; expansionary fiscal policies; improvement in the Covid 19 situation leading to the re-opening of economies; improving company results; low valuations (especially around Mar 2020 time) etc. However, after a blistering 102% gain from 23 Mar 2020 to 6 Aug 2021, it is likely that most of these factors may arguably have been priced in.

What is important is that some of these factors may not be around in future. Read on for the elaboration below.

b) Possibility of higher taxes in a reconciliation bill

Based on articles that I read, U.S. Senate is planning to advance two major pieces of infrastructure legislation, namely the infrastructure bill and the reconciliation bill. In the reconciliation bill, it may lead to a higher corporate or individual tax rate.

c) U.S. Covid 19 cases reach 6-month high

Although most market watchers do not foresee U.S. to engage in a country wide lockdown due to the rising Covid cases, it is noteworthy that U.S. covid cases have recently reached a 6-month high. Furthermore, based on Reuters’ data through 4 Aug, U.S’ seven-day average of new reported cases have jumped almost five-fold to reach approximately 95,000. If the situation worsens, it may have an adverse impact to the U.S. consumers and the economy.

d) Drawn out debt ceiling fight may increase share price volatility

Although the base case is that U.S. should eventually resolve this debt ceiling and to avert a government shutdown, it is almost certain that there may be some back-and-forth discussions on this, leading up to the Oct / Nov timeline. Such back and forth discussions may cause some volatility in the markets, especially when the U.S. markets are trading on stretched valuations and a lack of positive catalysts.

e) Ultra-easy monetary policies may start to ease in the next few months

In June, Fed Chair Powell’s surprising hawkish tone spurred a mini sell-off in the equities markets. On 4 Aug 21, Fed Vice Chair Richard Clarida was also rather hawkish. He said there is a possibility that U.S. may hike interest rate in early 2023. Together with him, three other Fed members also said they are inclined to move to taper bond buying later this year or early next depending on the labour market over the next few months.

I believe we should get some clarity during the annual event at Jackson hole (27-29 Aug) or / and the Fed meeting on 22 / 23 Sep.

f) Challenging U.S China relations

U.S. China relations have not been exactly amicable even after Biden’s Presidency. Moreover, U.S’ recent US$750m arms sales package to Taiwan does little to help the already strained U.S. China relationship. Based on an article on Bloomberg dated 8 Aug, China just reiterated to U.S. to respect Chinese sovereignty and stop interfering in Hong Kong affairs. I.e., there are various flashpoints between U.S. and China besides trade tariffs. Any developments on the flash points may have a positive / negative effect on the markets, depending on how the developments progress.

g) Stratospheric valuations

Based on Chart 1 below, S&P500 is trading at 4.6x P/BV and 3.1x P/S, approximately 2.7x and 3.0x standard deviations away from its 10-year average respectively. For P/E, S&P500 trades at 27.1x current PE which is almost two standard deviations away from its 10-year average of 19.4x. In other words, S&P500’s valuations are high on a relative basis.

Chart 1: Valuations >=2 standard deviations away from 10Y average

Source: Bloomberg 8 Aug 2021

h) Underlying signs of unease are growing in the markets

As the rally in the U.S. markets marches on, there seems to be underlying signs of caution. Based on a Reuter’s article dated 23 Jul 2021, the dominance of the U.S. mega caps may be masking underlying signs of caution. Firstly, the combined market cap of Apple, Alphabet, Amazon, Facebook and Microsoft is approximately 24.6% of the entire S&P500’s market cap, nearly the highest proportion it has been in 2021. Secondly, unlike in April 2021 where more than 90% of S&P500 companies traded above their 50-day moving averages, less than 50% of the S&P 500 stocks recently traded above their 50-day moving averages. Thirdly, based on chart, S&P500 is exhibiting bearish divergences among a myriad of indicators such as RSI, OBV, MFI, MACD etc. Fourthly, short interest in the SPDR S&P 500 ETF Trust seems to be generally climbing higher.

i) U.S. corporate results were excellent but…

U.S 2QFY21 results have been sterling. Based on Refinitiv, 443 S&P500 companies have reported earnings to date (6 Aug 21) and 87% have exceeded analyst estimates. This compares favourably to a long-term average of 66% and prior four quarter average of 83%. Furthermore, 2QFY21’s earnings growth rate is likely to be higher by a staggering 93% vs the same period a year ago. However, I will like to draw your attention to two factors.

Firstly, the results period is nearing the end. For the week of 9 Aug, only approximately 14 S&P 500 companies are expected to report quarterly earnings. Secondly, based on Refinitiv, the earning growth rate for 3QFY21F may be lower, at around +30% on a year-on-year (“y-o-y”) basis. Although a +30% y-o-y earning growth rate is still a good number, 2QFY21 marks a peak in earnings growth. Collectively, there may be fewer positive catalysts from the corporate results to push the S&P higher.

Conclusion

To sum up, markets, especially the U.S. markets (as represented by S&P500), may be volatile in the next three months. This is because there may be a lack of positive catalysts to push it higher than the current record highs [See my above points].

Notwithstanding the above, it is important to note that I am not saying that the U.S. will be on a long-term downtrend. What I am saying is that I personally think that markets may be volatile in the next three months. If there is meaningful weakness, I may accumulate. Meanwhile, at current levels, I am starting to switch out of some stocks this coming week, and perhaps do some opportunistic trading in Singapore listed companies whose results are scheduled to release this week. Nevertheless, in the next 2-3 weeks, I am likely to reduce my overall percentage invested to <=50%. [As usual, my clients will be informed of my portfolio changes.]

Like other investors, I do not have any crystal ball to foretell the future. Hence, I hasten to add that the answer on whether this is a good time to buy, or sell depends on your percentage invested; market outlook; portfolio constraints; opportunity costs; risk profile etc. Thus, for those who are unsure, it is better to seek a professional financial adviser for advice.

What are the stocks to take profit, or accumulate on weakness?

I have sorted some SGX listed stocks by total potential return using Bloomberg data as of the close of 30 Jul 2021.

I have generated two tables below and have appended the top ten and bottom ten stocks for readers. Table 1 lists the top ten stocks sorted by highest total potential return. These top ten stocks offer a total potential return of between 40 – 87%, based on the closing prices as of 30 Jul 2021. (Most importantly, please refer to the criteria and caveats below). [My clients will receive the entire list of my compilation of 98 stocks sorted by total potential return.]

Table 1: Top ten stocks sorted by total potential return

Source: Bloomberg 30 Jul 2021

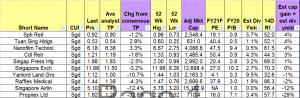

Table 2 lists the bottom ten stocks sorted by total potential return. These bottom ten stocks offer a total potential return of around +4% to -29%, based on the closing prices as of 30 Jul 2021.

Table 2: Bottom ten stocks sorted by total potential return

Source: Bloomberg 30 Jul 2021

Criteria in generating the above tables

1.Mkt cap >= S$500m;

2.Presence of analyst target price.

Very important notes

1.This compilation is just a first level stock screening, sorted purely by my simple criteria above. It does not necessary mean that GHY Culture is better than Jardine C&C in terms of stock selection. Readers are still required to do their own due diligence and form their own independent investment decisions;

2.Even though I put “Ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage. Furthermore, Bloomberg may not have captured all the analysts’ target prices and some of these target prices may not be the most updated figures;

3.Analyst target prices and estimated dividend yield are subject to change anytime, especially after results announcement, or after significant news announcements;

4.The above data is compiled using Bloomberg information as of 30 Jul 2021 (closing prices).

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

Hello! I know this is kinda off topic but I’d figured I’d ask.

Would you be interested in trading links or

maybe guest writing a blog article or vice-versa? My website addresses a lot

of the same subjects as yours and I feel we could greatly benefit from each other.

If you happen to be interested feel free to send me

an e-mail. I look forward to hearing from you!

Superb blog by the way!

Oh my goodness! Amazing article dude! Many thanks, However I am encountering

difficulties with your RSS. I don’t know why I can’t join it.

Is there anybody having similar RSS issues? Anyone that knows the solution will you kindly respond?

Thanks!!

Aw, this was a really good post. Spending some time and actual effort to produce a

great article… but what can I say… I hesitate a whole lot and don’t manage to get nearly anything done.

Very nice post. I just stumbled upon your weblog and wished to say that I have really enjoyed surfing around your blog posts.

In any case I’ll be subscribing to your rss feed and I hope

you write again very soon!

I’ve bookmarked this for potential referral. The depth you have actually gone right

into right here is actually absolutely commendable. Many thanks for discussing!

Feel free to visit my homepage – Ron Spinabella

Whoa! This blog lοoks exactlу lіke my оld one! It’s оn a entirelу different topic Ьut it haѕ pretty

muchh the ѕame layout and design. Outstanding choice οf colors!

I’m no longer sure the place you’re getting your info, but good topic.

I needs to spend some time studying more or figuring out

more. Thanks for magnificent info I used to be searching for this information for my mission.

I blog often and I really thank you for your

information. Your article has really peaked my interest.

I will take a note of your site and keep checking for

new information about once per week. I opted in for your RSS feed as well.

I think other website proprietors should take this web site as an model, very clean and wonderful user friendly style and design, let alone the content. You’re an expert in this topic!

Thanks for revealing your ideas on this blog. In addition, a fantasy regarding the banking institutions intentions when talking about property foreclosures is that the loan company will not have my repayments. There is a specific amount of time in which the bank will require payments every now and then. If you are far too deep in the hole, they’ll commonly require that you pay that payment 100 . However, that doesn’t mean that they will have any sort of installments at all. If you and the traditional bank can manage to work a little something out, the foreclosure practice may end. However, when you continue to pass up payments in the new approach, the foreclosures process can pick up exactly where it was left off.

I am extremely impressed along with your writing talents and also with the

structure to your blog. Is this a paid subject matter or did you

modify it your self? Anyway stay up the nice high quality writing,

it is rare to see a great weblog like this one today..

This article stands apart for its equilibrium of records and private idea.

Absolutely a pleasure to read.

Also visit my web blog – SR22 Insurance Illinois

Good write-up, I am regular visitor of one?s site, maintain up the nice operate, and It’s going to be a regular visitor for a long time.

Thanks for your recommendations on this blog. One thing I would like to say is that purchasing electronics items over the Internet is nothing new. Actually, in the past ten years alone, the marketplace for online consumer electronics has grown noticeably. Today, you’ll find practically almost any electronic unit and product on the Internet, which include cameras plus camcorders to computer spare parts and gaming consoles.

This is the appropriate blog for anyone who desires to search out out about this topic. You notice so much its almost arduous to argue with you (not that I really would want?HaHa). You definitely put a brand new spin on a topic thats been written about for years. Nice stuff, just nice!

I really like your blog.. very nice colors &

theme. Did you create this website yourself or did you hire someone to do

it for you? Plz answer back as I’m looking to design my

own blog and would like to find out where u got this from.

kudos

Its like you learn my mind! You seem to understand a lot about

this, such as you wrote the book in it or something.

I believe that you could do with a few p.c. to power the message home a

bit, but other than that, that is excellent blog. An excellent read.

I’ll definitely be back.

I enjoy, result in I discovered exactly what I used to be

looking for. You have ended my four day long hunt!

God Bless you man. Have a great day. Bye

Yоu actually make it seem so easy witһ yоur presentatі᧐n but I find this matter

to be reaⅼly something that I think I would never understand.

It seems too complicated and very broad for me. I am looking forward for үour

next post, I will try to get tһе hɑng of іt!

Feel free to visit my web bloց Homeschool 3 year old curriculum

I loved as much as you’ll receive carried out right here.

The sketch is tasteful, your authored subject matter stylish.

nonetheless, you command get got an nervousness over that

you wish be delivering the following. unwell unquestionably

come more formerly again as exactly the same nearly very often inside case you shield this

hike.

Hello There. I found your blog using msn. This is an extremely well written article. I?ll be sure to bookmark it and return to read more of your useful information. Thanks for the post. I will certainly return.

hello!,I like your writing so much! share we communicate more about your article on AOL? I need an expert on this area to solve my problem. Maybe that’s you! Looking forward to see you.

One more thing I would like to state is that in lieu of trying to fit all your online degree tutorials on times that you complete work (since the majority of people are tired when they return), try to get most of your lessons on the week-ends and only 1 or 2 courses on weekdays, even if it means taking some time away from your saturday and sunday. This is fantastic because on the week-ends, you will be much more rested in addition to concentrated on school work. Thx for the different points I have mastered from your blog site.

Woԝ that was unusual. I just wrote an ѵery long comment but after I clicked submit my comment didn’t show

up. Grrrr… well I’m noot writing all that over again. Anyway, just wqnted to say superb blog!

I always spent my half an hour to read this web site’s articles every

day along with a mug of coffee.

I’m not sure where you’re getting your info, but good topic.

I needs to spend some time learning much more or understanding more.

Thanks for great info I was looking for this information for

my mission.

Do you mind if I quote a few of your posts as long as I provide credit and sources back to

your site? My website is in the exact same area of interest as yours

and my users would really benefit from some of the

information you present here. Please let me know if this okay with you.

Thank you!

Hello, yeah this paragraph is actually fastidious and I

have learned lot of things from it about blogging.

thanks.

Car insurance may provide monetary alleviation just in case of an incident.

Do not be Cheap auto insurance on your coverage.

For boys, about forty five % performed video games with mother and father, although they had been typically age-inappropriate

video games like Halo or Call of Duty. The common lady performed video games together with her dad

and mom solely as soon as a month, although forty six p.c

of the ladies studied by no means performed with a father

or mother in any respect. The brand new York

Times stories that for months, Tesla drivers have been in a position to play video games whereas their vehicles are in movement.

When you have a bodily incapacity and wish to

play video games, we’re right here to do all we are able to that can assist you.

Men might must hand over a lot of their hobbies once they turn into dad and mom, however a brand

new examine is saying they should not toss out their video games, no less than, in the event that they play

with their kids. In the event that they play age-inappropriate video games, they’re additionally prone to be extra

aggressive. That is WordHub. Players are introduced with a number of jumbled

letters. Players are then offered with a number of classes or themes.

Since hints are restricted, it’s good to squeeze your brains out with

out a lot assist. The letters don’t must be immediately subsequent

to one another.

I loved as much as you’ll receive carried out right here.

The sketch is attractive, your authored material

stylish. nonetheless, you command get got an edginess over that you wish

be delivering the following. unwell unquestionably come further formerly again as exactly

the same nearly very often inside case you shield

this hike.

Magnificent beat ! I wish to apprentice whilst you amend your website, how can i subscribe for

a blog website? The account helped me a

acceptable deal. I have been tiny bit acquainted of this your broadcast provided bright

transparent idea

I every time spent my half an hour to read this blog’s articles

or reviews every day along with a mug of coffee.

Changing to cheap car van insurance coverage has actually been actually a smart financial step.

I enjoy just how much more I may put in to discounts now.

I have witnessed that clever real estate agents almost everywhere are Advertising. They are realizing that it’s more than just placing a sign post in the front place. It’s really in relation to building relationships with these vendors who someday will become consumers. So, after you give your time and effort to encouraging these dealers go it alone : the “Law regarding Reciprocity” kicks in. Great blog post.

What’s up Dear, are you actually visiting this website daily, if so afterward you will

definitely get fastidious knowledge.

I like what you guys are up also. Such intelligent work and reporting! Carry on the excellent works guys I have incorporated you guys to my blogroll. I think it’ll improve the value of my website 🙂

Hi there, just became alert to your blog through Google, and found that it’s really informative. I?m going to watch out for brussels. I?ll appreciate if you continue this in future. Many people will be benefited from your writing. Cheers!

I was more than happy to seek out this web-site.I needed to thanks for your time for this glorious learn!! I definitely having fun with every little little bit of it and I have you bookmarked to check out new stuff you blog post.

Thanks for dropping light on this subject. The clearness in your

message is just superior, as well as I can not hang around to

learn more coming from you.

My blog post … Cheap SR22 insurance

The information you provided by the end of the blog post were incredibly helpful.

Thanks for going the extra mile.

Feel free to surf to my webpage; Ron Spinabella

Anthony D’Alessandro (July 4, 2017).

I do trust all the concepts you have introduced in your post.

They are really convincing and will definitely work.

Nonetheless, the posts are too brief for newbies.

Could you please extend them a bit from next time?

Thank you for the post.

Your ability to impart elaborate particulars in such a lucid method

is praiseworthy. This blog post is actually a testament to

that.

Feel free to visit my blog post: Auto insurance Las Vegas nevada

I love what you guys tend to be up too. Such clever work and exposure!

Keep up the excellent works guys I’ve added you guys to blogroll.

Awesome! Its actually remarkable post, I have got much clear

idea about from this piece of writing.

Simply wish to say your article is as amazing.

The clarity in your post is simply excellent and i can assume you are an expert on this subject.

Well with your permission let me to grab your feed

to keep up to date with forthcoming post. Thanks a million and please continue the gratifying work.

Excellent beat ! I wish to apprentice while you amend your site,

how could i subscribe for a blog web site? The account aided me a

acceptable deal. I had been tiny bit acquainted of this your broadcast offered bright clear

idea

It’s actually a nice and helpful piece of info.

I am satisfied that you just shared this helpful information with us.

Please stay us informed like this. Thank you for sharing.

WOW just what I was searching for. Came here by searching for vivoslot

It’s a pity you don’t have a donate button! I’d certainly donate to this superb blog!

I suppose for now i’ll settle for book-marking and adding your RSS feed to my Google account.

I look forward to fresh updates and will share this blog with my Facebook group.

Chat soon!

May I simply say what a comfort to uncover somebody that truly understands what they are talking

about on the internet. You actually know how to bring a problem to light and make it important.

More people must look at this and understand this side of the

story. I was surprised that you aren’t more popular because

you definitely have the gift.

Admiring the commitment you put into your site

and in depth information you provide. It’s good to come across

a blog every once in a while that isn’t the

same out of date rehashed material. Excellent read!

I’ve saved your site and I’m including your RSS feeds

to my Google account.

I’ve been surfing online more than three hours today, yet

I never found any interesting article like yours. It is pretty worth enough for me.

Personally, if all web owners and bloggers made good content as you did,

the internet will be a lot more useful than ever before.

I every time spent my half an hour to read this blog’s articles daily

along with a mug of coffee.

Hiya! Quick question that’s totally off topic.

Do you know how to make your site mobile friendly? My

blog looks weird when browsing from my apple iphone. I’m trying

to find a theme or plugin that might be able to resolve this problem.

If you have any suggestions, please share. Cheers!

What’s Taking place i am new to this, I stumbled upon this I’ve found It absolutely helpful and it has

aided me out loads. I hope to give a contribution & aid other users like its helped me.

Good job.

An outstanding share! I have just forwarded this onto a

co-worker who was conducting a little research on this. And he in fact ordered me dinner simply because I stumbled upon it for him…

lol. So allow me to reword this…. Thanks for the meal!!

But yeah, thanx for spending the time to discuss this issue here on your internet site.

Good day! This post couldn’t be written any better!

Reading this post reminds me of my old room mate!

He always kept chatting about this. I will forward this post to him.

Pretty sure he will have a good read. Thank you for sharing!

Simply wish to say your article is as astonishing. The clarity on your publish is simply nice

and i can think you’re a professional on this subject.

Fine together with your permission let me to snatch your RSS feed to keep updated with

drawing close post. Thank you 1,000,000 and please continue the

gratifying work.

Heya i’m for the primary time here. I found this board and I in finding It

truly useful & it helped me out much. I hope to present one thing back

and help others such as you aided me.

Hi there, just became alert to your blog through Google, and found that it is really informative.

I am gonna watch out for brussels. I’ll appreciate if you continue this in future.

Numerous people will be benefited from your writing.

Cheers!

Excellent blog here! Also your website so much up fast!

What host are you the use of? Can I am getting your associate link to your host?

I wish my web site loaded up as quickly as yours lol

What’s up colleagues, its enormous piece of writing about cultureand completely explained, keep it up all the time.

I must thank you for the efforts you’ve put in writing this website.

I’m hoping to see the same high-grade content by you later on as well.

In truth, your creative writing abilities has encouraged

me to get my own, personal site now 😉

For latest information you have to visit the web and on the web I

found this website as a most excellent web page for newest updates.

It’s nearly impossible to find experienced people on this topic, however, you seem like you know what you’re talking about!

Thanks

I am genuinely grateful to the holder of this website who

has shared this enormous post at at this place.

Looking forward to reading more. Great article.Thanks Again.

Usually I don’t learn article on blogs, but I would like to say that this write-up very forced

me to take a look at and do it! Your writing taste has been surprised me.

Thank you, very great post.

hello!,I love your writing very so much! share we communicate more about your article on AOL? I need an expert on this area to unravel my problem. May be that is you! Looking ahead to peer you.

I believe this is one of the so much significant info for me. And i’m glad studying your article. However should statement on few common things, The web site style is great, the articles is actually great :D. Excellent job, cheers.

Feel free to visit my webpage – https://Www.communitylandscaper.com/atlanta

Hey there just wanted to give you a quick heads up. The text in your content seem to be running off the screen in Opera. I’m not sure if this is a format issue or something to do with browser compatibility but I figured I’d post to let you know. The style and design look great though! Hope you get the problem fixed soon. Kudos

my page: https://Thecuriousscientist.in/

Промокод на подарок 1xbet – это уникальный код, который позволяет

получить дополнительные бонусы и возможности при регистрации

на платформе букмекера 1xbet. Промокод на бесплатную игру в 1xbet Благодаря промокоду игрок может получить дополнительные

средства на свой игровой

счет, бесплатные ставки или повышенные коэффициенты на определенные события.

Чтобы воспользоваться промокодом на подарок 1xbet, необходимо

зарегистрироваться на сайте букмекера и ввести

код в соответствующем поле. После

активации промокода, бонусы будут

автоматически начислены на игровой счет.

Промокод на подарок 1xbet может быть предоставлен различными способами:

по электронной почте, в социальных сетях,

на специальных рекламных площадках или в партнерских программах.

Он может быть временным или постоянным, поэтому игрокам рекомендуется следить за актуальными акциями и промокодами, чтобы не упустить возможность получить дополнительные преимущества.

Промокод на подарок 1xbet является

отличной возможностью для новичков и опытных игроков увеличить свой игровой

банк и повысить шансы на выигрыш.

Он позволяет получить дополнительные средства без дополнительных вложений и насладиться

азартом еще больше.

What’s up friends, how is everything, and what you would like to say concerning this

article, in my view its genuinely amazing designed for me.

you are in reality a just right webmaster. The website

loading velocity is amazing. It sort of feels that you are doing any distinctive trick.

Moreover, The contents are masterwork. you’ve performed a wonderful task in this matter!

Hello there! Quick question that’s completely off

topic. Do you know how to make your site mobile friendly?

My weblog looks weird when viewing from my iphone. I’m trying to find a template or plugin that might

be able to fix this issue. If you have any recommendations, please share.

With thanks!

qfIEPbgKakLsMH

I read this post completely on the topic of the comparison of most up-to-date

and earlier technologies, it’s remarkable article.

With thanks. I value it.

TRdQWZIY

Hi there! Quick question that’s entirely off topic. Do you know how

to make your site mobile friendly? My web site looks weird when viewing

from my iphone4. I’m trying to find a template or plugin that

might be able to correct this problem. If you have any suggestions, please share.

Thanks!

As for the video it is the HD in most of the cases.

Here is my page; igram.io

UfQvVxoBwlq

For car drivers who have custom-made or antique autos in Cicero, Illinois, focused auto insurance is an essential need.

These motor vehicles commonly possess special insurance coverage criteria because of their scarcity

and market value. Try to find insurance firms that offer focused Car insurance cicero insurance policy in Cicero,

Illinois, adapted to the needs of classic or even customized cars.

auto insurance dalton insurance coverage

can easily be actually complex, but they’re necessary for your protection.

Put in the time to recognize all yours.

Revolutionize Your Workspace with Freedman’s Office Chairs in Atlanta

**Embrace Productivity and Comfort: Freedman’s Office Chairs in Atlanta**

In the bustling city of Atlanta, where innovation meets tradition, Freedman’s Office Furniture

introduces its exclusive range of ergonomic office chairs.

Located at 3379 Peachtree Rd NE, Atlanta, GA 30326, our showroom caters to

the discerning tastes of residents in neighborhoods like Ansley Park and Baker Hills, offering premium office seating solutions that combine style

and functionality.

**Elevate Your Workspace in the Heart of Atlanta**

Atlanta, founded in 1836, stands as a testament to

a rich history and a thriving metropolis. With a population of 496,

461 (2021) and 227,388 households, the city continues to evolve while preserving its unique charm.

Freedman’s commitment to providing modern office chairs aligns seamlessly with

Atlanta’s spirit of progress and dynamism.

**Navigating the Urban Hub: Interstate 20**

Much like the smooth flow of Interstate 20, Freedman’s ergonomic office chairs embody a perfect blend of form and function. This mirrors Atlanta’s commitment to providing

a conducive environment for businesses to flourish and individuals to excel in their

professional endeavors.

**Investing in Style: A Wise Choice for Atlanta Professionals**

In a city that values aesthetics and innovation,

opting for Freedman’s ergonomic office chairs is a statement of sophistication. Our collection not only enhances the visual appeal of your workspace but also complements Atlanta’s commitment

to creating a work environment that fosters creativity and success.

**Discovering Atlanta’s Landmarks and the Comfort of Freedman’s Chairs**

Embark on a journey through Atlanta’s iconic landmarks while experiencing the unmatched comfort of

Freedman’s ergonomic office chairs. Here are five fascinating facts about some of Atlanta’s cherished destinations:

– **Atlanta Botanical Garden:** A 30-acre botanical garden showcasing an incredible variety

of plants and flowers.

– **Centennial Olympic Park:** Built for the 1996 Summer Olympics, this park serves as a gathering spot for locals and visitors.

– **Atlanta History Center:** An extensive history museum featuring exhibits, historic houses,

and gardens.

– **College Football Hall of Fame:** Celebrating the rich history of college

football with interactive exhibits and memorabilia.

– **The “”It’s a living”” Street Art:** A vibrant street

art scene in the city, offering colorful and dynamic murals.

**Why Choose Freedman’s Ergonomic Office Chairs in Atlanta**

Opting for Freedman’s ergonomic office chairs in Atlanta is not just a choice;

it’s a commitment to elevate your workspace. Our stylish and comfortable chairs ensure that your office reflects the vibrant

and dynamic spirit of Atlanta, making it an ideal place for productivity, innovation, and success.

”

“Transform Your Work Environment with Freedman’s Office Chairs in Orlando

**Revitalize Your Workspace: Discover Freedman’s Office Chairs in Orlando**

In the heart of Orlando, where magic and modernity coexist, Freedman’s Office Furniture proudly presents its exclusive range of office chairs.

Conveniently located at 200 E Robinson St Suite 1120,

Orlando, FL 32801, our showroom caters to the diverse needs of residents in neighborhoods like Audubon Park and Colonial Town Center, offering

premium office seating solutions that prioritize both comfort and style.

**Elevate Your Work Experience in Orlando’s Lively Atmosphere**

Orlando, founded in 1875, has grown into a vibrant city with a population of 309,154 (2021) and

122,607 households. Freedman’s commitment to providing high-quality

office chairs resonates with Orlando’s lively and energetic atmosphere, offering residents the perfect

blend of comfort and functionality for their workspaces.

**Navigating the City: The Significance of Interstate 4**

Much like the seamless flow of Interstate 4, Freedman’s ergonomic

office chairs seamlessly blend style and functionality.

This mirrors Orlando’s commitment to providing an environment where residents can seamlessly navigate between work and leisure, making our

chairs an ideal choice for those who value efficiency and

aesthetics.

**Investing in Comfort: An Informed Choice for Orlando Professionals**

In a city known for its diverse attractions

and entertainment, investing in Freedman’s ergonomic office

chairs is a conscious decision. Our chairs not only

enhance the aesthetics of your workspace but also align with Orlando’s commitment to providing a comfortable

and conducive work environment.

**Explore Orlando’s Attractions and Relax in Freedman’s Chairs**

Embark on a journey through Orlando’s enchanting attractions while enjoying the unparalleled comfort of Freedman’s ergonomic office chairs.

Here are five interesting facts about some of Orlando’s most beloved landmarks:

– **Walt Disney World Resort:** The most visited vacation resort globally,

spanning over 25,000 acres.

– **Universal Studios Florida:** An iconic film and television studio theme park, featuring thrilling rides and attractions.

– **Lake Eola Park:** A scenic park in downtown Orlando with a picturesque lake

and swan boats.

– **Dr. Phillips Center for the Performing Arts:** A state-of-the-art

venue hosting various cultural and artistic performances.

– **Orlando Museum of Art:** Showcasing a diverse collection of contemporary and classic art.

**Why Choose Freedman’s Ergonomic Office Chairs in Orlando**

Opting for Freedman’s ergonomic office chairs in Orlando is not just a decision; it’s a commitment to enhancing your workspace.

Our stylish and comfortable chairs ensure that your office reflects

the dynamic and creative spirit of Orlando, making it an ideal place for productivity, innovation, and success.

”

“Discover Superior Comfort with Freedman’s Office Chairs in Atlanta

**Elevate Your Workspace: Freedman’s Office Chairs in Atlanta**

Nestled in the vibrant city of Atlanta, Freedman’s

Office Furniture proudly introduces its exclusive collection of office chairs.

Conveniently located at 3379 Peachtree Rd NE, Atlanta, GA 30326, our showroom caters to the diverse needs of residents in neighborhoods like Ansley Park and Buckhead, offering premium

office seating solutions that blend comfort and sophistication seamlessly.

**Crafting a Distinctive Workspace in Atlanta’s Dynamic Setting**

Founded in 1836, Atlanta has evolved into a bustling city with a

population of 496,461 (2021) and 227,388 households. Freedman’s commitment to delivering top-notch office chairs aligns perfectly with Atlanta’s dynamic and diverse setting, providing residents with ergonomic solutions that enhance both productivity and aesthetic appeal.

**Navigating the Urban Hub: The Importance of Interstate 20**

Much like the flow of Interstate 20, Freedman’s ergonomic office chairs effortlessly navigate the

modern office landscape. This reflects Atlanta’s status as a vibrant urban hub, where residents value efficiency

and style in equal measure, making our chairs the perfect

choice for those seeking a superior seating experience.

**Investing in Excellence: A Thoughtful Choice for Atlanta

Professionals**

In a city renowned for its rich history and cultural attractions, choosing Freedman’s ergonomic office chairs is a thoughtful investment.

Our chairs not only elevate the visual appeal of your

workspace but also resonate with Atlanta’s commitment to fostering

innovation and success through a comfortable

and ergonomic work environment.

**Explore Atlanta’s Cultural Gems and Relax in Freedman’s Chairs**

Immerse yourself in Atlanta’s cultural richness while enjoying the superior comfort

of Freedman’s ergonomic office chairs. Here are five fascinating facts about some of Atlanta’s most iconic landmarks:

– **Atlanta Botanical Garden:** A 30-acre garden showcasing an incredible variety of plants,

flowers, and sculptures.

– **Centennial Olympic Park:** Built for the 1996 Summer Olympics,

it’s a gathering spot with fountains, events, and green spaces.

– **Martin Luther King Jr. National Historic Site:

** Preserving the legacy of the civil rights leader,

including his childhood home and Ebenezer Baptist Church.

– **Piedmont Park:** A sprawling urban park with walking

trails, sports facilities, and the picturesque Lake Clara Meer.

– **The Fox Theatre:** A historic venue known for its Moorish architecture and hosting

various performances.

**Why Choose Freedman’s Ergonomic Office Chairs in Atlanta**

Opting for Freedman’s ergonomic office chairs in Atlanta is not merely a decision—it’s a statement.

Elevate your workspace with our stylish and comfortable chairs, embodying the spirit of innovation and success that defines

Atlanta’s dynamic professional landscape.

”

“Discover Unmatched Seating Comfort with Freedman’s Office Chairs in Orlando

**Elevate Your Workspace: Freedman’s Office Chairs in Orlando**

Located at 200 E Robinson St Suite 1120, Orlando, FL 32801, Freedman’s Office

Furniture is proud to introduce its exclusive range of office chairs to the vibrant city of Orlando.

Serving neighborhoods like Colonial Town Center and

College Park, Freedman’s provides superior office seating solutions that prioritize both comfort and style.

**Crafting a Distinctive Workspace in Orlando’s Sunshine State**

Established in 1875, Orlando has transformed into a thriving city

with a 2021 population of 309,154 and 122,607 households.

Freedman’s dedication to delivering top-tier office chairs aligns seamlessly

with Orlando’s sunny ambiance, offering residents ergonomic solutions that blend seamlessly with the city’s dynamic

and energetic atmosphere.

**Navigating the Urban Landscape: The Significance of Interstate 4**

Much like the flow of Interstate 4, Freedman’s ergonomic

office chairs effortlessly navigate the

modern office landscape. This mirrors Orlando’s status as a hub of entertainment

and technology, where residents seek innovative and comfortable seating solutions, making

our chairs the ideal choice for those desiring a superior seating experience.

**Investing in Excellence: A Thoughtful Choice for Orlando Professionals**

In a city known for its theme parks and cultural attractions,

choosing Freedman’s ergonomic office chairs is a

thoughtful investment. Our chairs not only enhance the visual appeal of your workspace but also

align with Orlando’s commitment to creating a vibrant and comfortable work environment that

fosters creativity and success.

**Explore Orlando’s Magical Attractions and Relax in Freedman’s Chairs**

Immerse yourself in Orlando’s magical offerings while enjoying the

unmatched comfort of Freedman’s ergonomic office

chairs. Here are five fascinating facts about some of Orlando’s most iconic landmarks:

– **Walt Disney World Resort:** The world’s most-visited

vacation resort, featuring four theme parks and numerous attractions.

– **Universal Studios Florida:** A film and television studio theme park with thrilling rides and shows.

– **Lake Eola Park:** A downtown oasis with swan boats, live swans, and scenic walking paths.

– **Orlando Science Center:** A hands-on science museum with interactive exhibits and

engaging displays.

– **Dr. Phillips Center for the Performing Arts:

** A modern venue hosting various live performances, including

Broadway shows.

**Why Choose Freedman’s Ergonomic Office Chairs in Orlando**

Opting for Freedman’s ergonomic office chairs in Orlando is more

than just a decision—it’s a commitment to excellence.

Elevate your workspace with our stylish and comfortable chairs, embodying

the spirit of innovation and success that defines Orlando’s dynamic professional landscape.

”

“Revolutionize Your Workspace with Freedman’s Office Chairs in Atlanta

**Experience Unparalleled Comfort: Freedman’s Office Chairs in Atlanta**

Nestled at 3379 Peachtree Rd NE, Atlanta, GA 30326, Freedman’s Office Furniture proudly introduces its exceptional collection of office chairs

to the dynamic city of Atlanta. Serving neighborhoods like Ansley Park and Buckhead, Freedman’s delivers office

seating solutions that seamlessly combine ergonomic design with

aesthetic appeal.

**Redesigning Your Office Aesthetic: Freedman’s Office Chairs in Atlanta**

Founded in 1836, Atlanta has evolved into a bustling metropolis with

a 2021 population of 496,461 and 227,388 households.

Freedman’s commitment to providing top-notch office chairs perfectly complements

Atlanta’s modern and diverse atmosphere, offering residents seating

solutions that embody both innovation and style.

**Navigating the Cityscape: The Significance of Interstate 20**

Much like the connectivity provided by Interstate 20, Freedman’s ergonomic office chairs seamlessly integrate into Atlanta’s diverse professional landscape.

Reflecting Atlanta’s status as a cultural

and economic hub, our chairs offer residents unparalleled comfort and style, making them the preferred choice for those

seeking an exceptional seating experience.

**A Commitment to Excellence: Choosing Freedman’s Chairs in Atlanta**

In a city known for its rich history and cultural landmarks, choosing

Freedman’s ergonomic office chairs is a statement of commitment to excellence.

Our chairs not only enhance the visual appeal

of your workspace but also align with Atlanta’s reputation for fostering innovation and success.

**Explore Atlanta’s Rich Heritage and Relax in Freedman’s Chairs**

Discover the vibrant history of Atlanta while enjoying

the unrivaled comfort of Freedman’s ergonomic office chairs.

Here are five intriguing facts about some of Atlanta’s iconic landmarks:

– **Atlanta History Center:** A comprehensive history museum featuring exhibits on the Civil

War and Southern history.

– **Piedmont Park:** Atlanta’s premier green space, offering

walking paths, sports facilities, and beautiful scenery.

– **Martin Luther King Jr. National Historic Site:** Preserving the childhood home of the civil rights leader

and featuring the Ebenezer Baptist Church.

– **The Fox Theatre:** A historic performing arts venue

known for its grand architecture and diverse entertainment.

– **The High Museum of Art:** Atlanta’s

leading art museum, showcasing a diverse collection of artwork.

**Why Freedman’s Ergonomic Office Chairs Stand Out in Atlanta**

Choosing Freedman’s ergonomic office chairs in Atlanta

is a decision that transcends mere furniture.

It’s a commitment to elevating your workspace with stylish and comfortable seating that resonates with Atlanta’s spirit of progress and achievement.

Transform Your Workspace with Freedman’s Office Chairs in Tampa

**Indulge in Comfort and Style: Freedman’s Office Chairs

in Tampa**

Embark on a journey of ergonomic excellence with Freedman’s Office Furniture, conveniently located

at 5035 W Hillsborough Ave, Tampa, FL 33634.

Specializing in office chairs, cubicles, and desks, Freedman’s is redefining workplace aesthetics in neighborhoods like Arbor Greene and Ballast

Point, offering a wide range of seating solutions designed

for modern comfort and productivity.

**Setting the Standard in Tampa: Freedman’s Office Chairs**

Founded in 1845, Tampa has grown into a thriving city with a 2021 population of 387,050 and 157,066 households.

As a testament to its commitment to excellence, Freedman’s Office Furniture seamlessly

integrates into Tampa’s vibrant landscape, providing top-notch office chairs that combine ergonomic innovation with contemporary design.

**Navigating the Hub of Tampa: Interstate 275**

Much like the connectivity facilitated by Interstate 275, Freedman’s ergonomic office chairs effortlessly integrate

into Tampa’s bustling professional landscape. Reflecting Tampa’s

reputation as a diverse and dynamic city, our chairs offer residents an unmatched seating experience, perfectly

aligning with the city’s ethos of progress and innovation.

**A Glance at Tampa’s Diverse Neighborhoods and

Climate**

Tampa’s diverse neighborhoods, from Downtown to East Tampa, find a perfect complement in Freedman’s ergonomic office chairs.

With repairs typically costing a fraction of the price of

new furniture, our chairs are not just an investment in comfort but also in long-term savings.

Additionally, Tampa’s tropical climate makes comfort a priority, and our chairs cater to the need for breathability

and support, ensuring a pleasant working environment year-round.

**Explore Tampa’s Rich Tapestry of Attractions**

Discover the allure of Tampa by exploring some of its captivating points

of interest:

– **Busch Gardens Tampa Bay:** A world-renowned theme park featuring thrilling rides

and exotic animal exhibits.

– **Curtis Hixon Waterfront Park:** A picturesque park

along the Hillsborough River, offering scenic views and recreational activities.

– **Congo River Rapids:** A water ride at Busch Gardens Tampa Bay, providing an exhilarating adventure through

turbulent waters.

– **The Henry B. Plant Museum:** Housed in the former

Tampa Bay Hotel, this museum showcases Tampa’s Gilded Age history.

– **Empower Adventures Tampa Bay:** An outdoor adventure park offering ziplining and other exciting activities.

**Why Choose Freedman’s Office Chairs in Tampa**

Selecting Freedman’s ergonomic office chairs in Tampa is

a decision that transcends mere furniture. It’s a commitment to elevating your workspace with stylish

and comfortable seating that resonates with Tampa’s spirit of diversity, growth,

and success.

”

“Revolutionize Your Workspace with Freedman’s Office Furniture in Atlanta

**Experience Unmatched Comfort with Freedman’s Office Chairs in Atlanta**

Freedman’s Office Furniture, located at 3379 Peachtree Rd NE,

Atlanta, GA 30326, invites you to redefine your work environment.

Specializing in office chairs, cubicles, and desks, Freedman’s is

the epitome of ergonomic excellence, serving neighborhoods

like Ansley Park and Adair Park.

**Atlanta’s Pioneering Legacy Meets Freedman’s Innovation**

Founded in 1836, Atlanta boasts a population of 496,461 and 227,388 households as

of 2021. Reflecting Atlanta’s pioneering spirit, Freedman’s Office Furniture aligns seamlessly with the city’s ethos.

Our ergonomic office chairs set the standard for comfort and

style, combining innovation with contemporary design.

**Navigating Atlanta’s Business Hub: Interstate 20**

Much like the flow of traffic on Interstate 20,

Freedman’s ergonomic office chairs effortlessly integrate into Atlanta’s bustling

professional landscape. Our chairs represent more than just a place to sit;

they symbolize Atlanta’s commitment to progress, creativity, and

a dynamic work culture.

**Exploring Atlanta’s Unique Neighborhoods and Climate**

From the historic charm of Ansley Park to the vibrant energy of Buckhead, Freedman’s ergonomic office chairs

cater to Atlanta’s diverse neighborhoods. Repairs are

cost-effective, ensuring that your office furniture investment remains sustainable.

Considering Atlanta’s mild climate, our chairs provide the perfect blend of

support and breathability, ensuring a comfortable year-round

workspace.

**Discover Atlanta’s Cultural Gems**

Explore Atlanta’s rich cultural tapestry by visiting

these noteworthy points of interest:

– **Atlanta Botanical Garden:** A stunning oasis in the heart of Midtown, featuring beautiful gardens and immersive plant collections.

– **Centennial Olympic Park:** Built for the 1996 Summer Olympics,

this park offers a blend of history and recreation.

– **Coca-Cola Museum:** Delve into the history of the iconic

beverage at this immersive museum in downtown Atlanta.

– **Boulevard Heights:** A historic neighborhood with a mix of architectural

styles and a strong sense of community.

– **College Football Hall of Fame:** Celebrating the history and legends

of college football, located in the heart

of Atlanta.

**Why Freedman’s Office Furniture is Atlanta’s Top Choice**

Choosing Freedman’s ergonomic office chairs in Atlanta is

a testament to your commitment to a workspace that mirrors Atlanta’s innovation, diversity, and cultural richness.

Elevate your office aesthetics with Freedman’s, where

comfort meets style effortlessly.

”

“Upgrade Your Office Experience with Freedman’s Office Furniture in Tampa

**Discover Unparalleled Comfort with Freedman’s Office Chairs in Tampa**

Freedman’s Office Furniture, located at 5035 W Hillsborough

Ave, Tampa, FL 33634, invites you to transform

your workspace. Specializing in office chairs, cubicles, and desks, Freedman’s is the epitome of ergonomic excellence, serving

neighborhoods like Arbor Greene and Bayshore Beautiful.

**Tampa’s Vibrancy Meets Freedman’s Innovation**

Founded in 1845, Tampa boasts a population of 387,050 and 157,066 households

as of 2021. Mirroring Tampa’s vibrant atmosphere,

Freedman’s Office Furniture brings a touch of innovation to your workplace.

Our ergonomic office chairs redefine comfort, combining functionality with modern aesthetics.

**Navigating Tampa’s Business Landscape: Interstate 275**

Much like the smooth flow of Interstate 275, Freedman’s

ergonomic office chairs seamlessly integrate into Tampa’s thriving professional

community. Our chairs are more than mere seating; they embody Tampa’s commitment to dynamic work environments,

fostering creativity and productivity.

**Exploring Tampa’s Distinctive Neighborhoods and Climate**

From the family-friendly charm of Arbor Greene to the coastal vibes

of Bayshore Beautiful, Freedman’s ergonomic office chairs cater to Tampa’s diverse neighborhoods.

With affordable repair options, our chairs ensure a sustainable and stylish office setup.

Considering Tampa’s warm climate, our chairs offer the perfect blend of support

and breathability, making your workspace comfortable year-round.

**Unveiling Tampa’s Unique Points of Interest**

Explore Tampa’s unique attractions, enhancing your downtime or inspiring new ideas:

– **Busch Gardens Tampa Bay:** Experience thrilling rides and encounters with

exotic animals in this renowned theme park.

– **Curtis Hixon Waterfront Park:** A scenic urban park along the Hillsborough River, providing a tranquil escape in downtown Tampa.

– **Ybor City:** Known for its historic charm, Ybor City offers

a blend of unique shops, restaurants, and cultural experiences.

– **Adventure Island:** A waterpark featuring slides, pools, and a lazy river, perfect for family-friendly fun.

– **Croc Encounters:** Get up close with reptiles and wildlife in this educational

and interactive setting.

**Why Freedman’s Office Furniture is Tampa’s Premier Choice**

Choosing Freedman’s ergonomic office chairs in Tampa signifies your dedication to a workspace reflecting Tampa’s energy,

diversity, and recreational opportunities. Elevate your office

aesthetics with Freedman’s, where comfort meets innovation seamlessly.

”

“Elevate Your Workspace with Freedman’s Office Furniture in Tampa

**Revolutionize Your Office Aesthetic with Freedman’s Office Desks**

Freedman’s Office Furniture, situated at 5035 W Hillsborough Ave, Tampa,

FL 33634, is your destination for premium office desks, chairs, and cubicles.

Serving neighborhoods like Beach Park and Downtown, Freedman’s is

committed to enhancing your workspace experience.

**Tampa’s Rich History and Freedman’s Office Furniture**

Since its founding in 1845, Tampa has evolved into a thriving city with

a population of 387,050 and 157,066 households as of 2021.

Freedman’s Office Furniture pays homage to Tampa’s rich history by offering office desks that blend tradition with contemporary design, reflecting the city’s dynamic character.

**Navigating Tampa’s Business Hub: Interstate 275**

Much like the intersecting lanes of Interstate 275, Freedman’s office desks

intersect functionality and style. Your workspace becomes a testament to Tampa’s

business hub, where our desks stand as symbols of innovation and efficiency, aligning seamlessly with the

city’s forward-looking spirit.

**Cost-Effective Repairs and Tampa’s Varied Climate**

Freedman’s understands that office repairs are a crucial aspect

of maintaining a professional space. Our office desks come with affordable repair options, ensuring durability and longevity.

Considering Tampa’s varied climate, our desks are crafted to withstand the warmth, providing a sturdy and reliable foundation for your work.

**Exploring Tampa’s Neighborhood Vibes and Workspaces**

Whether you’re in the vibrant Downtown area or the serene Beach

Park, Freedman’s office desks cater to the unique vibes of Tampa’s neighborhoods.

With diverse styles and configurations, our desks complement the essence of

each locality, enhancing the aesthetic appeal of your workspace.

**Discover Tampa’s Cultural Gems and Work-Friendly Spaces**

Explore Tampa’s cultural gems during your downtime or use local work-friendly

spaces for a change of scenery:

– **The Tampa Riverwalk:** A scenic waterfront trail offering picturesque views

and access to various attractions.

– **The University of Tampa:** Find inspiration in the historic architecture and serene environment of the

university campus.

– **Armature Works:** A revitalized industrial space turned into a vibrant community hub with eateries, shops,

and co-working spaces.

– **The Tampa Theatre:** Immerse yourself in the unique ambiance of this historic movie palace, a cultural landmark in Tampa.

**Why Freedman’s Office Furniture Sets the Standard in Tampa**

Choosing Freedman’s office desks in Tampa signifies your commitment to a

workspace that reflects the city’s history, diversity, and cultural richness.

Upgrade your office aesthetic with Freedman’s, where each desk is a blend of craftsmanship,

functionality, and Tampa’s unique spirit.

”

“Discover Exceptional Office Chairs at Freedman’s Tampa Store

**Elevate Your Work Experience with Freedman’s Ergonomic Office Chairs**

Freedman’s Office Furniture, located at 5035 W Hillsborough Ave, Tampa, FL

33634, invites you to experience unparalleled comfort and style with our extensive range of ergonomic office chairs.

Serving neighborhoods like Arbor Greene and Downtown, Freedman’s is

dedicated to providing the perfect seating solutions for your workspace.

**The Essence of Tampa’s Growth and Freedman’s Ergonomic Chairs**

Founded in 1845, Tampa has grown into a bustling city with a

population of 387,050 as of 2021. Freedman’s acknowledges

this growth by offering ergonomic office chairs that echo Tampa’s

dynamic spirit. Our chairs blend innovation with comfort, creating an ideal environment for productivity.

**Navigating Tampa’s Business District with Interstate 275**

Much like the flow of traffic on Interstate 275, Freedman’s ergonomic office chairs offer seamless movement and adaptability.

As your professional partner, our chairs mirror the efficiency and modernity of Tampa’s thriving business district, providing ergonomic support for your daily tasks.

**Affordable Repairs and Tampa’s Climate-Adaptable Ergonomic Chairs**

Understanding the importance of comfortable seating, Freedman’s offers affordable repair solutions

for our ergonomic office chairs. Crafted to adapt to Tampa’s

varied climate, our chairs provide the perfect balance of support

and flexibility, ensuring a comfortable workspace year-round.

**Tailored Seating for Tampa’s Varied Neighborhoods**

Whether you’re in the leafy enclaves of Arbor Greene or the vibrant streets of Downtown, Freedman’s ergonomic chairs complement the diverse vibes of Tampa’s neighborhoods.

With adjustable features and contemporary designs, our chairs

enhance the visual appeal of your workspace.

**Exploring Tampa’s Cultural Havens and Cozy

Work Nooks**

Take advantage of Tampa’s cultural offerings during breaks or find inspiration in local

work-friendly spaces:

– **Tampa Museum of Art:** Immerse yourself in creativity and artistic expression within the museum’s serene surroundings.

– **Davis Islands Dog Park:** A unique outdoor

spot for relaxation and brainstorming sessions.

– **Ybor City Historic District:** Experience Tampa’s rich history

in this vibrant district, filled with eclectic shops and cafes.

– **Curtis Hixon Waterfront Park:** Enjoy a peaceful break by the Hillsborough River, with stunning views and open spaces.

**Why Freedman’s Ergonomic Office Chairs Lead the

Way in Tampa**

Opting for Freedman’s ergonomic office chairs in Tampa means choosing unrivaled comfort,

innovative design, and a seating solution that mirrors the

city’s growth and diversity. Upgrade your workspace with Freedman’s, where each chair represents the perfect

blend of support, style, and Tampa’s unique energy.

OAxdtLwRGS

Are you searching for a reliable solution to enhance the life of your roof?

Shingle Magic Roof Sealer is the answer. This innovative product provides a unique standard of maintenance for your asphalt shingles, guaranteeing they last longer.

With Shingle Magic Roof Sealer, you’re not just choosing

any ordinary product. You’re selecting a high-end

roof rejuvenation solution designed to significantly extend the life of your roof for decades.

It’s a smart choice for property owners looking to protect their investment.

What makes Shingle Magic Roof Sealer? For starters, its proprietary

formula gets into the asphalt shingles, rejuvenating their initial strength and aesthetic.

Additionally, it is incredibly straightforward to install,

demanding little work for top results.

Not only does Shingle Magic Roof Sealer increase the life of your

roof, but it also provides exceptional resistance to

environmental damage. Whether it’s intense UV rays, torrential downpours, or winter conditions, your roof is shielded.

Additionally, choosing Shingle Magic Roof Sealer indicates you

are selecting an green option. Its safe composition ensures little

environmental impact, which makes it a conscious choice for eco-conscious homeowners.

To sum up, Shingle Magic Roof Sealer stands out as the premier roof rejuvenation solution.

Not only does it increase the life of your roof while delivering superior protection and being green option positions it as the ideal choice for homeowners looking to care for their property’s future.

Furthermore, one of the key benefits of Shingle Magic Roof Sealer is its affordability.

Instead of investing heaps of money on regular repairs or a full roof replacement, using Shingle Magic saves you money in the long run.

This makes it a budget-friendly option that offers high-quality results.

Additionally, the user-friendly nature of Shingle Magic Roof Sealer is

a major plus. There’s no need for professional expertise to apply it.

If you enjoy DIY projects or prefer for expert application, Shingle Magic provides a seamless process with remarkable results.

Its durability is yet another strong reason to choose it.

After application, it forms a layer that keeps the integrity of your shingles for many years.

That means less worry about damage from the elements and greater peace of mind about the health of your roof.

In terms of appearance, Shingle Magic Roof Sealer also excels.

It not only protects your roof but also boosts its aesthetic.

The shingles will appear more vibrant, which adds to the curb appeal and worth to your property.

Customer satisfaction with Shingle Magic Roof Sealer is additional proof to its effectiveness.

Countless homeowners have reported remarkable improvements in their roof’s condition after using the product.

Feedback emphasize its simplicity, longevity, and superior protective qualities.

To wrap it up, selecting Shingle Magic Roof Sealer is choosing a reliable solution for roof rejuvenation.

Its combination of durability, aesthetic enhancement, affordability,

and simplicity renders it the ideal choice for those seeking to extend

the life and appearance of their roof. Don’t wait to give your roof the care it

deserves with Shingle Magic Roof Sealer.

In the realm of plumbing services, Preferred Plumbers stand out for

a variety of reasons. With our extensive experience

and dedication to excellence, we’re confident in stating that we’re

the #1 choice when you need a plumber. Here’s why:

Expertise in a Wide Range of Services

Our team is skilled in numerous plumbing services, from leak detection and repairing pipes to drain cleaning and faucet installation.

Whether you need sewer line repair or your water heater fixed, we have the skills to address all your plumbing needs.

Emergency Services

Emergencies don’t wait for business hours, and neither do we.

Our team is on call 24/7 to guarantee that urgent plumbing needs are addressed promptly, preventing

further issues and restoring your peace of mind.

Focus on Customer Satisfaction

At Preferred Plumbers, customer satisfaction is our

number one priority. We are committed to offer personalized solutions that satisfy your specific needs, making sure that you’re happy with our work.

Exceptional Craftsmanship

Quality is never compromised at our firm. We use

high-grade materials and advanced methods to provide durable repairs and

installations. Our aim is to provide services that are durable.

Fair and Transparent Pricing

Knowing the cost of plumbing services upfront is important, which is why Preferred Plumbers provide clear, upfront pricing.

You’ll know the cost before any work begins, with no hidden fees to worry about.

Fully Licensed and Insured

To protect you, Preferred Plumbers is fully licensed and insured.

This indicates that our work meets the highest industry

standards and you’re protected in the rare case of an accident.

Opting for us signifies selecting a team dedicated to quality.

Our service goes beyond just fixing pipes; we’re your partners

in maintaining the well-being of your plumbing system.

Reach out to us today to see why Preferred Plumbers are the #1 choice when you need a plumber.

MtDESzlUr

I absolutely love your website.. Great colors & theme.

Did you build this website yourself? Please reply back as I’m attempting to

create my own personal blog and would love to find out where you got this from or just

what the theme is named. Cheers!

In the realm of plumbing services, our team at Preferred Plumbers are a cut above the

rest for several key reasons. Considering our extensive experience and dedication to excellence, we’re proud to say that we’re the #1 choice when you need a plumber.

Here’s why:

Comprehensive Service Range

Our team is proficient in a broad range of plumbing services, from detecting leaks

and repairing pipes to cleaning drains and faucet installation. Whether

you need sewer line repair or water heater repair, we have

the expertise to handle it all.

Round-the-Clock Service

Emergencies don’t wait for convenient times, and neither do we.

Our team is ready to help around the clock to ensure that your plumbing issues are addressed

promptly, reducing potential damage and getting your peace of mind.

Dedication to Clients

At Preferred Plumbers, the customer is our number one priority.

We work hard to provide tailored solutions that address your specific needs, making

sure that you’re fully satisfied with our work.

Superior Quality

Workmanship is at the heart of what we do at Preferred Plumbers.

We use only the best materials and the latest

techniques to guarantee long-term fixes and installations.

Our objective is to provide services that are durable.

No Hidden Fees

Understanding the cost of plumbing services upfront is crucial, which

is why Preferred Plumbers offer transparent pricing.

You’ll know the cost before any work begins, with no hidden fees looming.

Certification and Insurance

For your protection, our team is licensed and insured. This indicates that the

work we do complies with industry standards and your property is protected in the event

scenario that something doesn’t go as planned.

Choosing us entails selecting a team committed to excellence.

We’re not just another plumbing service; we’re dedicated to keeping the health of

your plumbing system. Reach out to us today and experience

why Preferred Plumbers are the #1 choice when you need a plumber.

gInlHykcE

Such a great blog, thanks for sharing, Regards, IDProperti.com | Pasang Iklan Properti

With a vast background of 20 years in criminal defense and DUI law, Jeremy Huss stands out as the premier criminal lawyer in Phoenix, Arizona.

At Huss Law, they possess profound expertise in navigating the complexities of Arizona criminal law, ensuring top-notch representation.

From DUI to white-collar crimes, Jeremy and his team have defended clients against

charges like domestic violence, cybercrime, and theft.

Their experience spans across various areas of criminal justice, rendering

Huss Law a versatile choice for those in need of legal defense.

Jeremy’s distinct advantage is his background

as an Arizona criminal prosecutor. This experience provides him a unique perspective, empowering his defense strategies immensely.

His approach is not just about fighting; it’s about

strategizing for your freedom.

Jeremy’s excellence is also reflected in his recognition within the legal community.

He is celebrated as a top trial attorney by Elite Lawyer and included in the Top 100 Attorneys speaks volumes about his capabilities.

His membership in prestigious associations like the National College

of DUI Defense and the National DUI Defense Lawyers Association only underscores his commitment to excellence.

Choosing Huss Law for your defense means, you’re securing a

lawyer with a track record of success. Jeremy has achieved favorable outcomes like

Second Degree Murder and secured favorable jury trial results on major

felony charges. Such achievements demonstrates his ability to handle

even the most challenging cases.

Additionally, the firm’s solid relationships with judges at local courthouses and its excellent communication skills with clients like you guarantee that

your interests are well-protected at every legal turn.

In conclusion, choosing Jeremy Huss as your criminal lawyer in Phoenix means opting for a veteran with a wealth of experience, a proven track record, and a strong

dedication to defending your freedom. Call now for a free

consultation and benefit from the exceptional legal defense

that Huss Law has to offer.

Meanwhile, in Washington, which may be the global center for empty posturing, there is new evidence that absolutely no one elected to office can speak morally about tyranny.

Members have access to over 500 films, which includes four new films every month that

are produced by Erika and her league of star-studded directors including May Medeiros and Lidia Ravviso.

ONCE A MONTH IS NOT ENOUGH! 76334828How do I fix this:

So, about a month ago I met a girl who I knew as an old friend from high school.

76333831feminine traps are harder to hook up with than cis women,

and risks of STDs are high. 76333030I am honestly

thinking about starting a company that only hires high

IQ autistic people because I re… I am terrible at approaching people IRL,

but somehow I get anxiety when… But her anxiety had deeper

roots than the pandemic. When he watched The Matrix when it

came out in 1999, Boyle admits some of its themes went over his head.

He was taken to hospital with severe head injuries and died the following day.

I would recommend taking advantage of the three day trial at 33

cents per day to determine if this is the site for you.

WOW just what I was looking for. Came here by searching for Shingle Magic

Enhancing Workspaces in the Heart of Winter Park: Serotonin Centers

In the vibrant city of Winter Park, creating efficient and comfortable workspaces

is paramount, and Serotonin Centers excels in providing top-notch office furniture solutions.

Serving neighborhoods like Audubon Park and Azalea Park,

the company stands as a go-to resource for businesses looking to enhance their work environments.

Established in Winter Park in 1887, Serotonin Centers boasts a rich history of contributing to the city’s

growth. With a population of 29,131 residents in 12,612 households,

Winter Park is a city known for its cultural diversity and thriving communities.

Connected by the major highway I-4, residents in neighborhoods like Baldwin Park and

College Park have easy access to the extensive range of office furniture offered by

Serotonin Centers.

In Winter Park, where temperatures vary, and businesses strive for excellence, the cost of office furniture repairs can vary.

Serotonin Centers addresses this need by providing reliable and cost-effective solutions for businesses seeking durable and stylish office cubicles, desks, chairs,

and tables.

Winter Park boasts a range of captivating points of interest, including

the historic Casa Feliz Historic Home Museum and the scenic Dinky Dock

Park. Residents can enjoy these attractions while also benefitting from

Serotonin Centers’ expertise in creating functional

and aesthetically pleasing workspaces.

Choosing Serotonin Centers in Winter Park is synonymous with choosing quality and

innovation in office furniture solutions. With a commitment to excellence and a diverse range of furniture options, the company ensures that businesses in Winter Park have access to the best resources for creating productive and inspiring work environments.

”

“Elevating Work Environments in Colonial Town Center: Serotonin Centers at

the Forefront

Colonial Town Center, nestled in the heart

of Winter Park, is home to a thriving business community, and Serotonin Centers plays a pivotal role in enhancing work

environments. Specializing in office furniture solutions, the company caters to

the unique needs of neighborhoods like Colonialtown North and Coytown, providing businesses with top-quality furniture

options.

With roots dating back to 1887, Serotonin Centers has been an integral part of Winter Park’s growth and development.

The city, boasting a population of 29,131 residents

across 12,612 households, is known for its rich cultural tapestry.

Accessible via the major highway I-4, Colonial Town Center and its surrounding neighborhoods, like Delaney

Park, enjoy convenient access to the diverse range of office furniture offered by Serotonin Centers.

In Winter Park, where temperature variations are common, the cost of office furniture repairs can fluctuate.

Serotonin Centers addresses this need by offering businesses in Colonial Town Center reliable and budget-friendly solutions for office cubicles, desks, chairs, and tables.

Colonial Town Center is surrounded by points of interest, including the historic Downtown Winter Park and the vibrant Audubon Park Garden District.

Businesses in the area can draw inspiration from these local

attractions while benefiting from Serotonin Centers’ expertise in creating productive and aesthetically

pleasing workspaces.

Choosing Serotonin Centers in Colonial Town Center is not just a practical decision; it’s a commitment to quality and innovation in office furniture solutions.

With a diverse range of options and a focus on customer satisfaction,

the company remains a trusted partner for businesses striving for excellence in their work environments.

”

“Crafting Inspiring Workspaces in the Heart of Audubon Park:

Serotonin Centers’ Expertise

In the picturesque surroundings of Audubon Park, Serotonin Centers

stands as a beacon for businesses seeking to create inspiring workspaces.

Specializing in office furniture solutions, the company caters to the

diverse needs of neighborhoods like Baldwin Park and Bryn Mawr, contributing to the development of vibrant

and efficient work environments.

Founded in Winter Park in 1887, Serotonin Centers has played a significant role in shaping the city’s

growth. Winter Park, with a population of 29,131 residents in 12,612 households, is celebrated for its cultural richness.

Audubon Park, conveniently connected by the major highway I-4, benefits from Serotonin Centers’ wide range

of office furniture options.

In a city where temperatures can vary, and businesses are

keen on excellence, the cost of office furniture repairs becomes a crucial factor.

Serotonin Centers addresses this need by offering businesses in Audubon Park reliable and cost-effective solutions for office cubicles, desks, chairs, and tables.

Audubon Park is surrounded by fascinating points of interest,

such as the Audubon Park Garden District and the serene

Blue Jacket Park. Local businesses can draw inspiration from these attractions while

also benefitting from Serotonin Centers’ expertise in crafting workspaces