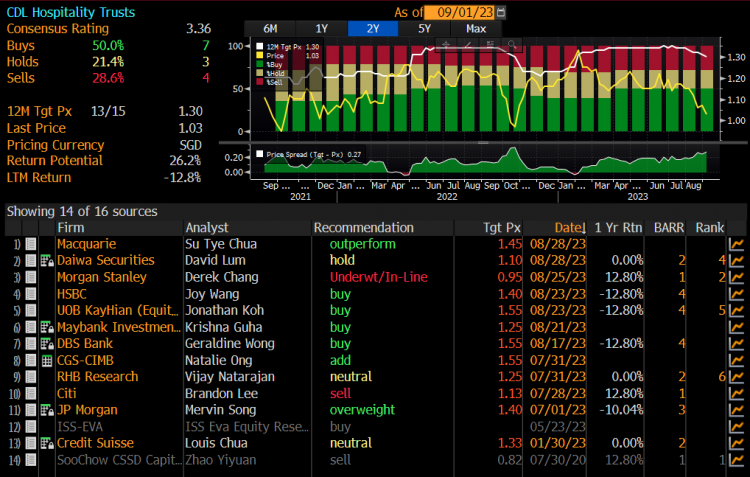

CDL Hospitality trades at multi-month low levels $1.03 despite strong 2H outlook! (3 Sep 23)

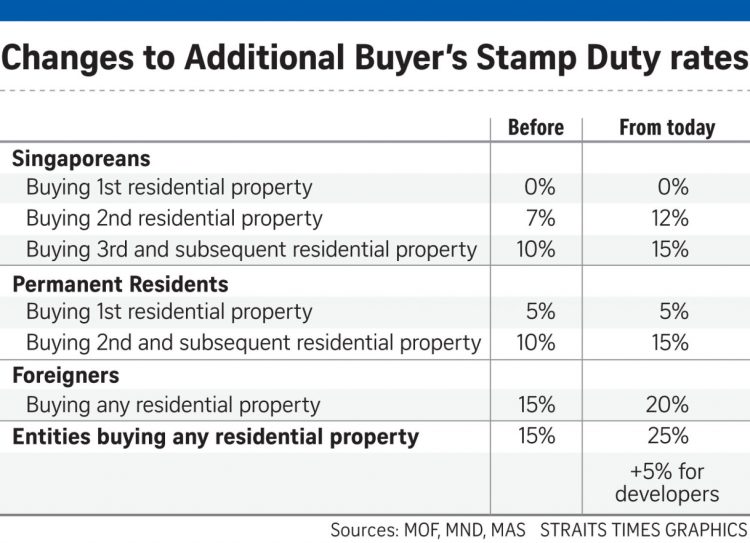

Dear all CDL Hospitality Trust (CDREIT) has caught my attention after slumping from $1.19 on 31 Jul to close $1.03 on 31 Aug. After taking into account of $0.0251 dividend per share ex on 4 Aug, it is still down 11.6% for the month, notching a multi-month low despite a likely buoyant 2HFY23F. Let’s take a closer look on why CDREIT has caught my attention. Firstly, why did it drop 12% in Aug? The drop in CDREIT’s share price may be attributed to three main reasons, viz. a) 1HFY23 results missed some analysts’ estimates 1HFY23 results released on 28 […]