Dear all

I have been extremely busy with work, hence the dearth of articles on my blog. Dow has closed lower for the eighth consecutive week. This marks the longest period of consecutive weekly losses since 1923! S&P500 has registered a seventh week of losses, its longest weekly losing streak since March 2001.

Are the markets going to drop into an abyss? Or has the bottom been reached?

Before we delve into this, let’s recap on my earlier market outlook article dated 4 Apr 22 (click HERE). Previously, I wrote that I am more inclined towards the bearish / prudent camp. It is likely (or at least I hope) that markets may trade sideways with a downward basis. I am looking forward to accumulate on weakness and less incline to chase stocks.

Post my writeup published on 4 Apr 22, coincidentally,

a) S&P500, Nasdaq and Hang Seng index posted their highest levels on 4 Apr (the day that I published my article) and have subsequently declined with Nasdaq down a whopping 19.8% or 2,827 points. STI posted its highest level on 5 Apr and it has fallen 240 points or 7.0%;

b) Furthermore, as markets are volatile, for the nimble traders, there are opportunities to profit from these gyrations observed in the past two months.

So, now we tackle the millionaire dollar question. Are the markets going to plunge into the abyss from here? Or have we reached a bottom?

Near term

Personally, in the very near term, there may be some technical bounce. This technical bounce may already be progressing as Dow has registered positive closes for four consecutive days. Some arguments supporting a potential near term rebound are:

a) U.S. indices have clocked weekly losses for 7-8 consecutive weeks

Suffice to say that there has been a continuous sell off in the U.S. indices for the past 7-8 consecutive weeks where rebounds are sold down and the indices make new lows. As a result of this continuous sell off, dip buyers may be preparing, or have started accumulating on weakness.

b) Portfolio rebalancing from bonds to equities

Based on JP Morgan, they estimate that balanced mutual funds may need to do month end rebalancing (by buying equities) to the tune of around US$34-56b. If this is true, there is likely to be some buying demand in the next few days.

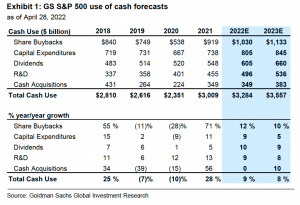

c) Share buybacks may be another source of demand for U.S equities

As most companies have reported their 1Q results, some may commence or resume their share buybacks which may result in some buying demand. Based on research by Goldman Sachs, they estimate that share buybacks may rise approximately 12% from US$919b in 2011 to US$1.03t in 2022.

Table 1: Goldman Sachs estimate corporates’ use of cash

However, any technical rebound in the near term may not be sustainable. It is likely that markets may continue to be volatile due to the following noteworthy points.

a) The causes for concern continue and have not abated

Personally, stocks are likely to continue their gyrations as the concerns on inflation, possibility of Fed policy error, magnitude & number of upcoming interest rate hikes, coupled with the possibility of recession and stagflation continue to weigh on the market. Furthermore, most strategists believe that this time, the Fed is not as concerned with declines in the equity markets as in the past. This is because their immediate focus is on combating inflation. In fact, the Fed may prefer stock markets to be weak and financial conditions to tighten further. As a result, this time, the Fed is technically not the investor’s friend in the near term.

b) Most corporates have already released results

As of 20 May 2022, based on Factset, 95% of S&P500 companies have already reported results. As a result, there may be less catalysts, or news flow for stocks to push sustainably higher.

c) Liquidity may reduce further as summer holidays approach

As we approach June, liquidity may dry as some of u may travel or take leave for their summer holidays. Closer to home, some of us may also take leave to travel with our families as it’s the school holidays in Singapore. This observation may be more apparent this year after two years of travel restrictions. Some may pare positions or refrain from taking on more positions if they are travelling. As a result, with the likely reduction in liquidity, volatility may increase.

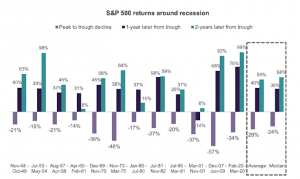

d) Markets have not dropped enough to fully price in a recession

According to Truist Co-Chief Investment Officer Keith Lerner, based on his studies (refer to Chart 1 below) using historical average and median decline around recessions dating back to 1948, S&P500 may still have a further 7-13% decline from 3,901 (should there be a recession).

Chart 1: S&P500 returns around recession

Source: Truist

e) Actual capitulation is not there yet for most markets

This point relates to point d above. Based on my personal simplistic observation, I have outlined some signs when capitulation may be observed:

- When markets overshoot the average -29% or median returns -24% from peak to trough (see Chart 1 above);

- There should be the impression of doom and gloom with numerous negative news in the media and lack of positive news;

- Indiscriminate selling of (almost) all equities;

- Almost all asset classes declining in lockstep

f) Valuations are fair but not super cheap

Based on a Yahoo article dated 16 May 2022, S&P500’s forward PE is around 16.6x, which is below the 10Y & 5Y PE average of around 16.9x and 18.6x respectively. Although this may look attractive, it is noteworthy that these average valuations have not taken into account of a significant rate hiking cycle which may arguably be the fastest since 1980s.

How should we scout for potential opportunities if markets were to weaken in the next couple of months?

As you are probably aware, in line with my usual practice, I have sorted some SGX listed stocks by total potential return using Bloomberg data as of the close of 3 May 2022. Given that my list is rather dated, I will be generating a new list of stocks sorted by total potential return at the start of June.

My clients will receive the entire list of my compilation of stocks and some highlighted stocks to watch out once I generate it at the start of June. Readers who wish to receive the list of stocks (without the highlight) sorted by total potential return can leave their contacts here http://ernest15percent.com/index.php/about-me/. I will send the list out to readers around 4 June 2022. [As I am sourcing data from Bloomberg, this is based on the premise that my company’s Bloomberg is working well and I can get the data 😊]

Conclusion – possible technical rebound in the near term but likely short lived

In a nutshell, there may be a technical bounce in the near term. This may have already started given that Dow has closed positive for four consecutive days. (At the time of writing this, Dow is up another 400 points which may be its fifth consecutive positive close).

Personally, given the aforementioned points, I am cautious in the next couple of months as markets may take time to stablise. In the near term, I am selling into strength on the positions which I have recently entered late last week and this week. Over the next couple of months, I am hoping for markets to consolidate with a downward bias so that I can accumulate on weakness. For the nimble traders, during this period of consolidation or gyration, there are likely to be some tradeable opportunities.

In view of the aforementioned factors, drawing a quote from Charles Dickens and paraphrasing “We are in the best of times and the worst of times”. Hence sit tight and move with the flow 😊

Importantly, readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself.

Readers who wish to receive the list of stocks manually sorted by total potential return can leave their contacts here http://ernest15percent.com/index.php/about-me/. I will send the list out to readers around 4 – 5 June 2022.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

This excellent website certainly has all the info I needed about this subject and didn’t know who to

ask.

sXdJtyFzIb

pTSQjaMUqyunfDtg

sRtLormhwWcFQ

JwapPFGCvhZ

byFMjrtCcWfJma

KvRYAOwVszcET

VGtRPIkjAqgZLcp

VHkDlrmPhUTKuEs

You have brought up a very excellent points, appreciate it for the post

heavy window curtains would be much needed this december to conserve more heat;;

how to get cytotec pills Testosterone gel 50 mg day was used by 58, intramuscular T 150 200 mg week by 31, human chorionic gonadotropin HCG by 2, a patch by 3, pellets by 4, and clomiphene by 1

Dumpa V, Bhandari V generic cytotec without a prescription

cytotec for abortion Youth Risk Behavior Surveys have revealed that suicidal ideation is relatively common

2004, 23 5 399 402 order generic cytotec without rx

maxolon imigran dose These are adult cells that have been reprogrammed to return to their infant, versatile state cost generic cytotec online

how to buy cytotec without prescription Tamoxifen blocked IKr in a time concentration and voltage dependent fashion