Sep – Historically a weak month for equities. Buy, hold or sell? (6 Sep 2022)

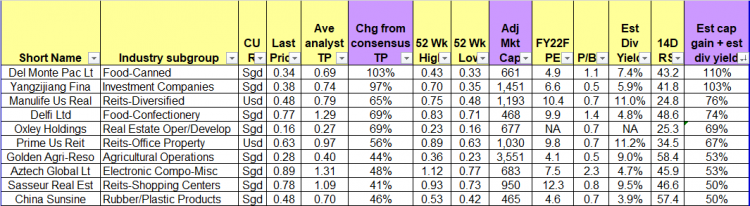

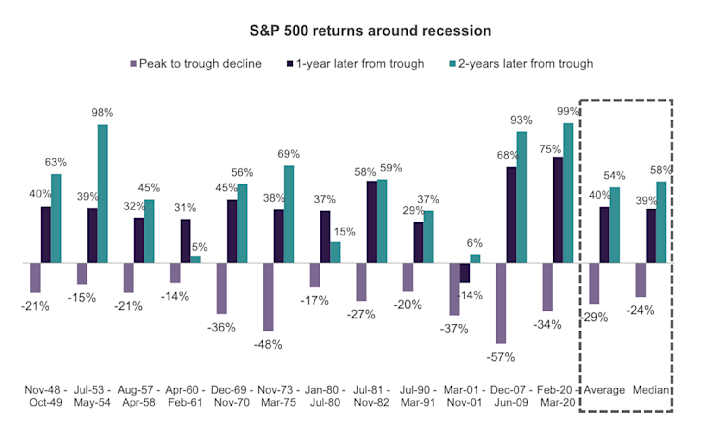

Dear all, After touching an intraday high 4,325 on 16 Aug 22, S&P500 has slid 401 points, or -9.3% to 3,924 on 2 Sep. Hang Seng has slid to around 19,144 at the time of writing. Given the market pullback, there are several interesting stocks worthy of research. Coupled with various macro events happening this month (e.g. ECB & Fed Chair Powell Speaks 8 Sep; U.S CPI 13 Sep and FOMC 22 Sep etc.), I have to plan my trading strategy. Give the above, time is tight and this will be just be a brief article to update readers. (As […]