Lendlease Reit – Under-appreciated reit; yields >7% per annum! (3 Jul 23)

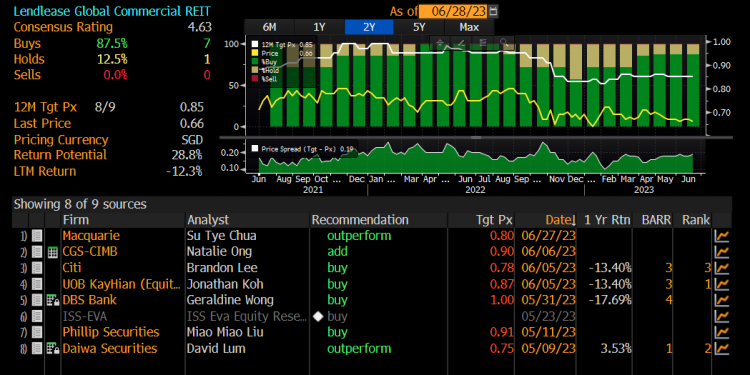

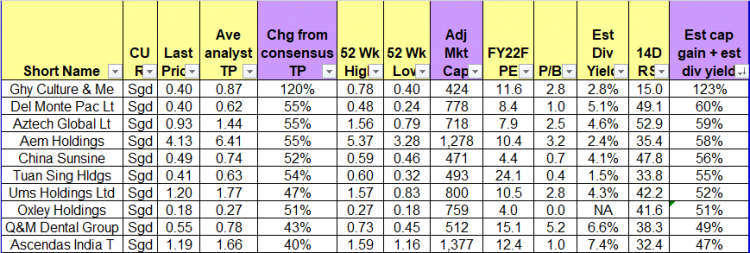

Dear all Lendlease Reit (“Lendlease”) caught my attention as according to consensus, it offers a potential dividend yield of around 7.1% in each of FY23F and FY24F (financial year ends in June). Furthermore, 7 analysts have rated Lendlease a buy with average analyst target price $0.85, representing a potential capital appreciation of around 28.8%. Lendlease closed at $0.660 on 30 Jun 2023. For a reit, such returns, if they indeed materialise, are rather substantial. As such, this leads me to dig deeper into the reit. Last month, I am fortunate to meet Mr Kelvin Chow, CEO of Lendlease Global Commercial […]