Two charts – Lendlease Reit and Manulife US Reit caught my attention (11 Jul 23)

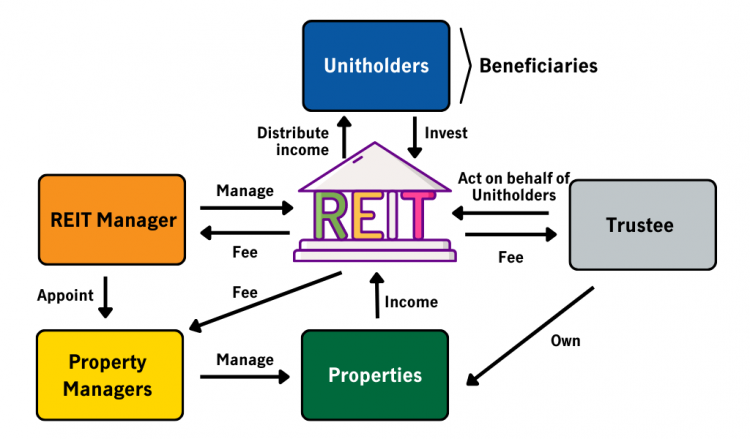

Dear all, Based on my personal reading, since a couple of months ago, investor interest seems to be gradually rotating back into the reit sector. Several reits have caught my attention. For this write-up, I will focus on Lendlease Reit and Manulife US Reit. 1) Lendlease Reit closed $0.660 With reference to my write-up on Lendlease Reit dated 3 Jul 2023 (click HERE), I have compiled my key takeaways from my 1-1 meeting with Lendlease Reit’s management and from what I gather from the various analyst reports and my other readings into this write-up. As such, I will not be […]