On 6 Nov 2019, I posted an article (using data as of 5 Nov) on my blog with regard to two stocks, namely ISOTeam and Sunpower (click HERE) for their potential bullish chart developments amid volume expansion. ISOTeam touched an intraday high of $0.250 last Friday and Sunpower traded to an intraday high of $0.600 on 18 Nov 2019 as compared to $0.240 for ISOTeam and $0.525 for Sunpower at the time of my write-up. Since then, Sunpower has seen some significant profit taking and touched an intraday low $0.510 on 21 Nov. For Sunpower, I have taken profit when it went up and have recently bought back on weakness. Same goes for Unusual where I have taken profit and have since bought back on weakness.

What is so interesting about Sunpower and Unusual now? Let’s take a look at the chart aspects and other noteworthy points.

1. Sunpower –Bullish chart underpinned by rising EMAs and volume

Bullish chart underpinned by rising EMAs and volume

Based on Chart 1 below, Sunpower has been trading in a multi month trading range $0.415 – 0.525 since 23 May 2019. After breaking out of its resistance $0.525 in early Nov, it surged to an intraday high of $0.600 on 18 Nov 2019 before profit taking set in. Personally, I like the fact that the stock has rebounded from its resistance turned support area $0.525 and closed at $0.550 on 26 Nov. Yesterday was T+6 of the sharp jump on 18 Nov 2019 and I believe most contra players should have already exited. ADX closed at 32.9, amid positively placed DI. All the exponential moving averages (“EMAs”) are rising, indicative of an uptrend, with golden cross formations. Volume has been picking up recently with the price increase. RSI closed at 57.8 on 26 Nov. A sustained break above $0.525 points to an eventual technical measured target of around $0.635.

Near term supports: $0.535 / 0.525 / 0.510 / 0.500

Near term resistances: $0.570 / 0.600 – 0.605 / 0.620

My personal view is that Sunpower’s chart looks positive and it is likely that the next push should be able to clear $0.600 over time.

Chart 1: Bullish chart underpinned by rising EMAs and strengthening indicators

Source: InvestingNote 26 Nov 2019

Other interesting aspects of Sunpower

A) Excellent set of 3QFY19 and 9MFY19 results till date

9MFY19 revenue and net profit (without the effects of convertible bonds and warrants) jumped 13% and 47% respectively to RMB2.2b and RMB189.9m respectively. In fact, Sunpower has been delivering good results on a quarterly basis. For those readers who emphasise more on fundamentals for stock selection, they can consider take a closer look at Sunpower.

B) 4QFY19 is the usual peak quarter and FY19 net profit may be >=RMB300m

Based on my pure observation, Sunpower’s FY19 net profit should meet UOB estimates of RMB300m as its 9MFY19 is already at RMB190m. 4Q is typically the strongest quarter for both Sunpower’s M&S and GI business segments. Last year, 4QFY18 makes up approximately 52% of entire FY18 net profit. Even if 4QFY19F can make up 40% of entire FY19 net profit (due to prudence and a larger base), based on current information, it is likely to be enough to meet / exceed UOB Kayhian estimates.

C) Investment community may take note of this in due course

Sunpower is currently only actively covered by UOB Kayhian. Assuming it continues to deliver on results, it should get some attention from the investment community in due course and perhaps some additional initiation reports. You can view Sunpower’s analyst reports HERE.

Risks

Some of the possible risk factors include but not limited to are a broad market selloff; project execution risk; M&A risk; S chip risk; higher leverage from expansion; forex risk, subjectivity of chart etc.

2. Unusual – bullish chart as interest picks up

Since my write-up on Unusual (done on 4 Nov and posted on 5 Nov – see HERE), Unusual has appreciated 15% from $0.275 on 4 Nov to an intraday high of $0.315 on 13 Nov and 20 Nov. It has also seen a strong pickup in average 30 day volume from 267K / day to 2.6m / day. After I mentioned on 19 Nov (to my clients) that Unusual’s profit taking seemed to be ending, Unusual jumped from an intraday low of $0.285 to touch an intraday high $0.315 on 20 Nov which was coincidentally the target level around $0.320 indicated on my 5 Nov write-up.

Yesterday marked the 4th to 5th day of the relatively large swing seen on 19 and 20 Nov, thus most contra players might have already exited to some extent. From a chart perspective, there might be a mini double bottom formation around $0.245 – 0.290. Stock has appreciated above $0.290 and touched an intraday high $0.315 before profit taking set in. It is now testing the resistance turned support area around $0.290 and closed at $0.280 yesterday. ADX closed at 34.4 amid positively placed DI on 26 Nov 19. RSI closed at 46.9.

Near term supports: $0.280 / 0.275 / 0.270 / 0.260

Near term resistances: $0.290 / 0.300 / 0.310 / 0.320

My personal view is that odds are likely that Unusual may rebound off this resistance turned support $0.290 over time. A sustained breach above $0.290 with volume expansion points to an eventual technical target $0.335. This is an eventual technical measured target and may not be reached immediately.

Nevertheless, it is noteworthy that Unusual’s long term EMAs are still sliding, though the rate of decline is decreasing. i.e. in terms of chart, Sunpower’s chart looks stronger than Unusual for now.

Chart 2: Unusual – profit taking may end soon

Source: InvestingNote 26 Nov 2019

Other interesting aspects of Unusual

A) Investment community starts to pay attention

Since my write-up on Unusual (done on 4 Nov and posted on 5 Nov – see HERE), Unusual has seen a strong pickup in average 30 day volume from 267K / day to 2.6m / day. The strong pickup in volume is likely attributed to Unusual’s strong results and positive reports from brokers. UOB Kayhian recently initiated with a buy call and target price of $0.440 last week (RHB’s target price is $0.420). Furthermore, RHB has also mentioned Unusual a few times in the papers. It is good that Unusual is getting more interest from the investment community which should help its share price, if it continues to deliver good results.

B) Excellent 2QFY20 results with a possibly even better 3Q!

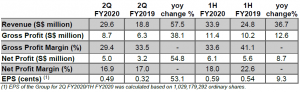

Based on Table 1 below, Unusual has posted a sterling set of results in its latest quarterly results. Notwithstanding a quiet 1QFY20, 1HFY20 revenue and net profit made up for lost ground by posting 37% and 9% growth to $34m and $6m respectively. RHB expects 3QFY20F to be even stronger, judging from their pipeline of shows. U can view the analyst reports HERE.

Table 1: Solid set of results

Source: Company

Risk factors

Some of the possible risk factors include but not limited to a broad market selloff; usual business risks such as cancellation or postponement of concerts; accidents; subjectivity of chart etc.

Conclusion

The above is written on the basis of technical chart. To my best effort, I have included in some updates for Unusual and Sunpower so as to give you more information. Do note that as I am a full time remisier, I can change my trading plan fast to capitalize on the markets’ movements (I am not the buy and hold kind). Furthermore, I wish to emphasise that I do not know whether the aforementioned stocks will drop or rebound. As everybody is different in terms of their percentage invested, returns expectation, risk profile, investment horizon, personal market outlook etc., do exercise your independent judgement and make your own independent decisions.

P.S: I have already notified my clients to take note of Sunpower and Unusual when they were trading around $0.520-0.525 and $0.280-0.290 respectively. I am vested in both for trading purposes only.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

I’ve seen other bloggers have more than one image per post, but the templates blogspot only allows one image per post. Does anyone know the .html or is there something else I have to do to get multiple images?.