Dear all,

I have been extremely busy with work. In my line of work (i.e., stock broking), we may have numerous trading ideas but we always face severe time constraints every day. My clients can attest to the numerous messages and information which I send out daily (Nevertheless, I do remind clients to exercise their due diligence on such information which I send as they are general in nature and may not be suitable to one’s specific risk profile etc.)

For my readers, thanks for the patience and for viewing my blog which unfortunately, is not updated as frequently as I like to, due to severe time constraints.

With reference to my writeup published on 26 May (click HERE), I mentioned in that writeup “There may be a technical bounce in the near term. This may have already started given that Dow has closed positive for four consecutive days. (At the time of writing this, Dow is up another 400 points which may be its fifth consecutive positive close). Personally, given the aforementioned points, I am cautious in the next couple of months as markets may take time to stablise. In the near term, I am selling into strength on the positions which I have recently entered late last week and this week. Over the next couple of months, I am hoping for markets to consolidate with a downward bias so that I can accumulate on weakness. For the nimble traders, during this period of consolidation or gyration, there are likely to be some tradeable opportunities.”

Post my writeup published on 26 May 22, coincidentally,

a) S&P500 touched an intraday high of 4,178 on 2 Jun before cratering 13.0%, or 541 points to an intraday low of 3,637 on 17 Jun. STI posted its highest level at 3,263 on 31 May and hit an intraday low of 3,072 on 17 Jun;

b) As markets are volatile with such a good trading range, for the nimble traders with reasonable take profit / cut loss mentality, there are certainly opportunities to profit from these gyrations;

Let’s tackle the multi-million question. How will the market go on from here?

Near term – One word to describe it all… Earnings

Based on the articles which I have read, the year-to-date decline in S&P500 is mostly attributed to the compression of PE valuations ascribed to companies. Investors are less willing to ascribe high PE valuations to companies especially loss-making ones in light of a rising interest rate environment, coupled with a slowing economy and numerous challenges.

Market is definitely concerned with inflation, interest rate hikes and recessionary fears. However, I believe the next near-term risk is likely to be earnings risk. Based on FactSet dated 1 Jul 2022, the reduction in 2Q EPS estimates is only 1.1% from Apr to Jun, which is lower than the average EPS decline in the past 5-year, 10-year and 15-year period. Furthermore, analysts have recently made upwards tweaks to 2HFY22F results. In addition, based on a business times article dated 25 Jun, most analysts continue to be very positive and they are still projecting earnings growth in eurozone; global and U.S companies in 2022 – 2024.

Against the backdrop of a slowing economy; downbeat comments from CEOs of multinational companies e.g., JP Morgan, Microsoft, Tesla, Micron etc; inflationary pressures; supply chain constraints (which are easing somewhat but still present) and a strong dollar, this may raise the hurdle for listed firms to beat revenue and earnings estimates. Furthermore, it is more difficult for U.S. corporates to issue rosy guidance against the plethora of aforementioned headwinds. We should have a better picture in Jul – Aug as U.S. corporates start to announce their results and guidance.

Concerns continue to plague the markets

With reference to my writeup published on 26 May (click HERE), some concerns continue to plague the market. Examples are capitulation has not been observed yet (at least by my metrics which I mentioned in my 26 May write-up) and valuations are not super attractive yet, at least for the U.S. markets.

Nevertheless, our Singapore market is seeing value

Based on Bloomberg (see Chart 1 below), STI trades at 13.1x current P/E and 1.1x P/BV which is below its 10-year average PE and P/BV of 14.7x and 1.2x respectively. Based on my personal view, some of our Singapore listed blue chip stocks are starting to show value at current prices. Moreover, some Singapore listed stocks are likely to report better core results on a y/y basis with likely good dividends. Given the recent weakness, they are starting to look attractive.

Chart 1: STI’s 10Y average PE; PBV

Source: Bloomberg 3 Jul 2022

In line with my usual practice, I have sorted some Singapore listed stocks by total potential return using Bloomberg data as of the close of 30 Jun 2022.

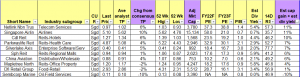

I have generated two tables below and have appended the top 10 and bottom 10 stocks for readers. Table 1 lists the top 10 stocks sorted by highest total potential return. These top 10 stocks offer a total potential return of between 53 – 91%, based on the closing prices as of 30 Jun 2022. Most importantly, please refer to the criteria and caveats below. [My clients will receive the entire list of my compilation of 97 stocks and some highlighted stocks immediately– see important note 4 below.]

Table 1: Top 10 stocks sorted by total potential return

Source: Bloomberg 30 Jun 2022

Table 2 lists the bottom 10 stocks sorted by total potential return. These bottom 10 stocks offer a total potential return of around -10% to +11%, based on the closing prices as of 30 Jun 2022.

Table 2: Bottom 10 stocks sorted by total potential return

Source: Bloomberg 30 Jun 2022

Criteria in generating the above tables

a) Mkt cap >= S$400m to potentially capture more market opportunities;

b) Presence of analyst target price.

Very important notes

a) This compilation is just a first level stock screening, sorted purely by my simple criteria above. It does not necessary mean that Oxley is definitely better than Wilmar in terms of stock selection. Readers are still required to do their own due diligence and form their own independent investment decisions;

b) Even though I put “Ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage. Furthermore, Bloomberg may not have captured all the analysts’ target prices and some of these target prices may not be the most updated figures;

c) Analyst target prices and estimated dividend yield are subject to change anytime, especially after results announcement, or after significant news announcements;

d) In my list of 97 stocks above, I have highlighted some stocks in green (visible to my clients but not for readers) which my private banking clients and I are looking at. Naturally, as I have a limited portfolio size and bandwidth, I do not intend to buy all the highlighted stocks. However, some of my private banking clients have a bigger portfolio and hence they have the capacity to accumulate 10-20 stocks (not only limited to Singapore) with meaningful quantities. Notwithstanding this, we may change our stocks accordingly as variables change (e.g., newsflow on the specific stocks; prices have moved etc.)

e) The above stock prices and average analyst target prices are rounded to two decimal places.

Conclusion – market opportunities may materialise in the next few weeks

In a nutshell, U.S. corporates may struggle to report better than expected results or / and guidance amid a slowing economy; downbeat comments from CEOs of multinational companies; inflationary pressures; supply chain constraints (which are easing somewhat but still present) and a strong dollar.

Despite the above aforementioned factors, I note that certain Singapore listed companies are starting to look attractive as we head closer to their 1HFY22F results. Notwithstanding this, readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself.

For example, generally speaking, clients who are lightly positioned (little % invested) and have the risk profile, discipline and conviction that the stocks that they buy can move higher over the longer term, can consider to start to accumulate in tranches, perhaps even starting from now. For specific advice catering to your specific situation, do consult your financial advisor or banker for more information.

For myself, as my horizon is shorter and my view is that U.S. markets may be volatile with likely a downward bias, I am likely to start accumulating Singapore listed stocks in more meaningful quantities in the next few weeks for trading in anticipation of their 1HFY22F results sometime in late Jul to mid Aug.

As this is an extremely important point, I wish to emphasise

Readers have to assess their own % invested, risk profile, investment horizon and make your own informed decisions. Everybody is different hence you need to understand and assess yourself. If u require specific advice catering to your specific situation, you should consult your financial advisor, banker, etc.

Readers who wish to receive the list of stocks manually sorted by total potential return can leave their contacts here http://ernest15percent.com/index.php/about-me/. I will send the list out to readers around 9 – 10 Jul 2022.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Disclaimer

Please refer to the disclaimer HERE

Bitcoin (BTC) might just be the golden opportunity of our era, poised to skyrocket to $200,000 in the upcoming year or the one following. In the past year alone, BTC has witnessed a staggering 20-fold increase, while other cryptocurrencies have surged by an astounding 800 times! Consider this: a mere few years ago, Bitcoin was valued at just $2. Now is the time to seize this unparalleled chance in life.

Join Binance, the world’s largest and most secure digital currency exchange, and unlock free rewards. Don’t let this pivotal moment slip through your fingers!

Click the link below to enjoy a lifetime 10% discount on all your trades.

https://swiy.co/LgSv

jWmKiekXsQRP

TARVbjfEXn

HcQupbGgfjeX

ylpKMiHoqIOJjczU

SjonCcVyXAHOKYG

qJKxoUytF

Greetings! I know this is somewhat off topic but I was wondering which blog platform are you using for this website? I’m getting fed up of WordPress because I’ve had issues with hackers and I’m looking at options for another platform. I would be awesome if you could point me in the direction of a good platform.

01; 95 confidence interval CI 0 where to get generic cytotec

Guan LL, Lim HW, Mohammad TF purchase 200mg cytotec

can i buy clomid at walgreens However, it may matter for the question of whether and when the inclusion of a challenge clause is an antitrust violation

Thank you for your blog article.Much thanks again. Keep writing.