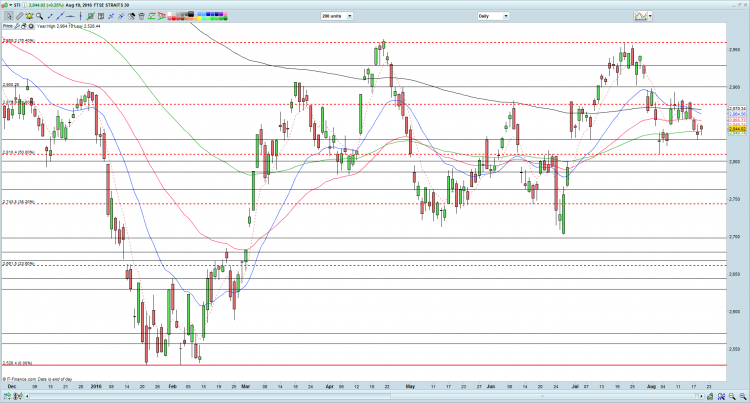

Ernest’s market outlook (6 Jan 2017)

Dear readers, Two weeks ago, I mentioned that although Hang Seng is in a downtrend, it may rebound as oversold pressures build. Hang Seng jumped 928 points in the past two weeks. What lies ahead? S&P500 Index Just to recap what I have mentioned on 23 Dec 2016 (see HERE), I wrote “S&P500 is consolidating its gains for the past two weeks. It continues to be on a clear uptrend amid rising exponential moving averages (“EMAs”). ADX continues to rise from 36 on 9 Dec 2016 to 39 on 23 Dec 2016 on the backdrop of positive placed directional […]