Yangzijiang (“YZJ”) has weakened approximately 13% from $1.11 on 13 Jan 2021 to close $0.970 on 5 Feb 2021. It has significantly underperformed STI (STI only dropped around 3% over the same period) and is the top STI constituent stocks with the highest potential return (see HERE).

Why is it interesting? Read on for more…

Interesting points on YZJ

a) Orders are likely to improve in FY21F

Based on DBS Research 3 Dec 2020 report, the surge in China (Export) Containerized Freight Index (highest since Mar 2015) and the tripling of the Baltic Dry Index may prompt ship owners to start ordering newbuild orders for containerships and bulk carriers. Such orders may have been postponed due to Covid and the implementation of International Maritime Organisation 2020.

b) Citigroup is even more bullish and predicts a slew of orders in the next three months

Citigroup (cited by Dow Jones, 25 Jan 21) is positive on container lines, especially for 1HFY21. The strong demand vs supply situation is mainly attributed to high spot freight rates due to inventory stocking, tight supply, low base effect in 2020 and possible increase in global container volumes. Citigroup predicts that YZJ may have some positive catalysts by April and raises the stock’s target price from $1.35 to S$1.40.

According to Xinde Marine News and TradeWinds dated 5 and 4 Feb 2021 respectively, ZhongGu Logistics has just ordered 10 panamax boxships worth US$350m with YZJ. If this is accurate, it is a good start to YZJ’s 2021.

Besides ZhongGu Logistics, on the new orders’ front, German container line Hapag Lloyd, in its 8 Dec 2020 is talking to numerous shipyards and a decision on newbuilds may be expected in the next six months. Although Hapag Lloyd may not order from YZJ, this still bodes well to the entire shipbuilding industry.

c) Laggard share price vis-a-vis shipbuilding and shipping industry peers

CLSA in its 8 Dec 2020 report notes that shipbuilders such as Samsung Heavy Industries (-4%) and Daewoo Shipbuilding (+1%) have outperformed YZJ (-17%). CLSA observes share prices across both sectors began to soar from late October. Since late Oct, YZJ has merely appreciated from $0.905 on 30 Oct 20 to close $0.970 on 5 Feb 2021.

d) Most analysts believe YZJ should be able to comfortably give $0.04 – 0.045 dividends in FY20F

Most analysts believe YZJ should be able to dish out dividends amounting to at least S$0.04 / share in FY20F. They base their projections on YZJ’s investment income, coupled with an approximate net cash of $0.23 / share. If I assume YZJ to give $0.045 dividend per share (same as FY19), this works out to be around 4.6% dividend yield.

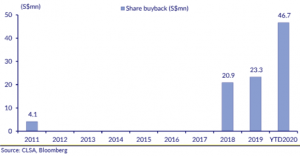

e) Share price typically bottoms after share buybacks – Massive $45m share buyback in 4Q is positive

Based on Chart 1 below, YZJ has spent approx. $46.7m on share buybacks from start of 2020 through 8 Dec 2020. According to UOB Kayhian, $45m was spent in 4QFY20 (just one quarter) alone for share buybacks! This is the largest record amount spent on share buybacks since 2011.

Based on a DBS Research report, they observe that YZJ’s share price typically bottoms a few months after the share buybacks. They base their observation with two examples in 2018 and 2019. In 2018, YZJ purchased shares after its share price dipped to around $0.90. In 2019, YZJ started accumulating its shares post a share price slump on concerns over the company’s ex-Chairman (Mr Ren Yuanlin) assisting in investigations on a former government official.

Chart 1: YZJ share buyback from 2011 to 8 Dec 2020

f) 4Q20F results may be strong

Based on UOB Kayhian 4 Jan 2021 report, they postulate that YZJ’s 4QFY20F results may be strong on the following reasons. Firstly, YZJ’s new order wins peak in 4Q at nearly US$1b. Secondly, there may be a tax writeback approximately RMB100m as YZJ’s new shipyard may qualify as a “New High-Tech Enterprise”, with a lower tax rate of 15% vs the current 25% tax rate. Thirdly, the massive share buyback in 4Q may signal management’s confidence of its FY20F results and guidance in 2021.

g) Cheap valuations – shipbuilding business is almost free

Based on Bloomberg, YZJ trades at 0.53x FY21F P/BV and 7.0x FY21F PE. Based on 3QFY20 results, if we sum its net cash position and the current portion of its debt investments of Rmb13.6b, this equates to approximately $3.7b which is equivalent to its current market capitalisation of around $3.7b. In other words, investors are getting its shipbuilding business (order book worth US$2.4b as of 30 Sep 2020) almost free.

h) Analysts remain positive with an average target price $1.22

Based on Bloomberg, most analysts are positive on YZJ with an average target price of $1.22. Coupled with an estimated FY20F dividend yield of around 4.6%, total potential return is around 30%. In fact, based on sginvestors.io website, YZJ is the top STI constituent stocks with the highest potential return (see HERE). Readers can also refer to YZJ’s analyst reports HERE.

Figure 1: Analysts are broadly positive with average target $1.22; 26% potential capital upside

Source: Bloomberg

Potential risk factors

It is noteworthy that I have only outlined some of the risks that readers should be aware. They are by no means the only risks.

a) Revenue is denominated mainly in USD

Based on DBS Research’s estimates, every 1% USD depreciation could result in a 1.5% drop in profit on 50% unhedged net exposure. Every 1% increase in steel cost (20% of COGS), may lead to a 0.8% drop in profit.

b) Slower than expected order wins and order cancellations;

A slower than expected order wins or / and a deterioration in the macro environment (resulting in less orders clinched or / and orders being cancelled, and less investment appetite on YZJ’s shares) are likely to have some adverse effect on YZJ.

c) Credit risks in its large debt investments portfolio

Based on 3QFY20 statements, YZJ’s total debt investments amount to around RMB16.2b with Rmb13.6b (84% of total) as current and the balance being non-current in its debt investment portfolio. Although management cites “no significant increase in risk” in its debt investment portfolio as almost all its investments are collateralised (DBS Research notes that most of YZJ’s investments are backed by collateral of 1.5-2.5x) and YZJ has not seen any deterioration of its coverage ratios, there is still a risk. Any spike in credit risks in its debt investment portfolio may have an adverse impact on YZJ.

d) Lesser than usual dividends

YZJ has typically dished out good dividends to shareholders. From 2016 to 2019, YZJ has given out dividends ranging from $0.040 – $0.050 / share. A “lesser than usual” dividend per share, if materialise, may have some negative “signalling effect”.

e) Chart is mixed

The recent drop since 27 Jan 2021 is accompanied with volume. Short term exponential moving averages (EMAs) have turned down with death cross formation. In the short term, it looks weak but over the long term, YZJ is still on an uptrend with an important support at $0.940. A sustained breach below $0.940 with volume expansion is bearish for the chart. Conversely, a sustained breach above $1.03 with volume expansion is bullish.

Near term supports: $0.960 / 0.940 / 0.920

Near term resistances: $0.985 – 0.990 / 1.02 / 1.04 – 1.05

Chart 2: YZJ’s selling pressure seems strong but support at $0.940 – 0.980 seems strong too

Source: InvestingNote 5 Feb 2021

f) Regulatory risk

It is noteworthy that there are always risks operating in China, especially on the regulatory front. A case in point was in 2019 where YZJ’s ex-Chairman Mr Ren Yuanlin was called on to assist in investigations on a former government official. Even Jack Ma, the billionaire founder of fintech giant Ant Group Co. Ltd was not sparred by “regulatory risk” in China.

Conclusion

Personally, I find YZJ interesting on a brighter outlook on its industry; extremely cheap valuations; good dividends and positive analyst reports. However, it is noteworthy that raw material price increase; a drop in US$; slower than expected order wins and regulatory risks are some of the potential risks that investors have to contend with.

As usual, as everybody is different, readers are advised to do their own research and exercise their own independent judgement.

P.S: I have informed my clients to take a look at YZJ on 1 Feb & 5 Feb. I am vested.

Disclaimer

Please refer to the disclaimer HERE

Fullhdfilmizle ile Full HD film izle deneyimi sizlerle! Türkçe dublaj ve Altyazı arşivimizle 1080p kalite kesintisiz film izleme sitesinin tadını çıkar! Toney Pavon

Wow that was odd. I just wrote an very long comment but after I clicked submit my comment didn’t show up.Grrrr… well I’m not writing all that over again. Anyways, justwanted to say great blog!

Fullhdfilmizlesene ile en yeni vizyon filmler Full HD ve ücretsiz film sizlerle. Orijinal film arşivimizle en kaliteli film izle fırsatı sunuyoruz. Ethan Fehrenbach

Fullhdfilmizlesene ile en yeni vizyon filmler Full HD ve ücretsiz film sizlerle. Orijinal film arşivimizle en kaliteli film izle fırsatı sunuyoruz. Patrick Eye

Film izle, jetfilmizle internetin en hızlı ve güvenilir film, sinema izleme platformudur. Binlerce film seçeneğiyle her zevke uygun filmleri Full HD kalitesinde sunar. Jacques Stahmer