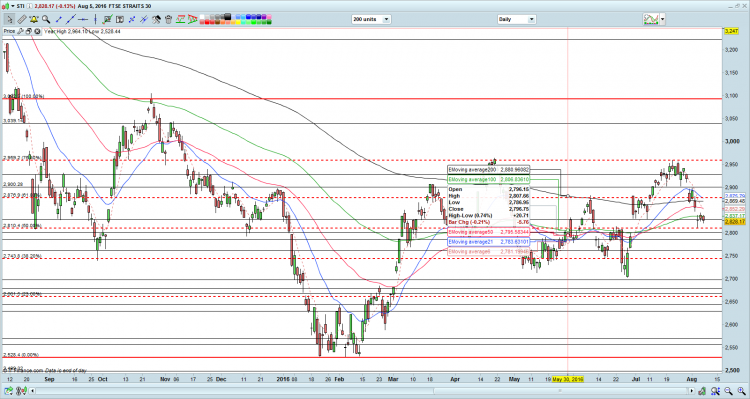

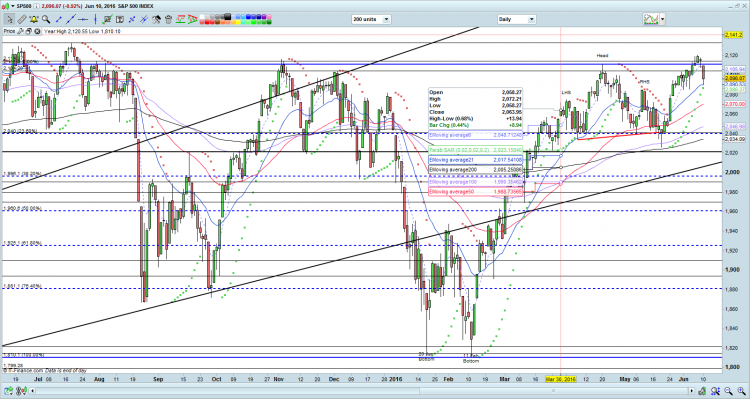

Ernest’s market outlook (14 Oct 16)

Dear readers, Although my market outlook is a biweekly issue, the technical outlook for some technical indices has deteriorated and I view it timely to update my clients. See below. S&P500 Index Just to recap what I have mentioned on 7 Oct 2016 (see HERE), I wrote “all the exponential moving averages (“EMAs) are converging and trending higher. ADX has slipped from 22 on 23 Sep 2016 to 20 on 7 Oct 2016, indicative of a lack of trend. Indicators are neutral and stuck in a range. Although the trend continues to be an uptrend until proven otherwise, my […]