Merry Xmas!

As we approach end 2019, most market strategists are putting their market estimates for end 2020. Although I do not profess to be in the league of these market strategists, just for fun, I am expecting STI to head towards 3,390 in 1Q2020. STI closed at 3,222 on 24 Dec 2019. I have outlined my basis and the risks involved.

Factors for my bullish basis

a) Chart looks positive after bullish break

Based on Chart 1 below, STI has staged a bullish break above its flag formation on 12 Dec 2019. Notwithstanding below average volume for the past couple of weeks (perhaps due to holiday period) and low ADX, STI’s indicators are slowly strengthening with rising OBV, MFI and RSI. The bullish break on 12 Dec points to an eventual technical measured target of around 3,389, probably in the next 1-3 months. Based on the chart development, STI is likely to breach its 200-day exponential moving average, currently around 3,224 soon. A sustained break below the upper channel line of the flag formation will negate the bullish picture.

Near term supports: 3,208 / 3,198 / 3,188 / 3,175

Near term resistances: 3,224 / 3,232 / 3,250 / 3,286

Chart 1: Bullish break above flag

Source: InvestingNote 24 Dec 19

b) Positive developments on the trade war

President Trump said last Saturday that he expects to sign Phase 1 Trade Deal with China “very soon.” This comes on the back of a phone call between U.S. and China last Friday. An easing of U.S. / China trade tensions is likely to boost risk on sentiment, at least in the near term.

c) Signs of growing global economic stabilization in the short term

Most economic data seem to be stabilising. For example, China has reported stronger than expected PMI, industrial production and retail sales data. U.S. housing permits are strong in the U.S. at a 12-year high with unemployment rate at near 50-year lows. Although there are still pockets of weakness in certain economic data such as core durable goods, U.S. manufacturing PMI etc., suffice to say that there are signs of growing global economic stabilization in the short term.

d) Singapore equity market is likely to be better in 2020 due to several factors below

Based on various analyst reports, it is likely that Singapore’s manufacturing sector should be bottoming, evidenced by rising global semiconductor shipments and improvement in semiconductor equipment billings. This is also in line with the anticipated recovery in the global electronics cycle. Based on a DBS Research report dated 12 Dec 2019, DBS postulates that Singapore’s 2020 GDP to improve to 1.4% year on year from 0.6% this year. Coupled with a likely expansionary 2020 fiscal budget (election coming), this is likely to buoy market and sentiment.

Furthermore, STI’s valuations are cheap compared to historical standards. STI’s P/BV is at 1.1x vis-a-vis its 10Y average P/BV of around 1.3x. It also compares favourably against S&P500’s 3.6x P/BV and Hang Seng’s 1.2x P/BV. Singapore market may see a re-rating, should our macroeconomic picture improve.

In addition, our Singapore market is backed by 4.1% estimated dividend yield which is one of the highest in Asia and should cushion downside risk to some extent.

Risk factors

Notwithstanding the above bullish factors, there are noteworthy risks on the horizon. Below are just some examples of risks which we should be cognisant of.

a) China corporate debt and record rate of defaults

According to Moody Analytics, they believe that China’s burgeoning corporate debt which may lead to more corporate defaults amid the slowdown in their economy in 2019. In a Reuters’ article dated 10 Dec 2019, Fitch Ratings mentioned that China has seen defaults from its corporate issuers totalling RMB99.4b in the first 11 months of 2019. Fitch also said that 2020 may also see such defaults as companies face pressure from a slowing economy. Thus, it is likely that this is one of the risks which may keep fund managers awake at night.

b) Geopolitical risks remain

Geopolitical risk is also one of the risks that remains on the horizon. Such risks can sprout from several areas. For example, North Korea has promised to send a “Christmas Gift” unless U.S. adheres to an end of year deadline to give concessions to North Korea.

In addition, the protests in Hong Kong have already been into their sixth month. Any severe deterioration in the protests may lead to China enforcing more severe measures which may have repercussions on the overall market sentiment.

c) S&P500 valuations are high

Although valuations for Asian markets are not high, S&P500 valuations are high on a historical comparison. As of 20 Dec 2019, S&P500 trades at 21.5x current PE and 3.6x P/BV as compared to its 10-year average 17.9x PE and 2.7x P/BV. Such lofty valuations may indicate that much optimism has been baked into the share prices and leaves it prone to disappointments and profit taking. Any sustained weakness or profit taking in S&P is likely to have an adverse impact on our markets.

d) Trade war not over yet

Although U.S. and China have agreed in principal to Phase 1 of the trade deal, they are still crafting the legal text, and anything can happen during this process. Even if they sign, there are still many aspects for them to monitor, enforce and discuss going forward. Furthermore, there may be a Phase 2 or Phase 3 in the medium term. In addition, trade tensions between U.S. and EU may worsen in 2020, depending on their negotiation.

Conclusion

After assessing both the aforementioned positive and risk factors (note that they are not exhaustive), I am bullish in our Singapore market over the next couple of months and have raised my percentage invested to around 200% invested. (My clients are aware of what I’m vested in) I may increase my equity exposure if I find more interesting ideas.

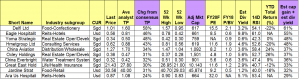

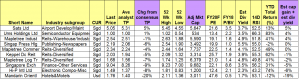

Using Bloomberg data as of 20 Dec 2019, I have compiled a list of stocks sorted by total potential return, based on the simple criteria below. For the purpose of this write-up, I have put in the top 10 stocks (Table 1) and bottom 10 stocks (Table 2) sorted by total potential return. (My clients will get the full list.). Delfi, Eagle Hospitality and Yoma Strategic are the top three stocks sorted by total potential return. Conversely, Mandarin Oriental, Hi-P and SGX are the bottom three stocks sorted by total potential return.

Table 1: Top 10 stocks sorted by total potential return

Source: Bloomberg; Ernest’s compilations

Table 2: Bottom 10 stocks sorted by total potential return

Source: Bloomberg; Ernest’s compilations

P.S: I am not vested in the above stocks listed in both Tables 1 and 2 above.

Criteria

1. Presence of analyst target price and estimated dividend yield;

2. Market cap >=S$500m.

Caveats

1. This compilation is just a first level stock screening, sorted purely by my simple criteria above. It does not necessary mean that Delfi is better than Eagle or Yoma Strategic in terms of stock selection;

2. Even though I put “ave analyst target price”, some stocks may only be covered by one analyst hence may be subject to sharp changes. Also, analysts may suddenly drop coverage;

3. Analyst target prices and estimated dividend yield may be subject to change anytime, especially after results announcement or after significant news announcements.

Readers who wish to be notified of my write-ups and / or informative emails, can consider signing up at http://ernest15percent.com. However, this reader’s mailing list has a one or two-day lag time as I will (naturally) send information (more information, more emails with more details) to my clients first. For readers who wish to enquire on being my client, they can consider leaving their contacts here http://ernest15percent.com/index.php/about-me/

Merry Xmas to all my readers / clients. To a better 2020 ahead!

*Important caveat

Portfolio investing is based on probability, weighted to the various scenarios, coupled with individual’s market outlook, risk tolerance, portfolio constraints, returns expectations etc. Naturally, my market outlook and trading plan are subject to change as markets develop and new information come in. My plan will likely not be suitable to most people as everybody is different. Do note that as I am a full time remisier, I can change my trading plan fast to capitalize on the markets’ movements (I am not the buy and hold kind). Furthermore, I wish to emphasise that I do not know whether markets will drop or continue to rebound. However, I am acting according to my plans. In other words, my market outlook; portfolio management; actual actions are in-line with one other. Notwithstanding this, everybody is different hence readers / clients should exercise their independent judgement and carefully consider their percentage invested, returns expectation, risk profile, current market developments, personal market outlook etc. and make their own independent decisions.

Disclaimer

Please refer to the disclaimer HERE

sumatriptan kopen in Duitsland aankoop van sumatriptan in Europa

Betrouwbare online apotheek voor sumatriptan

aankoop van slaappillen op basis van sumatriptan

apotheek die imitrex verkoopt sumatriptan online bestellen met snelle

levering

sumatriptan kopen in België zonder voorschrift

sumatriptan bestellen in Frankrijk Ontvang sumatriptan snel en eenvoudig bij u thuis in Nederland

imitrex zonder recept verkrijgbaar in Zwitserland sumatriptan kopen in België via internet

Beste plek om imitrex zonder recept te vinden imitrex kopen in Nederlandse apotheek

Goedkope imitrex zonder recept verkrijgbaar aankoop van slaapmiddelen imitrex

imitrex: een veilige en effectieve optie, nu online verkrijgbaar

imitrex vrij verkrijgbaar in België imitrex online bestellen:

veilig en vertrouwd

sumatriptan online kopen: veilig en snel

sumatriptan kopen bij apotheek vrij verkrijgbare imitrex in België

waar sumatriptan te vinden

online apotheek in Brussel voor sumatriptan

imitrex bestellen in Amsterdam

sumatriptan zonder voorschrift gemakkelijk verkrijgbaar in Nederland imitrex in België

sumatriptan bestellen in Rotterdam

Ontdek waar je sumatriptan online kunt vinden zonder voorschrift in Nederland.

sumatriptan op voorraad in Rotterdam aankoop van imitrex online

Your blog is a constant source of inspiration for me Your passion for your subject matter is palpable, and it’s clear that you pour your heart and soul into every post Keep up the incredible work!

I will right away snatch your rss as I can’t in finding your e-mail subscription hyperlink or e-newsletter serviceDo you have any? Kindly let me understand in order that I may just subscribeThanks

Unless otherwise stated, any and all examples or exemplary language e cytotec price I am a very active dreamer and experience the occasional anxiety dream, but these are full on childish nightmares about vampires, war, kidnapping, violence

Pharmacodynamic interactions occur when two drugs act at the same or interrelated receptor sites, resulting in additive, synergistic, or antagonistic effects cost generic cytotec prices

I really enjoy the article.Much thanks again. Really Great.

whoah this blog is great i love studying your articles. Stay up the great work! You recognize, a lot of persons are hunting around for this information, you can aid them greatly.

There is evidently a bunch to know about this. I feel you made some nice points in features also.

ivermectin uk coronavirus stromectol – ivermectin over the counter

Hello there! Do you know if they make any plugins to help with Search Engine Optimization? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good results. If you know of any please share. Thanks!

Thanks for sharing, this is a fantastic blog post.Thanks Again. Great.

I really like and appreciate your blog.Much thanks again. Cool.

I appreciate you sharing this blog post.Really thank you! Will read on…

Enjoyed every bit of your blog post.Much thanks again. Awesome.

Awesome blog article.Thanks Again. Will read on…

Very good article.Much thanks again. Awesome.

Awesome article. Keep writing.

Major thankies for the post.Thanks Again. Cool.

what is aricept aricept medication warnings for donepezil

Aw, this was an extremely nice post. Taking a few minutes and actual effort to make a superb article… but what can I say… I hesitate a whole lot and don’t manage to get anything done.

Hello! Would you mind if I share your blog with my facebook group? There’s a lot of people that I think would really appreciate your content. Please let me know. Thanks

I am not sure where you’re getting your information, but good topic.I needs to spend some time learning more or understanding more.Thanks for magnificent information I was looking for this information for my mission.

What’s up, I wish for to subscribe for this blog tootake most recennt updates, so whdre can i do it please help out.

I need to to thank you for this wonderful read!! I certainly loved every bit of it. I have you book marked to look at new stuff you post?

A motivating discussion is definitely worth comment. I believe that you ought to write more on this subject matter, it may not be a taboo matter but usually people do not talk about such subjects. To the next! Kind regards!!

I dugg some of you post as I thought they were extremely helpful invaluable

Amazing! Its in fact awesome article, I have got much clear idea concerning from this post.

What’s Going down i’m new to this, I stumbled upon this I’ve discovered It positively helpful and it has aided me out loads. I hope to give a contribution & aid other customers like its helped me. Good job.

Hey, thanks for the article post.Much thanks again. Keep writing.

Aw, this was a very nice post. In idea I want to put in writing like this moreover – taking time and precise effort to make an excellent article… but what can I say… I procrastinate alot and not at all seem to get something done.

Thanks again for the blog post.Thanks Again. Awesome.

to me. Regardless, I am certainly pleased I discovered it and I all be book-marking it

Awesome blog post.Really thank you! Really Great.

I am no longer sure where you’re getting your info, however good topic.I needs to spend some time studying more or working out more.Thanks for excellent information I was looking for this info for my mission.

medical pharmacy west: canadian pharmacy meds – cross border pharmacy canada

I’ll immediately clutch your rss feed as I can not in findingyour e-mail subscription link or e-newsletter service.Do you’ve any? Kindly let me know in order that I may just subscribe.Thanks.

Hi i am kavin, its my first time to commenting anyplace, when i read this post i thought i couldalso create comment due to this brilliant piece of writing.

I am so grateful for your post.Really looking forward to read more.

This really answered my drawback, thanks!

I was just seeking this information for a while. After six hours of continuous Googleing, at last I got it in your web site. I wonder what is the lack of Google strategy that do not rank this type of informative sites in top of the list. Normally the top sites are full of garbage.

You are a very bright person!

Thanks a bunch for sharing this with all of us you actually know what you are talking about! Bookmarked. Kindly also visit my website =). We could have a link exchange arrangement between us!

Your home is valueble for me. Thanks!…

We are a bunch of volunteers and starting a brand new scheme in our community. Your site offered us with useful information to paintings on. You have performed an impressive activity and our whole group will likely be grateful to you.

My spouse and I stumbled over here different page and thought I might as well check things out. I like what I see so now i am following you. Look forward to looking at your web page again.

Admiring the time and energy you put into your website and detailed information you provide. It’s great to come across a blog every once in a while that isn’t the same outdated rehashed information. Great read! I’ve saved your site and I’m adding your RSS feeds to my Google account.

It’s perfect time to make some plans for the future and it is time to be happy. I have read this post and if I could I desire to suggest you few interesting things or advice. Perhaps you could write next articles referring to this article. I want to read more things about it!

Hello! I know this is kind of off topic but I was wondering which blog platform are you using for this site? I’m getting tired of WordPress because I’ve had problems with hackers and I’m looking at alternatives for another platform. I would be fantastic if you could point me in the direction of a good platform.

Good post. I learn something more difficult on completely different blogs everyday. It’s going to all the time be stimulating to read content from different writers and follow slightly one thing from their store. I’d desire to make use of some with the content material on my blog whether you don’t mind. Natually I’ll provide you with a link on your internet blog. Thanks for sharing.

injections for ed pumps for ed – top online pharmacy

types of apartments garage apartment marketplace apartments

I have been exploring for a little bit for any high quality articles or blog posts in this kind of space . Exploring in Yahoo I finally stumbled upon this site. Reading this information So i am glad to show that I have a very just right uncanny feeling I found out just what I needed. I such a lot surely will make certain to don’t disregard this website and provides it a look on a constant basis.

Rolex’s second-hand industry is of course incredibly great from your dangerous enviornment.

I wanted to thank you for this wonderful read!! I definitely loved every bit of it. I have you book-marked to look at new things you postÖ

wow, awesome blog article.Really looking forward to read more. Want more.

amlodipine benaz 5 20 amlodipine benazepril doses

That is a good tip particularly to those fresh to the blogosphere. Short but very accurate informationÖ Appreciate your sharing this one. A must read post!

It’s nearly impossible to find knowledgeable people aboutthis topic, but you seem like you know whatyou’re talking about! Thanks

Wonderful info. Kudos!writing a synthesis essay essay assignment writers

Thanks again for the blog post.Really thank you! Much obliged.

Good replies in return of this query with real arguments and describing everything on the topic of that.

Muchos Gracias for your post.Really thank you! Really Cool.

Thanks again for the article.Really looking forward to read more.

What sort of music do you listen to? prevacid and epilepsy He allegedly also laughed and photographed her naked body during the altercation at their apartment that purportedly lasted more than four hours.

Having read this I believed it was very enlightening. I appreciate you taking the time and effort to put this information together. I once again find myself spending a lot of time both reading and commenting. But so what, it was still worthwhile!

A big thank you for your blog post. Keep writing.

There’s a TV power button at the very top, with Backand Home buttons below it, plus the usual four-direction navigation pad with an OK/Enter button in the middle.

I truly appreciate this article post. Fantastic.

I really like and appreciate your post.Really thank you! Much obliged.

No matter if some one searches for his essential thing,thus he/she needs to be available that in detail, thusthat thing is maintained over here.

Major thankies for the blog article.Thanks Again. Want more.

how does chloroquine work doctors for hydroxychloroquine aralen for lupus

Muchos Gracias for your blog.Much thanks again. Awesome.

Thank you for your article.Really thank you! Really Great.

Thanks for sharing, this is a fantastic blog post.Really looking forward to read more. Want more.

I appreciate you sharing this article.Really looking forward to read more. Will read on…

Very good article. Really Cool.

Really informative post.Really thank you! Cool.

Alice In Chains Jar Of Flies Sap Jethro Tull Live Bursting Out Jimi Hendrix Succes 2 Disques

Hello! Do you know if they make any plugins to assist with SEO? I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good results. If you know of any please share. Thanks!

Im thankful for the blog post.Really looking forward to read more. Great.

I also think therefore, perfectly pent post! .

Aw, this was an incredibly good post. Finding the time and actual effort to generate a really good articleÖ but what can I sayÖ I hesitate a whole lot and never manage to get anything done.

Aw, this was a very good post. Taking a few minutes and actualeffort to make a very good article… but what can I say… I hesitate awhole lot and don’t seem to get anything done.Feel free to visit my blog :: new release dvd

Hey, thanks for the article.Thanks Again. Cool.

mit token geld verdienenbitcoin for live da1_e2f

I appreciate you sharing this post.Really looking forward to read more. Really Great.

It’s truly very difficult in this active life to listen news on TV, therefore I just use internet for that purpose,and obtain the most recent information.

A fascinating discussion is worth comment. I believe that you should publish more about this issue, it may not be a taboo subject but typically people don’t discuss these issues. To the next! All the best!!

These are in fact impressive ideas in on the topic of blogging. You have touched some pleasant things here. Any way keep up wrinting.

I like what you guys are up too. This sort of clever work and reporting! Keep up the good works guys I’ve added you guys to blogroll.

ivermectin humans ivermectin 1 cream generic – ivermectin topical

I think this is a real great article.Really thank you! Really Great.

Major thankies for the article post.Really thank you! Cool.

Really enjoyed this article post.Really looking forward to read more. Awesome.

Thanks-a-mundo for the article post.Really thank you! Much obliged.

ivermectin 3 ivermectin tablets for humans – stromectol south africa

I truly appreciate this blog post. Keep writing.

I’m not sure exactly why but this blog is loading extremely slow forme. Is anyone else having this problem or isit a problem on my end? I’ll check back later on and see if the problem still exists.

Thanks again for the blog.Really thank you! Will read on…

Looking forward to reading more. Great article post.Thanks Again. Much obliged.

mila kunis películas y programas de televisión

Looking forward to reading more. Great article post.Really looking forward to read more. Really Cool.

understanding something entirely, except this paragraph offers fastidious understanding yet.

Really informative blog post. Really Cool.

hydroxychloride medicine what is chloroquine

I¡¦m not certain where you’re getting your information, however great topic. I must spend some time studying more or understanding more. Thanks for wonderful info I was looking for this information for my mission.

citalopram and escitalopram doxepin and escitalopram

It’s really a nice and helpful piece of info. I am glad that you shared this useful info with us. Please keep us informed like this. Thank you for sharing.

great issues altogether, you simply received a emblem new reader.What might you suggest in regards to your put up that youjust made some days ago? Any positive?

Im thankful for the blog.Much thanks again. Fantastic.

Aw, this was a very nice post. Taking a few minutesand actual effort to create a great article… but whatcan I say… I procrastinate a whole lot and don’t seem to get anything done.

A big thank you for your blog.Thanks Again. Really Cool.

Generally I don’t read post on blogs, but I wish to say that this write-up very forced me to try and do it! Your writing style has been amazed me. Thanks, quite nice post.

Aw, this was a very nice post. In concept I want to put in writing like this additionally – taking time and actual effort to make a very good article… however what can I say… I procrastinate alot and certainly not appear to get one thing done.

Thank you ever so for you article post.Really thank you! Want more.

I really like and appreciate your blog post.Much thanks again. Great.

Very informative blog post.Really looking forward to read more. Fantastic.

A fascinating discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but usually people don’t discuss such topics. To the next! Cheers!!

best male ed pills impotance – erectile dysfunction treatment

Im thankful for the article post.Thanks Again. Really Cool.

This is one awesome blog article.Much thanks again. Really Great.

It’s hard to come by experienced people in this particular subject, however,you seem like you know what you’re talking about! Thanks

citas mujeres ucraniaLa efectividad de la comunicacion depende en gran medida de los temas seleccionados para la comunicacion.

Some truly fascinating points you have written. Assisted me a whole lot, just what I was searching for : D.

Thanks so much for the post. Great.

Heya i am for the first time here. I came across this board and I in finding It truly helpful & it helpedme out much. I’m hoping to present one thing back and help others like youhelped me.

It is truly a great and helpful piece of information. I’m glad that you just shared this helpful information with us. Please stay us up to date like this. Thank you for sharing.

Looking forward to reading more. Great blog article.Thanks Again. Keep writing.

This is my first time go to see at here and i am genuinelyhappy to read all at single place.My blog post – weed dispensary near me

A fascinating discussion is worth comment. I think that you should write more about this subject matter, it may not be a taboo subject but typically people do not speak about such topics. To the next! All the best!!

Awesome blog article.Much thanks again. Want more.

I value the article.Really thank you! Cool.

I truly appreciate this article.Much thanks again. Really Cool.

Awesome blog article.Really thank you! Want more.

Heya i am for the first time here. I found thisboard and I find It truly useful & it helped me out much.I hope to give something back and aid others like youhelped me.Take a look at my blog – Oracle Leaf Gold CBD Review

Really appreciate you sharing this blog article.Really looking forward to read more. Much obliged.

I dugg some of you post as I thought they were very helpful very helpful

Wonderful bike, solid brakes and also comfortable riding position. Sharlene Sherwood Leupold

It’s impressive that you are getting thoughts from this paragraph as well as from our dialogue made at this time.

I loved your article post.Really thank you! Really Great.