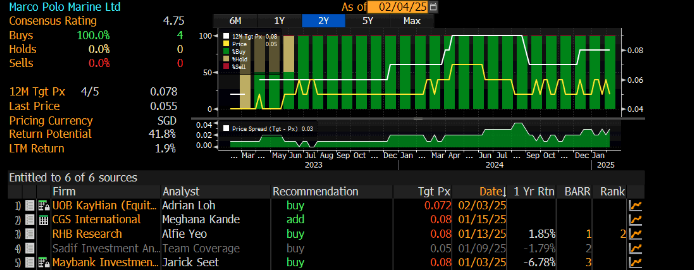

Marco Polo Marine – sailing on smoother seas ahead (5 Feb 25)

Dear all, Marco Polo Marine (MPM) has caught my attention. It closed at $0.055 on 5 Feb 2025. Read on as I outline the reasons that it has caught my eye. Firstly, what does MPM do? MPM, listed on the SGX-ST since 2007, is a regional integrated marine logistics company involved in shipping and shipyard operations. The company charters offshore support vessels (OSVs) and tugboats/barges for industries such as mining, construction, and infrastructure across regional waters, including the Gulf of Thailand, Malaysia, Indonesia, and Taiwan. It has expanded into offshore wind farm projects, capitalizing on the growing wind energy industry […]